Table Of Contents

What Is A Credit Card Minimum Payment Calculator?

A Credit Card Minimum Payment Calculator is a tool used to calculate the minimum amount that shall be required to be paid by the credit card holder at every end of the credit card billing cycle. The credit card users also get to know the time they would take if they decided to repay the installments as minimum amounts to the creditors.

In most cases, the minimum due would be more than the interest charges. If one is only paying the minimum due each month, it will take decades and years to complete the payment, or further, it could send a red alert to lenders that the credit card holder might be struggling to repay the debt.

Investors seeking a comprehensive platform may consider Saxo Bank International for a variety of account types and investment options.

How Does A Credit Card Minimum Payment Calculator Work?

A credit card payment calculator is a tool that allows creditors to find out the amount they would have to pay to the creditors if they decide to pay the minimum amounts applicable for repayment. This calculator also gives them an opportunity to figure out the time span of clearing the outstanding dues with creditors on paying minimum payments at regular intervals to them.

The Hargreaves Lansdown provides access to a range of investment products and services for UK investors.

At times, the credit card users do not have the financial capacity to pay in big amounts. This is where this calculator appears to be of their help. They calculate the smallest amount applicable for them to repay the creditors and accordingly schedule payments over time. As a result, they are able to repay the creditors without struggling much financially.

Formula

The formula for calculating Credit Card Minimum Payment is below:

(A * P) + I + L OR Minimum Fixed Amount in Dollars

Whichever is the higher amount would be the minimum payment on the credit card

Wherein,

- A is the total amount spent in a billing cycle

- I is the Interest if any applicable

- L is the Late fees charges

- P is the percentage or rate

A minimum payment on the credit card would mean that what is the bare minimum amount that one would be obligated contractually to pay each billing cycle of the credit card? If one cannot pay at least the minimum amount by the due date, then the credit card holder could be charged with a penalty APR (annual percentage rate) or late fee. After thirty days, if the credit card holder doesn't pay at least the minimum due amount, the account could be reported as delinquent, and further, the credit score will also take a hit.

Hence, it becomes necessary for the credit card holder to know what the minimum amount shall be due, which shall help him avoid any late payment fees and interest.

For efficient cross-border payments, many individuals and businesses use the Wise Money Transfer UK or Wise Money Transfer US services for transparent and low-cost transfers.

How to Calculate?

One needs to follow the below steps to calculate the Minimum Payment.

- Determine the total spending made by the credit card holder in the given billing cycle of the credit card.

- Multiply the amount arrived at in step 1 by the rate, which the bank decides as the minimum payment percentage.

- Compare the amount arrived in step 2 to the minimum fixed payment set up by the bank, and if it is less than that, then that amount shall be the minimum amount due, or else the bank decides the fixed payment.

- Find out if any interest or late fee charges have been applied in the billing cycle.

- Take the sum of the values in steps three and 4, which shall be the total minimum amount due on the credit card for that billing cycle.

Examples

Let us consider the following instances to understand how this calculator works:

Example #1

Mr. X has held a corporate credit card for the last five years. He has been fulfilling his payments by claiming a reimbursement in time. But since the policy has changed and since then, some of the payments were not made in time, and he was charged with a late fee payment of $ 10, and interest was applied to $160. In the last billing cycle, he spent around $55,000, which includes both personal and official expenses. The Bank has fixed 5% as the minimum due amount, which shall be required to be paid by the credit card holder, and the amount cannot be less than $50.

Based on the given information, you must calculate the total minimum amount due on this corporate credit card.

Solution:

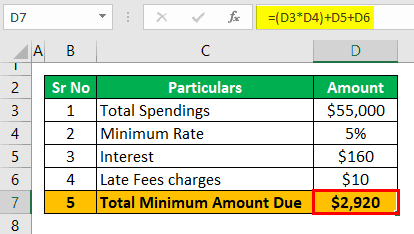

We are given the below details:

| Sr No | Particulars | Amount |

|---|---|---|

| 1 | Total Spendings | $55,000 |

| 2 | Minimum Rate | 5% |

| 3 | Interest | $160 |

| 4 | Late Fees Charges | $10 |

Now, we can use the below formula to calculate the total minimum amount due on this corporate credit card.

- = ($55,000 * 5%) + $160 + $10

- = $2,920.

The above amount should be more than $50, or else $50 would be the minimum payment.

Therefore, the minimum due on their corporate credit card, Mr. X, would be $2,920.

Example #2

Miss Renuka is a young woman who has a hobby of shopping. She just received her new amazon IDIDI credit card and is enthusiastic about starting using it. She has already created a list of which she wants to do the shopping. First, she swipes the credit card at a shopping mall wherein she purchases a dress for $600 and drinks tea at the mall for $5. She also uses the card to recharge her mobile cell bill for $25 and makes her insurance payment by the same credit card for $800.

During the same billing cycle, she spends on the movie $15 and goes to a fine dining restaurant wherein she spends $30. The bank has fixed 3% as the minimum amount due, and the amount cannot be less than $60.

Based on the given information, you must calculate the total minimum amount due to the credit card holder by Miss Renuka.

Solution:

We are given the below details:

- Interest Charges as $0

- Late Payment Charges $0

| Sr No | Particulars | Amount |

|---|---|---|

| 1 | Shopping Mall Bill | $600 |

| 2 | Tea bill | $5 |

| 3 | Mobile Bill | $25 |

| 4 | Insurance Payment | $800 |

| 5 | Movie | $15 |

| 6 | Restaurant | $30 |

| 7 | Minimum Rate | 3% |

| 8 | Interest | - |

| 9 | Late Fee Charges | - |

The total amount of spending needs to be calculated below:

Now, we can use the below formula to calculate the total minimum amount due on this credit card.

- = (1,475 * 3%) + 0 + 0

- = $44.25

The above amount should be more than $60, or else $60 would be the minimum payment.

Therefore, the total minimum due to their credit card Miss Renuka would be $60.

Importance

A credit card minimum payment calculator can calculate the minimum amount due on the credit card; that shall be useful if the credit card holder is a little short of income in a particular billing cycle — for example when they had recently very large expenses or were in between jobs.

This calculator makes it easier for credit card users to calculate the smallest amounts that they can pay easily for using credit cards. They just need to put in the details of the amount they would could easily repay at regular intervals and therefore find out the span of time to be taken and the interest payments applicable for the schedule.

Based on the results, they decide what amount to pay back every month to ensure repayment is effectively done without much of financial struggle. This calculator gives preference to the credit card users’ capability of paying off and hence calculates other details based on the most feasible amount they are fine with paying every month. As a result, they can easily find multiple ways of dealing with the repayments.

Want a smarter way to bank on the go? Revolut offers a user-friendly app with global access, crypto and stock trading, and innovative budgeting tools—all in one powerful platform.

Disclosure: This article contains affiliate links. If you sign up through these links, we may earn a small commission at no extra cost to you.