Table Of Contents

Key Takeaways

- Country Risk Premium (CRP) refers to the extra returns the investor anticipates to assume the investment risk in foreign markets compared to the domestic country.

- When determining the Country's Risk Premium, macroeconomic factors such as inflation, currency fluctuations, fiscal deficit, and concerned policies must be considered.

- The equity risk premium encourages investors to invest in risky assets in domestic markets. Moreover, it offers further force to take uncertainties in foreign markets.

- It is a dynamic statistic. In addition, it must be continuously tracked and updated in financial markets and investment analyses.

Examples

Let us see some examples of country risk premium to understand it better.

Example #1

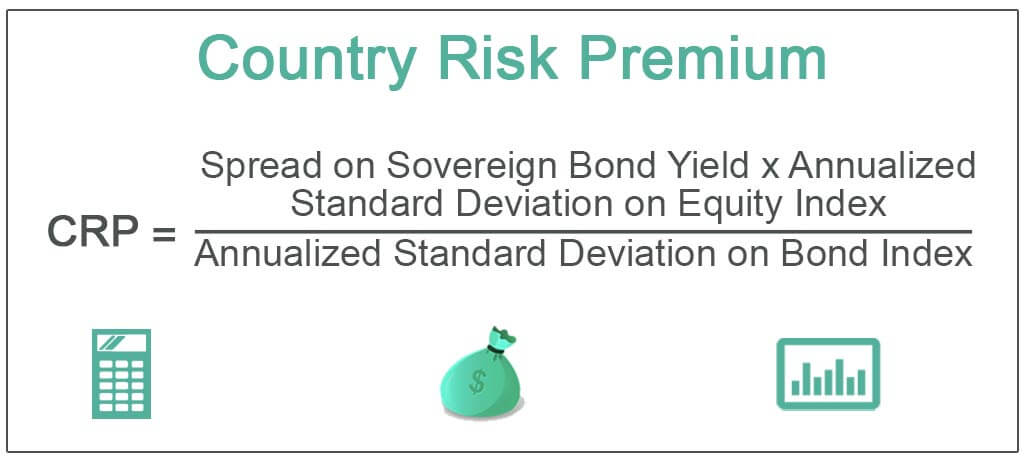

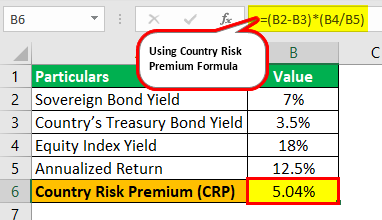

If a country has an annualized return of 18% and 12.5% on equity and bond index, respectively, over 5 years, what is the country's risk premium? The country's treasury bond has yielded a 3.5% return. In contrast, the sovereign bond has a 7% yield in a similar period.

Solution:

Simple substitution in the formula above gives us the CRP.

- CRP = (7% - 3.5%) x (18%/12.5%)

- CRP = 3.5% x 1.44%

- CRP = 5.04%

Example #2

Calculate the CRP with similar yields as the example above, other than the equity index yield of 21%.

Solution:

Again, putting the values in the formula, we get:

- CRP = (7% - 3.5%) x (21%/12.5%)

- CRP = 5.88%

Notice that as the equity index yield increases from 18% to 21%, the CRP increases from 5.04% to 5.88%. That can be attributed to the higher volatility in the equity market, which has produced a higher return and raised the CRP with it.

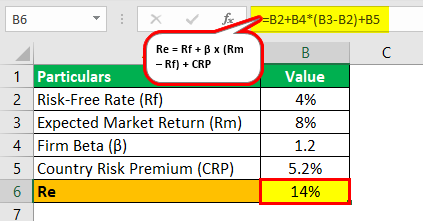

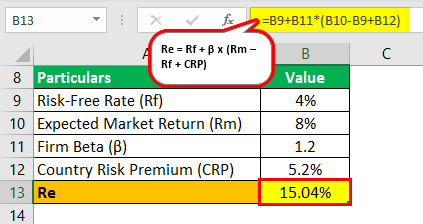

Investors’ Perspective

While the equity risk premium incentivizes investors to invest in risky assets in domestic markets, it provides further impetus to accept uncertainties in foreign markets. Some of the advantages of CRP are: -

- To a significant extent, country risk premia clearly distinguish between developed economies' risk-return profiles against developing economies. Prof. Aswath Damodaran has summarized country risk premia and related components globally. Below is an excerpt:

| Country | Equity Risk Premium | Country Risk Premium |

|---|---|---|

| Iraq | 16.37% | 10.41% |

| India | 8.60% | 2.64% |

| Korea DPR | 22.61% | 16.65% |

| UK | 6.65% | 0.69% |

| USA | 5.96% | 0.00% |

- According to some analysts, beta does not estimate the country risk for firms, thus resulting in a low equity risk premium for the same risk ventures.

- Some scholars also argue that the risks due to a country’s macroeconomics are better captured by the cash flow positions of the firm. That raises the issue of the futility of country risk estimation as an additional level of security.

Conclusion

A country risk premium is a difference between the market interest rates of a benchmark country and that of the subject country. Of course, the less attractive economies have to offer a higher risk premium for foreign investors to attract investments.

It is a dynamic statistic that needs to be continuously tracked and updated in analyses around financial markets and investments. It assumes many factors while ignoring many others. Country risk can be better estimated when every significant aspect is appropriately valued in risk and return. Events such as the Russia-NATO conflict, tensions in the Gulf region, Brexit, etc., will certainly impact the geopolitical risk scenario.