Table of Contents

Contract Asset Meaning

Contract assets, as defined by the IFRS (15), are conditional rights to receive payment by an organization for delivery before payment to the customer. The right arises owing to the previous transfer of goods or services to a company's customer before payment (consideration)

These assets typically arise in terms of contracts, especially long-term contracts. They arise when the party involved in the contract has completed the work but has not issued an invoice or received payment. In addition, they could have recognized it as revenue to date. The arrangement is for accounting treatment purposes.

Key Takeaways

- Contract assets arise when a business or organization gains a conditional right of payment for goods and services that have been transferred

- But have not received payment. This right is conditional on something other than the passage of time.

- They are accounted for according to IFRS 15 standards and calculated by subtracting the recorded revenue to date from the invoice amount to date.

- There are no specific guidelines for recording contract assets and liability. Companies are to use their discretion to treat them according to standards.

Contract Asset Explained

Contract assets are an organization's right to payment in exchange for goods or services transferred without payment. This right is applicable when it is conditioned on criteria other than the passage of time. They are assessed according to the financial instruments' standard for impairment. The IFRS (International Financial Reporting Standards) 15 deals with the accounting standards regarding these assets.

The right to payment is subject to fulfillment of a future obligation. The asset created due to partial performance is known as the contract asset. Since customer payment is dependent on a future event, it is also referred to as the unbilled receivable.

Calculation under IFRS 15 is simple. The organization records the revenue recognized to date and subtracts the amounts invoiced to date to find the contract asset. In cases where the performance conditions were satisfied over the period, the organization should calculate the revenue to be recognized to date.

However, the contract asset IFRS standards do not specify if the contract assets and liabilities have to be put together with other items or as separate items. Therefore, entities apply general accounting principles for offsetting requirements and presenting financial statements. It shall be noted that the nature of a contract asset and contract liability and costs associated with fulfillment differ under different contracts. Therefore, an entity shall consider the prevailing circumstances and facts to determine the nature of the item. Thus, determining the nature is important to aid in the accurate classification of financial position statements.

Examples

Let us look at a few examples to understand the concept better.

Example #1

Let's imagine a hypothetical situation where there are two clients. Client A is a construction company that has signed an agreement with client B. Client B wanted a new office building. Their contract specifies full payment on handing over the keys. The period given was 6 months, and the estimated value was $1 million. Client A had completed 75 % of the construction and informed Client B that only a few days were left and that it would be completed, and the payment had to be made. Let's say Client A has not invoiced it to Client B, but it has recognized it as revenue, and the keys are shipped. This creates a contract asset on the balance sheets of client A, and once it is fully completed, the keys are delivered, and client B is obligated to pay the full amount. This is because they have yet to get the payment, but the keys have been shipped.

Example #2

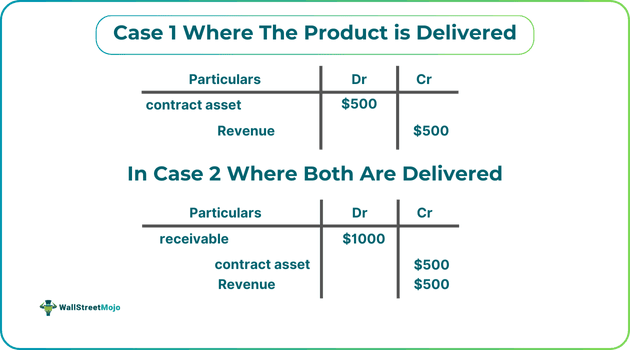

Let's look at another hypothetical example to understand how to make a contract asset journal entry. Suppose in 2024, Company A enters into a contract with Company B to deliver a good and a service for a compensation of $1,000. A contract has been made, and it requires delivery in two parts, first the goods and then the services. The payment will only be made if the product has been made first and $500 has been allocated for each obligation fulfillment.

The contract asset journal entry sample for this would be:

Contract Asset vs. Trade Receivable vs Account Receivable

Given below are some of the differences between both concepts

| Parameters | Contract Asset | Trade Receivable | Account Receivable |

|---|---|---|---|

| Concept | These are rights of consideration possessed by companies as a result of the transfer of goods and services before payment dues. | Trade receivables are payments that a company has yet to receive but has delivered goods or services to the consumers. Ideally, the transfer should have been after receiving goods and services, but in these cases, they are transferred before the payment. | Account receivables are the class of assets that are created when businesses provide goods or services to customers on credit. |

| Essence | They are conditional rights, conditioned on the fulfillment of specific obligations. | Similar to contract assets, they are unconditional rights. | They are often referred to as trade receivables. |

| Treatment | Contract asset IFRS 15 deals with the treatment of current assets. | They are treated under IAS (International Accounting Standards) 15. | Accounts receivables are treated as per IAS (International Accounting Standards) 39. |