Table Of Contents

What Is Cost of Funds?

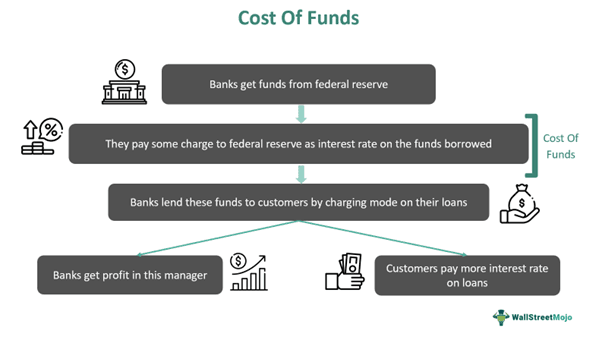

Cost of funds (COF) relates to a term used in the banking and financial sector, which means the amount spent by lenders to get funds for lending to their customers. The cost of funds helps lenders calculate their profit by subtracting it from the interest levied on the borrowers. The funds get borrowed by lenders or financial institutions from the US federal reserve.

A lower cost of funds allows the banks to get better returns from the funds they lend to borrowers, and the customers have to pay lower interest rates. Meanwhile, customers generally get to pay more interest rate to banks when the COF for banks are on the higher side. Every financial institution tries to reduce its COF to maximize its profits, which get passed on to the borrower at a lower interest rate.

Key Takeaways

- Cost of funds (COF) has been used in the banking and financial sectors to refer to the sum lenders pay to obtain cash before lending to their clients.

- It is determined by multiplying the outstanding debt by the interest rate and the period.

- Lenders can determine their profit by deducting the cost of financing from the interest charged to borrowers. Lenders or other financial entities borrow money from the United States Federal Reserve.

- It is the amount of cost paid by banks to obtain funds for their lending business, whereas the Cost of Capital is the cost at which various businesses obtain funds for their business.

Cost Of Funds Explained

Cost of funds meaning refers to the cost associated with the raising of funds by a lender from the federal reserve or interbank market to allow itself to provide loans to eligible customers. Sometimes, it also means the cost incurred by the borrower for borrowing the funds from its lender. In Both cases, the cost consists of the aggregated fees and interest levied on the principal amount borrowed from the market or central bank.

In terms of economics, the annual interest rate that a bank needs to pay back or is willing to pay concerning the wholesale liabilities gets adjusted for reserve requirements plus other requirements imposed by various regulators, state or federal government, and local administration as recognized by the bank. The difference between the cost of the money and the interest rate imposed on debtors is among the major profit sources for several financial organizations.

Moreover, the COF also represents the interest rate paid by any financial institution and bank to obtain funds for their lending business. In general terms, the interest rates charged to the depositors, like savings accounts plus time deposits, determine and dictate the COF. Besides financial institutions, all other entities also incur the COF while obtaining funds for their new projects, expansion, or any other operational activities.

Every lender charges more interest rates on their retail, wholesale, and business customers, including bigger institutions, than the cost at which they obtain their funds from other sources. As a result, banks make profits on the cost of funds banking by providing loans to :

- Customers at “cost-plus loan pricing, which means the operating cost of servicing loan plus risk premium plus the profit margin

- Customers are at the prime rate, around three percent higher than its COF.

The Hargreaves Lansdown provides access to a range of investment products and services for UK investors.

Cost of Funds Formula

For calculating the COF, one can use the below formula:

Cost of Funds,

COF=B∗IR /100∗T

where,

- COF = cost of funds ($)

- B = borrowed amount of funds ($)

- IR = interest rate of the borrowed funds (%)

- T = total amount of time the funds are borrowed

Examples

Let us try to understand the topic using some examples.

Example #1

Let us suppose bank Almeda has a requirement for funds for its lending business. It takes a loan from the federal reserve at 2 percent. Now, it has to profit by lending the funds obtained at a profit. Therefore, it charges the borrower a rate of 5 percent. Therefore, its COF got compensated by charging more to its customers.

Example #2

Let us suppose Amazon corporation has a requirement for funds for its logistics business. It takes a loan from the market at 6 percent. Now, it has to profit by charging the customers by including it in the selling price of products on its online platform. Therefore, it charges the customers 5 percent more for all the products they buy. Therefore, its COF got compensated by charging more to its customers.

Cost Of Funds vs. Cost of Capital (in points or as a table)

Let us use the table below to understand the difference between the two terms:

| Cost Of Funds | Cost of Capital |

|---|---|

| the amount of cost paid by banks to obtain funds for their business of lending. | It is the cost at which various businesses obtain funds for their business |

| Banks obtain it from either the depositors' funds or the federal reserve. | Businesses obtain these funds from banks, investors, private lenders, and shareholders. |

| It is directly related to the rate of federal reserve charges on the banks. | The interest rate depends on the sources of funds deployed by the business. |

| Loans are the main factors affecting the COF, including other sources. | The lowest possible rate of return gets expressed as a percentage earned by any business on their new investments. |

Disclosure: This article contains affiliate links. If you sign up through these links, we may earn a small commission at no extra cost to you.