Table Of Contents

What Is A Consumer Proposal?

A consumer proposal is an agreement between an individual (the debtor) and their creditors that outlines a plan to pay back the debts owed. The primary goal of a consumer proposal is to provide a way for individuals struggling with debt to agree with their creditors and avoid bankruptcy.

It aims to provide a fair and reasonable solution for both the debtor and the creditors by allowing the debtor to make manageable payments while still paying back a portion of what they owe and by providing the creditors with some assurance that they will receive at least some of the money owed to them.

Table of contents

- What is a Consumer Proposal?

- A consumer proposal is a legal process governed by Canada's Bankruptcy and Insolvency Act. It allows individuals to negotiate a settlement with their creditors and pay back a portion of their debts over some time, usually up to 5 years.

- It allows individuals to avoid the negative consequences of bankruptcy while still taking responsibility for their debts.

- It may hurt the individual's credit score, but the impact is generally less severe than with bankruptcy.

- It is only available to individuals with unsecured debts of less than $250,000, not including their mortgage.

How Does A Consumer Proposal Work?

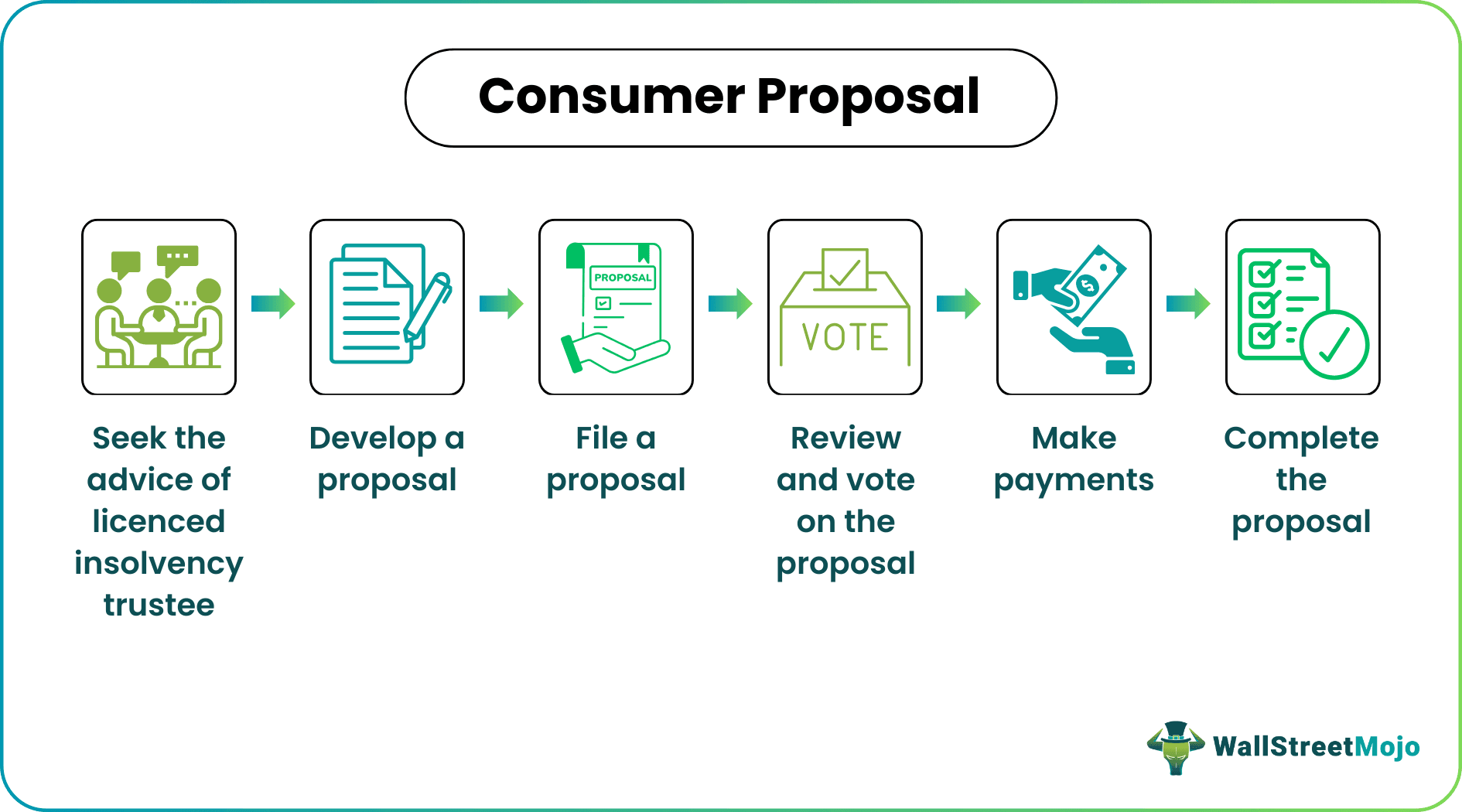

A consumer proposal is a process that allows individuals to negotiate a settlement with their creditors and avoid bankruptcy. Here is a step-by-step breakdown of how a consumer proposal works:

Step #1 - Seek The Advice Of A Licensed Insolvency Trustee (LIT)

The first step in the consumer proposal process is to seek the advice of a licensed insolvency trustee. A trustee is a licensed professional authorized to administer consumer proposals and other debt-relief options. The trustee will review the financial situation and determine whether a consumer proposal suits you.

Step #2 - Develop A Proposal

If a consumer proposal seems the right option, the trustee will help develop a proposal outlining an offer to the creditors. The proposal will include details such as the amount one is offering to pay, the timeline for payments, and any other conditions or terms one wants.

Step #3 - File The Proposal

After developing the proposal, the trustee will file it with the Office of the Superintendent of Bankruptcy (OSB) and notify the creditors. The OSB will review the proposal to ensure it meets the Bankruptcy and Insolvency Act requirements.

Step #4 - Review And Vote On The Proposal

After filing the proposal, creditors will have 45 days to review it and vote on whether to accept or reject it. For the approval part, the submission must be received by most of the creditors, representing at least 50% of the total value of the debts.

Step #5 - Make Payments

After the approval, one must pay the trustee according to the terms outlined. Then, the trustee will distribute these payments to the creditors.

Step #6 - Complete The Proposal

Once one has made all the required payments, the proposal will be considered complete. Accordingly, one will receive a Certificate of Full Performance from the trustee, and any remaining debts covered by the proposal will be discharged.

Examples

Let us understand the concept with the help of these examples:

Example #1

Suppose John has accumulated significant unsecured debts on his credit cards and personal loans. He struggles to keep up with his monthly payments and worries about bankruptcy. Finally, he contacts a Licensed Insolvency Trustee (LIT) who helps him develop a consumer proposal to settle his debts.

After reviewing John's financial situation, the LIT determines that he can repay 50% of his debts over five years. The proposal is presented to John's creditors and is accepted by a majority vote. As a result, John makes regular payments to the LIT over the next five years, and any remaining debts are discharged at the end of the term.

Example #2

In 2020, Cirque du Soleil, a world-renowned entertainment company, filed for bankruptcy due to the financial impact of the COVID-19 pandemic. However, Cirque du Soleil filed a consumer proposal to its creditors instead of liquidating the company's assets and shutting down. The proposal was accepted, and the company could restructure its debts and emerge from bankruptcy. As a result, Cirque du Soleil saved thousands of jobs and continued to entertain audiences worldwide.

How To Qualify?

To qualify for a consumer proposal, one must meet specific requirements:

- First, you must be an individual, not a business or corporation.

- Second, it would be best to have debts of less than $250,000, excluding your mortgage.

- Third, you must be able to make regular payments towards the proposal.

- Finally, one must be able to offer the creditors more than they would receive if they filed for bankruptcy.

In addition, you must work with a licensed insolvency trustee to develop and file the proposal. The trustee will review the financial situation and help you determine if a consumer proposal suits you. The trustee will help you develop and present the proposal to your creditors.

Pros And Cons

Some of the advantages and disadvantages of a consumer proposal are:

Pros

- Debt Relief: A consumer proposal provides a way for individuals to settle their debts and get relief from overwhelming debt.

- Avoid Bankruptcy: A consumer proposal allows individuals to avoid the negative consequences of bankruptcy, such as the loss of assets and damage to credit rating.

- Manageable Payments: A consumer proposal allows individuals to make manageable payments towards their debts, which can help to reduce stress and anxiety.

- Protection from Creditors: Once a consumer proposal is accepted, creditors must stop contacting the debtor or taking legal action to collect the debt.

- Flexible Terms: A consumer proposal allows for more flexibility regarding the payment amount, timeline, and other negotiated conditions or phrases.

Cons

- Negative Impact on Credit Score: A consumer proposal will hurt the debtor's credit score, making it a little difficult to obtain credit in the future.

- Costly: The consumer proposal also includes fees for the licensed insolvency trustee and legal fees, which can add up quickly.

- Public Record: A consumer proposal is a public record, meaning anyone can assess who searches the debtor's credit history.

- Impact on Employment: In some industries, employers may view a consumer proposal negatively, which could impact future employment opportunities.

- Creditors may reject the proposal: Creditors may reject the bid if they feel that the terms are unfavorable, which could result in further negotiation or bankruptcy.

Consumer Proposal vs Debt Consolidation vs Bankruptcy

Some key differences between a consumer proposal, debt consolidation, and bankruptcy:

#1 - Consumer Proposal

- It is a legal process that requires the involvement of a licensed insolvency trustee.

- It allows individuals to negotiate a settlement with their creditors and repay some of their debts over time.

- It allows individuals to avoid the negative consequences of bankruptcy while still taking responsibility for their debts.

- It may hurt the individual's credit score, but the effect is generally less severe than with bankruptcy.

- It is only available to individuals with unsecured debts of less than $250,000, not including their mortgage.

#2 - Debt Consolidation

- It is a process of combining multiple debts into a single loan or payment.

- It can simplify debt repayment and may result in lower interest rates and monthly payments.

- It does not involve a formal legal process or the negotiation of a settlement with creditors.

- It may hurt the individual's credit score, but the effect is generally less severe than with bankruptcy.

#3 - Bankruptcy

- It is a legal process that involves liquidating assets to pay off debts or negotiating a settlement with creditors.

- It provides a fresh start for individuals who cannot repay their debts.

- It can hurt the individual's credit score and remain on a credit report for up to 7 years.

- It involves the appointment of a trustee to look after the liquidation of assets and distribution of funds to creditors.

- It is available to individuals with significant debt and who need help to repay.

Consumer Proposal vs Debt Settlement vs Credit Counselling

Some key differences between a consumer proposal, debt settlement, and credit counseling:

#1 - Consumer Proposal

- It is a formal legal process governed by Canada's Bankruptcy and Insolvency Act.

- It may involve the sale of assets to repay the debt, although this is not always the case.

- The amount paid to creditors in a consumer proposal is generally more than what they would receive in bankruptcy.

- It requires the involvement of a licensed insolvency trustee who will help develop and file the proposal, negotiate with creditors, and distribute payments to creditors on the debtor's behalf.

#2 - Debt Settlement

- It is negotiating a settlement with creditors to pay off the debts owed.

- It may be done by the individual or with the aid of a debt settlement company.

- It can significantly reduce the amount owed but may also hurt the individual's credit score.

- It does not involve a formal legal process or the appointment of a trustee.

- It may result in tax implications for the individual if the amount of debt forgiven is considered taxable.

#3 - Credit Counselling

- It is a process of working with a credit counselor to develop a plan to repay debts.

- It may involve negotiating with creditors for lower interest rates or payments.

- It can provide education and resources to help individuals improve their financial situation.

- It does not involve a formal legal process or the negotiation of a settlement with creditors.

- It generally helps the individual's credit score.

Frequently Asked Questions (FAQs)

Yes, a consumer proposal will harm the credit score. However, the impact is generally less severe than with bankruptcy.

In most cases, one can keep their assets in a consumer proposal. However, the value of the assets is under consideration when developing the proposal.

Unsecured debts can be part of it, including credit card debts, personal loans, and medical bills. However, some debts, such as child support and certain tax debts, cannot be included.

The cost varies depending on factors such as the amount of debt, the complexity of the case, and the fees charged by the licensed insolvency trustee. However, the prices are typically less than the fees associated with bankruptcy.

Recommended Articles

This article has been a guide to what is Consumer Proposal. Here, we compare it with debt consolidation & bankruptcy, its examples, pros, cons, and qualification. You may also find some useful articles here -