Table Of Contents

What Is Cost of Capital?

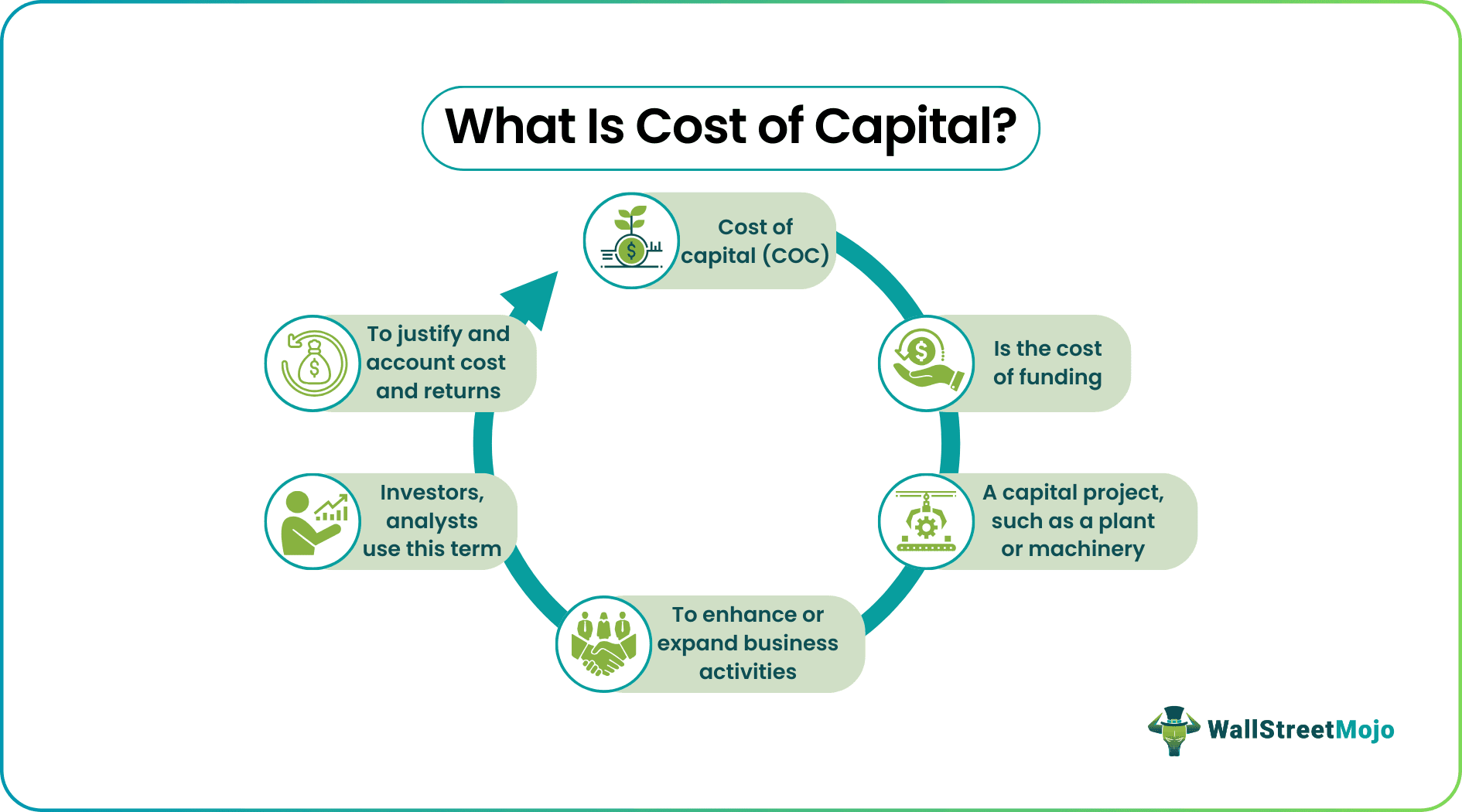

Cost of capital (COC) is the cost of financing a project that requires a business entity to look into its deep pockets for funds or borrowings. Businesses and investors use the cost of employing capital to account for and justify the equity or debt funding required for such projects.

The cost of capital accounts for and enables a business to offset the costs of establishing a plant or purchasing machinery to facilitate business activities. It reflects the returns an investment will generate and the risks involved. Businesses source the funds for such projects through debt or equity financing, which becomes a company's cost.

Key Takeaways

- Cost of capital is a method of accounting for the returns on an investment that helps an investor to offset the costs.

- It enables the investors to detect any risks or loopholes in the process that might lower their returns and increase risks.

- The weighted average of costs incurred in employing capital helps to know a company’s value and risks for an investor. The higher a company’s debt, the greater the premium or returns demanded by investors.

- The weighted average of the equity or debt capital invested reflects the total premium costs a company owes its investor for the risk taken.

Cost Of Capital Explained

The cost of capital is a way to measure the returns and investment risks to expand or facilitate business operations. A business may incur this cost from its profits, debt, or equity financing. If a business has availed of debt and equity financing to expand its operations, the overall cost of capital is measurable by the weighted average cost of capital (WACC).

Accounting and justifying the costs of capital expenditure also evaluate returns for the investors by identifying risks and opportunities. Thus, minimizing risks and seizing opportunities will ensure the future growth of the business and generate higher profits. Consequently, a healthy investment will generate increasing returns for its investors that exceed the costs of capital employed.

When considering the case of stocks or equity shares, it becomes necessary for an investor to substantiate the cost of capital for equity with higher returns. Therefore, an investor will first identify the volatile factors that can bring down his earnings, like a company’s financial position. Simultaneously he will restructure his portfolio to avoid losses.

Thus, they assess a company’s loss-making or poor-performing stocks or shares to offset the lower returns. Consequently, they divert their money to acquire other high-yielding shares or investments to offset the lower returns.

For optimization of returns and to justify capital investments into a project, its investors should ensure sustainable business practices. These include sufficient research and development, optimizing resource utilization, early detection of risks, and ensuring their resolution.

Additionally, good credit ratings and rigorous business accounting methods give management, shareholders, and other investors an accurate picture. As a result, higher returns will neutralize the high project costs, and business operations will continue to generate higher profits.

Cost of Capital - Explained in Video

How To Determine Cost of Capital?

A basic way to estimate the costs of employing a capital investment is to determine the breakeven point. It is when a company generates revenue for an investment higher than the cost incurred or the amount of capital invested. A business also calculates the breakeven point for investments in a project, its product line, subsidiary, etc.

However, in the case of borrowings of a company, the weighted average cost of capital formula is determined by debt and equity sell-out. Therefore, the WACC determines the weighted average of all types of debt and equities of a business on its balance sheet.

A company can have a combination of debt and equity borrowings for capital investment depending on the project's purpose. For instance, a start-up might sell equity in return for investment to expand or run its operations smoothly as it might not have enough collateral to pledge for an institutional debt.

Similarly, investment in a research and development (R&D) or innovation-based project might have a higher COC than the capital invested for revenue-generating operations. Again, it is because, in the case of the former, the risk factor for an investor might be higher and depend on the success of the research or innovation undertaken.

Calculation

Let us look at the formula of cost of capital to estimate returns on different kinds of investments or borrowings,

#1 - Determining the Cost of Debt –

Thus, to determine the effective interest rate, i.e., post payment of any corporate tax, the total interest is multiplied by (1-Tax Rate).

#2 - Determining the Cost of Equity –

The cost of capital for equity is much more volatile (represented as ‘X’) than the cost of debt. It is because the demand and supply market forces play a greater role in determining investors’ returns. Thus,

where,

- R1 = Risk-free Rate of Returns

- R2 = Market rate of Returns

#3 - Weighted Average Cost of Capital (WACC) – The weighted average COC (WACC) is a company’s overall debt and equity capital cost. The company pays this premium to its investors as a reward for the risks undertaken. Its calculation involves,

where,

- C (E) = is the cost of equity

- C (D) = is the cost of debt (after tax)

Example

Let us look at the cost of capital example to understand capital investment implications for a business and its investors,

For instance, Joe owns a coffee chain – Coffee Brew and Churros (CB&C), that generates $10,000,000 annually from all its chains. The business valuation of CB&B is $7.5 million, and $2.5 million are its operating expenses. Thus, the market capitalization of its stock holdings drives its business value and book value.

Here, CB&B pays its cost of debt and equity capital from its earnings, i.e., $7.5million, and recovers this cost through profiting business operations from all its chains. Thus, a successful capital structure of CB&B allows it to yield an increasing rate of returns year on year for its investors.

Thus, over the years, CB&B has evolved a balanced capital budgeting system having a multiplier effect on its earnings and cash flow, making it a zero-risk on returns type of investment for its investors. Subsequently, the enhanced trust and confidence have also led its investors not to demand a risk premium or a higher rate of return than normal.

Importance

Let us now look at some key factors for accounting and justifying the cost of debt or equity capital,

- It helps determine the discount rate for the company’s current cash flows. As a result, this facilitates the planning and executing of future operations and projects to continue generating profits.

- It helps businesses or companies lower capital supply costs by determining the best combination of capital structures. For instance, a start-up might get a lower price on equity borrowings than through debt.

- On the other hand, a strategic and well-planned capital structure can help the company save cash flows as interest payments are tax deductible and help a company to reduce its taxable income.

- Ultimately, well-maintained accounts for the debt and equity costs allow investors to be more accurate about future returns, thus building greater trust in the company or business. Additionally, this account reflects real income or returns for the investor when zero risk on returns is involved.

- For a business, a comprehensively calculated cost of borrowings or capital can help them know the project’s maturity period, and they can take measurable risks.