Table Of Contents

Examples of Cost of Goods Sold (COGS)

Costs of goods sold are those costs directly related to the production of goods and services. These costs are also referred to as the cost of the sales or cost of the services and play a very important role in the decision-making process. Examples of Cost of Goods Sold include the cost of the materials, prices of the goods purchased for reselling further, the distribution cost, etc.

Top 3 Examples of Cost of Goods Sold (COGS)

Example #1

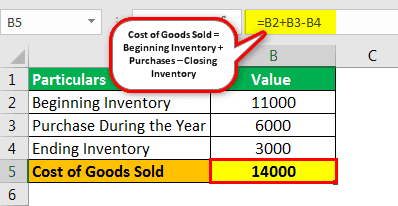

Company ABC Ltd. has the following details for recording the inventory for the calendar year ending on December 31st, 2018.

Inventory at the beginning of the calendar year, recorded on January 1st, 2018, is $11,000, and the Inventory at the end of the calendar year, recorded on December 31st, 2018, is $3,000. During the calendar year, the company makes purchases of $6,000. Calculate the cost of goods sold during the calendar year ending on December 31st, 2018.

Solution

Using the above details, the COGS will be calculated for the year ending on December 31st, 2018, for company ABC Ltd.

Calculation of Cost of Goods Sold is as follows –

Cost of Goods Sold formula = Beginning Inventory + Purchases – Ending Inventory.

Cost of Goods Sold = $11,000 + $6,000 – $3,000

Cost of Goods Sold = $14,000

Analysis

Thus in the present case, the cost of goods sold by company ABC Ltd. for the year ending on December 31st, 2018, is $14,000. This number is vital for the company as it will help it make a better decision. E.g., Let’s say the same material is available at a better rate in the market. The company will compare prices and go for low costing with the same product quality.

Along with the evaluation of the cost and profits, the cost of goods sold will also help the company in planning out the purchases for the next year as the company will get to know that out of beginning inventory and purchases, what is left out as ending inventory for the following year.

Example #2

At the beginning of the calendar year 2018, company XYZ Ltd started purchasing and selling batteries. It made purchases worth $50,000 during this period. By the year-end, it had goods worth $ 10,000 as the closing inventory. Calculate the cost of goods sold by the company for the year ending.

Solution: In the present example, the details given are as follows:

- Purchases during the year: $50,000

- Closing inventory: $10,000

Cost of Goods Sold Calculation -

Cost of Goods Sold = Opening inventory + Purchases – Closing Inventory

Cost of Goods Sold = $ 0 + $50,000 – $10,000

Cost of Goods Sold = $40,000

In this case, since the operations were only started during the current year, there will be no opening inventory of the company. Thus, the same will be taken as zero while calculating the cost of goods sold.

Example #3

Company ABC Ltd. manufactures and sells cookies. The direct cost of manufacturing one packet of cookies comes to $ 1.5 per unit. The opening inventory of the cookies is 3,000 units. During the year, it made purchases worth $50,000, received a discount of $5,000, and incurred $10,000 as freight expenses. Out of the total purchases, purchases worth $7,000 were returned to the party. At the end of the year, it had 1,000 units as the closing inventory. Calculate the cost of goods sold.

Solution

The calculation of Opening Inventory Cost will be as follows-

- Opening Inventory Cost = Opening units * direct cost per unit

- Opening Inventory Cost = 3,000 * $ 1.5 = $4,500

The calculation of Closing Inventory Cost will be as follows-

- Closing Inventory Cost = Closing units * direct cost per unit

- Closing Inventory Cost = 1,000 * $ 1.5 = $1,500

Cost of Goods Sold Calculation

- Cost of Goods Sold = Opening inventory + Purchases – Discount –Purchase return + Freight in - Closing Inventory

- Cost of Goods Sold = $4,500 + $50,000 – $5,000 – $7,000 + $10,000 - $1,500

- Cost of Goods Sold = $51,000

Analysis: The cost of goods sold by the company is $51,000. Return and allowances are deducted while calculating the cost of goods sold as they are returned to the customers. Discount received decreases the purchase cost, reducing the cost of goods sold. Freight is the direct expenditure incurred for purchasing the material and thus added while calculating the cost of goods sold.

Video Explanation of Cost of Goods Sold Examples

Conclusion

The accounting term, which describes the expenses incurred for creating the goods or obtaining the goods to sell them, is known as the cost of the goods sold. It includes direct costs only. The businesses that are into the business of selling the products can only list the cost of the goods sold on their statement of income. While calculating the cost of the goods sold, only the inventory sold during the current accounting period should be included.

The cost of the goods sold is shown in the statement of income. It should be taken as an expense while analyzing that accounting period. The cost of the goods sold is matched with revenues earned from selling the goods, thereby considering the gross profit. The cost of the goods sold is matched with revenues earned from selling the goods, thereby considering the matching principle of the accounting. When the cost of the goods is subtracted from the total revenue, the results will be the gross profit. While calculating the cost of the goods sold, the inventory methods used by the company for valuing the inventory should be taken care of as it can give the different costs of the goods sold for the identical companies.