Table of contents

What Is Cost of Debt (Kd)?

Cost of debt is the expected rate of return for the debt holder and is usually calculated as the effective interest rate applicable to a firms liability. It is an integral part of the discounted valuation analysis, which calculates the present value of a firm by discounting future cash flows by the expected rate of return to its equity and debt holders.

- The cost of debt may be determined before tax or after tax.

- The total interest expense incurred by a firm in any particular year is its before-tax Kd.

- The total interest expense upon total debt availed by the company is the expected rate of return (before tax).

- Since interest expenses are deductible from taxable income resulting in savings for the firm, which is available to the debt holder, the after-tax cost of debt is considered for determining the effective interest rate in DCF methodology.

- The after-tax Kd is determined by netting off the amount saved in tax from interest expense.

Key Takeaways

- The cost of debt is the return expected by those who hold a company’s debt. Determining a company’s present value is crucial by factoring in expected returns for equity and debt holders in discounted valuation analysis.

- The cost of debt can be calculated before or after tax. The yield to maturity (YTM) considers market rate changes, providing valuable insights.

- To fully understand funding returns, compare the cost of debt with expected income growth from capital investment.

- Higher debt cost means higher risk for a firm

Cost of Debt Formula (Kd)

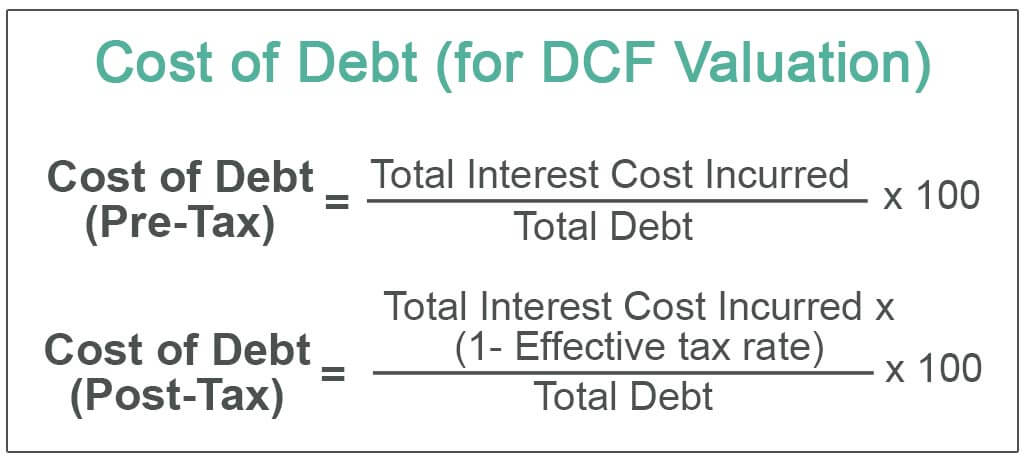

The formula for determining the Pre-tax Kd is as follows:

Cost of Debt Pre-tax Formula = (Total Interest Cost Incurred / Total Debt )*100

The formula for determining the Post-tax cost of debt is as follows:

Cost of DebtPost-tax Formula = *100

To calculate the cost of debt of a firm, the following components are to be determined:

- Total interest cost: Aggregate of interest expenses incurred by a firm in a year

- Total debt: Aggregate debt at the end of a fiscal year

- Effective tax rate: Average rate at which a firm is taxed on its’s profits

Examples

Example #1

For example, if a firm has availed a long term loan of $100 at a 4% interest rate, p.a, and a $200 bond at 5% interest rate p.a. Cost of debt of the firm before tax is calculated as follows:

(4%*100+5%*200)/(100+200) *100, i.e 4.6%.

Assuming an effective tax rate of 30%, after-tax cost of debt works out to 4.6% * (1-30%)= 3.26%.

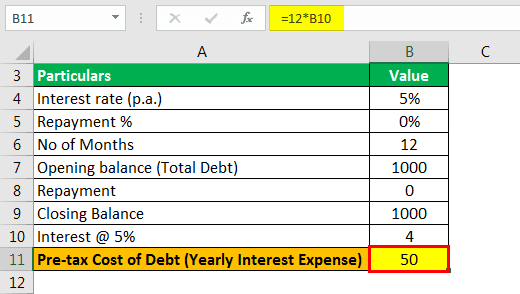

Example #2

Let us look at a practical example for the calculation of the cost of debt. Suppose a firm has subscribed to a $1000 bond repayable in 5 years at an interest rate of 5%. The yearly interest expense incurred by the company would be as follows:

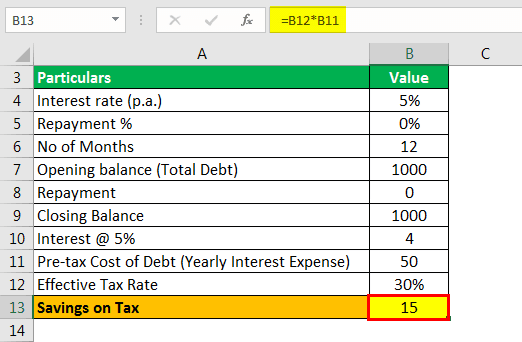

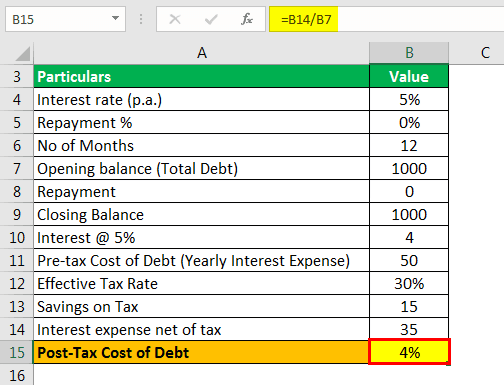

i.e., the interest expense paid by the firm in 1 year is $50. Savings on tax at an effective tax rate of 30% would be as follows:

i.e., the firm has deducted $15 from taxable income. Hence the interest expense net of tax works out to $50-$15=$35. The post-tax cost of debt is calculated as follows:

Example #3

For DCF valuation, determination of cost of debt based on the latest issue of bonds/loans availed by the firm (i.e., the interest rate on bonds v/s debt availed) may be considered. This indicates the riskiness of the firm perceived by the market and is, therefore, a better indicator of expected returns to the debt holder.

Where the market value of a bond is available, Kd may be determined from yield to maturity (YTM) of the bond, which is the present value of all the cash flows from the bond issuance, which is equivalent to the pre-tax cost of debt.

For example, if a firm has determined that it could issue semi-annual bonds of face value $1000 and a market value of $ 1050, with an 8% coupon rate (paid semi-annually) maturing in 10 years, then it’s the before-tax cost of debt. It is calculated by solving the equation for r.

Bond price= PMT/(1+r) ^1+ PMT/(1+r) ^2+…..+ PMT/(1+r)^n+ FV/(1+r)^n

i.e

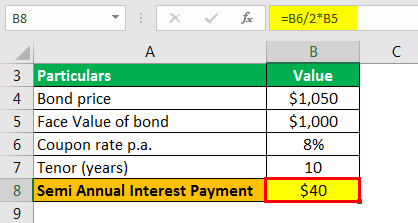

The semi-annual interest payment is

- = 8%/2 * $1000

- = $40

Putting this value in the above-given formula we get the following equation,

1050 = 40/(1+r)^1+ 40/(1+r)^2+…..+ 40/(1+r)^20+ 1000/(1+r)^20

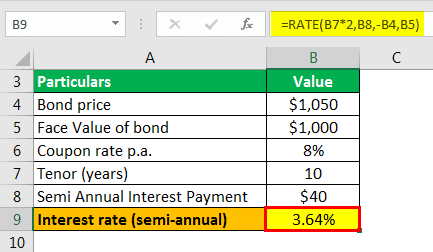

Solving for the above formula using a financial calculator or excel, we get r= 3.64%

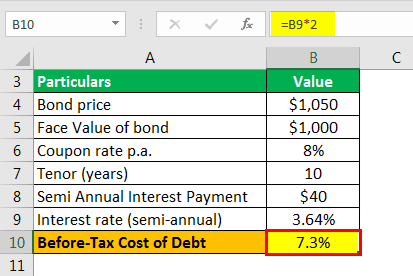

So, Kd (Before -tax) is

- = r*2 (since r is calculated for semi-annual coupon payments)

- = 7.3%

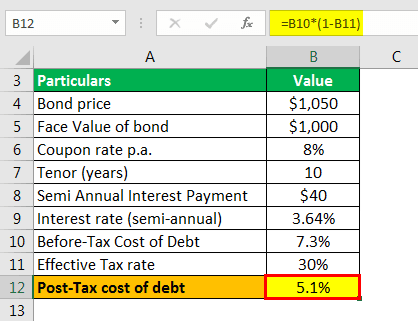

Kd (Post-tax) is determined as

- 7.3% * (1- effective tax rate)

- = 7.3%*(1-30%)

- = 5.1%.

The YTM incorporates the impact of changes in market rates on a firm’s cost of debt.

Advantages

- An optimum mix of debt and equity determines the overall savings to the firm. In the above example, if the bonds of $1000 were utilized in investments that would generate return more than 4%, then the firm has generated profits from the funds availed.

- It is an effective indicator of the adjusted rate paid by the firms and thus aids in making debt/equity funding decisions. Comparing the cost of debt to the expected growth in income resulting from the capital investment would provide an accurate picture of the overall returns from the funding activity.

Disadvantages

- The firm is obligated to pay back the principal borrowed along with interest. Failure to pay back debt obligations results in a levy of penal interest on arrears.

- The firm may also be required to earmark cash/FD’s against such payment obligations, which would impact free cash flows available for daily operations.

- Non-payment of debt obligations would adversely affect the overall creditworthiness of the firm.

Limitations

- Calculations do not factor in other charges incurred for debt financing, such as credit underwriting charges, fees, etc.

- The formula assumes no change in the capital structure of the firm during the period under review.

- To understand the overall rate of return to the debt holders, interest expenses on creditors and current liabilities should also be considered.

An increase in the cost of debt of a firm is an indicator of an increase in riskiness associated with its operations. The higher the cost of debt, the riskier the firm.

In order to make a final decision on the valuation of a firm, the weighted average cost of capital (comprising of cost of debt and equity) should be read along with valuation ratios such as Enterprise value and Equity value of the firm.