Table Of Contents

Formula

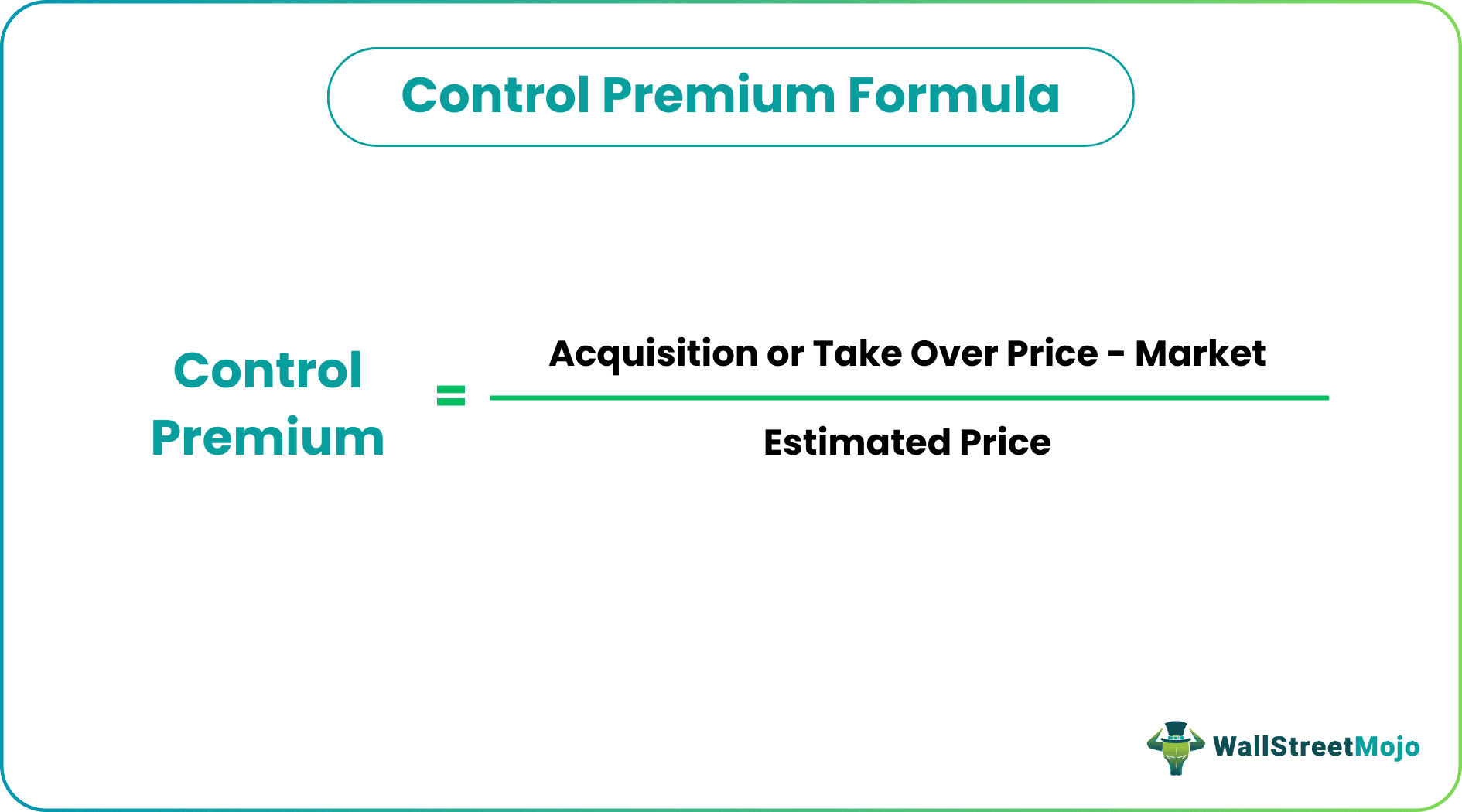

The formula mentioned below gives an idea about how to calculate control premium.

Control Premium = Acquisition / Take Over Price (-) Market / Estimated Price

Examples

Example #1

X Corp. wants to acquire ABC Inc. The value per share of ABC Inc. is $15, but X Corp. offers $20. This premium X Corp. willing to pay is $5 per share (i.e.) 30% premium .

Solution

It varies from business to business, depending on the industry and the value and benefits derived from the acquisition. In addition, it also depends on the competition present in the acquisition. Finally, the premium is determined based on the share price considered for acquisition.

Example #2

Z Group wants to acquire SM Corp. The valuation of the business of SM Corp. comes to $8,000,000.

Solution

Z Group believes that if SM Corp. merges with Z Group, there will be more business opportunities and synergy, bringing more gain to the business. In addition, post-acquisition Z Group estimates that the value of SM Corp. may increase to $12,000,000. Therefore, the additional benefit derived by acquisition is $4,000,000.

Z Group decides to pay a premium to acquire the shares. It has decided to $2,000,000 as an acquisition premium (i.e.) 25% premium. Total takeover value is $10,000,000.

Valuation

The control premium is a significant consideration in mergers and acquisitions. An average control premium can range from 20% to 80%; it purely depends on the business condition of the acquiring firm and market demand for the same. It shall be determined based on the company's intrinsic value, additional value, or the synergy one can derive from acquiring the target company.

This premium is unnecessary if the target company cannot maximize the value post-acquisition. The premium's size may influence by various factors like possible maximization of value post-acquisition, any other rival firm/competitors trying to acquire the same target firm, or the expectation of the existing shareholders to give up their stake in the company.

By acquiring a 51% stake in the target company by paying the premium, they have major power to direct business activities. They can be part of all decision-making; If they acquire 26% or more, they can exercise significant influence in directing the activities.

It varies according to the business line and industry. It also depends on the period of acquisition and market and economic conditions.

One may pay using cash or in the form of shares of the acquiring company or a combination of both. An average control premium is decided based on the needs and expectations of the acquiring firm and the existing shareholders.

Advantages

- Control premium enables the acquisition of shares from existing shareholders as the price offered for the shares is more than the market price.

- It helps to complete the acquisition before more competitors enter the deal.

- It helps acquire the controlling interest in the business and can exercise significant control over its operations.

Frequently Asked Questions (FAQs)

DCF has premiums, not control premiums. The well-known DCF method needs to give more guidance in valuing control premiums, and comparable company analysis is complex, separating it from other target company valuation elements. The following approach deals with these shortcomings.

The control premium equals the offer price per share divided by the current price minus one.

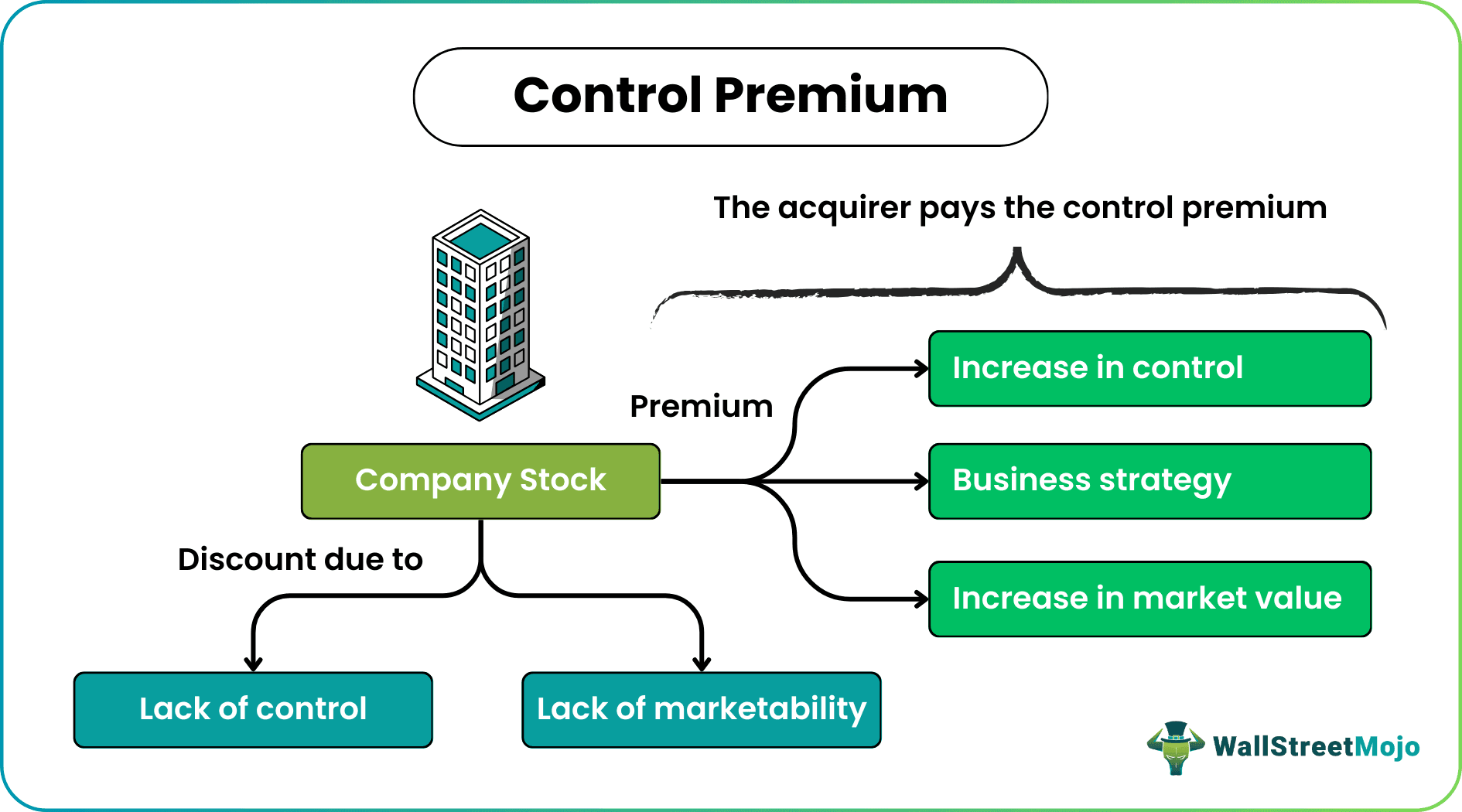

The amount a buyer pays to acquire company control of a company increases typically its current market value based on its market capitalization. The amount the buyer provides, commonly referred to as the control premium, gives the buyer a controlling interest in the company.

Recommended Articles

This article is a guide to what is Control Premium. We explain its valuation and formula along with examples and its advantages.. You can learn more about it from the following articles: -