Table Of Contents

What Is CREST?

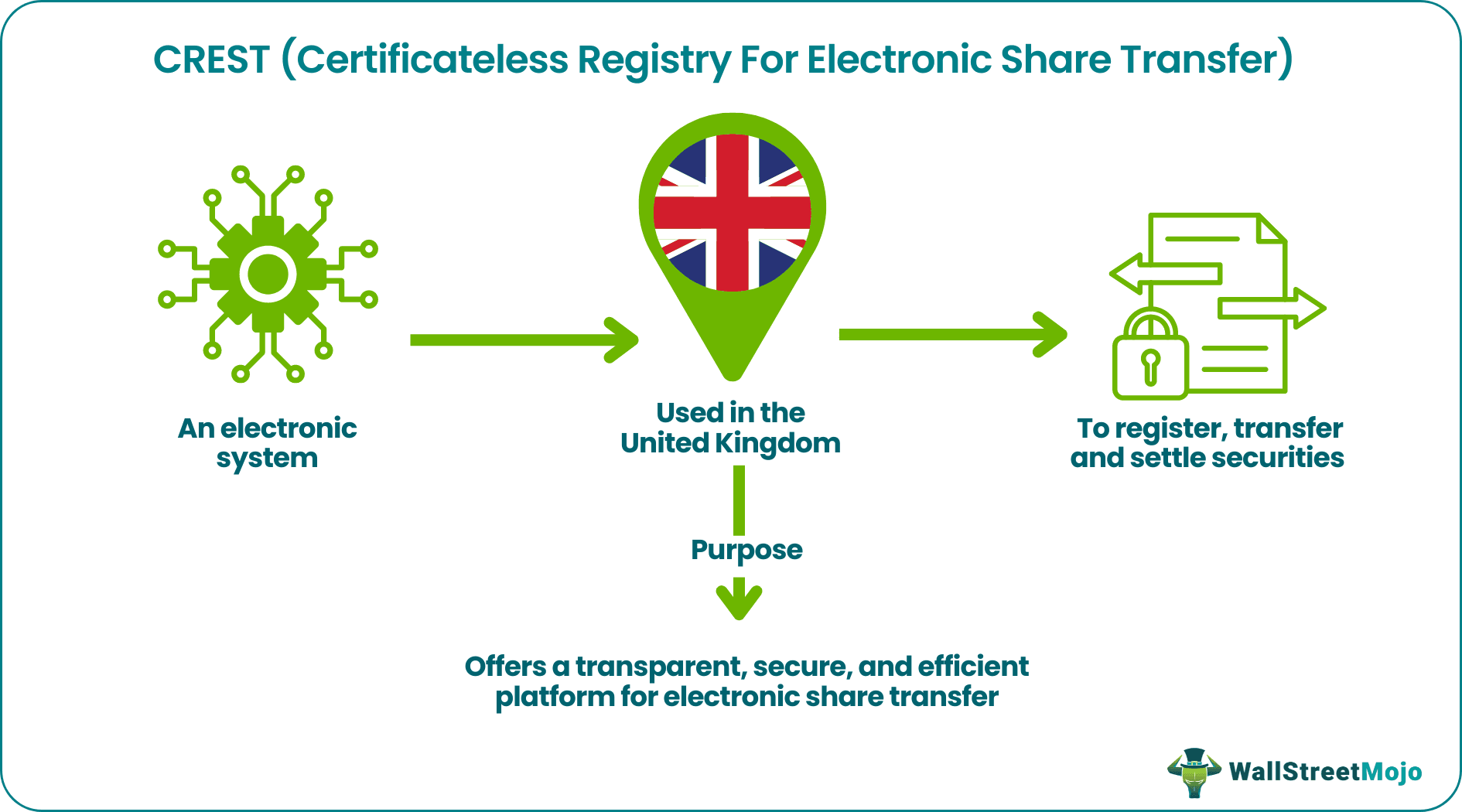

CREST, which stands for Certificateless Registry for Electronic Share Transfer, refers to an electronic system used in the United Kingdom to register, transfer, and settle securities. Its primary purpose is to offer a transparent, secure, and efficient platform for electronic share transfers.

CREST is useful to individual investors, brokers, asset managers, and investment bankers since the platform allows them to electronically maintain, update, and transfer securities held by retail investors. It mainly acts as a central electronic registry to maintain accurate records of securities ownership. CREST has modernized the handling of assets/securities while simplifying processes, increasing security, and ensuring the efficiency of the electronic securities transfer process.

Key Takeaways

- The Certificateless Registry for Electronic Share Transfer (CREST) is an electronic system used in the United Kingdom to register, transfer, and settle securities.

- Its primary objective is to provide a transparent, secure, and efficient platform for electronic share transfers.

- It ensures secure fund transfer, reduces administrative costs, boosts market integrity and transparency, and enables immediate clearing of securities transactions. However, funds are required to cover the initial setup costs. Euroclear UK/Ireland registration is a must.

- While CREST specializes in electronic registration, transfer, and settlement of securities, primarily in the UK, SwiftNet serves as a global secure messaging network for financial transactions.

How Does CREST In Trading Work?

CREST is an electronic platform that enables the registration, transfer, and settlement of securities in the United Kingdom. Securities are held in their dematerialized form for parties involved in the purchase and sale of such assets. It acts as a securities depository to facilitate trading without the use of physical documents. In the trading jargon, this function is referred to as 'Paperless Trading.'

CREST is a centralized electronic registry that eliminates the need for maintaining physical share certificates. The platform helps reduce paperwork and streamlines the trading process. It began operating as a securities depository in the UK in 1996. The platform helped replace physical share certificates with electronic ones. It was designed to digitize and modernize the securities trading process, leading to an efficient and transparent system of share transfer.

CREST creates and maintains an electronic register of securities and updates and records any change in shares ownership. It enables the electronic transfer of securities, handles the settlement process end-to-end, and administers the release of funds (against the right corresponding securities) for transactions executed between sellers and buyers.

Many traders use Saxo Bank International to research and invest in stocks across different markets. Its features like SAXO Stocks offer access to a wide range of global equities for investors.

Examples

Let us study a few examples to understand the topic in detail.

Example # 1

Jane, a shareholder, buys shares of Oakshire Pharmaceuticals through Smith & Co. Investments. Smith & Co. Investments is a CREST-registered member in Oakshire (a fictional city), UK. Jane's share ownership is updated in the computerized register, and CREST administers the settlement procedure. This guarantees that the transaction will be executed on time, and Jane and the seller will exchange funds and securities per the agreement. Simply put, CREST reduces the risks involved in securities trading for both parties.

Example # 2

A client named John wishes to sell his Meadowville Energy assets. ABC Brokerage Firm in Meadowvale (a fictional city), UK, helps him execute the sale. The share transfer procedure was started by ABC Brokerage Firm, a registered member of CREST. The firm updated the computerized register to reflect the details of ownership changes. CREST supervises the settlement to ensure a safe exchange of money and transfer of securities between John and the buyer.

Pros

CREST ensures secure and efficient funds transfer, decreases administrative costs, and increases market integrity and transparency. Companies can pay dividends to shareholders plus execute rights issues, manage the Electronic Trade Confirmation (ETC) system, and offer transparent and accurate records of share ownership and transfers for every trade. It also offers immediate clearing of securities transactions since it runs a clearing system and retains securities.

As part of digital innovation, CREST revolutionized the market for securities trading in the UK, allowing electronic share purchase, registration, and sale by traders and investors. It simplified administrative processes, provided an accurate and auditable register of share ownership, and reduced settlement risks. Through its quick, safe, and transparent electronic share transfers, CREST improved overall market integrity and decreased administrative costs.

Cons

The initial cost of setting up the system and integrating it with existing systems must be borne by participants/users. Those who wish to use this depositories service and access the CREST system must register with Euroclear UK and Ireland as members or have trading accounts with them.

CREST vs SwiftNet

The functions performed by CREST and SwiftNet are similar but the platforms still differ in many aspects. Some notable differences can be seen in their operations and have been discussed in the table below:

| CREST | SwiftNet |

|---|---|

| CREST refers to the storage and transfer of securities in electronic form. It stands for Certificateless Registry for Electronic Share Transfer. | SwiftNet refers to fund transfers through a global secure messaging network created for financial transactions. It stands for Society for Worldwide Interbank Financial Telecommunications. |

| It is mostly used in the United Kingdom. | It is used on a global level for fund transfer. |

| Individual investors, brokers, asset managers, and investment bankers operating in the UK and Irish financial markets use it. | Financial institutions, banks, and corporations around the world use it for fund transfers. |

| It eliminates the need for physical share certificates. | It provides a standardized messaging format/protocol for communication regarding secure fund transfers. |

| It offers reliability and security to participants operating through CREST-registered members during securities transfer. | As part of its messaging protocol, SwiftNet secures communication between banks and ensures confidentiality. |

| It enhances transparency in sharing ownership records through the central electronic registry. | It has increased the transparency levels in global financial transactions. |

| CREST manages the settlement process, enabling the smooth transfer of funds and securities between sellers and buyers. | It facilitates efficient and secure settlement of transactions through secure bank communications. |

| It plays a vital role in facilitating securities transactions in the UK. | It plays a crucial role in facilitating international trade. |

Disclosure: This article contains affiliate links. If you sign up through these links, we may earn a small commission at no extra cost to you.

Frequently Asked Questions (FAQs)

It is a centralized electronic platform in the UK for securities transactions, including stocks and bonds. It oversees settlement procedures, ensuring seamless transaction processing to reduce risks for both buyers and sellers. CREST also enables smooth ownership transfers.

Enhanced efficiency, increased security, reduced costs, and higher transparency are some specific advantages. It facilitates electronic securities transfers, minimizes manual documentation, and reduces risks associated with fraud and discrepancies. CREST reduces administrative expenses through a centralized electronic register. It maintains precise records of share ownership, enhances transaction integrity and investor confidence, simplifies compliance, increases market efficiency, and strengthens the trading environment.

It is primarily used by various market players who trade securities in the UK. These participants include brokers, investment bankers, asset managers, and private investors. Individuals must be registered members or have accounts with Euroclear UK and Ireland, the organization operating the system, to use it.

By eliminating paper certificates, ensuring quick settlement, and maintaining records in a centralized electronic registry, CREST streamlines securities trading. Transaction security, cost saving, and increased accessibility to market infrastructure are key features of this system.