Table Of Contents

Corporate Raider Definition

A corporate raider is an investor who benefits by buying a large stake in an undervalued company, either with a motive to influence the company’s decision-making process or sell it for a profit. The most common example is a change in the Board of Directors, which will help them influence the company’s vital decisions.

Table of contents

- Corporate Raider Definition

- A corporate raider refers to an investor who benefits from purchasing a significant stake in an undervalued company, either intending to influence the company's decision-making process or sell it for a gain.

- The primary motive of a corporate raider is to make pivotal changes in the company to enhance the company's overall reputation, which positively influences the company's share price in the stock market.

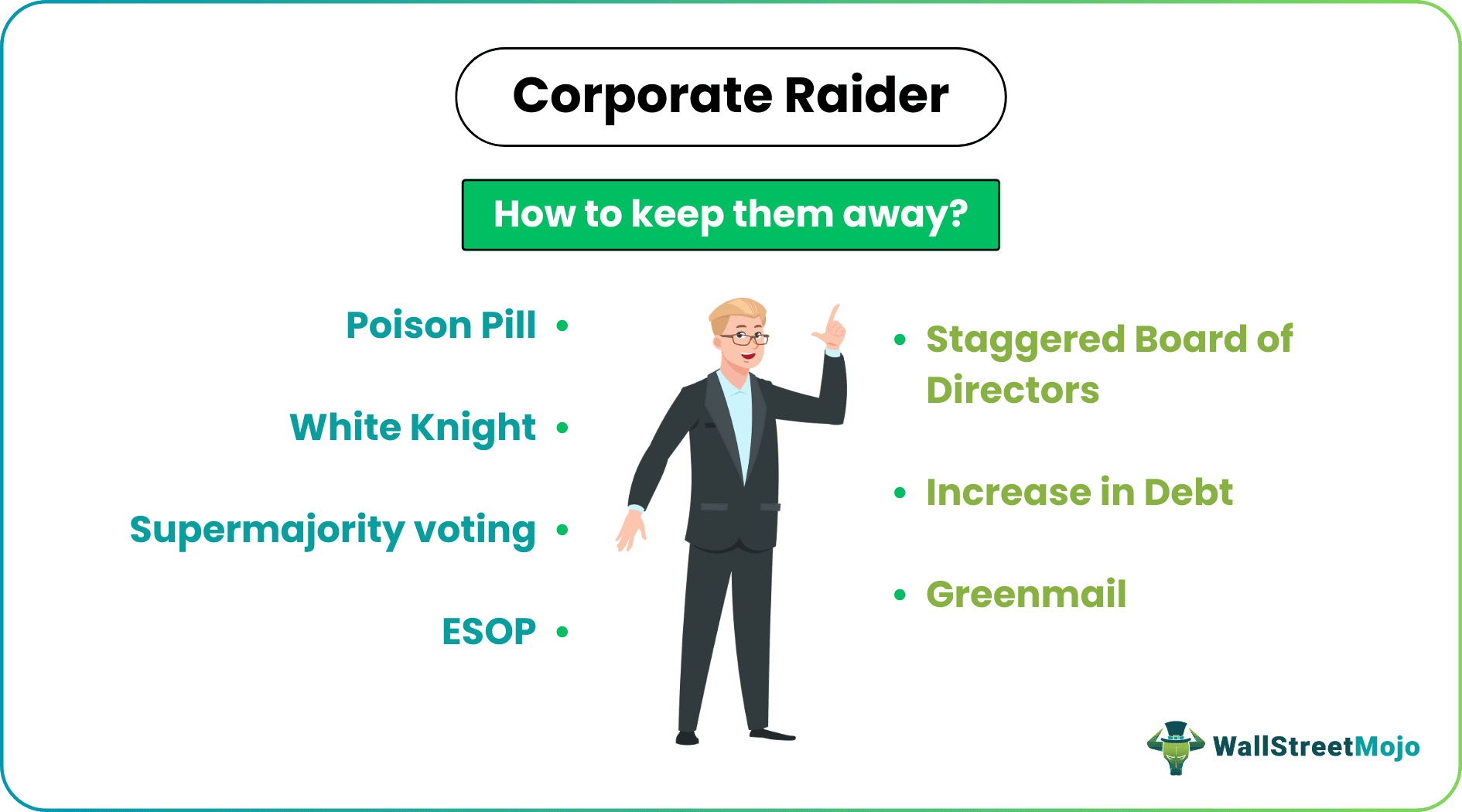

- Poison Pill, supermajority voting, staggered Board of Directors, Greenmail, increase in company's balance sheet debt, White Knight, and ESOP is some techniques to offset the threats to corporations.

The Motive of the Corporate Raider

The basic motive of a corporate raider is to make such pivotal changes in the company so that the company's overall reputation improves, which positively impacts the company's share price in the stock market. When the shares sell at a premium price, they earn a handsome profit. A corporate raider who accumulates more than 5% of the company’s outstanding shares must register with the U.S. Securities and Exchange Commission.

Example of Corporate Raider

To illustrate, we can assume that a company whose share is trading at $3 but has $5 a share in cash with no debt. In this scenario, the corporate raider will buy the shares in bulk to control the entity. Once it has a major stake, it would distribute $5 in cash, per share, to all its shareholders. They can earn decent gains by seeking leveraged buyouts and benefit the raider well.

One of the finest examples of a corporate raider is Carl Celian Icahn, the founder and controlling shareholder of Icahn Enterprises. In 1980, Carl Icahn profited from the hostile takeover of American airline TWA. He bought 20% of Trans World Airlines’ stock and made a good fortune of $469 million. He converted the TWA company to a private company, changed the Board of Directors, and finally called for the divestiture of assets. This deal bankrupted the airlines, but the corporate raider enriched himself with decent personal gains.

Another example is Victor Posner, who acquired a major stake in DWG Corporation and used it as an investment vehicle that executed a takeover of other corporations (like Sharon Steel Corporation).

How to Keep Corporate Raiders Away?

Seeing the evil impact on the company by the indecisive acts of corporate raiders, the companies decide to follow stringent counterbalance. Some of the techniques to counteract the threats to corporations are: -

- Poison Pill: Poison Pill makes the stock more expensive or sells the shares to existing shareholders at a discount.

- Supermajority voting.

- Staggered Board of Directors: Directors may divide into different classes, with another period to stagger elections.

- Greenmail: Buyback of shares from the raider at a premium price to protect the interest of the shareholders.

- Increase in Debt: A dramatic increase in the company’s balance sheet debt.

- White Knight: Strategic mergers with a white knight (white knight mean a ‘friendly’ takeover by an individual or company at a fair consideration to save the company from being rude by unscrupulous bidders).

- ESOP: ESOP is a tax-qualified retirement plan that provides tax savings to the company and its shareholders. By establishing ESOP, employees hold ownership of the company.

Advantages

The following are the advantages of being a corporate rider: -

- Such hostile takeovers allow a rethinking of their business strategy to improve their balance sheet and compete with the competitors in the market.

- Synergy or combinational gains result in economies of scale and efficiencies in cash management so that the company, as a whole, gets the maximum benefit from such takeovers.

- Acquisition by a corporate raider provides a chance to replace incompetent managers. In addition, they get an opportunity to make a significant change in the Board of Directors, who make rational decisions for the company.

- The acquisition results in speculative gains to corporate raiders, thus providing them psychic rewards or additional financial compensation.

- One may seek acquisitions for tax benefits as such takeovers can increase tax shield by depreciating the assets at a higher rate. Sometimes, they may also finance such takeovers with debt.

Disadvantages

Below are the disadvantages of corporate riders: -

- Such corporate raider’s strategies are not long-term strategies. Instead, divisions are closed down or sold, people are sacked, and halted development.

- Such takeovers naturally provoke anguish among the management as it results from the cut-throat competition.

- They get the opportunity to flip the corporation’s management and might use such powers for their gains, tarnishing its image.

- The sudden increase in the share price of the company and subsequent booking of profits would result in a sharp fall in no time, affecting the retail investors.

- Replace experienced senior executives with carpet begging speculators or empire builders who do not know their growing businesses will destroy its long-term performance.

- Corporate raider to harvest, divest, and load the company with debt. The companies, before the acquisition, eliminate investments, sell off valuable subsidiaries, and assume substantial debt before a rider comes.

Conclusion

To conclude, one can say that corporate raiders can play the cards their way because the ultimate destiny of the company is in their hands. The corporate raider, who owns a huge stake in the corporation, can either make personal gains or think for the company's benefit as a whole. History has witnessed examples like Nelson Peltz, Saul Steinberg, Asher Edelman, etc. Some of them worked for the corporate image of the corporation, while a few made decent gains to load their pockets. Corporate Governance laws and code of ethics tried to limit the role of a corporate raider.

In the end, we can say that they can be a boon and a bane to the corporation, depending upon the interest of the raider.

Frequently Asked Questions (FAQs)

A corporate raider is an investor who buys a considerable interest in a corporation whose assets are identified to be undervalued. The objective of a corporate raider is to influence good change in the company's share prices and sell the company or its shares for a gain in the future.

A corporate raider is an individual or a party that buys a significant position (sufficient to get a controlling position) in a company that is judged undervalued. It means that a corporate raider is an individual that undertakes an undervalued company's control (commonly through a hostile takeover).

The deal-making world is very rough and a nose-dive. But Elon Musk may combat any forebears.

Corporate raids were widespread in the United States between the 1970s and the 1990s. However, by the end of the 1980s, the management of many significant publicly traded corporations opted for legal methods they created to stop potential hostile takeovers and corporate raids. Later, activist shareholders used several corporate raiding practices that purchase equity stakes in a corporation to affect its Board of Directors and impose pressure on the management.

Recommended Articles

This article is a guide to the Corporate Raider definition. We discuss the motive of a corporate rider with examples and the techniques to keep them away. We also discuss the advantages and disadvantages. You may learn more about our articles below on finance: -