Table Of Contents

What Is A Corporate Division?

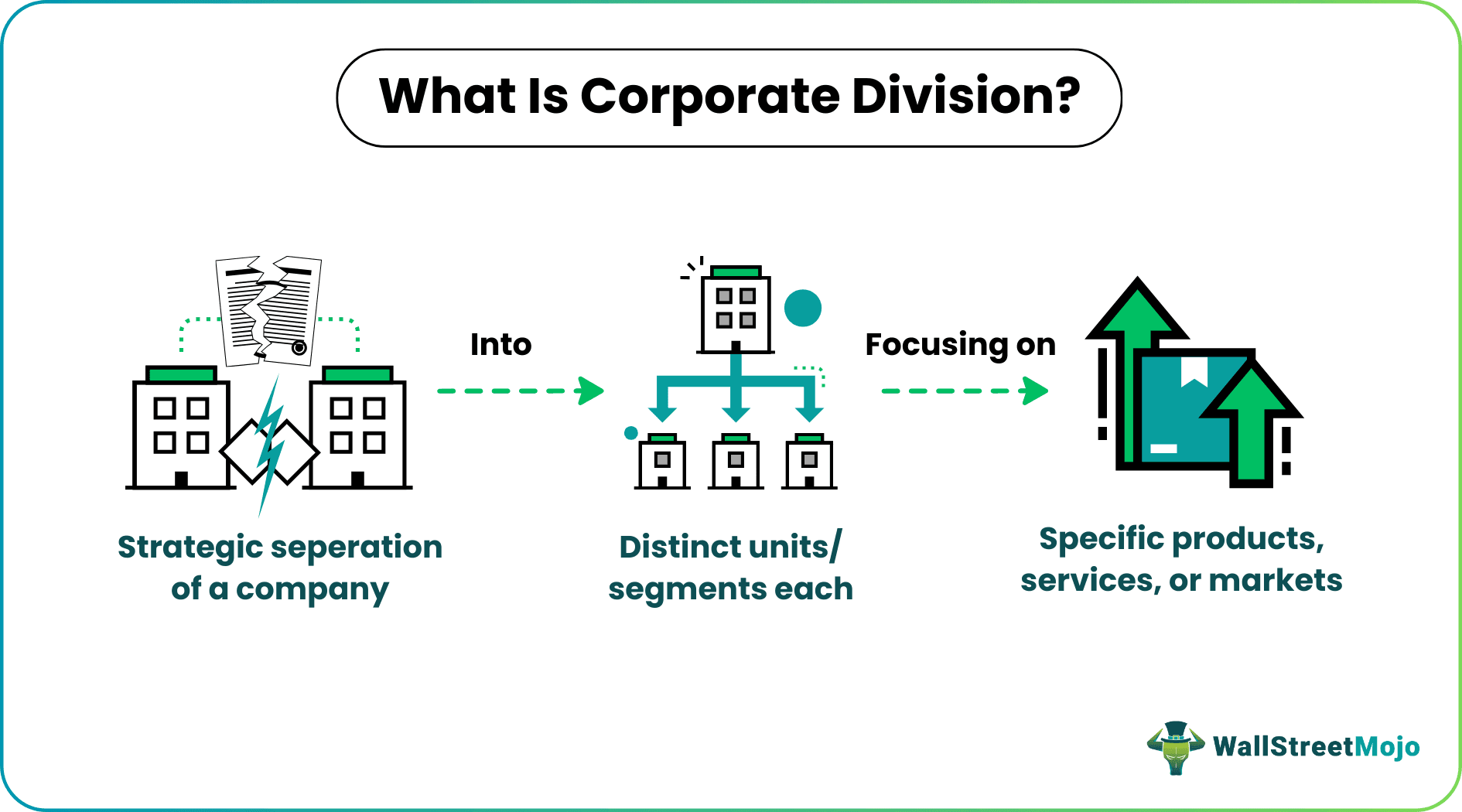

Corporate Division refers to a business unit functional under a larger organization that operates like a distinct firm with individual goals, responsibilities, and strategies. Although these units may not have a separate legal entity, they enjoy a certain degree of freedom in decision-making.

Also known as strategic business units (SBUs) or business divisions, these entities are often a part of a company's expansion strategy. As the company grows, a need arises for setting up separate units to handle diverse product or service lines, geographical regions or markets, or business functions. Moreover, a parent company can have multiple SBUs.

Key Takeaways

- A corporate division or a strategic business unit (SBU) is an in-house division of a company that centralizes its operations around a particular product line, market segment, or function of the business.

- Such an entity has no separate legal existence but relishes some degree of freedom in setting its goals, processes, strategies, and benchmarks.

- Also, an SBU's liabilities, obligations, profits, and losses are added to those of the parent company.

- It differs from a subsidiary, which is a separate legal entity whose significant shareholding relies on the parent company, but it has individual management, goals, strategies, and workforce.

Corporate Division Explained

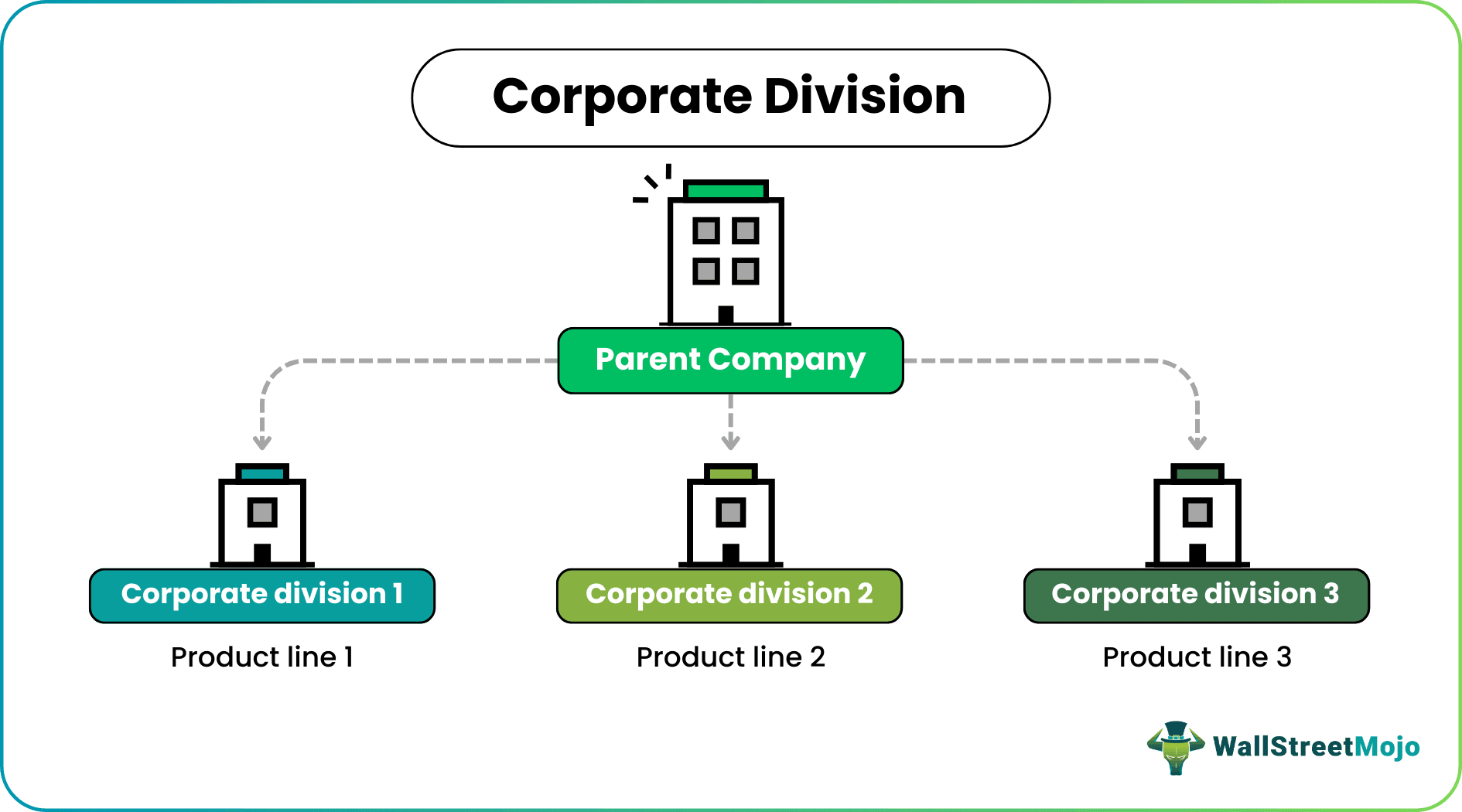

A corporate division is a part of the organizational structure created by a business organization to improve its overall efficiency and decision-making through proper allocation of managerial resources for individually fostering and concentrating on the various product lines, offerings, customer segments, market segments, and geographical locations. Thus, it aims at giving equal importance to each sector for enhancing overall customer satisfaction.

The firms can set up multiple business divisions based on their specific needs and expansion strategies. Also, each of these SBUs is managed and run by a separate management team, often headed by a divisional head. They have individual goals, objectives, budgets, roles, and responsibilities, but all these must align with the overall organizational goal of the parent company. Moreover, these divisional heads are accountable for the respective business unit's daily operations, performance, and decisions. Further, they must report to the company's director, executive management, or headquarters.

Examples

Large corporations often have several SBUs to streamline their operations and cater to diverse market segments efficiently. Let us now have a look at specific examples where these business divisions play a critical role in corporate success:

Example #1

Suppose ABC Ltd. is a premium perfume manufacturing company based in Paris, France. To address the challenge of high transportation costs, the company decided to establish divisions in some of the most significant perfume-importing regions. Consequently, it set up the following geographic corporate divisions:

1. ABC Ltd. North America Division (covering areas such as New York and Florida

2. ABC Ltd. Middle East Division (with a central hub in Dubai, UAE)

As the business expanded, the headquarters in France found it challenging to manage the increasingly diverse operations effectively. To streamline this, ABC Ltd. restructured its organization to create separate divisions based on product lines, leading to the formation of:

1. ABC Ltd. Perfume Division

2. ABC Ltd. Deodorant Division

This restructuring allowed each division to focus on specific market demands and operational efficiencies while maintaining alignment with ABC Ltd's overall strategic objectives.

Example #2

A British universal bank, Barclays, has divisions based on its geographical presence:

Barclays UK

Barclays UK (BUK) includes a trio of core services: UK Personal Banking, UK Business Banking, and Barclaycard Consumer UK. These services are primarily delivered through Barclays Bank UK PLC, and additional entities within the Group conduct these services. While UK Personal Banking offers retail solutions, UK Business Banking caters to business clients with tailored advice. Additionally, Barclaycard Consumer UK is a prominent credit card provider that prioritizes flexible borrowing and a superior customer experience.

Barclays International

Barclays International (BI) specializes in a diverse range of financial services, including Corporate and Investment Banking, along with Consumer, Cards, and Payments businesses. It is operated by Barclays Bank PLC and its subsidiaries, as well as certain other entities within the Group. BI is dedicated to delivering global customer and client satisfaction. The division's diversified portfolio emphasizes balance, resilience, and growth opportunities, thus holding substantial global market positions. BI invests in people and technology to ensure sustainably increasing returns while offering a variety of offerings in both wholesale and consumer banking.

Barclays Execution Services (BX)

Within both divisions, Barclays Execution Services (BX), an essential service arm of the Barclays group, plays a crucial role. It facilitates the company's operations, functions, and technology services, ensuring streamlined services across the board.

Corporate Division vs Subsidiary

The corporate division and subsidiary are two different kinds of child firms functional under a large business entity. Let us now discuss these distinctions:

| Basic | Corporate Division | Subsidiary |

|---|---|---|

| Definition | It is a sub-unit of a large business entity that is set up for a specific product or service line, function, or location. Such a unit often relishes a certain degree of autonomy. | It is a separate firm that functions independently of its parent company, but the latter has a controlling interest in such an entity with more than 50% of the subsidiary's shareholding. However, it has individual goals, management, and teams. |

| Separate Legal Entity | Functions as a parent's unit and doesn't have a separate legal entity | It has a separate legal entity. |

| Identifiers | Shares the parent company's identifiers like employer identification number and tax identification number | Has distinct tax identification number, employee identification number, and other identifiers from that of its holding company |

| Parent Company’s Control | The parent company controls it since the divisional heads need to report to corporate headquarters. | The parent firm has the primary controlling interest in the subsidiary. |

| Autonomy | Such in-house subsidiaries have limited freedom of decision-making. | These firms have a higher degree of autonomy in decision-making related to business operations, goals, strategies, etc. |

| Focus | Established for a specific product, service, function, or location | Broader business focus or even operates in different industry |

| Role | Accommodates the parent firm's request even after having individual goals | Functions independently and may or may not accommodate the holding company's requests |

| Tax Burden | Adds to the parent corporation’s tax burden | Separate tax burden |

| Financial Reporting | A division’s financial transactions are reported in the parent company’s statements. | Has to maintain individual financial statements |

| Liabilities and Obligations | It's the parent firm's accountability. | The parent company's liability is limited to its investment in the subsidiary. |

| Wages and Remuneration | Handled by parent company | Individual wages and remuneration cycle and administration |

| Constitution | It has its protocols and practices governed by the parent corporation's constitution. | Have its constitution |

Corporate Division vs Department

A company may have different sub-units depending on its business needs, size, and objectives. Corporate divisions and departments are two of such organizational parts, which differ in the following ways:

| Basis | Corporate Division | Department |

|---|---|---|

| Definition | A corporate division is a strategic business unit (SBU) of a massive corporation formed to focus on a particular product line, service, location, or function. | A department is a separate unit of an enterprise responsible for performing a particular business function. |

| Scope | Concentrates on a specific product or service line, function, or geographical location | Handles a specific business function |

| Size | Large business units with multiple departments | Comparatively smaller units |

| Hierarchy | A corporation can have various divisions | A business division can have multiple departments |

| Management | Director or division head | Managers or department head |

| Autonomy | It has a certain degree of freedom in operations and strategic decision-making. | Negligible autonomy and needs to function strictly according to the company's guidelines. |