Table Of Contents

What Is the Cost-Benefit Analysis Formula?

Cost-benefits analysis formula is an expression that helps figure out the most productive initiatives among the queued tasks. The cost-benefit analysis process involves comparing the costs to the benefits of a project and then deciding whether to go ahead with the project.

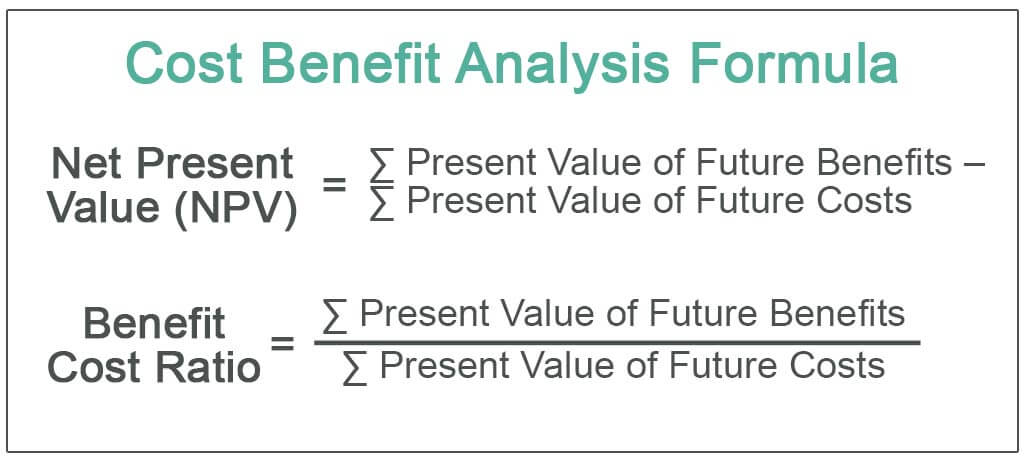

The costs and benefits of the project are quantified in monetary terms after adjusting for the time value of money, which gives a real picture of the costs and benefits. There are two popular models for carrying out cost-benefit analysis calculations – Net Present Value (NPV) and benefit-cost ratio.

Cost-Benefit Analysis Formula Explained

Cost-benefit analysis formula helps firm compare and calculate which project or task would offer maximum profits in minimum costs involved. As discussed above, Net Present Value (NPV) and Benefit-Cost ratio are two popular models of carrying out a cost-benefit analysis formula in excel.

Net Present Value

For calculating Net Present Value, use the following steps:

Step 1: Find out the future benefits.

Step 2: Find out the present and future costs.

Step 3: Calculate the present value of future costs and benefits. The present value factor is 1/(1+r)^n. Here r is the rate of discounting, and n is the number of years.

The formula for calculating present value is:

Present Value of Future Benefits = Future Benefits * Present Value Factor.

Present Value of Future Costs = Future Costs * Present Value Factor

Step 4: Calculate the Net Present Value using the formula:

NPV = ∑ Present Value of Future Benefits - ∑ Present Value of Future Costs

Step 5: If the Net Present Value (NPV) is positive, the project should be undertaken. If the NPV is negative, the project should not be undertaken.

Benefit-Cost Ratio

For calculating the cost-benefit ratio, follow the given steps:

Step 1: Calculate the future benefits.

Step 2: Calculate the present and future costs.

Step 3: Calculate the present value of future costs and benefits.

Step 4: Calculate the benefit-cost ratio using the formula

Benefit-Cost Ratio = ∑ Present Value of Future Benefits / ∑ Present Value of Future Costs.

Step 5: If the benefit-cost ratio is greater than 1, go ahead with the project. If the benefit-cost ratio is less than 1, you should not go ahead with the project.

Examples

Let’s see some simple to advanced practical examples of the cost-benefit analysis equation to understand it better.

Example #1

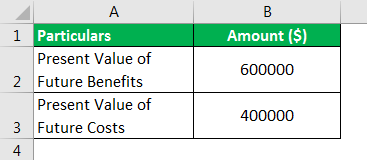

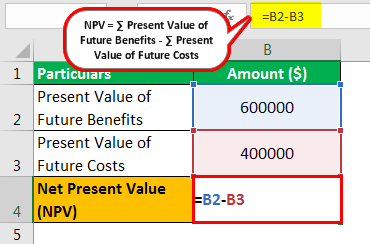

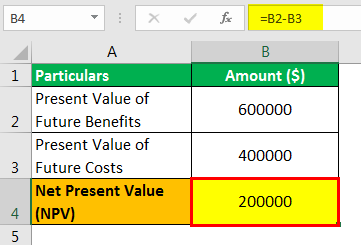

The present value of the future benefits of a project is $6,00,000. The present value of the costs is $4,00,000. Calculate the Net Present Value (NPV) of the project and determine whether the project should be executed.

Solution

Use the below given data for the calculation of Net Present Value (NPV)

Calculation of Net Present Value (NPV) can be done as follows-

- = $6,00,000 - $4,00,000

Net Present Value (NPV) will be -

- = $2,00,000

Since the NPV is positive, the project should be executed.

Example #2

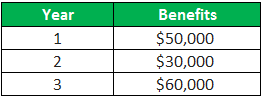

The CFO of Briddles Inc. is considering a project. He wants to determine whether the project should be executed. He decides that he would use the NPV model to determine whether the company should be executing the project.

The upfront cost of $1,00,000 would be incurred. It is the given information relating to the benefits. Use the discounting rate of 6% to calculate the NPV of the project. Also, determine whether the project is viable.

Solution

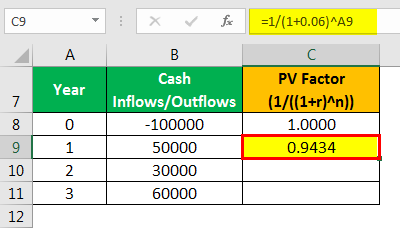

To calculate the net present value (NPV), we need to first calculate the present value of future benefits and the present value of future costs.

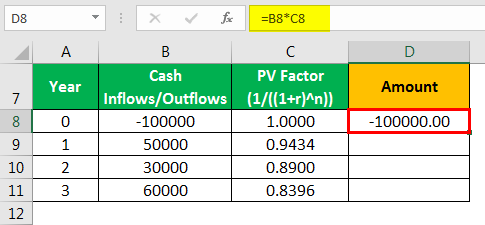

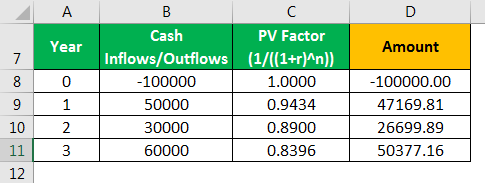

Calculation of PV Factor for Year 1

- =1/(1+0.06)^1

- =0.9434

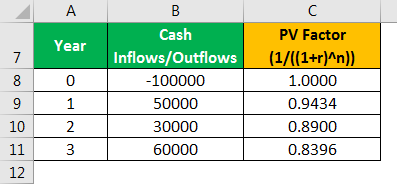

Similarly, we can calculate the PV Factor for the remaining years

Calculation of present value of future costs

- =-100000*1.0000

- =-100000.00

Calculation of Total Value of Future Benefits

- =47169.81+26699.89+50377.16

- =124246.86

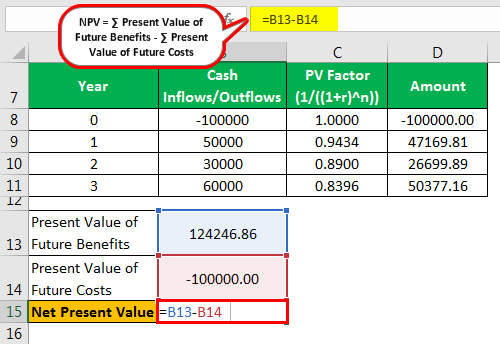

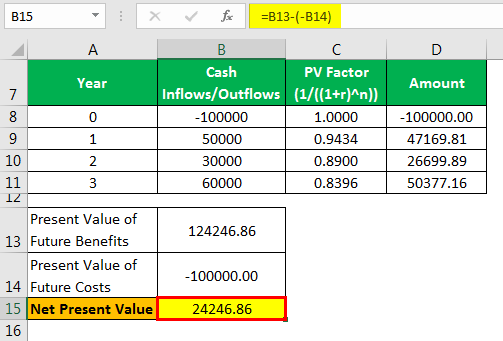

Calculation of Net Present Value (NPV) can be done as follows-

- =124246.86-(-100000.00)

Net Present Value (NPV) will be -

- NPV =24246.86

Since the Net Present Value (NPV) is positive, the project should be executed.

Example #3

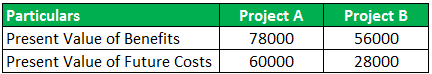

The CFO of Jaypin Inc. is in a dilemma. He has to decide whether to go for Project A or Project B. He decides to choose the project based on the benefit-cost ratio model. The data for both the projects is as under. Choose the project based on the benefit-cost ratio.

Solution

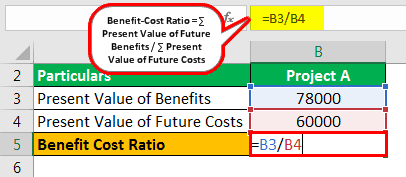

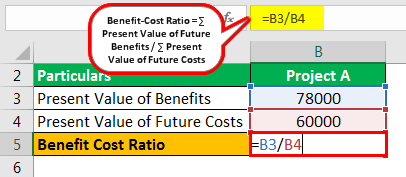

Project A

Calculation of the Benefit-Cost Ratio can be done as follows,

- =78000/60000

Benefit-Cost Ratio will be -

- Benefit-Cost Ratio = 1.3

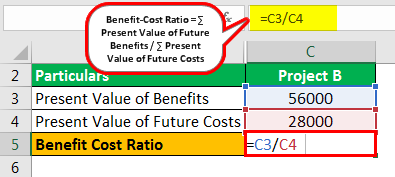

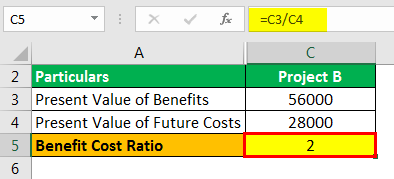

Project B

Calculation of the Benefit-Cost Ratio can be done as follows,

- =56000/28000

Benefit-Cost Ratio will be -

- Benefit-Cost Ratio = 2

Since the benefit-cost ratio for Project B is higher, Project B should be chosen.

Cost-Benefit Analysis Formula in Excel (with Excel Template)

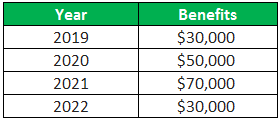

The CFO of Housing Star Inc. gives the following information related to a project. Costs of $1,80,000 are to be incurred upfront at the start of 2019, which is the date of evaluation of the project. Use a discounting rate of 4% to determine whether to go ahead with the project based on the Net Present Value (NPV) method.

Solution:

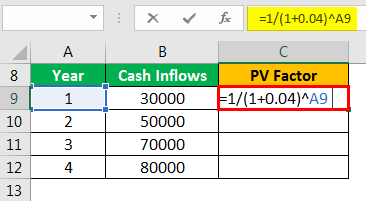

Step 1: Insert the formula =1/(1+0.04)^A9 in cell C9 to calculate the present value factor.

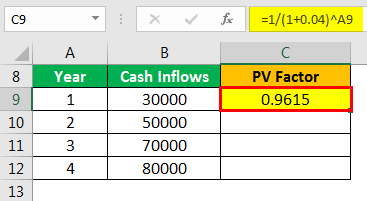

Step 2: Press Enter to get Result

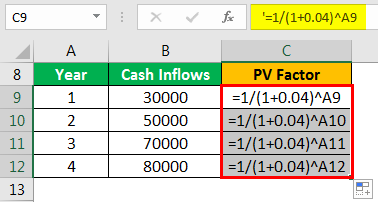

Step 3: Drag the formula from cell C9 up to cell C12.

Step 4:Press Enter to get Result

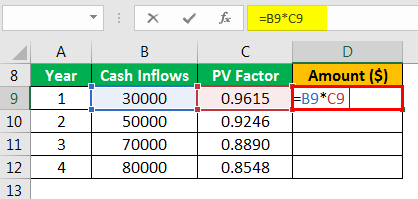

Step 5: Insert the formula =B9*C9 in cell D9

Step 6: Drag the formula up to cell D12.

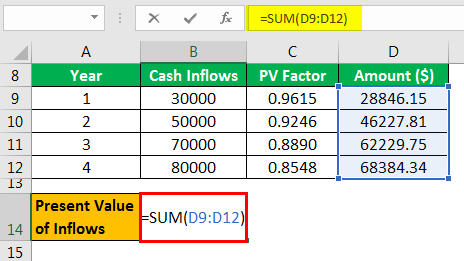

Step 7: Insert the formula =SUM(D9: D12) in B14 to calculate the sum of the present value of cash inflows.

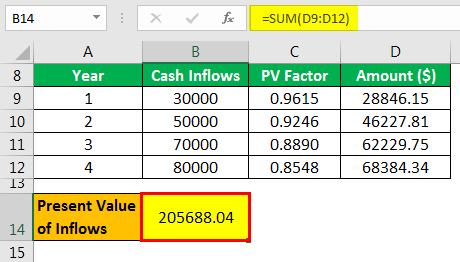

Step 8: Press Enter to get Result

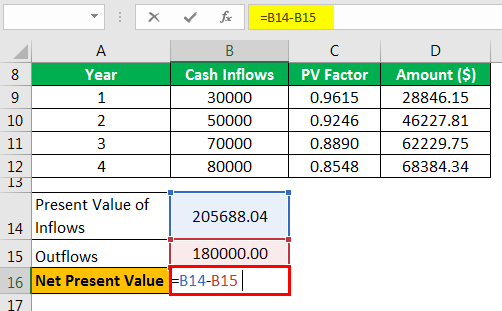

Step 9: Insert the formula =B14-B15 to calculate the Net Present Value.

Step 10: Press Enter to get Result

Step 11: If the NPV is greater than 0, the project should be implemented. Insert the formula =IF(D8>0, “Project should be implemented,” “Project should not be implemented”) in cell B17.

Since NPV is greater than 0, the project should be implemented.

Relevance and Uses

Cost-benefit analysis is useful in making decisions on whether to carry out a project or not. Decisions like whether to shift to a new office, and which sales strategy to implement are taken by carrying out a cost-benefit analysis. Generally, it is used for carrying out long-term decisions that have an impact over several years. This method can be used by organizations, governments as well as individuals. Labor costs, other direct and indirect costs, social benefits, etc. are considered while carrying out a cost-benefit analysis. The costs and benefits need to be objectively defined to the extent possible.

The cost-benefit analysis formula in Excel helps in comparing different projects and in finding out which project should be implemented. Under the NPV model, the project with a higher NPV is chosen. Under the benefit-cost ratio model, the project with a higher benefit-cost ratio is chosen.