Table Of Contents

What Is Cost Recovery Method?

The Cost Recovery Method is one of the revenue recognition methods in which the company does not record gross profit or income generated against the goods sold to the customer until the total cost element related to the respective sale has been received fully by the company from the customer.

After the whole cost amount has been received, the remaining amount will be recorded as an income. This means that the amount received from the customers for all products and services sold must exceed the cost of producing those goods. The differential value is ultimately the profit secured for a business.

Table of contents

Cost Recovery Method Explained

Cost recovery method, as the name suggests, refers to the method of computing profits based on how efficiently the cost of goods have been recovered through the sale of products. This technique helps businesses live in reality instead of considering the sales figures as their success.

There are times when businesses sell unexpected number of goods and services, but they are hardly able to cover up for the cost of goods and products. Cost recovery method of accounting is adopted by businesses that believe in covering this cost of goods and services rather than how much sales figures they have achieved for a period.

The businesses calculate the cash gathered from the sale of the goods and services and then compute the total cost of those items sold. If the former is more than the latter, the differential amount is the profit for that business.

Though this method is one of the significant tools of calculating the profits for a business, it comprises some uncertainties. This is because the calculation of the net profit completely depends on the cash collected against the cost of goods and services, which are two uncertain factors. Therefore, this cost recovery method is opted for when businesses are unable to figure out accurate revenue generated because of confusing or non-dependable information on sales figure.

When To Use?

In the case of the cost recovery method, the company will recognize the amount earned over and above the cost as gross profit or income when the same has been received after recovering all the costs incurred by the company, i.e., the company will recognize the revenue only when the actual money has been received by it from the customers against the sales made. Cost recovery method of revenue recognition can also be used in multiple scenarios, which have been mentioned below:

- The company uses the cost recovery approach for revenue recognition in case there is reasonable uncertainty concerning the collection of money from the customers against the sales made on the credit basis because, by far, this method is the most conservative out of all of the revenue recognition methods available.

- This method is utilized mainly when collection against the sales of the goods from the customers is highly uncertain for the company and also where it is difficult to justify the installment method.

- Also, in case the company cannot accurately determine the sale value. This method is preferred because, in those cases, since total revenue earned by the is difficult to determine, recording the revenue equal to receipts that match the cost incurred by the company is prudent.

- With the cost recovery method, there is a delay in the due date of the tax payment as the tax will be payable only after the company has recovered the full cost of the product. So, with this method, the owner of the business can make some savings.

Examples

Let us consider the following instances to understand how cost recovery method of accounting even better:

Example #1

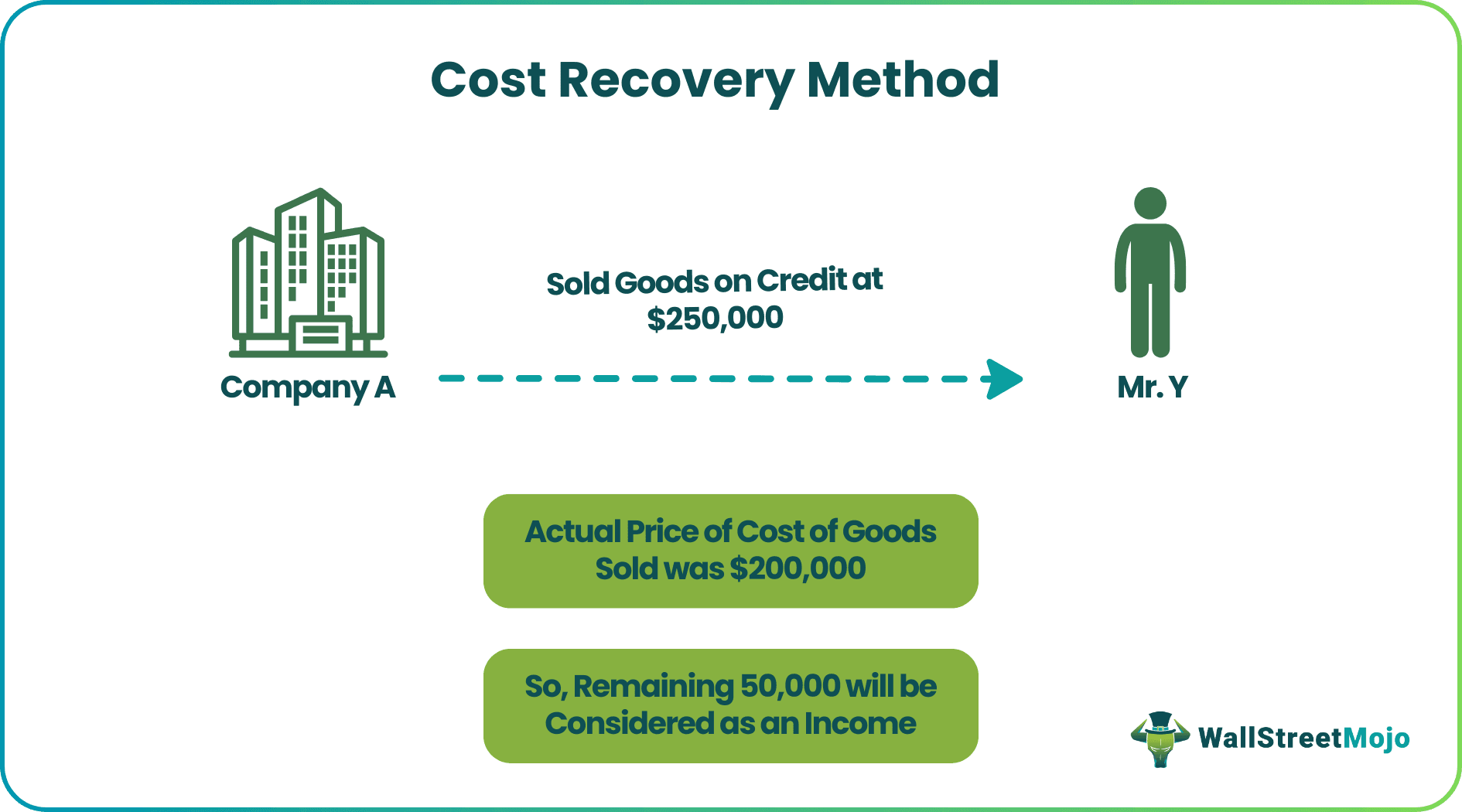

For revenue recognition, the company follows the cost recovery method as there is uncertainty concerning the recovery rate of the money from many of the business's customers. For example, Company A ltd. sells the goods on credit to its customers. On September 1, 2016, it sold some goods on credit to one of its customers, Mr. Y, for $ 250,000. The cost of the goods sold for company A ltd was $ 200,000.

When to recognize the company's profits as per the cost recovery method? At the time of sale, the company received $ 50,000 instantly, and the company received the rest of the payments in the subsequent years. $ 50,000 were received in the year 2017, $ 100,000 in the year 2018, and the balance of $ 50,000 was received in the year 2019.

According to the cost recovery method, the company will not record the gross profit or the income generated against the goods that are sold to the customer until the total cost element related to the respective sale has been received fully by the company from the customer. After the whole cost amount has been received, the remaining amount will be recorded as an income.

- In the present case, the company sold some goods on credit to Mr. Y on September 1, 2016, for $ 250,000. The actual cost of the goods sold was $ 200,000.

- The company received the payment against the goods sold in installments. $ 50,000 were received instantly, $ 50,000 were received in 2017, $ 100,000 in 2018, and the balance of $ 50,000 in 2019.

- Now, $ 50,000 ($ 250,000 – $ 200,000) is the profit of the company, which it will not recognize in the accounting period in which the sales are made; rather, the same will be recognized as income in the period in which payment is received after recovering the cost of goods sold.

- The Sum of the amount received in 2016, 2017 and 2018 is $ 200,000 ($ 50,000 + $ 50,000 + $ 100,000) which is equivalent to the cost cost of goods sold, so, no earnings will be recorded in those years.

- However, the amount received above the cost of goods sold in 2019, amounting to $ 50,000, will be recorded as the earnings of 2019.

Example #2

On October 1, 2013, the Sapphire Corporation, a steelmaker, sold some steel bars for $80,000. The customers are required to satisfy four yearly payments of $20,000 and interest payments every October 1, starting November 1, 2013, as per the agreement. The steel bar formation cost is $56,000. The firm's fiscal year concludes on December 31.

| Date | Cash Collected | Cost Recovery | Gross Profit Recognized |

|---|---|---|---|

| October 1, 2013 | $20,000 | $20,000 | $ – |

| October 1, 2014 | $20,000 | $20,000 | – |

| October 1, 2015 | $20,000 | $16,000 | 4,000 |

| October 1, 2016 | $20,000 | – | 20,000 |

| Totals | $80,000 | $56,000 | $24,000 |

The company has begun to recognize profits after two straight years of operations starting October 1, 2015, and after successful cost recovery.

Advantages

Cost revenue method is a method that helps figure out the revenue figures clearly by segregating the amount collected from the sale of goods and products from the total amount collected from customers. If the latter exceeds the former, it is considered a profit.

Let us check some of the benefits of the process below:

- The company uses the cost recovery approach for revenue recognition in case there is reasonable uncertainty concerning the collection of money from the customers against the sales made on the credit basis because, by far, this method is the most conservative out of all of the revenue recognition methods available.

- With the cost recovery method, there is a delay in the due date of the tax payment as the tax will be payable only after the company has recovered the full cost of the product. So, with this method, the owner of the business can make some savings.

Disadvantages

Undoubtedly, the cost recovery method has multiple benefits, but its calculation of profits witnesses some challenges as well. Let us look at the limitations of the cost recovery method of accounting below:

- Using the cost recovery method, although the company recognizes the cost and sales, the gross profit in respect of the same will not be recognized even if some sale is essentially the receivable for the company, and the gross profit will be recognized only in case the entire receipts have been received.

- In this method, the company's profits are referred to as the period when the payment against that profit is received. So even if the sale pertains to one period, the company would not be able to show it as income for that period.

Recommended Articles

This article has been a guide to what is Cost Recovery Method. Here, we explain the concept along with examples, when to use it, advantages and disadvantages. You can learn more from the following accounting articles –