Table Of Contents

What Is A Credit Card Sign-Up Bonus?

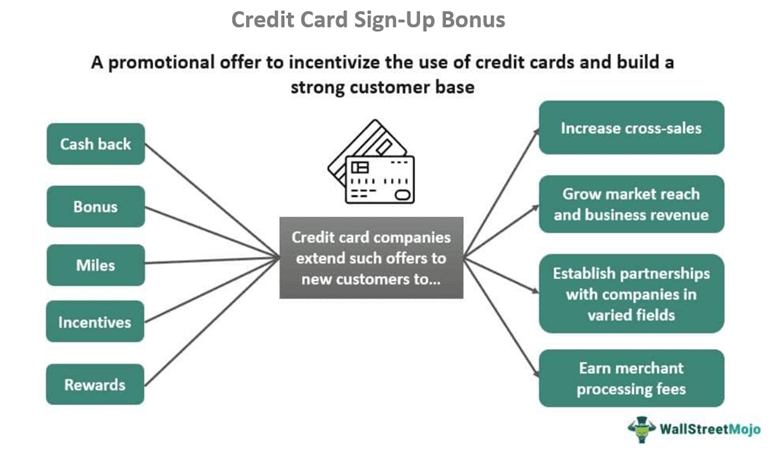

A Credit Card Sign-up Bonus is an incentive offered by credit card issuers, usually in the form of bonus points or cash back, to individuals who sign up for a new credit card and fulfill certain spending criteria. The purpose is to motivate people to open new credit card accounts and begin using them consistently.

These sign-up bonuses provide immediate value to cardholders by offering extra rewards on card activation. They also serve as a marketing tool for credit card issuers. It acts as a lucrative monetary encouragement that helps onboard new customers, keep them engaged, boost revenue, form alliances with brands in various industries, improve cross-selling, earn credit card processing fees, and grow market share.

Investors seeking a comprehensive platform may consider Saxo Bank International for a variety of account types and investment options.

Key Takeaways

- Credit card sign-up bonuses, offered by banks to attract new customers, provide immediate value and long-term benefits.

- Consumers benefit by earning extra rewards, like bonus points or cash back, upon meeting specified spending criteria within a given timeframe.

- These bonuses vary. Some offer rewards after the first purchase, while others require spending at specific merchants or reaching a spending threshold.

- To maximize benefits, consumers should review the terms and conditions carefully and understand the offer details

- Leveraging sign-up bonuses strategically can offset expenses and provide valuable rewards. Additionally, ongoing rewards for spending further enhance a credit card's value proposition.

- While the benefits are attractive, credit cards must be used judiciously to protect one’s financial health.

How Does Credit Card Sign-Up Bonus Work?

A credit card sign-up bonus is a promotional offer extended by banks and credit card companies to encourage new customers to apply for their credit cards and use them regularly. These welcome bonuses offer users extra points or cash back upon meeting a designated spending requirement within a specified timeframe. Additionally, welcome bonuses may occasionally include supplementary perks such as reduced annual fees or complimentary merchandise.

These perks motivate prospective customers to apply for cards from specific credit card issuers and potentially associate with them for a long time. These rewards can then be used to reduce the financial burden of future expenditures, effectively providing savings or discounts on essential or desired items.

One must note that it is crucial to manage credit card balances responsibly by paying them off promptly to avoid accruing high interest charges. This ensures that the value of the sign-up bonus is maximized without being offset by interest charges. Therefore, by taking advantage of sign-up bonuses and maintaining prudent financial habits, credit card users can effectively leverage credit cards and enjoy the varied benefits and perks they offer.

The Hargreaves Lansdown provides access to a range of investment products and services for UK investors.

Welcome bonuses represent a great incentive for both banks and consumers. They serve as an enticing tool for banks to attract credit card signups while offering consumers a valuable opportunity to benefit from a bank's marketing efforts directly. When considering a new credit card, it is essential to factor in welcome bonus offers. Understanding the specifics of the offer, such as points or miles, and devising a plan to qualify for it are vital steps.

Typically, these bonuses are advertised on issuer websites or through mail offers, in addition to social media promotions. Reviewing and comprehending the terms and conditions ensure eligibility and clarity on qualifying purchases. Exploring various options allows consumers to compare welcome bonuses from different banks, optimizing the value of a credit card in the initial year. Utilizing resources like credit card reviews and bank websites helps in grasping current offers and associated terms.

Interpreting the terms and conditions imposed by credit card companies on credit card usage reduces any probable future hassles with respect to how a benefit can be availed, under which circumstances the perks are available, or which products and services qualify for discounts or offers is key.

For efficient cross-border payments, many individuals and businesses use the Wise Money Transfer UK or Wise Money Transfer US services for transparent and low-cost transfers.

Types

Being aware of the types of welcome bonuses can facilitate product choice. In this section, let us discuss the types of credit card sign-up bonuses.

- Bonus points or cash backs - Cardholders are provided with a cash rebate or statement credit corresponding to their initial expenditure. The offers that say something like 20 points after purchases worth $1000 belong to this category. Typically, welcome bonuses are earned through a one-time lump sum. However, certain credit cards with substantial signup incentives may divide the bonus into multiple segments, each with its eligibility criteria.

- Discount on purchase (current or future) - This type of welcome bonus is common when cashiers at department stores offer a 15% off on purchases today deal for customers who sign up for an in-store credit card. Many co-branded retail credit cards provide discounts as welcome bonuses. These discounts may come in various forms, such as an immediate reduction upon approval, a coupon or discount code provided later, or a statement credit after the initial purchase. While this practice is most prevalent with co-branded credit cards offered by physical retailers, it also applies to online retailers.

- Annual fee waiver for the first year - Some co-branded travel and premium rewards credit cards typically charge annual fees to offset the rewards they provide. However, as a welcome offer, these cards may waive the annual fee for the first year, thereby enticing people to apply for and secure a credit card.

- Additional spending rewards or bonuses - Financial institutions might provide additional rewards for expenditures during the first year of holding a card. This incentive promotes card usage and is typically restricted by a timeframe or a set monetary limit.

- Points or miles - Card users have the option to exchange their miles and reward points for a variety of benefits. These include airline tickets, hotel accommodations, gift cards, merchandise, statement credits, or cash back, depending on the terms of the relevant rewards program.

Examples

Let us study a few examples to understand the concept better.

Example #1

Suppose Dianne, a salaried employee, obtained her first credit card and received a sign-up bonus offer. The offer mandated spending $3000 to get points worth 300 that can be redeemed to buy home appliances at a discount.

Dianne spent $3,000 within the first three months, earning $300 bonus points that could be redeemed for home appliances at a discounted rate. She strategized her spending, making essential purchases like groceries, gas, and utility bills. She also planned a vacation and booked flights and accommodations.

As the three-month mark approached, Dianne diligently tracked her spending and crossed the $3,000 threshold. The credit card issuer credited her rewards account with the promised bonus points. With the $300 bonus points, Dianne chose a brand-new vacuum cleaner that cost $1500, which received a substantial discount of $300 out of pocket, saving her a substantial amount that she could spend on something else.

This experience served as a valuable lesson for Dianne, showcasing the potential benefits of credit card sign-up bonuses and how they could enhance her financial well-being.

Example #2

Let us discuss a product as an example of how these credit card offers are made to customers. Citi, a financial institution, aims to attract new customers by offering enticing rewards and benefits.

Under a specific product section titled Special Travel Offer, the bank offers its customers certain credit card benefits. They are:

- Cardholders can earn 20,000 bonus points by spending $1,500 within the first 3 months of account opening. These can be redeemed for $200 in gift cards or travel rewards at thankyou.com.

- A special travel offer allows users to earn 5 ThankYou Points for every dollar ($1) spent on hotel, car rentals, etc., booked on CitiTravel.com up to December 31, 2025.

- The card also offers a 0% introductory annual percentage rate (APR) on the available balance transfers and purchases for the next 15 months, with a variable APR of 18.74% up to 28.74% after that.

- An introductory balance transfer fee of 3% applies (minimum $5) for transfers when done within the first 4 months, increasing to 5% (minimum $5) after that.

- The bank also states that no annual fee will be charged.

This has been published on Citi’s website. Customers who wish to secure new credit cards can visit the websites of credit card issuer companies and decide which product they need. It is important to understand the terminology and terms & conditions of each product before making a purchase decision.

Example #3

A March 2024 USA Today article highlights the importance of prioritizing credit card payments to ensure one does not end up accumulating heavy debt while focusing on reward points and cash back. In one of the sections above, we have discussed why it is important to judiciously manage one’s finances and follow good money management practices to stay financially sound and healthy. Let us analyze this point further using a practical viewpoint.

The article throws light on how credit card users focus on collecting reward points, cash back, and other offers, even when they have not been able to pay their credit card bills. It says that gathering rewards may be lucrative, but increasing one’s debt burden is not. Ted Rossman, Bankrate’s senior industry analyst, weighed in on this matter after a survey was conducted by his team to understand how people use credit cards in the US.

Ted Rossman said that credit card users must prioritize interest payments over reward points to ensure they can rid themselves of debt sooner rather than later, as credit card debt can threaten an individual’s financial stability. He explained that while rewards offer benefits worth 1% to 5%, the interest charged on credit cards may go up to as high as 20% or more. Hence, striving to earn reward points is simply unintelligent.

How To Benefit From It?

Consumers can benefit from credit card sign-up bonuses by strategically leveraging them to offset significant expenses or planned purchases. By meeting the minimum spending criteria within the specified period, individuals can earn valuable rewards such as cash back or travel points.

To reap the benefits of the advertised welcome bonus, consumers typically must fulfill specific requirements, such as spending a set amount within a defined period, making purchases at designated merchants, or spending in specific bonus categories.

These criteria vary from one credit card issuer to another, so it is important for consumers to adequately review the terms and conditions of each welcome bonus offer. Let us look at a few offers to decode this concept further.

- Some credit cards provide the welcome bonus immediately after the first purchase or upon approval of the application. This is particularly common with smaller banks or for smaller bonuses. Consumers need to make purchases within designated limits to access bonuses.

- Co-branded retailer credit cards often require purchases at specific merchants to unlock specific portions of the signup bonus. Hence, card users need to purchase from these outlets or stores only to avail themselves of such benefits.

- Large or significant bonuses usually necessitate reaching a spending threshold within a specified timeframe, with defined start and end dates.

- Understanding deadlines is crucial. Consumers should be aware of the timeframes for meeting spending requirements to avoid missing out on the bonus due to late postings or miscalculated timeframes. Consumers are required to spend in the defined window to unlock potential benefits.

- If one is uncertain about whether the qualifying requirements have been met or what portion of it has been utilized or availed, they can seek clarification from the bank through secure messages or phone calls.

- Bonus rewards for spending as part of the welcome offer are earned incrementally with card usage. Before applying, consumers should assess whether their spending habits align with the ongoing reward conditions to maximize benefits.

Want a smarter way to bank on the go? Revolut offers a user-friendly app with global access, crypto and stock trading, and innovative budgeting tools—all in one powerful platform.

Disclosure: This article contains affiliate links. If you sign up through these links, we may earn a small commission at no extra cost to you.