Table Of Contents

What Is Copy Trading?

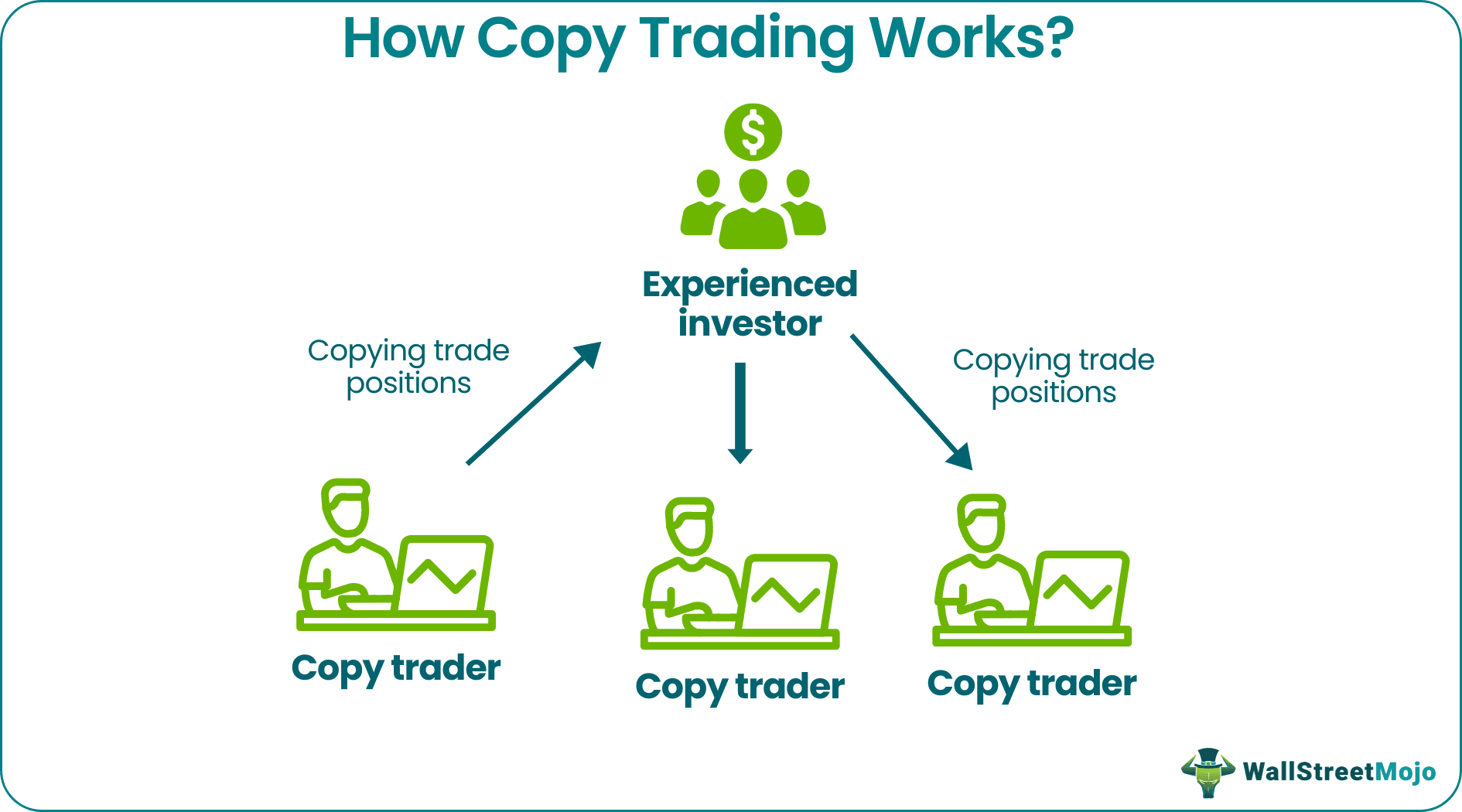

Copy trading is a trading strategy where one trader's position or portfolio is copied by another when opened or closed. It is suitable for traders who are new to the stock market and need more expertise, time, and commitment to analyze the market. It can be done either manually or automatically.

The traders whose position is copied are typically experienced and backed by years of knowledge. Therefore, a trader can choose the amount they want to invest. Still, performing some form of evaluation is advisable because even when a trader copies another person's position, their capital is still at risk.

Key Takeaways

- Copy trading is the simple strategy of copying the positions or portfolios of an experienced trader by a new or inexperienced trader in the market.

- The process can be manually and automatically implemented by traders and is often called a branch of social trading.

- Typically, the manual practice of imitating positions is a form of free copy trading; else, semi and fully-automated trading come with pricing.

- It is common for traders who need more time and expertise in the market and want to profit using other traders' knowledge.

How Does Copy Trading Work?

Copy trading is the process of imitating the trade positions of a chosen or experienced trader into a personal portfolio. All investors must do is choose a preferred trader and align their portfolio with them. The trader can choose how much money they want to invest, and the trading occurs in real-time. It is possible in capital markets like crypto and stock market and even takes place as Forex copy trading in currency markets.

Copy trading goes back to 2005, when automated trading algorithms began to be duplicated. The people revised it and explored its potential when there was no need to monitor trade positions constantly. As a result, Etoro and Zulutrade were the first to allow traders to connect their accounts to their platforms, and the need to submit specific strategies was eliminated.

Today there are many copy-trading brokers available in the market. A survey reported that one of every three traders finds traditional trading complex and may switch to copy trading. It lets traders have the ability to open and close trades as per their wish and take advantage of another trader's skill and knowledge.

Many traders use Saxo Bank International to research and invest in stocks across different markets. Its features like SAXO Stocks offer access to a wide range of global equities for investors.

Strategy

Following are the three main copy trading strategies:

#1 - Manual

It is similar to normal trading, where a trader decides whether to follow or not another trader who is known for good returns or simply because the first trader likes their investing style and copies their trade manual initiating every position. It is also called social trading.

#2 - Semi-Automated

The semi-automated strategy allows traders to view the positions of their preferred traders. From there, they can choose which positions to trade and automatically initiate with those positions. It is semi-automated because it takes an effort from the trader, and the other process gets done without human activity.

#3 - Automated

This type of strategy is only used with complete packages, as every platform has its options to offer its users. The traders choose their preferred investors and the best strategies in a fully automated system. Therefore, the absolute position and subsequent trading are imitated automatically into their portfolio.

Examples

Check out these examples to get a better idea:

Example #1

Jason has started his new job and earns well. He has always been keen on investing in the stock market but needs more knowledge and time to monitor and analyze the market. He studies and does a little research about William, a well-established and ace investor.

Jason is convinced with William's investing style and manually imitates his trades and portfolio positions. In addition, he keeps track of any new investing move Willam makes and copies the same in his portfolio. In nine months, Jason has earned up to 11% returns and therefore continues to follow in the investing footsteps of William. This simple stock copy trading example explains how a new trader follows an ace investor to earn good returns without worrying about knowledge, expertise, or analysis.

Example #2

Taking the first example further, Jason's sister Emily liked this idea but was more interested in cryptocurrency. So she did her research and found that there is another cryptocurrency investor named Steve, who is well known for his good track record of high returns. So Emily, just like her brother, invests a good amount of money in crypto copy trading of Steve's positions.

After four months, Emily's crypto portfolio is at a loss of -9%, the same as Steve's. However, Steve, an old investor, has a higher risk appetite than Emily. Both these examples elaborate on how following copy trading strategies has advantages and disadvantages. Where on the one hand, Jason earned good returns. Emily, on the other hand, suffered a loss.

Pros And Cons

The following are the pros of copy trading -

- A trader can take advantage of someone else's knowledge and expertise.

- Saves traders' time, energy, and effort as they don't have to commit to stock market movements and analysis.

- Typically, traders follow an ace investor with a proven record of success and high returns, and there is low risk involved.

- There are many trading platforms available that allow and offer ready-made portfolios from different experienced investors.

The following are the cons of copy trading -

- A trader's entire investment is based on someone else's positions and returns.

- The positions can be copied, but eventually, the risk is always there for the investor.

- When following an ace investor, a certain loss can be small for them but not for the trader, as each has its risk appetite.

- There are additional fees involved when using a platform for auto-copy trading.

- Every investor is flawed, and positions can always backfire as there are no guarantees.

- A trader deliberately follows another investor. In case of loss, there is no one to blame but the trader.

Frequently Asked Questions (FAQs)

Copy trading can be done both manually and automatically. However, many platforms allow new traders to initiate copy trading in easy and hassle-free steps. For example, traders can pick the portfolio they want to copy, and they take the same positions in their portfolio.

This trading tactic does help new investors in avoiding common and beginner mistakes in the market, but the risk is always present, and there is no guarantee offered, and it can backfire as well. Therefore, it is generally advised that beginners should choose their investors wisely. Nevertheless, after enough research and observation, copy trading can benefit newbie traders or those who lack years of experience or expertise, like established traders.

This kind of trading is mostly done through online platforms and is an automated process. However, every platform has guidelines and a minimum deposit amount with which any new trader can start copy trading and investing practices.