Table Of Contents

What Is The Cost of Goods Manufactured?

The cost of goods manufactured in the total production cost of goods produced and completed by the company during an accounting period. Typically, businesses whose principal line of business is manufacturing create a separate schedule to calculate the cost of goods manufactured to determine their cost-effectiveness.

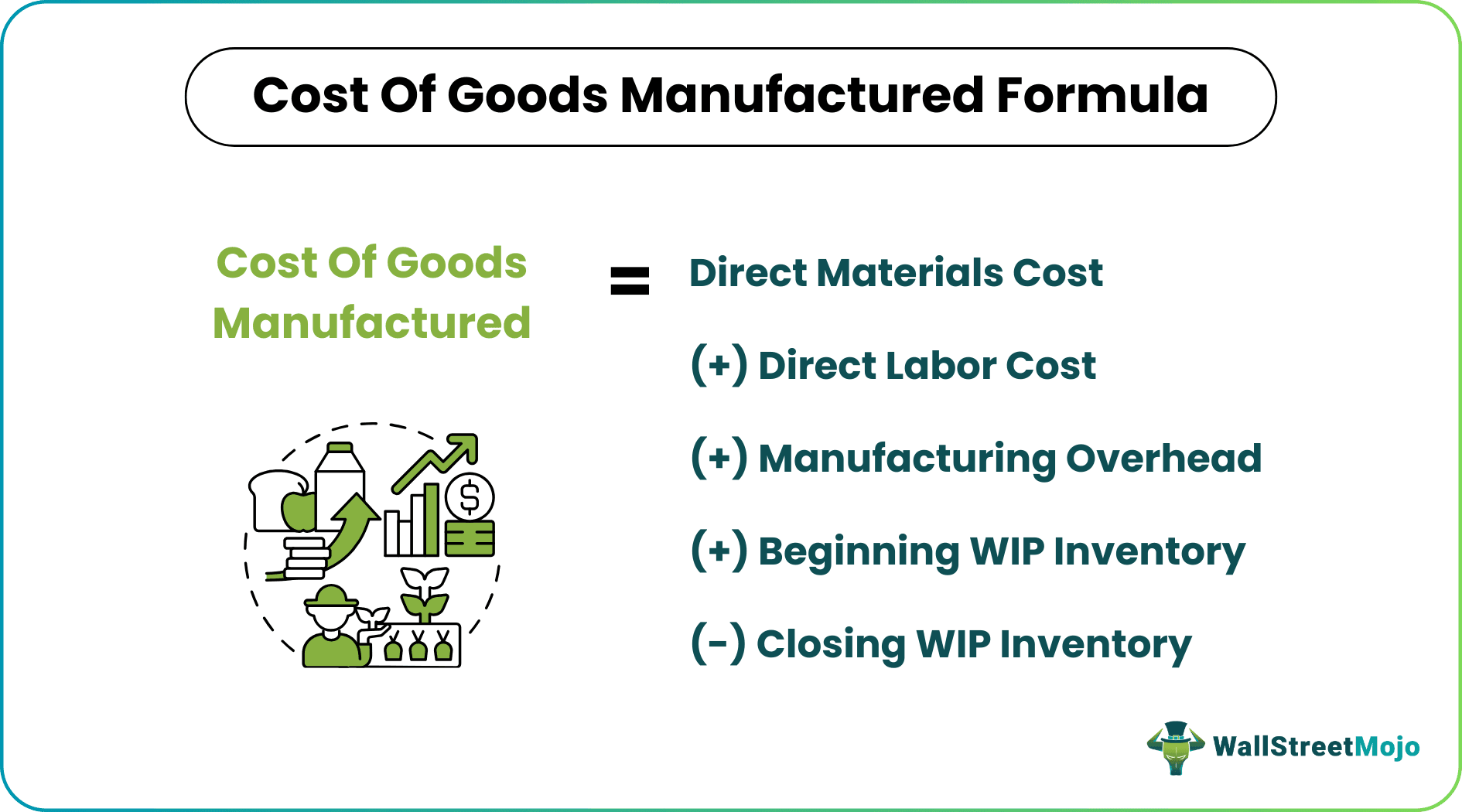

Cost of Goods Manufactured Formula

The cost of goods manufactured formula is represented as follows,

Cost of Goods Manufactured = Direct Materials Cost (+) Direct Labor Cost (+) Manufacturing Overhead (+) Beginning WIP Inventory (-) Closing WIP Inventory

Explanation

The Cost of goods manufactured can be calculated by summing up the total cost of manufacturing; which shall include all direct labor costs, direct materials cost, and other factories' overhead costs; to the opening work-in-process stock and then deducting the ending inventory in the process stock. This is nothing but the cost sheet of the company, and it includes prime cost as well. Hence adding all of the manufactured stage inventory and all the direct expenses will sum up to the cost of goods manufactured, and when one divides the same by the number of units produced will yield the cost of goods manufactured.

Examples

Example #1

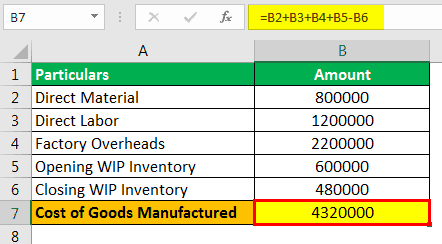

PQR Ltd. has produced the following details from its production department. Therefore, you are required to calculate the cost of goods manufactured.

- Direct Material: 800000

- Direct Labor: 1200000

- Factory Overheads: 2200000

- Opening WIP Inventory: 600000

- Closing WIP Inventory: 480000

Solution

Therefore, the calculation of the cost of goods manufactured is as follows,

- = 8,00,000 + 12,00,000 + 22,00,000 +6,00,000 - 4,80,000

Cost of Goods Manufactured will be -

- Cost of Goods Manufactured = 43,20,000

Example #2

Mr. W has been working in the FEW manufacturing, and he has been asked to work on creating the cost sheet of the Product “FMG” and present the same in the next meeting. Therefore, the following details have been obtained from the production department.

- Number of Units: 500

- Material Cost Per Unit: 250

- Labor Cost Per Unit: 200

- Factory Overheads: 250000

- Opening WIP Inventory: 79000

- Closing WIP Inventory: 63200

Based on the above information, you are required to calculate the cost of goods manufactured.

Solution

Here we are not given directly Material and Labor Cost. We need to calculate the same first.

We just need to multiply the cost per unit by the number of units as per below:

Calculation of Material and Labor Cost

- Material Cost = 250 x 500

- =125,000

- Labor Cost = 200 x 500

- = 100,000

Therefore, the calculation of the cost of goods manufactured is as follows,

- = 125,000 + 100,000 + 250,000 + 79,000 - 63,200

Cost of Goods Manufactured will be -

Hence, the cost of goods manufactured will be 490,800.

Example #3

Start industries have started to manufacture a new product called “Avenger Sword.” It will be used during war times and is designed in such a way that it can be used as a sword and as well as a shield. However, being a nonprofit organization, they are not worried about its pricing. But to continue production, they need to recover the cost at least. Hence the management of the start industries has asked the production department to send over the cost incurred while producing the newly invented product “Avenger Sword.”

Below are the details provided by the production department:

- Number of Units: 100

- Material Cost Per Unit: 491250

- Labor Cost Per Unit: 378000

- Factory Overheads: 43750000

- Opening WIP Inventory: 29862000

- Closing WIP Inventory: 23889600

The above details are in US$ and in thousands. You are required to calculate the cost of goods manufactured and also per unit cost.

Solution

Here we are not given directly Material and Labor Cost. We need to compute the same first.

We just need to multiply the cost per unit by the number of units as per below:

Calculation of Material and Labor Cost

- Material Cost = 491,250 x 100 = 49,125,000

- Labor Cost = 378,000 x 100 = 37,800,000

Therefore, the calculation of the cost of goods manufactured is as follows,

= 49,125,000 + 37,800,000+ 4,37,50,000 + 2,98,62,000 - 2,38,89,600

Cost of Goods Manufactured will be -

- Cost of Goods Manufactured = 13,66,47,400

Hence, the cost of goods manufactured will be 13,66,47,400 and per unit, it will be 1,366,474 when divide it by 100.

Relevance and Uses

Cost of Goods Manufactured or Manufacturing Account calculations serve the following purposes:

- It shall help in setting out with appropriate classification of the elements of the costs in detail.

- This will also aid the management in the reconciliation of financial records with the costing records.

- Further, this statement will also serve as the basis for the comparison of operations of manufacturing on a year-to-year basis.

- All of the above will also allow the firm to properly plan its resource utilization, product pricing strategy, volume production planning, etc.

- If the firms have schemes such as profit sharing plan and are in force, then it may also help them in fixing the amount of production along with profit-sharing bonuses.