Table Of Contents

Cross Holding Meaning

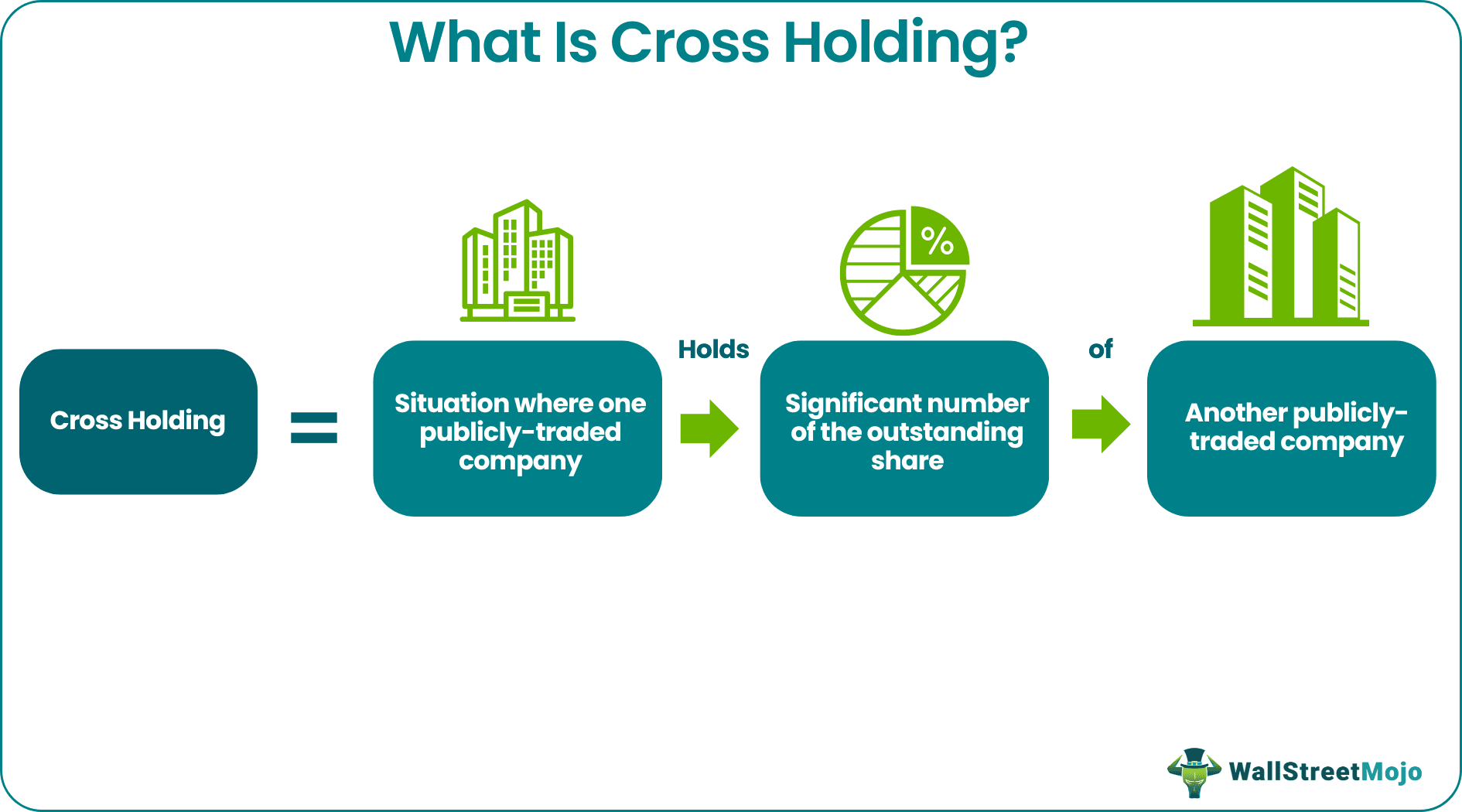

Cross holding is when one company holds the outstanding shares of another company, both being publicly traded entities. It can facilitate strategic alliances and partnerships between companies, allowing them to collaborate more closely on various initiatives, such as joint ventures, research and development, and market expansion.

Cross holdings can strengthen relationships between companies, fostering mutual trust and cooperation. It can lead to better communication, shared goals, and improved coordination. Cross holdings sometimes offer tax advantages or benefits through strategic ownership structuring.

Key Takeaways

- Cross holding is when one publicly listed company holds shares or equity stakes in another publicly listed company.

- It can involve companies from the same industry or sectors, aiming to leverage each other's strengths and resources.

- Cross holding promotes collaboration and mutual support through reciprocal ownership, fostering company synergy.

- On the other hand, chain holding involves a linked ownership structure that can lead to centralized control and complex ownership dynamics, potentially raising regulatory flags.

- It has the potential to offer a strategic edge by allowing companies to tap into novel markets and distribution channels through their interconnected ownership.

Cross Holding Explained

Cross holding, a strategic approach employed by companies, involves a reciprocal ownership arrangement where two or more firms invest in each other's equity or shares.

For instance, Company A might purchase some of Company B's shares. At the same time, simultaneously, Company B acquires shares of Company A. This interlocking ownership creates a dynamic partnership driven by strategic intentions.

Typically, companies engage in cross-holding to establish closer alliances, pool resources, and collaborate on projects. The ownership percentages dictate the extent of involvement and influence each company has in the other's decisions. This collaboration extends beyond mere financial interests, often resulting in joint ventures, shared expertise, and coordinated efforts in research and development or market expansion.

It signifies a long-term commitment, emphasizing trust and mutual benefits. However, navigating the complex corporate structures and potential regulatory implications requires careful planning to ensure successful implementation.

Britain and the U.S. markets have historically embraced capitalism characterized by a widespread ownership base. It contrasts continental Europe, where ownership tends to be concentrated within a close-knit group of insiders. The reasons behind this disparity vary from one country to another.

In France, the concentration of ownership can be attributed to the government's preference for having large businesses under friendly licenses and the absence of institutional investors. In other parts of Europe, the astute handling of powerful family dynasties, such as the Wallenbergs in Sweden and the Agnellis in Italy, has significantly shaped ownership structures.

Until recently, due to lax disclosure standards, assessing the degree of ownership concentration in European companies was challenging. However, new and more stringent disclosure standards clarify ownership patterns.

Examples

Let us look at the cross holding examples to understand the concept better.

Example #1

Imagine three small companies, Company X, Company Y, and Company Z operating in the technology sector. Company X invests in Company Y by purchasing a 15% share stake, while Company Y invests by acquiring a 10% stake in Company Z. This cross holding of shares creates a strategic partnership among the companies sharing stakes. They now share an interest in each other's success and collaborate on joint projects, such as developing new software solutions.

Company X's ownership in Company Y gives it a voice in its decisions and the same becomes applicable to Company Y for Company Z. This partnership goes beyond just financial transactions; it signifies a commitment to work closely together for mutual benefit. If Company X, Company Y, and Company Z were to succeed in the market, they would reap the rewards, demonstrating the potential advantages of cross-holding in fostering collaboration and growth.

Example #2

Naspers and Prosus plan to simplify their cross holding structure to support a share buyback initiative at the Naspers level. The move aims to streamline complexity while preserving economic interests and aligning legal ownership. This change, approved by the South African Reserve Bank, will grant Naspers around 43% ownership of Prosus N ordinary shares, leaving 57% for Prosus free-floating shareholders. This adjustment removes limitations on share repurchasing, ensuring the program's continuity at the Naspers level.

This Nasper-Prosus example signified inter-firm cross holding where two companies have stakes in each other's firms and hence they work for the betterment of each other.

Advantages And Disadvantages

Let us understand its advantages-

- Strategic Collaboration: Cross holding can foster closer collaboration between companies, leading to joint ventures, shared projects, and synergies that leverage each other's strengths.

- Risk Diversification: Owning shares in each other's companies can help diversify investment portfolios, reducing the impact of market fluctuations on financial performance.

- Long-Term Commitment: It signals a commitment to a long-term relationship, promoting stability, trust, and shared goals between companies.

- Resource Sharing: Companies can access each other's resources, technologies, and expertise, increasing innovation and competitive advantages.

Listed below are its disadvantages-

- Complex Ownership Structures: Cross holdings can create intricate and challenging ownership structures, which might be difficult to manage and understand.

- Conflicts of Interest: Conflicts can arise due to differing priorities and interests between cross holding companies, potentially leading to disagreements on strategic decisions.

- Corporate Governance Issues: It might complicate corporate governance, as it could blur ownership and decision-making responsibility lines.

- Lack of Market Discipline: It can lead to a lack of market discipline, as companies might need to be more accountable to external shareholders' interests.

Cross Holding vs Chain Holding

Cross and chain holding involve companies holding shares in each other's capital but exhibit unique characteristics and implications. Let us understand the differences between them.

| Basis | Cross holding | Chain holding |

|---|---|---|

| Definition | It involves two or more companies holding shares in each other's capital, creating a reciprocal ownership relationship. | It encompasses a series of companies owning shares in one another linearly, forming a linked ownership structure. |

| Relationship | Fosters a strategic partnership where companies collaborate on projects and ventures, leveraging complementary strengths. | It can lead to centralized control if one company owns substantial stakes in multiple companies. |