Table Of Contents

What Is A Contract Note?

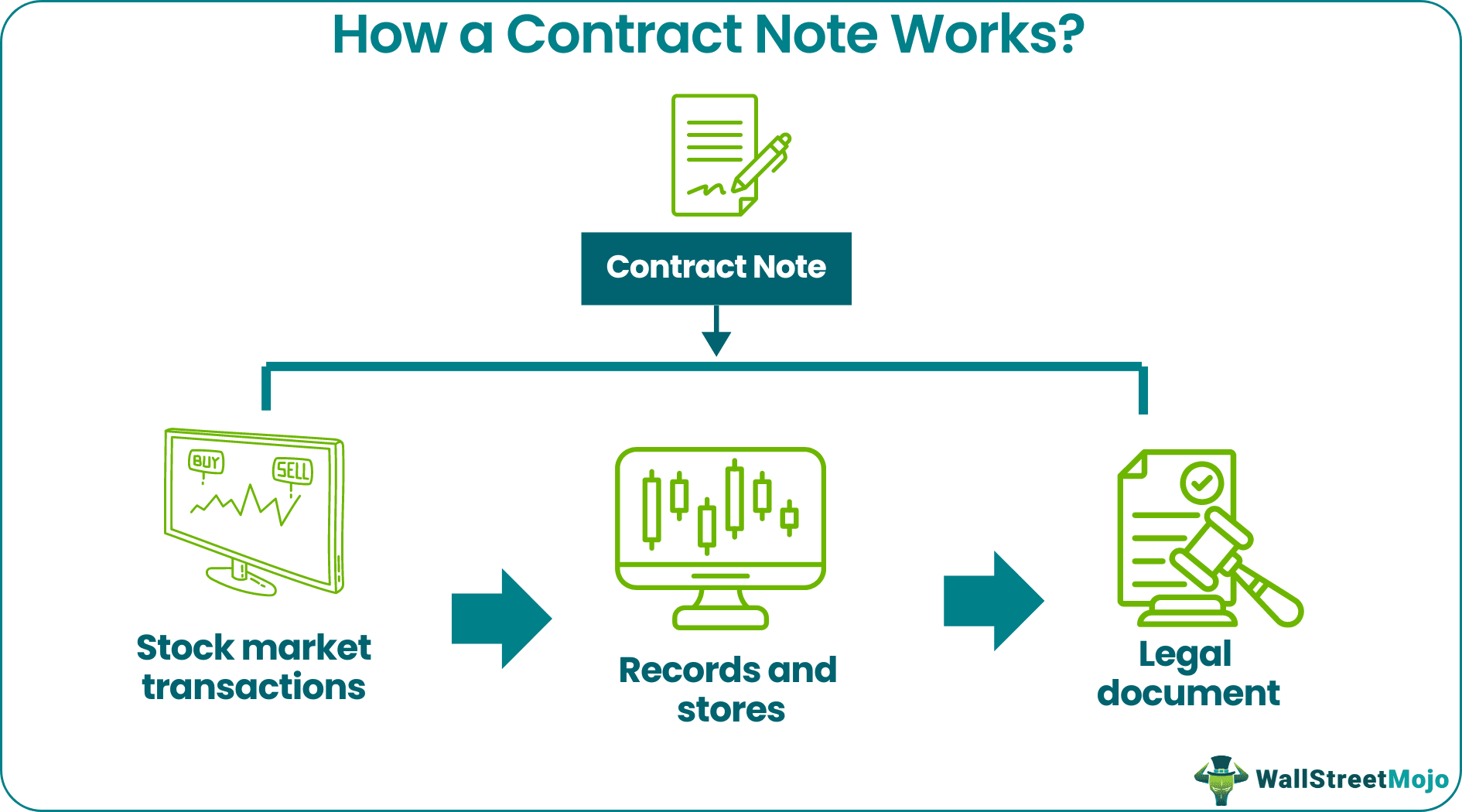

A contract note is a recorded document that stores all the details about the successful trades conducted during the day. This note confirms and provides the details of all the trades that occurred during the day. It is popularly used in the Indian stock market as proof of total transactions in a day.

Contract note in the stock market serves as legit proof of all the stock transactions. It contains details like quantity purchased, taxes, fees, and others. In addition, it acts as a transparent door for investors. Brokers can issue a digital contract note or printed note.

Key Takeaways

- A contract note is a legal document that records and stores all the transactions the trader performs in a single trading session.

- It was first introduced by SEBI (Securities Exchange Board of India) in India. It allows the brokers to issue a note to trading members complying with the Exchange rules and bye-laws.

- The note details include price, quantity, date, time, number, security description, fees, brokerage, name, address, digital signature, and others.

- An affected party can only claim charges if the complaint is made within 30 days to 6 months.

Contract Note Explained

A contract note records all stock market transactions during a single day. Likewise, the broker will send this note in electronic (email) or paper format. So, an individual can anytime have access to the transaction details. However, SEBI (Securities Exchange Board of India) only allows digital contract notes.

According to the SEBI guidelines, only brokers can issue contract notes of traded shares. The main reason for issuing these notes was the increasing fraudulent activities within the market. In addition, day traders used to trade many deals in a single day. So, it became difficult to monitor trades performed by a single trader. As a result, the brokers or the broking platform will share contract notes of shares by the end of the trading session. So, whenever traders trade shares, futures, or options, they receive a note that contains the following details. Let us look at the contract note format details in depth:

- Price

- Contract note number

- Order time

- Quantity purchased

- Securities description and others.

Many traders use Saxo Bank International to research and invest in stocks across different markets. Its features like SAXO Stocks offer access to a wide range of global equities for investors.

Rules

Let us look at the rules and guidelines suggested by the SEBI for contract notes:

- The contract note shall imply the Exchange rules, bye-laws, and regulations.

- The note must disclose all the details regarding the transaction, like the order number, order time, quantity, price, and others.

- The broker must show the brokerage charged to the client or sub-broker separately in this note.

- The broker must issue the note to the trading member (trader) on behalf of the rules.

- Brokers should only release notes for the transactions conducted by the member on the Exchange's ATS (Alternative Trading System).

- Traders can take up any claim arising from the note issue. However, it can be void as per the Exchange Rules and Bye-laws.

- The affected party can complain to the Investor's Grievance Cell of the Exchange within 30 days.

- If the complaint is not applied within six months, the person cannot claim any interest arising from the situation.

- For large firms, it will be issued under the company seal. Therefore, no sole proprietor can receive a contract note in that case.

- The note will be considered invalid if it is not signed or unauthorized.

- According to the Information Technology Act 2000, traders can receive digital contract notes. However, individuals also have a right to claim printed notes.

- For preparing confirmation memos, this note can be helpful.

Examples

Let us look at the examples of contract notes in the stock market to understand the concept better:

Example #1

Suppose Vaibhav is an intraday-based trader dealing in the Indian stock market. He trades more than $800 worth of shares daily on a medium scale. As a result, he used to receive a contract note that stated the number of trades executed in a single day. But, after the amendment, Vaibhav will receive it electronically.

For example, on December 14, 2022, he traded $350 shares of a steel company, $20 in textile, and the rest $190 in other corporations. By the end of the trading session (around 5 pm), he received an email where a note attached. It mentioned the number of shares, price, stock name, time, and other details. As a result, Vaibhav could easily track the trades that occurred every month.

Example #2

On March 26, 2022, the National Stock Exchange (NSE) issued a new version of the contract note format. Also, it stated that every trading member must obtain a note from the broker within one day.

Sample

Let us look at the contents of a sample contract note:

#1 - Quantity Purchased

It consists of the number of shares bought or sold of a particular stock by the trader.

#2 - Price

Price usually depends on the time when the trading member executed the trade. For example, if during the morning session, the share price was $23, and during the trade, it was $24, the latter will be considered.

#3 - Contract Note Number

The stock brokers issue a unique identification number to the clients. It can be either numerical or alpha-numeric.

#4 - Settlement (Order) Number And Date

Order number and date specify the date on which the trade gets executed. So, if the trade occurs on January 5, the broker will assign a settlement number as the process takes a minimum of time.

#5 - Name, Email Address Of The Investor

It includes the name and email address of the trader. Also, it has details about the brokering firm.

#6 - Security Description

Most of this note represents data regarding the securities or stocks purchased by the trader. Some details include the name of the particular stock, quantity, and position of the trade (bought or sold).

#7 - Trade Time

It includes the exact time of the day when the trader executed the deal.

#8 - Brokerage (Per Unit)

It includes all the fees charged as brokerage by the broker.

#9 - Closing Rate (For Derivatives)

For derivatives, the note will mention the closing rate during the trade.

#10 - Taxes Applicable

Apart from the brokerage, it includes all the taxes like capital gains, clearing charges, CGST (Central Goods and Services Tax), SGST (State Goods and Services Tax), UGST (Union Territory Goods and Services Tax), SEBI turnover fees, stamp duty, and others.

#11 - Net Amount Payable/Receivable

The last part of the note includes the net amount that the trader will receive or has to pay to the firm.

Disclosure: This article contains affiliate links. If you sign up through these links, we may earn a small commission at no extra cost to you.

Frequently Asked Questions (FAQs)

Contract notes are released within a day of the transactions. These notes are easily available on any booking platform. Although the broker does issue them before the deadline, a trader can request them on their customer service support and access them. Older contract notes are also available from the stock broker's website.

According to the SEBI (Securities Exchange Board of India), only brokers can issue these notes to the trading members. Therefore, these brokers should also be identified as trading members. In addition, they need to comply with the exchange rules, regulations, and bye-laws governing the country.

Contract notes are official proof of all trade transactions. SEBI has made it mandatory to issue these notes if trades are executed within one trading session to protect and safeguard the interest of the investors plus traders.