Table Of Contents

Controlled Foreign Corporation (CFC) Definition

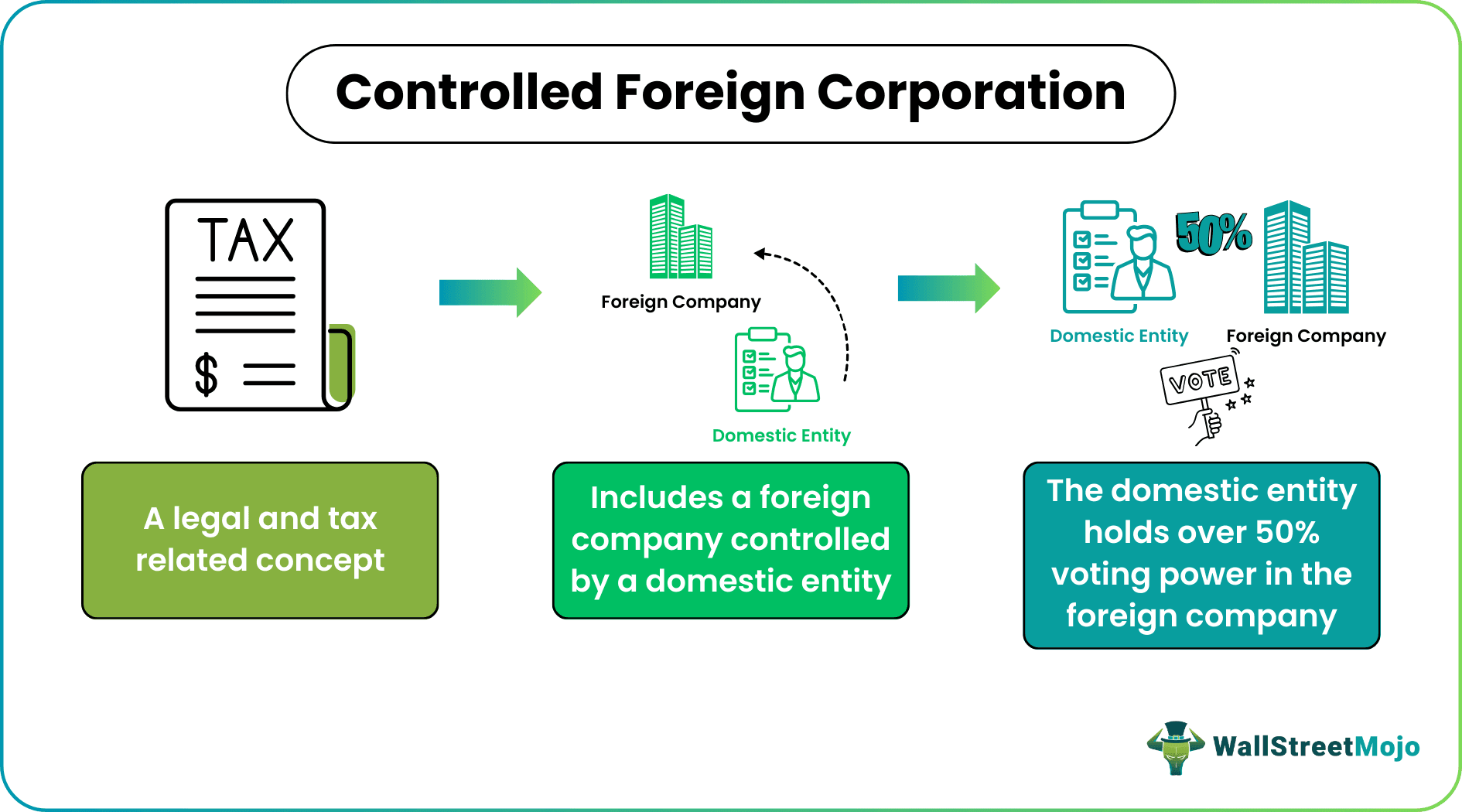

A Controlled Foreign Corporation (CFC) is a legal and tax-related notion that signifies a foreign corporation controlled by a domestic entity or individual. The controlling entity usually holds more than 50% of the foreign corporation's voting rights or value. It is designed to prevent tax evasion by individuals or companies relocating profits to low-tax jurisdictions.

When a corporation is deemed a CFC, the controlling entity is subject to taxation on the CFC's income. This is a crucial concept in international taxation, which ensures that individuals or entities cannot exploit favorable tax conditions in foreign jurisdictions to reduce their overall tax liability.

Key Takeaways

- A Controlled Foreign Corporation(CFC) is a foreign corporation that is controlled by a domestic corporation or individual. Usually, the foreign corporation's controlling entity owns more than 50% of its voting power.

- A CFC's income is taxed on the controlling entity.

- This is a crucial concept in international taxes because it ensures that individuals or businesses cannot take advantage of favorable tax conditions in other countries to reduce their overall tax liability.

- The controlling organizations must provide tax authorities with information on their foreign subsidiaries. Thus, this step enhances openness and aids the tax authorities in tracking compliance.

How Does A Controlled Foreign Corporation Work?

A controlled foreign corporation is a foreign corporation that a domestic entity or individual controls. It is a significant concept in international taxation. It has been created to prevent tax avoidance and ensure a fair distribution of tax responsibilities across borders. In such organizations, control is typically defined by holding over 50% of the foreign corporation's voting power or worth.

The CFC rules prevent individuals or companies from exploiting variations in tax rates across different jurisdictions, known as tax havens, to minimize their overall tax liability. The rules ensure that the controlling entity is subject to taxation on the CFC's earnings, which helps prevent the erosion of the domestic tax base. Moreover, the taxation of CFC income acts as a countermeasure to discourage the shifting of profits to jurisdictions with more favorable tax conditions.

Rules

The controlled foreign corporation rules are as follows:

- A CFC is a foreign corporation that is controlled, directly or indirectly, by a domestic entity or individual. The percentage of ownership often determines control in terms of voting power or value.

- The income generated by the CFC is attributed to the controlling entity in the home country, irrespective of whether the profits are returned to the foreign country. Thus, the controlling entity is liable for taxes on the CFC's income.

- Controlling entities are required to disclose information about their foreign subsidiaries, including financial details and ownership structures, to the tax authorities. Hence, this measure enhances transparency and helps tax authorities monitor compliance.

- The CFC rules may include anti-abuse provisions to prevent individuals or entities from structuring their activities with the sole purpose of avoiding CFC taxation. These provisions are also designed to ensure the rules are effective in preventing tax evasion.

Examples

Let us understand this corporation with the help of the following examples:

Example #1

Suppose Rose Cosmetics is a U.S.-based company that owns a subsidiary, Panache Ltd, in a country with a lower tax rate. If Rose Cosmetics holds more than 50% of Panache Ltd's voting rights and value, Panache Ltd is considered a CFC. The U.S. tax laws require Rose Cosmetics to report and pay taxes on Panache Ltd's income. This approach prevents Rose Cosmetics from exploiting the lower tax rate in foreign countries to reduce its overall U.S. tax liability.

Example #2

The boundaries between nations have grown blurred owing to increased globalization. Many multinational corporations attempt to take advantage of their global presence by employing tax planning strategies in low-tax jurisdictions to reduce their overall tax expenses. Multinational companies adopt strategies like parking profits in low-tax nations instead of transferring them to the ultimate parent business, which is based in a country with comparatively higher tax rates.

Sometimes, this practice leads to a significant or permanent postponement of tax payments on such profits. Today, the world recognizes the significance and benefits of CFC regulations. Additionally, the OECD's Base Erosion and Profit Shifting ("BEPS") Action Plan has identified CFC regulations as an essential measure.

Liquidation

The liquidation of a controlled foreign corporation involves the process of winding down the foreign subsidiary's operations and distributing its assets or proceeds to its shareholders. However, the liquidation of a CFC is complicated due to the tax implications associated with it. When any such entity is liquidated, the controlling entity must consider the tax consequences in the foreign jurisdiction where the CFC operates and the home jurisdiction.

Additionally, anti-abuse provisions in tax laws are designed to prevent the inappropriate use of liquidation strategies solely for tax avoidance. The process involves meeting legal requirements in the foreign jurisdiction and the home country, which often includes filing appropriate documentation and providing detailed financial information to tax authorities.

Taxation

The controlled foreign corporation taxation includes the following:

- The income generated by a CFC is attributed to the controlling entity.

- The controlling entity is subject to taxation on the CFC's income in its home country. This prevents entities from exploiting lower tax rates in foreign jurisdictions to reduce their overall tax liability.

- CFC rules often include anti-deferral mechanisms in order to discourage the delay of taxation.

- Some jurisdictions also provide exemptions or deferrals for certain types of income or active business operations in a foreign country.

- Some countries allow the controlling entity to claim foreign tax credits for taxes paid by the CFC in the foreign jurisdiction to avoid double taxation.

Controlled Foreign Corporation vs Disregarded Entity

The differences between the two are as follows:

Controlled Foreign Corporation

- A CFC is a tax-related idea wherein a domestic entity controls a foreign corporation.

- It is usually defined by ownership of more than 50% of the voting power or value.

- The CFC rules are designed to prevent tax avoidance. It helps maintain the integrity of a country's tax system by subjecting the controlling entity to taxation on the CFC's earnings.

Disregarded Entity

- A disregarded entity refers to a business entity that, for tax purposes, is not treated as a separate entity from its owner. It often applies to single-member limited liability companies (LLCs).

- The income and expenses of a disregarded entity are reported directly on the owner's tax return.

- A disregarded entity does not face separate taxation. Its activities are treated as if conducted directly by the owner.