Table Of Contents

What Is The Cost of Sales?

Cost of Sales can be referred to as those directly attributable to the production of the goods that shall be sold in the firm or an organization. It can be calculated by adding the cost of the goods purchased or manufactured to the opening stock of that period and subtracting the closing stock of that period, where the cost of goods manufactured includes the cost of direct and indirect material, direct and indirect labor and overhead manufacturing costs.

By comprehensively understanding the components that constitute cost of sales equation, businesses can make important decisions about pricing strategies, production efficiency, and overall financial health. Monitoring and managing these direct costs not only provide insight into a company's operational efficiency but also serve as a linchpin for strategic planning, ensuring sustainable growth and long-term success in a competitive economic landscape.

Cost of Sales Explained

Cost of sales, often referred to as COGS, represents the direct expenses incurred in the production of goods or services that a company sells. This essential metric encompasses various expenditures directly tied to the creation of a product, from raw materials to direct labor costs and manufacturing overheads.

At its core, the cost of sales is a reflection of the resources invested to bring a product to market. Raw material expenses constitute a significant portion of COGS, encompassing the costs associated with acquiring the essential components needed for the production process. This extends beyond mere purchase prices to include shipping, handling, and any other expenses directly related to obtaining these materials.

Direct labor costs, another integral facet of cost of sales, encapsulate the wages and benefits paid to the workforce directly involved in the production process. This spans everyone from assembly line workers to machine operators, whose efforts contribute directly to the creation of the final product.

In addition to raw materials and labor, manufacturing overhead costs also factor into the cost of sales calculator. These overheads encompass a wide array of indirect expenses, including utilities, facility maintenance, and equipment depreciation, all of which play a vital role in the production process. Still, they aren’t directly tied to specific units of output.

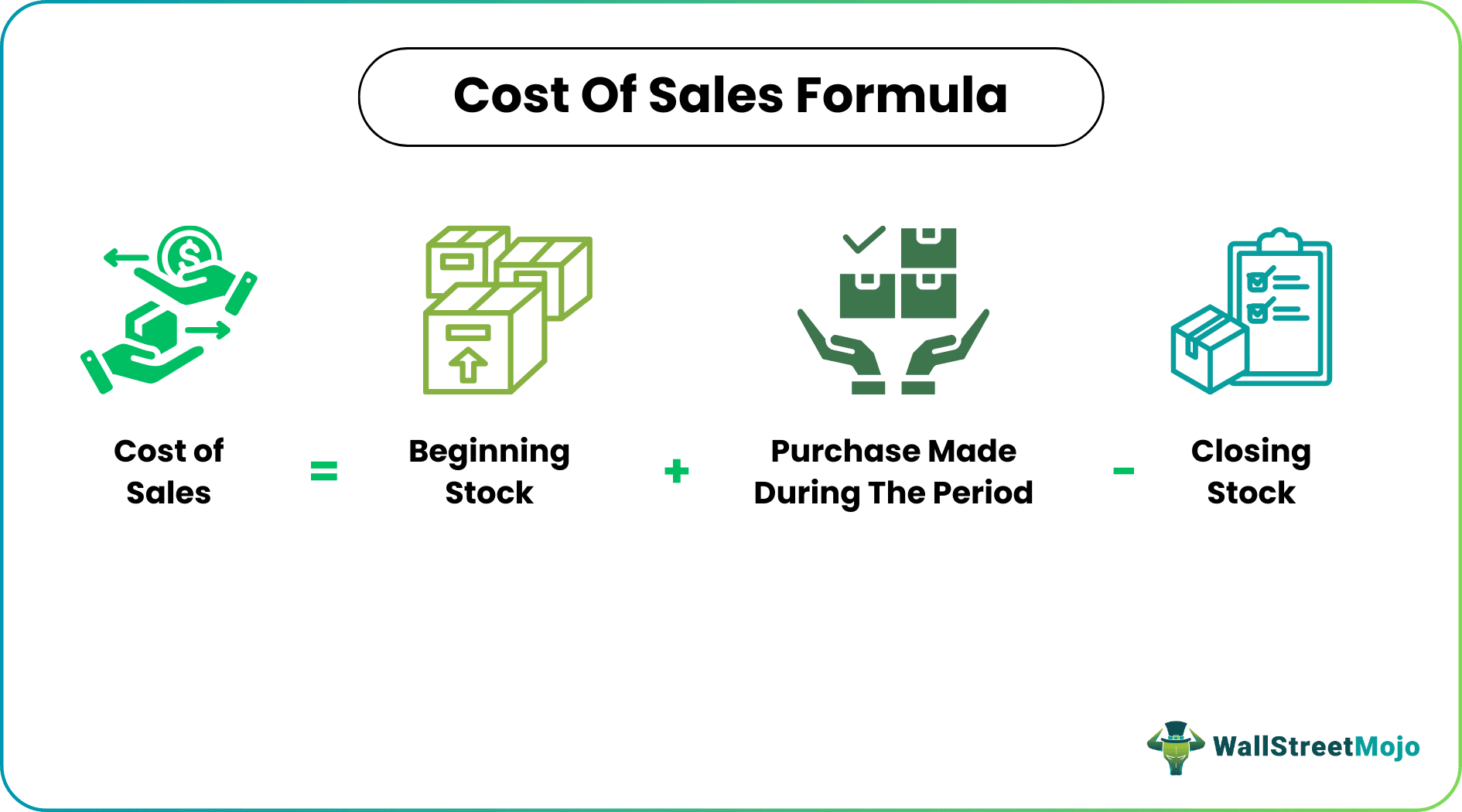

Formula

Let us understand the formula that shall act as the basis of our understanding of the intricate details of the cost of sales equation through the discussion below.

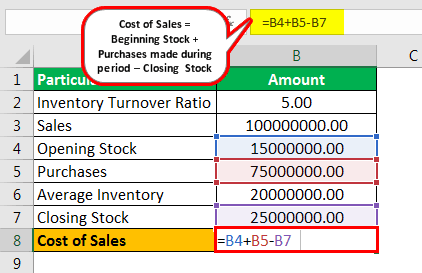

Cost of Sales = Beginning Stock + Purchases made During the Period – Closing Stock

Here,

- Inventory sold by the company will appear in the profit and loss statement under the Cost Of Goods Sold account. The beginning stock for the year is the stock that is leftover from the prior year—that is, the merchandise or the product which was not sold in the prior year.

- Any new or additional purchases or productions made by a retail or a manufacturing firm shall be added to the beginning stock.

- At the end of the current reporting period, the products or the merchandise that was not sold shall be subtracted from the total of the beginning stock and any new or additional procurements or purchases.

- The resultant or the final number derived from the above calculation will be the cost of sales, or in other words, it will be the cost of goods sold for the reporting period.

Revenue vs Sales Explained in Video

Examples

Now that we understand the basics and related factors of the cost of sales calculator, let us apply the theoretical knowledge to practical application through the examples below.

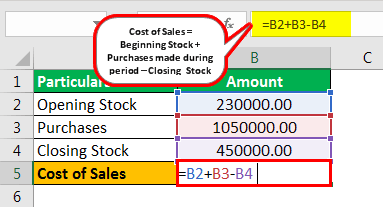

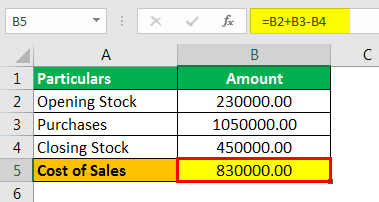

Example #1

Inventory limited reported goods sales numbers this quarter. The Gross profit was reported as better than in the previous quarter. The company reported 230,000 as of the opening stock, 450,000 as closing stock, and 10,50,000 as net purchases. You are required to compute the cost of sales for inventory limited.

Solution:

We are given opening stock, closing stock, and purchases; therefore, we can use the below formula to calculate the cost of sales.

- Opening Stock: 230000.00

- Purchases: 1050000.00

- Closing Stock: 450000.00

The calculation can be done as follows:

= 230,000 + 10,50,000 – 450,000

Example #2

AMC limited recently reported its numbers. The shareholders have asked for an internal audit as they believe the management has conceded certain facts. Mr. J & Co. was appointed as the internal auditors of the company. He wanted first to calculate the company's gross profit via production records. He first wanted to calculate the cost of sales based on available information. You are required to compute the cost of sales. He was given the following details:

- Inventory Turnover Ratio: 5.00

- Sales: 100000000.00

- Opening Stock: 15000000.00

- Purchases: 75000000.00

Solution

Here, we are not given directly closing stock, which we first need to calculate.

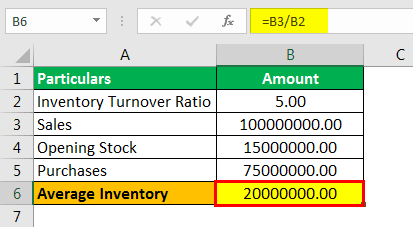

Average Inventory

Inventory Turnover Ratio = Sales /Average inventory

5 =100,000,000 /Average inventory

Average Inventory = 100,000,000 / 5

- Average Inventory = 20,000,000

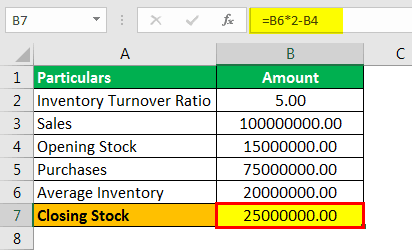

Now, we can calculate closing stock using the below formula

Average Inventory =Opening stock + Closing stock/ 2

20,000,000 = 15,000,000 + Closing stock / 2

Closing stock= 40,000,000 – 15,000,000

- Closing Stock=25,000,000

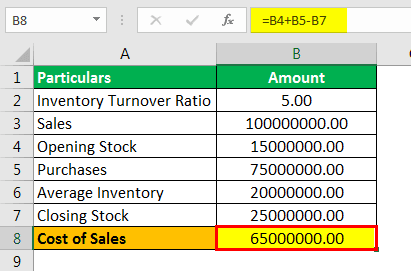

Calculation can be done as follows:

=15,000,000 + 75,000,000 – 25,000,000

Cost of Sales will be -

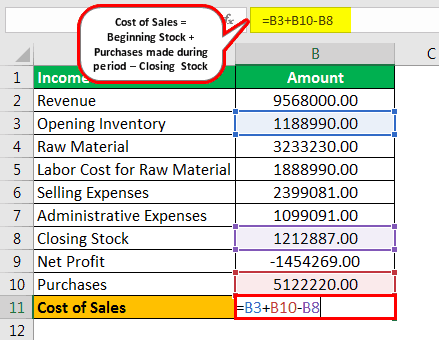

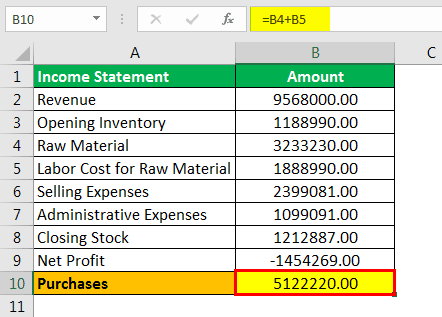

Example #3

XYZ, a newly listed company on the stock exchange, has reported below the income statement. From the below statement, you are required to compute the cost of sales.

- Revenue: 9568000.00

- Opening Inventory: 118899.00

- Raw Material: 3233230.00

- Labor Cost for Raw Material: 1888990.00

- Selling Expenses: 2399081.00

- Administrative Expenses: 1099.91.00

- Closing Stock: 1212887.00

- Net Profit: -1454269.00

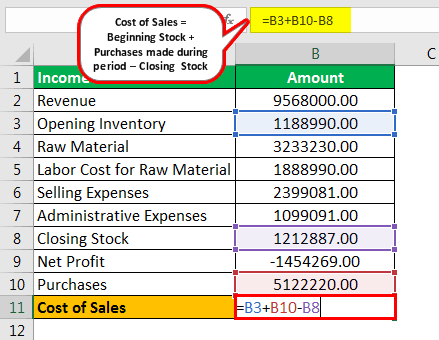

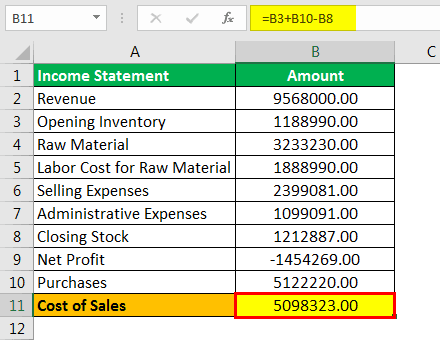

Solution:

We are given opening and closing stock here, but we are not given the net purchase figure directly. First, we shall calculate the purchase cost.

Purchase Cost

Purchases =51,22,220

We shall take the total raw material and labor cost for raw material as purchase cost, which is 32,33,230 + 18,88,990, which equals 51,22,220.

The calculation can be done as follows:

= 11,88,990 + 51,22,220 – 12,12,887

Relevance and Uses

Now that we have a fair understanding of the concept and its intricacies, it would be incomplete to not know its relevance and uses in the world of business and finance. Let us do so through the explanation below.

Cost of Sales is a vital metric on the financial statements of the company as this figure is subtracted from the firm’s sales to determine its gross profit. The gross profit is a type of profitability measure that evaluates how efficient the firm or an organization is in managing its supplies and labor in production.

Because the cost of sales is the cost of conducting the business, this can be recorded at the expense of the business in the face of the profit and loss statement. Knowledge of this cost shall help the investors, analysts, and managers estimate the firm's bottom-line figure. Businesses or companies try to keep their sales cost low so that the net income can be reported as higher. If the Cost Of Goods Sold increases, the company's net profit would decrease. While this movement can be beneficial for income tax purposes, the company or the firm will have low profit for its investors or shareholders.

Cost of Sales Vs Cost of Goods Sold

Despite the close association of both the terms, let us understand the distinctions between the two concepts through the comparison below.

Cost of Sales

- Cost of Sales (COS) is a comprehensive financial metric that accounts for all direct expenses incurred by a business in the process of selling either goods or services.

- It refers to a broader spectrum, COS includes the costs directly associated with the production and delivery of both tangible goods and services. It extends beyond the realm of physical products to cover expenses related to service provision.

- COS includes raw material costs, direct labor expenses, and manufacturing overhead. For service-oriented businesses, it also considers costs associated with delivering the service, such as labor and any necessary materials.

- The calculation involves summing up all direct costs, making it a more inclusive metric that provides a holistic view of the resources invested in bringing products or services to market.

Cost of Goods Sold

- Cost of Goods Sold (COGS) is a specific subset of COS, focusing exclusively on the direct expenses related to the production of tangible goods.

- COGS is primarily applicable to businesses dealing with physical products. It is a narrower concept than COS and is commonly used in industries such as retail and manufacturing.

- COGS considers costs such as raw materials, direct labor, and manufacturing overhead that are directly attributable to the creation of tangible goods.

- The formula for COGS is straightforward: it involves adding up the direct costs associated with the production of goods, excluding any indirect or service-related expenses.

- Businesses often use COGS to assess the profitability of their core product offerings, making it a vital metric for pricing strategies and overall financial planning.