Table Of Contents

Corporate Action Meaning

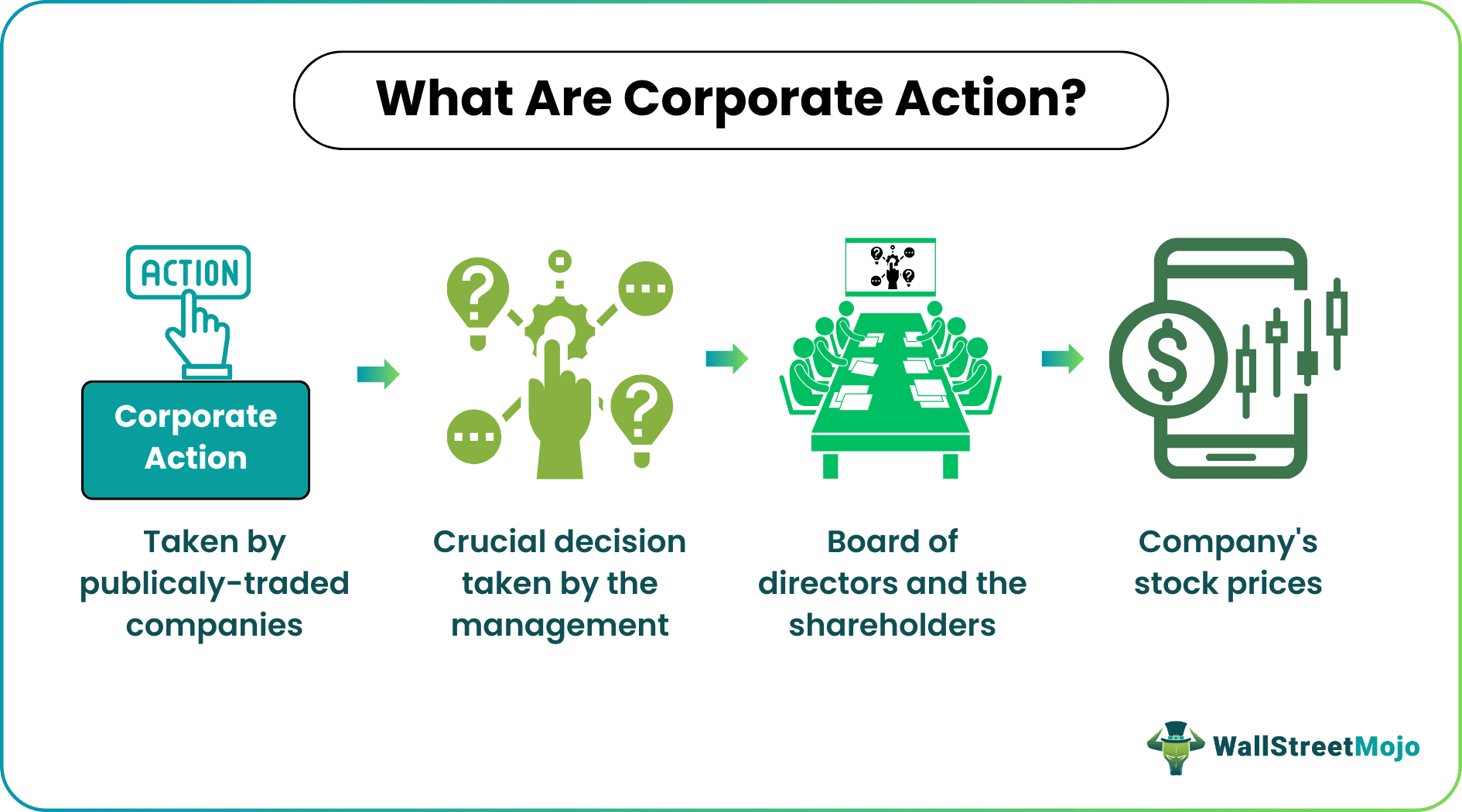

Corporate action refers to any crucial decision the management takes after seeking approval from the board of directors and the shareholders since it would affect the publicly listed company's stock prices. It includes mergers and acquisitions, demergers, spin-offs, stock splits, rights issues, buybacks, bonuses, and dividend payments.

Investors and creditors often analyze the publicly listed firm's corporate actions and their overall impact on their profitability, share prices, and financial well-being to make stock buying or selling decisions for successful trading. Since corporate decisions and initiatives can impact the shareholders' positive and negative value long-term, their interpretation is essential for portfolio management.

Key Takeaways

- Corporate fraud, also white-collar crimes, is a crime by employees or directors of a company for indulging in illegal activities to earn extra money.

- This concept was referenced in the mid-20th century by American sociologist Edwin Hardin Sutherland while addressing the American Sociological Association.

- The three main types of corporate fraud include corruption, misappropriation of assets and cash, and financial statements fraud.

- The major historical scandals include Enron (2001), WorldCom and Sarbanes-Oxley Act 2002, and the Rajat Gupta case of 2010.

Corporate Action Explained

Corporate actions are events that significantly influence a company's stock prices. A single piece of news related to any corporate event can elicit excitement or concern among investors as they assess the potential impact on stock prices. Market sentiments and predictions of future price fluctuations are crucial in such reactions. These actions are decisions a company's management makes that can affect its financial structure, ownership, or operations.

Investors and stakeholders find corporate actions essential, as they provide insights into a publicly listed company's financial health, market standing, and short-term growth potential. For example, investors in a target company involved in a potential merger can be optimistic about future stock price increases. Conversely, news of a reverse split might raise concerns about the company's financial well-being, as it indicates significant stock price declines and an effort to avoid being categorized as penny stocks.

However, it is vital to note that short-term price movements may not always accurately reflect the company's long-term fundamentals. The life cycle of corporate action encompasses various events and decisions undertaken by a company that can significantly impact its operations, financial structure, and shareholders.

Types

Any financial initiative is a critical decision for a publicly listed firm since it has to examine both sides of the coin, i.e., the positive and negative outcomes of such an action.

Below are some corporate actions performed by publicly listed companies:

- Dividend Distribution: A company may distribute some of its profits to its shareholders through dividends. Dividends can be announced in cash, additional shares, or other assets.

- Stock Split: A stock split involves dividing existing shares into multiple shares, thereby increasing the number of outstanding shares while curtailing the stock price proportionally.

- Reverse Stock Split: Reverse stock split or stock consolidation is an action that involves combining multiple shares into one share, reducing the number of outstanding shares while increasing the share price proportionally.

- Rights Issue: Companies may offer existing shareholders to buy additional shares at a lower or discounted price to raise additional capital.

- Bonus Issue: A bonus issue, also known as a scrip dividend, is when a company issues additional shares to existing shareholders without extra cost.

- Mergers and Acquisitions: Mergers involve combining two companies into one, while acquisitions involve one company purchasing another. These actions can lead to changes in share ownership and value.

- Spin-Off: In a spin-off corporate action, a company creates an independent entity by separating one of its divisions or subsidiaries. Existing shareholders of the parent company are then given shares in the newly formed company.

- Share Buyback: In a share buyback, a company repurchases its shares from the market, reducing the number of outstanding shares.

- Delisting: Delisting is the removal of a company's shares from a stock exchange, often due to various reasons such as restructuring or poor financial performance.

- Rights Redemption: If a company has issued redeemable preference shares, it may redeem them at a predetermined date or at the shareholder's option.

- Name Change: Companies may change their names for various reasons, such as rebranding or reflecting a change in business focus.

Examples

Let's understand the concept through some real-world and hypothetical examples.

Example #1

Suppose ABC Pharmaceuticals, a publicly listed company, announces a dividend distribution of $0.50 per share to its shareholders. Investors holding 1,000 shares will receive a total dividend of $500. The dividend distribution signals the company's vital financial health and profitability.

Shareholders welcomed the news and became optimistic about the company's prospects, leading to increased demand for the stock. As a result, ABC Pharmaceuticals' stock prices rise by 5% in the market following the dividend announcement.

Example #2 - Buybacks And Cost Cuts Soared Meta Stock Prices

Meta, formerly Facebook Inc., marked a rise of 23% in its stock prices after the company announced the buyback of $40 billion worth of stocks. The investors and shareholders became optimistic after the release of the fourth-quarter revenue report of the company. Meta's cost-cutting targets and planning are openly accepted and appreciated by investors.

Example #3 - ViewRay Delisted From NASDAQ On July 26, 2023

As the VRAY stock failed to sustain a $1 per share minimum bid price, it has filed a voluntary petition seeking relief under the US Bankruptcy Code's Chapter 11. However, the company has lost the trust of the investors and shareholders since it is now expected to trade on the OTC platform.

Impact On Stock Prices

The effect of corporate actions on stock prices can be complex and is often influenced by factors such as market sentiment, economic conditions, and the company's historical performance.

The effects of various corporate events on a publicly listed firm's stock prices can be as follows:

- Dividend Distribution: When a company declares dividends, it signals its financial health and profitability. Stocks with attractive and regular dividend yields may attract income-seeking investors, increasing demand and higher stock prices.

- Stock Splits: These involve dividing existing shares into multiple shares. For example, in a 2-for-1 stock split, shareholders receive two shares for each one they previously owned. Although the total value remains the same, stock splits can increase affordability and accessibility, potentially leading to increased demand and higher prices.

- Bonus Shares Issuance: The companies sometimes issue bonus stocks to incentivize their shareholders, say, one share for every ten units of holding. Such decisions strengthen the investors' confidence in the company's financial health and boost the stock prices.

- Share Buybacks: Stock buybacks occur when a company repurchases its shares from the market. This reduction in outstanding shares can boost the stock price due to increased earnings per share and signaling management's confidence.

- Rights Issue: When the company allots new stocks to its shareholders at a discounted price, it may negatively trigger its stock prices and earnings per share.

- Mergers and Acquisitions: M&A activities can result in significant price movements. The acquiring company's stock price may decline if investors are concerned about overpayment or integration challenges. Conversely, the target company's stock price may rise as investors expect a premium on the acquisition price.

- Spin-offs and Divestitures: When a company spins off a subsidiary or divests a business unit, the newly independent entity's stock may experience price fluctuations. The impact depends on market sentiment toward the new company's prospects and potential.

Other corporate restructuring efforts such as demergers, debt restructuring, reverse stock splits, or large-scale layoffs can cause a company's stock price volatility as investors reassess its prospects and risk.

Mandatory vs Voluntary Corporate Actions

Corporate actions can be classified into two main categories: voluntary corporate actions and mandatory corporate actions. Let us discuss the dissimilarities between both forms of corporate events:

| Basis | Mandatory Corporate Action | Voluntary Corporate Action |

|---|---|---|

| Definition | Mandatory corporate actions are events that shareholders must comply with as they are legally binding and do not require shareholder consent. | Voluntary corporate actions are decisions a company makes that allow its shareholders to make choices regarding specific events. |

| Shareholders’ Choice | Shareholders have no choice but to comply with the decision. | Shareholders have the option to participate or not participate in the decision. |

| Legally Binding | Yes | No |

| Results From | Regulatory authorities and stock exchanges dictate it due to legal or circumstantial reasons. | The board of directors makes decisions with the shareholders' approval for the benefit of the owners or the company. |

| Examples | Merger and acquisition, reverse stock split, stock split, dividend, bonus issue | The Tender offer, right issue, buyback, exchange offer |

Other than voluntary and mandatory corporate events, some corporate actions are mandatory with choice, like conversion, stock dividend with option, and certain mergers. These initiatives provide an alternative for the shareholders to choose their participation or go for the default choice.