Credit spread and default risks are critical considerations when investing funds in fixed-income assets. Let us find out the various points of dissimilarities between them:

Table Of Contents

What Is Credit Spread Risk?

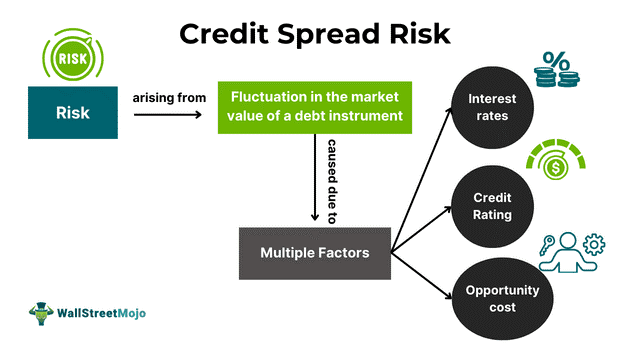

Credit Spread Risk refers to the risk that arises because of a debt instrument's ability to fluctuate in market value. It leads to the letting go of an instrument with a considerable default risk and a subsequently higher interest rate while opting for a debt instrument with a comparatively lesser default risk but also a lower interest rate.

Credit spread risk is not the same as the risk associated with credit spread options. These two are different terms, with the latter being a derivatives contract whereby one party transfers the credit risk to another party in exchange for promised cash payments. Suppose the credit spread between fixed-income assets like corporate bonds and government bonds increases. In that case, investors' risk exposure also rises, which makes them demand a higher risk premium or better returns.

Key Takeaways

- Credit spread risk is the cost of letting go of an opportunity to invest in a fixed-income security with a higher return and high risk for investing in another debt instrument that holds lower default risk but offers a lesser yield.

- If the credit rating of these debt instruments declines, the issuer must offer a higher interest rate as a risk premium to the investors, and the market value of these fixed-income securities also tends to fall subsequently.

- It differs from the default risk, which is the possibility of potential non-repayment by the borrower.

Credit Spread Risk Explained

Credit spread risk involves losing out on a higher interest rate of a fixed-income asset with significant default risk when selecting a more secured debt instrument with a comparatively meager interest rate. In short, credit spread risk management completely depends on the default risk associated with a security.

Credit spread risk seems to exist in two forms – true credit spread risk and risks arising from credit spreads. While the former involves a decrease in the market value of an investment due to the better performance and value of another asset or instrument, the latter is recorded considering the difference between the yields of various debt instruments.

Investors often need to choose between risk and returns. However, with floating-interest debt instruments, it becomes even more essential to gauge the risk associated with the credit spread of these assets.

The credit spread denotes the difference between the yields of high-risk debt instruments and risk-free or low-risk debt instruments with the same maturity date. This spread can broaden due to fluctuations in the risk-free return and interest rates of these assets. Thus, when the credit spread of the debt instruments broadens, the market value of such assets falls, which causes the investors to incur a loss.

Financial institutions like banks and fintechs often perceive such uncertainties when making favorable investment or lending decisions. However, the investors fail to consider this type of risk while prioritizing the default risk.

Investors and lenders need to devise proper strategies for credit spread risk management to ensure higher returns with limited risk exposure. Indeed, this helps them adjust their investment portfolio from time to time with the changing economic conditions and the bond's creditworthiness. The bright side of such uncertainties is a higher bond yield in the form of a risk premium.

Examples

Let us discuss some instances to understand the credit spread risk definition better and emphasize its prevalence while including the debt instruments in the investment portfolio:

Example #1

Suppose Bill invests $10,000 in a 7-year corporate bond rated AA, which has a low default risk and an interest rate of 5.5%. While opting for this investment product, he lets go of the opportunity to buy another 7-year corporate bond-rated BBB, which holds a higher default risk but offers an interest rate of 7.2%. Thus, forgoing a 7.2% interest rate for selecting a more secure investment product is the credit spread risk that Bill takes.

Another investor, Merlin, purchases the 7-year corporate bond rated BBB for a higher interest rate. As a result, she receives a premium, i.e., 1.7% more interest on her investment, for taking this higher credit spread risk. Later, the credit spread widened in the next two years in comparison to the benchmark debt instrument since this bond's credit rating declined to B. Therefore, the market value of the bonds held by Merlin also declined, negatively affecting her investment portfolio.

Example #2

According to a June 2024 report, JP Morgan SE in the European Union, a subsidiary of JP Morgan US, allocated €318 million ($349 million) for dealing with the structural credit spread risk.

The publication also stated that the European Banking Authority (EBA) mandated in 2023 that financial institutions include the assessment of credit spread risk (CSRBB) in addition to interest rate risk (IRRBB) as an element of their internal capital adequacy assessment process (ICAAP).

How To Reduce?

The banks and other lenders are more vulnerable to the rising credit spread risk in fixed-income securities. However, it equally impacts the retail investors who buy bonds with a lower default risk. Let us understand some strategies to mitigate such uncertainties:

- Diversification: The best way to cover the lost interest income due to a more secure investment selection is to diversify the funds across fixed-income assets with different risk and return profiles.

- Hedging: Investors can enter into forwards and options contracts based on these debt instruments to benefit from interest rate fluctuations.

- Analysis of Credit Rating: Another critical strategy is to track the credit rating of the bonds included in the portfolio to avoid losses arising from falling market values.

- Assessing Market Conditions: It is essential to gauge bond market conditions to understand their potential impact on the investor's portfolio.

Credit Spread Risk vs Default Risk

| Basis | Credit Spread Risk | Default Risk |

|---|---|---|

| 1. Definition | It is the risk that arises either when someone has to choose instruments with lower interest rates because they are less risky or due to risk associated with credit spreads. | It is the chances of the borrower non-repaying the debt obligation. |

| 2. Cause | Fall in borrower's creditworthiness or credit rating, market fluctuations, or change in interest rates | Poor cash flow, mismanagement, bankruptcy or insolvency of the borrower; economic downturns |

| 3. Impact | The market value of the debt instrument drops, causing a fall in the portfolio value of the investor | Direct financial loss to the lenders due to non-recovery of the amount. |

| 4. Risk Measurement | Calculating the difference or credit spread between the high-risk fixed-income assets and risk-free or low-risk bonds | Determined through the probability of default (PD) model and credit ratings issued by credit rating agencies like S&P and Moody's |

| 5. Management | Such uncertainties can be managed through the proper analysis of credit rating, diversification, and hedging. | They can be mitigated through the use of collateral, credit analysis, covenants, and higher interest rates. |

| 6. Example | A retail investor buys corporate bonds worth $50,000 whose credit rating falls after a year, ultimately reducing its market value to $48,000 in comparison to the government bond with the same maturity date. | The bank invests $50,000 in collateralized corporate bonds with a higher risk of non-repayment. |