Table Of Contents

What Are Credit Rating Agencies?

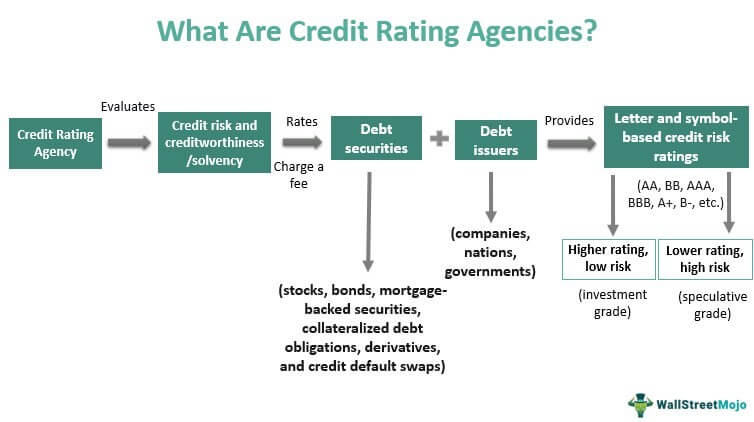

Credit rating agencies (CRAs) evaluate and rate the creditworthiness of debt securities and their issuers, including companies and countries. These agencies assign credit risk ratings to such entities based on quantitative and qualitative analyses. Ratings show the likelihood of a borrower to default or repay a loan with interest.

Credit rating services use unique letter codes to depict the default risk and the financial stability of the debt issuer. While these ratings provide risk measures for an entity, investors get to know about its creditworthiness. Besides corporations and nations, these ratings can be for stocks, bonds, mortgage-backed securities, collateralized debt obligations, and credit default swaps.

Key Takeaways

- Credit rating agencies assess and rate the creditworthiness of fixed-income securities and debt obligations of their issuers. Ratings indicate the likelihood of an enterprise or the government defaulting on debt or repaying it with interest.

- The rating services assign letters to represent the risk of default and financial viability of the debt issuer, based on quantitative, qualitative, and contextual analyses.

- Standard & Poor's, Moody's Investors Service, and Fitch Ratings are the 3 big credit rating agencies, with a combined market share of approximately 95%.

- The United States Office of Credit Rating monitors, regulates, and governs CRAs.

How Do Credit Rating Agencies Work?

Credit rating agencies evaluate and rate companies, nations, governments, or financial instruments. They essentially provide information about the quality of fixed-income securities and debt obligations and their issuers' ability to repay the principal amount and interests. In short, these credit risk ratings help retail and institutional investors get an idea of the solvency of the borrower and its products. They can decide whether the security in question is worth the investment or just speculation.

The credit rating agencies meaning is that these services collect financial information for loans and insurance, perform quantitative, qualitative, and contextual analyses, and assess the borrower’s ability to repay the debt.

These services charge a fee in exchange for rating an entity (business and nation) or providing a rating for use by an entity (banks and financial institutions). And for that reason, they are criticized for giving good ratings to issuers that pay them. Therefore, the United States enacted the Credit Rating Agency Reform Act in 2006 to regulate these agencies.

These agencies assign letter codes and symbols to entities and instruments, such as AA, BB, AAA, A+, B-, etc. The higher the rating (AAA) of a security, the most lucrative investment it is, and the lower the rating (C or D), the more speculative it will be.

It is also worth noting that these codes do not serve as investment advice but as a factor determining the ability of the issuer to meet its obligations. The debt issuers may range from companies to countries, municipal to state governments, and special-purpose institutions to non-profits. Standard & Poor's, Moody's, and Fitch are the 3 big credit rating agencies, with a combined market share of roughly 95%.

History Of Credit Rating Agencies

In the mid-1970s, mortgage-backed securities (MBS) were the first to receive such ratings. However, credit rating services later began assigning codes to other asset-backed securities.

During the 2008 financial crisis, the US credit rating agencies rated debts like MBS higher, which proved to be risky investments and later resulted in defaults and loss of investors’ confidence. Experts criticized these agencies for failing to recognize investment risks. Furthermore, security issuers bribed rating services to obtain a good credit score.

These agencies are now more specific, accurate, and efficient in providing the appropriate credit scores to entities and debt instruments. It has been possible due to increased oversight, regulations, policies, and governance by the U.S. Office of Credit Ratings.

What Do Credit Ratings Say?

Credit rating meaning differs with entities and financial instruments, though they evaluate issuers’ credit or default risks and debt obligations. For example, a company can use it to rate its debt securities, while a country can use the same to attract domestic and foreign investments. Ratings for sovereign debts indicate the country's ability to repay its debt. Also, a sovereign credit rating facilitates access to international financial markets for the government.

Similarly, a bank can use it to assess the risk premium on loans. Poorly rated loans have a higher risk premium and higher interest rates. A higher credit rating enables the borrower to obtain loans at a lower interest rate. Credit ratings allow traders to trade fixed-income on the secondary market and influence their interest rates – a higher grade gets a lower interest rate.

Credit risk ratings indicate the likelihood of a borrower defaulting on its obligation. While low risk suggests investment, high risk implies speculation. Furthermore, these scores provide an outlook for an issuer or financial product in the future. Also, these scores aid in the development of the financial market and its regulations.

Role Of Credit Rating Agencies

The primary role of credit rating services is to assess the credit risks and solvency of structured debt securities and their issuers, i.e., companies and governments. Since they also act as financial intermediaries, there are multiple objectives that they fulfill, such as:

- Lower information costs, attract potential borrowers and foster liquid markets

- Boost the supply of risk capital and economic growth

- Assist in structured financial transactions of securities backed by assets, residential and commercial mortgages, and collateralized debt obligations and derivatives

- Evaluate assets underlying the security and focus on the capital structure

- Provide ratings for sovereign debtors, including municipalities, governments, and transnational entities backed by a sovereign state

- Help investors make well-informed decisions about an investment by providing insights into risks and rewards associated with it

- Provide credit scores to companies, governments, and debt obligations

- Encourage entities to pay on time and clear off their dues regularly to avoid a decrement in their credit scores, which eventually help them take loans and debts in the financial markets

- Enable nations and states to sell bonds to investors in domestic and international markets

List Of Top Credit Rating Agencies

The credit rating services provide lenders and borrowers with accurate information about the risks and opportunities associated with debt. Several agencies function internationally. With a combined market share of about 95%, Standard & Poor's, Moody's Investors Service, and Fitch Ratings are the three most well-known international credit rating agencies. Here is how they work:

#1 - Fitch Ratings

Fitch Ratings is an international credit rating agency established in 1923 and operating in New York and London, England. The company analyzes debts and the interest rate sensitivity they hold. It considers the politico-economic situations of a nation before assessing its sovereign debt.

The agency uses a letter-based scoring system, with AAA, AA, A, and BBB representing investment grade and BB, B, CCC, CC, C, DDD, DD, and D showing non-investment class. For example, AAA rating denotes the high value of an entity or security, while D rating signifies a greater risk of defaulting on a loan. Many investors trust ratings provided by Fitch to distinguish investments that will not default and present significant returns.

#2 - Moody's Investors Service

Another credit rating service, Moody's Investors Service, created in 1909, offers investors financial information on bonds issued by firms and governments. The company is well-known for its business analysis, risk assessment, and investment services.

When assessing debts, the agency employs a unique letter system for debt securities, with investment grades ranging from Aaa to Baa3, indicating the debtor's ability to repay, and speculative classes ranging from Ba1 to C, indicating the issuer's risk of default.

The firm undertakes open research in collaboration with large multinational corporations and local governments. Moody's assessments have long been trusted for their market insights and understanding of the market volatility while also providing a global perspective on debt markets.

#3 - Standard & Poor's

Standard and Poor's has been assigning ratings to bonds of companies and government since 1941. The firm is well-known as a data provider for investment benchmarks. It has a comprehensive rating system with 17 letter-based scores.

It assigns AAA to BBB ratings to investment-grade debts with the potential to repay and BB+ to D ratings to speculative-grade loans with higher credit risks. Simply put, a higher credit rating assures investors that the issuer will not fail on its loans.