Table Of Contents

Creditworthiness Meaning

Creditworthiness is a measure of judging the loan repayment history of borrowers to ascertain their worth as a debtor who should be extended a future credit or not. For instance, a defaulter's creditworthiness is not very promising, so the lenders may avoid such a debtor out of the fear of losing their money.

Creditworthiness applies to people, sovereign states, securities, and other entities whereby the creditors will analyze the borrower's creditworthiness before giving a new loan. It is important because if the borrower does not have the repayment capacity and is yet given a loan, there is a strong default possibility and a loss to the lender.

Table of contents

- Creditworthiness is a grade for an individual, security, or sovereign state that evaluates the entities' ability to pay and accrue debt.

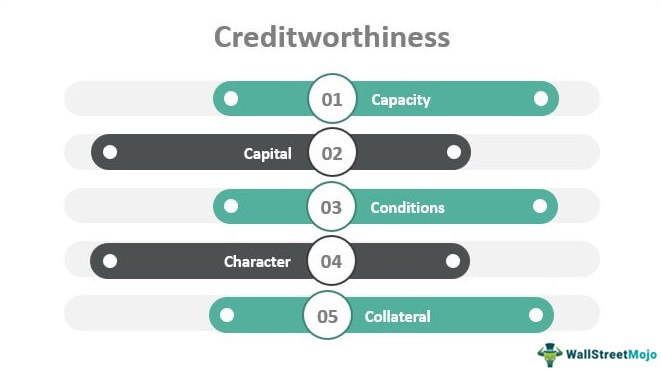

- There are five criteria of evaluation that lenders use for individuals and businesses: capacity, capital, conditions, character, and collateral.

- The three biggest credit rating agencies for securities and sovereign states are Moody’s, Standard & Poor, and Fitch.

Creditworthiness Explained

Creditworthiness is the method of assessing the possibility of a borrower defaulting in his credit obligation or loan repayment. In other words, the lender has to understand whether a borrower is worthy of receiving a loan or not.

It is usually assessed based on the past repayments made by the borrowers, their earnings, assets in possession, etc, Based on these things they get a credit score which is actually a numerical representation evaluating credit worthiness.

The lender should check for any amount due in the past, bankruptcies, defaults, missed or late payments, and the financial condition overall. These points are noted to judge the creditworthiness of borrowers. The higher the score, the better it is, which also means there is a better chance to get loan on a lower interest rate because the lenders risk is less.

The Hargreaves Lansdown provides access to a range of investment products and services for UK investors.

Factors

Creditworthiness of borrowers are evaluated based on several factors. Typically, lenders will take a qualitative and quantitative look at the 5 C’s of Credit when evaluating a borrower: capacity, capital, conditions, character, and collateral, which are detailed below:

#1 - Character

This part judges the background of the borrower. As such, the creditor will evaluate the borrower's educational and employment background. It is a way to learn about an individual's ethics and personal conduct. For example, a swindler's character assessment will discuss the lack of integrity.

#2 - Capacity

Here, it determines whether the individual has a steady income to pay the installments and interests. Whether they’d have enough savings left after paying their expenditure to arrange for their debt obligations. The creditors are also interested in learning about the source of the cash with which the borrower will repay the loan. They’d try to determine if the source of cash will be reliable enough to help them honor their debt obligations.

The creditors will also evaluate the potential borrowers' credit history using their credit scores. A credit score defines a person's creditworthiness assessment using numbers ranging from 300 to 850. Usually, a credit score between 670-739 is considered a sound score.

The lender will also evaluate the borrower’s current credit utilization rate (percent of credit card debt currently being used) and total debt service to income.

#3 - Capital

Suppose a woman has approached a bank to borrow money to start a snack delivery business out of her home. If the bank learns that the woman has already invested a good deal of her finance into her small business, it will boost its borrowers' confidence. Having some form of monetary interest at stake not only makes a borrower appear as a party who would make good use of the borrowed funds, but it also obligates the borrower to be successful if they aren't planning on losing their money. It helps to strengthen the borrower's case.

#4 - Conditions

Lenders will look into the reason for acquiring the loan. A lender will usually request a reason for a loan, which could be to purchase a house. Apart from the borrowers' financial conditions, the creditors look for reasons not related to them.

These could be the political-economic conditions of a country. If a country is in recession with interest cuts and job losses, it will weaken a borrower’s case.

#5 - Collateral

What is the borrower pledging in assets as a security for this loan? Several studies have been conducted to understand the requirement of pledging an asset as a security against a loan. The easiest example is when lenders can foreclose upon a property if a property owner cannot make their payments.

The factors for a company's creditworthiness assessment are the same as above, but the analysis is done concerning the business. Lenders often look for secured loans or guarantees, especially in the case of high-risk borrowers. A high-risk borrower has a greater chance of defaulting. Besides, they also charge higher interest rates from such a group to compensate for the greater risk.

Video Explanation Of Creditworthiness

Example

For example, in 2011, a popular credit rating agency, S&P, reduced the credit rating of the U.S. to AA-plus due to the case of a mounting budget deficit and debt liability. The move had affected the investors' trust in the state, especially since it held S&P's AAA rating since 1941.

Ratings

A state cannot exert its financial or political risk rating to invest in its debt instruments. Sovereign states will receive a Sovereign Credit Rating, an independent evaluation.

A third-party credit rating agency will give a rating to a country judging its economic and political risks. A mounting budget deficit will degrade a nation's creditworthiness.

A low credit rating reflects the low creditworthiness of customers that could prevent them from raising money from the global market and bodies. The top three credit rating agencies are Standard & Poor's, Moody's, and Fitch. The S&P will give a BBB or higher rating to countries that they consider less risky for investment. Moody calls this same lower level of risk a Baa3 rating.

Evaluation Of Securities

Securities are just financial instruments to raise funds in capital markets. The three types of securities are equity, debt, and hybrid too. Just like lenders judge a company's creditworthiness, securities are also put through this test. The securities are also evaluated with credit ratings. Securities’ credit ratings are a financial indicator of the success and strength of the security.

Moody's, the S&P, and Fitch assign credit ratings to bonds and companies. These three agencies evaluate over 95% of the rating business and are registered with the SEC. There are two parts of the grade: the score itself and an evaluator that describes the future credibility of the security (such as likely to upgrade or likely to downgrade for Moody’s designation).

How To Improve?

Let us look at the various ways to improve the creditworthiness of customers.

- It is necessary to understand one’s own financial capacity before taking a loan. If the income or assets are not enough to support borrowing, then it is better to delay it.

- The borrower should keep in mind that repaying the loan is a responsibility, and any late payment , default will result in lower credit score. Thus repayment should be the top priority.

- Every individual taking opting for loans should keep a control on it. Taking too many loans will take the situation out of hand and become a problem while evaluating credit worthiness.

- Overspending or overindulging in luxury items should be avoided so that a loan is available for essential purposes when needed, and it is also possible to maintain a good credit score.

Disclosure: This article contains affiliate links. If you sign up through these links, we may earn a small commission at no extra cost to you.

Frequently Asked Questions (FAQs)

A person, business, or organization's capacity to fulfill financial commitments is determined by creditworthiness. It suggests trust in a party's capacity to pay back its loans from financial institutions and its debts.

The debt-to-income (DTI) ratio is calculated by lenders using your income and debt. The lower the DTI, the more creditworthy one seems to potential lenders. The DTI reflects the percentage of your monthly income consumed by your debt commitments.

Creditworthiness is based on several variables, including your credit score and payback history. When determining the likelihood of default, specific lending organizations additionally consider your available assets and total obligations.

Yes, creditworthiness can have broader implications beyond borrowing. Landlords, employers, and insurance companies may also consider an individual's creditworthiness when deciding on renting, employment, or insurance premiums.

Recommended Articles

This has been a guide to Creditworthiness and its meaning. We explain it with example, factors, how to improve, ratings and evaluation of securities. You may also have a look at the following articles to learn more –