Table Of Contents

What Is Cost Equity?

Cost of equity is the percentage of returns payable by the company to its equity shareholders on their holdings. It is a parameter for the investors to decide whether an investment is rewarding; otherwise, they may shift to other opportunities with higher returns.

The cost of equity becomes the minimum rate of return on the investments that shareholders make. It becomes one of the most important metrics in the stock valuation models and helps investors learn about the risks involved in an investment.

Key Takeaways

- The cost of equity is the return percentage a company pays to shareholders. Investors consider it when deciding if an investment is profitable. If it's low, they may seek better opportunities.

- The cost of equity can be calculated in two ways: Dividend Discount Model and Capital Asset Pricing Model (CAPM).

- To understand a company's profits and acquire more capital, investors use the cost of equity.

- But a more thorough way is to consider the Weighted Average Cost of Capital (WACC), which also includes the cost of Debt and affects dividends.

Cost of Equity Explained

The cost of equity is the rate of return the investor requires from the stock before looking into other viable opportunities. It measures how much returns a company has to produce to keep its shareholders invested in the company and raise additional capital whenever necessary to keep operations flowing.

Image Source: Financial Modeling and Valuation Course Bundle

The cost of equity is a great measure for an investor to understand whether to invest in a company or not. Though it is an important metric, looking at WACC (Weighted Average Cost of Capital), would give them a holistic picture as the cost of debt also affects the dividend payment for shareholders.

It is one of the most significant attributes that you need to look at before investing in the company's shares. Let us look at the graph above. The Cost for Yandex is 18.70%, while that of Facebook is 6.30%. What does this mean? How would you calculate it? What metrics do you need to be aware of while looking at Ke?

Looking at the concept of "opportunity cost" makes one understand it better. Suppose you have US $1000 to invest! So you look for many opportunities. And you choose the one which, according to you, would yield more returns. As you decided to invest in one particular opportunity, you would let go of others, maybe more profitable opportunities. That loss of other alternatives is called “opportunity cost.”

Let’s come back to the Ke. If you, as an investor, don’t get better returns from company A, you will go ahead and invest in other companies. And company A has to bear the opportunity cost if they don’t put in the effort to increase the required rate of return (hint – pay the dividend and put effort so that the share price appreciates).

Let's take an example to understand this.

Mr. A wants to invest in Company B. As Mr. A is a relatively new investor, he wants a low-risk stock that can yield him a good return. Company B's current stock price is US $8 per share, and Mr. A expects that the required rate of return will be more than 15%. And through the calculation of the cost of equity, he will understand what he will get as a required rate of return. If he gets 15% or more, he will invest in the company; and if not, he will look for other opportunities.

Video Explanation Of Cost of Equity

How To Calculate?

There are two methods of cost of equity using which this percentage of shareholders’ equities can be calculated. One is the Dividend Discount method and the other is the Capital Asset Pricing Model (CAPM). These two methods are used for computation only when the usual method that investors use does not yield reliable results.

Let us look at them in detail below:

#1 - Dividend Discount Model

So we need to calculate Ke in the following manner –

Cost of Equity = (Dividends per share for next year / Current Market Value of Stock) + Growth rate of dividends

Here, it is calculated by taking dividends per share into account. So here’s an example to understand it better.

Learn more about the Dividend Discount Model

Mr. C wants to invest in Berry Juice Private Limited. Currently, Berry Juice Private Limited has decided to pay US $2 per share as a dividend. The current market value of the stock is US $20. And Mr. C expects that the appreciation in the dividend would be around 4% (a guess based on the previous year’s data). So, the Ke would be 14%.

How would you calculate the growth rate? We need to remember that the growth rate is the estimated one, and we need to calculate it in the following manner –

Growth Rate = (1 – Payout Ratio) * Return on Equity

If we are not provided with the Payout Ratio and Return on Equity Ratio, we need to calculate them.

Here's how to calculate them -

Dividend Payout Ratio = Dividends / Net Income

We can use another ratio to find out dividend pay-out. Here it is –

Alternative Dividend Payout Ratio = 1 – (Retained Earnings / Net Income)

And also the Return on Equity –

Return on Equity = Net Income / Total Equity

In the example section, we will make the practical application of all of these.

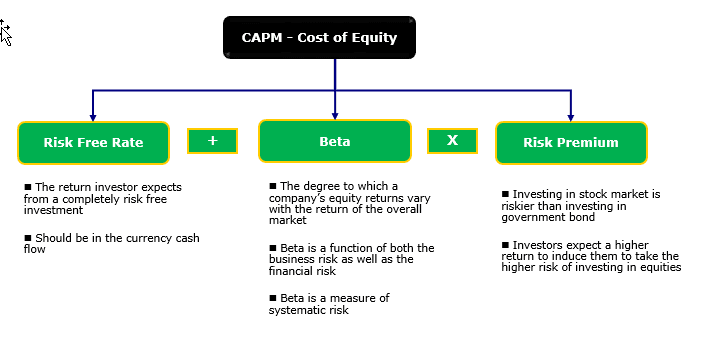

#2- Capital Asset Pricing Model (CAPM)

CAPM quantifies the relationship between risk and required return in a well-functioning market.

Here's the Cost of Equity CAPM formula for your reference.

Cost of Equity = Risk-Free Rate of Return + Beta * (Market Rate of Return – Risk-free Rate of Return)

The formula also helps identify the factors affecting the cost of equity. Let us have a detailed look at it:

- Risk-free Rate of Return - This is the return of a security with no default risk, no volatility, and a beta of zero. A ten-year government bond is typically taken as a risk-free rate

- Beta is a statistical measure of a company's stock price variability concerning the stock market overall. So if the company has a high beta, that means the company has more risk, and thus, the company needs to pay more to attract investors. Simply put, that means more Ke.

- Risk Premium (Market Rate of Return - Risk-Free Rate) - It measures the return that equity investors demand over a risk-free rate to compensate them for the volatility/risk of an investment that matches the volatility of the entire market. Risk premium estimates vary from 4.0% to 7.0%

Let’s take an example to understand this. Let’s say the beta of Company M is 1, and the risk-free return is 4%. The market rate of return is 6%. We need to calculate the cost of equity using the CAPM model.

- Company M has a beta of 1, which means the stock of Company M will increase or decrease as per the tandem of the market. We will understand more of this in the later section

- Ke = Risk-Free Rate of Return + Beta * (Market Rate of Return – Risk-free Rate of Return)

- Ke = 0.04 + 1 * (0.06 – 0.04) = 0.06 = 6%.

Examples

We will take examples from each model and try to understand how things work.

Example # 1

| In US $ | Company A |

|---|---|

| Dividends Per Share | 12 |

| Market Price of Share | 100 |

| Growth in the next year | 5% |

Now, this is the simplest example of a dividend discount model depicted in the form of a calculation of the cost of equity in Excel.. We know that the dividend per share is US $30, and the market price per share is US $100. We also know the growth percentage.

Let's calculate the cost of equity.

Ke = (Dividends per share for next year / Current Market Value of Stock) + Growth rate of dividends

| In US $ | Company A |

|---|---|

| Dividends Per Share (A) | 12 |

| Market Price of Share (B) | 100 |

| Growth in the next year (C) | 5% |

| Ke | 17% |

So, Ke of Company A is 17%.

Example # 2

MNP Company has the following information –

| Details | Company MNP |

|---|---|

| Risk-Free Rate | 8% |

| Market Rate of Return | 12% |

| Beta Coefficient | 1.5 |

We need to calculate Ke of MNP Company.

Let’s look at the formula first, and then we will ascertain the cost of equity using a capital asset pricing model.

Ke = Risk-Free Rate of Return + Beta * (Market Rate of Return – Risk-free Rate of Return)

| Details | Company MNP |

|---|---|

| Risk-Free Rate (A) | 8% |

| Market Rate of Return (B) | 12% |

| (C) | 4% |

| Beta Coefficient (D) | 1.5 |

| Ke | 14% |

Note: To calculate the beta coefficient for a single stock, you need to look at the stock's closing price every day for a particular period. Also, the closing level of the market benchmark (usually S&P 500) for a similar period and then use excel in running the regression analysis.

Cost of Equity CAPM Example - Starbucks

Let us take an example of Starbucks and calculate the Cost of Equity using the CAPM model.

Cost of Equity CAPM Ke = Rf + (Rm – Rf) x Beta

Most Important - Download Cost of Equity (Ke) Template

Learn to calculate Starbucks Cost of Equity (Ke) in Excel

#1 - RISK-FREE RATE

Here, I have considered a ten-year Treasury Rate as the Risk-free rate. Some analysts also take a 5-year treasury rate as the risk-free rate. Please check with your research analyst before taking a call on this.

source – bankrate.com

EQUITY RISK PREMIUM (RM – RF)

Each country has a different Equity Risk Premium. Equity Risk Premium primarily denotes the premium expected by the Equity Investor.

For the United States, Equity Risk Premium is 5.69%.

source – stern.nyu.edu

BETA

Let us now look at Starbucks Beta Trends over the past few years. The beta of Starbucks has decreased over the past five years. It means that Starbucks stocks are less volatile than the stock market.

We note that the Beta of Starbucks is at 0.794x

source: ycharts

With this, we have all the necessary information to calculate the cost of equity.

Ke = Rf + (Rm – Rf) x Beta

Ke = 2.42% + 5.69% x 0.794

Ke =6.93%

Interpretation

The Ke is not exactly what we refer to. It’s the responsibility of the company. The rate the company needs to generate to allure the investors to invest in their stock at the market price.

That's why the Ke is also referred to as the "required rate of return."

So let’s say as an investor, you don’t have any idea what the Ke of a company is! What would you do?

First, you need to find out the total equity of the company. If you look at the balance sheet of the company, you would find it easily. Then you need to see whether the company has paid any dividends or not. You can check their cash flow statement to be ensured. If they pay a dividend, you need to use the dividend discount model (mentioned above), and if not, you need to go ahead and find out the risk-free rate and calculate the cost of equity under the capital asset pricing model (CAPM). Calculating it under CAPM is a tougher job as you need to find out the beta by doing regression analysis.

Image Source: Financial Modeling and Valuation Course Bundle

Let's have a look at the examples of how to calculate the Ke of a company under both of these models.

Industry-wise Cost of Equity

Ke can differ across industries. As we saw from the CAPM formula above, Beta is the only variable unique to each of the companies. Beta gives us a numerical measure of how volatile the stock is compared to the stock market. The higher the volatility, the riskier the stock is.

Please note -

- Risk-Free Rates and Market Premium is the same across sectors.

- However, Market premium differs from each country.

#1 - Utilities Companies

Let us look at the Ke of Top Utilities Companies. The below table provides us with the Market Cap, Risk-Free Rate, Beta, Market Premium, and Ke data.

Please note that Risk-Free Rate and Market Premium are the same for all the companies. It is the beta that changes.

| S. No | Name | Market Cap ($ million) | Risk-Free Rate | Beta (5Y) | Market Premium | Ke (R(f) + Market Premium x Beta) |

|---|---|---|---|---|---|---|

| 1 | National Grid | 47,575 | 2.42% | 0.4226 | 5.69% | 4.8% |

| 2 | Dominion Resources | 46,856 | 2.42% | 0.2551 | 5.69% | 3.9% |

| 3 | Exelon | 33,283 | 2.42% | 0.2722 | 5.69% | 4.0% |

| 4 | Sempra Energy | 26,626 | 2.42% | 0.47 | 5.69% | 5.1% |

| 5 | Public Service Enterprise | 22,426 | 2.42% | 0.3342 | 5.69% | 4.3% |

| 6 | FirstEnergy | 13,353 | 2.42% | 0.148 | 5.69% | 3.3% |

| 7 | Entergy | 13,239 | 2.42% | 0.4224 | 5.69% | 4.8% |

| 8 | Huaneng Power | 10,579 | 2.42% | 0.547 | 5.69% | 5.5% |

| 9 | Brookfield Infrastructure | 9,606 | 2.42% | 1.0457 | 5.69% | 8.4% |

| 10 | AES | 7,765 | 2.42% | 1.1506 | 5.69% | 9.0% |

source:ycharts

- We note that the Cost of Equity for Utility companies is pretty low. Most of the stocks in this sector have Ke between 3%-5%

- It is because most companies have a beta of less than 1.0. It implies that these stocks are not very sensitive to the movement of the stock markets

- Outliers here are Brookfield Infrastructure and AES, which have the Ke of 8.4% and 9.4%, respectively.

#2 - Steel Sector

Let's now take the example of the Steel Sector's cost of equity.

| S. No | Name | Market Cap ($ million) | Risk-Free Rate | Beta (5Y) | Market Premium | Ke (R(f) + Market Premium x Beta) |

|---|---|---|---|---|---|---|

| 1 | ArcelorMittal | 28,400 | 2.42% | 2.3838 | 5.69% | 16.0% |

| 2 | POSCO | 21,880 | 2.42% | 1.0108 | 5.69% | 8.2% |

| 3 | Nucor | 20,539 | 2.42% | 1.4478 | 5.69% | 10.7% |

| 4 | Tenaris | 20,181 | 2.42% | 0.9067 | 5.69% | 7.6% |

| 5 | Steel Dynamics | 9,165 | 2.42% | 1.3532 | 5.69% | 10.1% |

| 6 | Gerdau | 7,445 | 2.42% | 2.2574 | 5.69% | 15.3% |

| 7 | United States Steel | 7,169 | 2.42% | 2.7575 | 5.69% | 18.1% |

| 8 | Reliance Steel & Aluminum | 6,368 | 2.42% | 1.3158 | 5.69% | 9.9% |

| 9 | Companhia Siderurgica | 5,551 | 2.42% | 2.1483 | 5.69% | 14.6% |

| 10 | Ternium | 4,651 | 2.42% | 1.1216 | 5.69% | 8.8% |

source:ycharts

- We note that the Ke for the steel sector is high. Most companies have Ke over 10%

- It is because of the higher betas of steel companies. Higher beta implies that steel companies are sensitive to the stock market movements and can be a risky investment. United States Steel has a beta of 2.75 with a cost of Equity of 18.1%

- Posco has the lowest Ke among these companies at 8.2% and a beta of 1.01.

#3 - Restaurant Sector

Let us now take Ke Example from the Restaurant Sector.

| S. No | Name | Market Cap ($ million) | Risk-Free Rate | Beta (5Y) | Market Premium | Ke (R(f) + Market Premium x Beta) |

|---|---|---|---|---|---|---|

| 1 | McDonald's | 104,806 | 2.42% | 0.6942 | 5.69% | 6.4% |

| 2 | Yum Brands | 34,606 | 2.42% | 0.7595 | 5.69% | 6.7% |

| 3 | Chipotle Mexican Grill | 12,440 | 2.42% | 0.5912 | 5.69% | 5.8% |

| 4 | Darden Restaurants | 9,523 | 2.42% | 0.2823 | 5.69% | 4.0% |

| 5 | Domino's Pizza | 9,105 | 2.42% | 0.6512 | 5.69% | 6.1% |

| 6 | Aramark | 8,860 | 2.42% | 0.4773 | 5.69% | 5.1% |

| 7 | Panera Bread | 5,388 | 2.42% | 0.3122 | 5.69% | 4.2% |

| 8 | Dunkin Brands Group | 5,039 | 2.42% | 0.196 | 5.69% | 3.5% |

| 9 | Cracker Barrel Old | 3,854 | 2.42% | 0.3945 | 5.69% | 4.7% |

| 10 | Jack In The Box | 3,472 | 2.42% | 0.548 | 5.69% | 5.5% |

source:ycharts

- Restaurant companies have low Ke. This is because their beta is less than 1.

- Restaurant Companies seem to be a cohesive group, with Keranging between 3.5% and 6.7%.

#4 - Internet & Content

Examples of Internet and Content Companies include Alphabet, Facebook, Yahoo, etc.

| S. No | Name | Market Cap ($ million) | Risk-Free Rate | Beta (5Y) | Market Premium | Ke (R(f) + Market Premium x Beta) |

|---|---|---|---|---|---|---|

| 1 | Alphabet | 587,203 | 2.42% | 0.9842 | 5.69% | 8.0% |

| 2 | 386,448 | 2.42% | 0.6802 | 5.69% | 6.3% | |

| 3 | Baidu | 64,394 | 2.42% | 1.9007 | 5.69% | 13.2% |

| 4 | Yahoo! | 43,413 | 2.42% | 1.6025 | 5.69% | 11.5% |

| 5 | NetEase | 38,581 | 2.42% | 0.7163 | 5.69% | 6.5% |

| 6 | 11,739 | 2.42% | 1.1695 | 5.69% | 9.1% | |

| 7 | VeriSign | 8,554 | 2.42% | 1.1996 | 5.69% | 9.2% |

| 8 | Yandex | 7,833 | 2.42% | 2.8597 | 5.69% | 18.7% |

| 9 | IAC/InterActive | 5,929 | 2.42% | 1.1221 | 5.69% | 8.8% |

| 10 | SINA | 5,599 | 2.42% | 1.1665 | 5.69% | 9.1% |

source:ycharts

- Internet and Content companies have varied Costs of Equity. It is because of the diversity in the Beta of the companies.

- Yandex and Baidu have a very high beta of 2.85 and 1.90, respectively. On the other hand, Companies like Alphabet and Facebook are fairly stable, with Beta of 0.98 and 0.68, respectively.

#5 - Ke - Beverages

Now let us look at Ke examples from Beverage Sector.

| S. No | Name | Market Cap ($ million) | Risk-Free Rate | Beta (5Y) | Market Premium | Ke (R(f) + Market Premium x Beta) |

|---|---|---|---|---|---|---|

| 1 | Coca-Cola | 178,815 | 2.42% | 0.6909 | 5.69% | 6.4% |

| 2 | PepsiCo | 156,080 | 2.42% | 0.5337 | 5.69% | 5.5% |

| 3 | Monster Beverage | 25,117 | 2.42% | 0.7686 | 5.69% | 6.8% |

| 4 | Dr. Pepper Snapple Group | 17,315 | 2.42% | 0.5536 | 5.69% | 5.6% |

| 5 | Embotelladora Andina | 3,658 | 2.42% | 0.2006 | 5.69% | 3.6% |

| 6 | National Beverage | 2,739 | 2.42% | 0.5781 | 5.69% | 5.7% |

| 7 | Cott | 1,566 | 2.42% | 0.5236 | 5.69% | 5.4% |

source:ycharts

- Beverages are considered to be defensive stocks, which primarily means that they do not change much with the market and are not prone to the market cycles. This is evident from Beta's of Beverages Companies that are much lower than 1.

- Beverage companies have Ke in the range of 3.6% - 6.8%

- Coca-Cola has a cost of equity of 6.4%, while its competitor PepsiCo has a Ke of 5.5%.

Limitations

There are a couple of limitations we need to consider –

- Yandex and Baidu have a very high beta of 2.85 and 1.90, respectively. On the other hand, Companies like Alphabet and Facebook are fairly stable, with Beta of 0.98 and 0.68, respectively.

- In the case of CAPM, it’s not always easy to calculate the market return and beta for an investor.

Cost of Equity vs Cost of Debt vs Cost of Capital

The three terms – the cost of equity, the cost of debt, and the cost of capital – have a vital role to play when it comes to determining the share of the shareholders in a firm in exchange for the risks they undertake while making an investment. Though they serve the same objective, they differ widely.

Let us look at the differences between them:

- The cost of equity and cost of debt constitute two major kinds of cost of capital, which comprises the opportunity cost for investment.

- While the cost of equity includes the proportion of return applicable to equity investments, the cost of debt is applied to investments concerning debts. On the other hand, the cost of capital, as the name implies, includes the computation of return percentage for investments related to both debts and equities.

Image Source: Valuation Course

- The cost of equity is normally higher than the cost of debt with the cost of capital summing up both the figures.