Table Of Contents

Consumer Price Index Definition

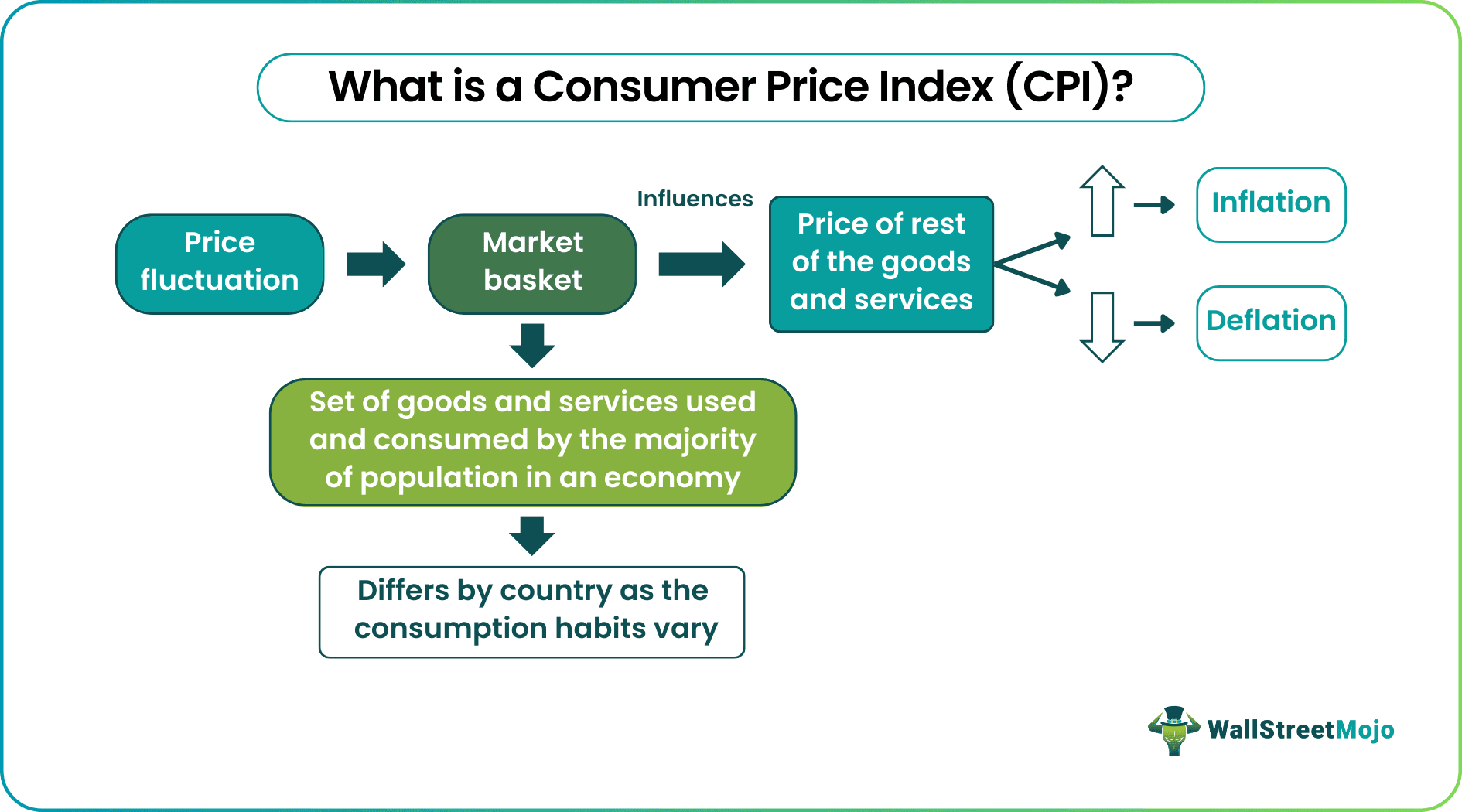

A Consumer Price Index (CPI) measures the fluctuation in the prices of goods and services in a market basket. A market basket comprises a varied set of goods and services that most households use, and the change in the prices of which directly affects an economy every year. Studying the CPI indicates the level of inflation in a nation.

The CPI of the current year is compared with that of the base year, which is considered 100. The CPI for the current year is either more or less than 100, with the former indicating an increase in the prices of the goods and services and the latter signifying the decrease in the costs over a period.

Key Takeaways

- CPI measures the price fluctuation as indicated by the change in the prices of the goods and services in the market basket, which represents the most-used household items in an economy.

- The U.S. Bureau of Labor Statistics (BLS) has set the cost of the market basket for a base year at 100.

- The CPI assesses the level of inflation, deflation, and the purchasing power of an economy's currency.

- As a significant economic indicator, CPI helps policymakers make informed financial decisions.

Consumer Price Index (CPI) Explained

Consumer Price Index (CPI) helps assess the inflation or deflation of an economy. The price fluctuations indicate how the cost of living would be affected. Plus, it also assesses the purchasing power of a nation’s currency.

The consumer price index report is calculated based on the changes in the price of the goods and services in the market basket. This market basket, as mentioned above, contains a set of goods and services that are widely used by a population. However, the items included in these baskets vary based on the consumption habits of the nationals.

It is used as an economic indicator that acts as a proxy for the government’s policies, intending to keep inflation low to improve purchasing power. The changes in the CPI guide the government and policymakers to make suitable decisions for the benefit of the economy.

Formula

The CPI is calculated as the change in the prices of the products and services in the market basket for a period with respect to the same for the base year. The U.S. Bureau of Labor Statistics (BLS) has set the base year CPI to 100 during 1982-84.

The Consumer Price Index formula used for calculating the price fluctuation of the market basket’s items is:

As per the formula, in the numerator, we see cost of market basket in current year, which is the total cost of all goods and services for the present year that can be determined through survey. It takes into account some products and services as representative of goods that consumers typically use.

In the denominator, same thing is done but only for the base year. The base year of consumer price index data is a reference of benchmark against which the change in price for current year is determined.

Thus, the value obtained is then multiplied with 100 in order to express the value in percentage. This helps in easy comparison.

This consumer price index report is very valuable and a key economic indicator for various statistical institutes of the country, policy makers and government. It gives an idea about inflation level of an economy, and design policies and adjustments to ensure financial and economic stability.

Components

Let us study the components used in the calculation of the consumer price index data.

This index is the most widely accepted measure of inflation. So, as the name suggests, it is related to all consumers and they products and services they commonly use. The method of calculation involves collection of data related to hundreds of goods and services, commonly termed as Basket, that are collected from households, retailers, service providers, outlets sell goods online, etc.

The data also includes rent related information collected from tenants or landlords.

Another category of goods include food items, like groceries sold by small shops or supermarkets, snacks or other related food products. Products related to energy, like gasoline or cooking gas, kerosene, propane, firewood and piped gas, etc are also accounted for.

Motor fuels used in vehicles are an important component. All kinds of vehicles including tracks, busses, cars, taxis use them. Therefore it is necessary to assess the inflation rate of then through calculation of consumer price index.

Examples

Let us consider the following Consumer Price Index examples to understand things better:

Example #1

The market basket for the year 2021 reflects the price change in the products and services with respect to that for the base year 2012. The details are as follows:

| Item | Quantity | Price in Base Year (2012) | Price in Current Year (2021) |

|---|---|---|---|

| Maize | 100 | $15 | $20 |

| Corn | 50 | $17 | $21 |

| Bread | 50 | $10 | $10 |

| Wheat | 150 | $7 | $12 |

| Clothes | 25 | $19 | $24 |

Example #2

A country had four items on its CPI index- food, clothes, education, and fuel. A country has 2000 as the base year for measuring the CPI. In the year 2005, the government wanted to see if the purchasing power of the people of the country had improved or deteriorated. The price of each item is as below: –

| Item | Quantity | Price in Base Year (2000) | Price in Current Year (2005) |

|---|---|---|---|

| Food | 30 | 38 | 42 |

| Clothes | 20 | 43 | 40 |

| Education | 30 | 35 | 38 |

| Fuel | 20 | 60 | 55 |

Now, calculating the market basket for each year and then calculating the index based on consumer price index equation we may get,

Market Basket Base year – 2000

Market Basket Current given year – 2005

Consumer Price Index Table

CPI = 101.18

Uses

Let us have a look at the list of uses to understand the Consumer Price Index definition in a better and easier way:

- As an indicator of the economy, it helps policymakers to make informed decisions.

- CPI assesses consumers’ purchasing power. The increase in prices reduces the purchasing power of the customers and vice-versa.

- The consumer price index equation acts as an adjusting factor, which authorities consider to determine the change in the wages or decide the minimum wage levels.

- It is used as an index to check the government’s social schemes and adjust the people’s living costs accordingly.

- Assessing the CPI can also help in adjusting other economic indicators accordingly. For example, adjusting the monthly/annual income of an employee.

Importance

Let us study the importance of the concept in financial market.

- Inflation study – It is a very good measure to understand the level of inflation prevailing in the market, the rate at which it is rising, which indicates changes in cost of living of consumers.

- Monetary policy formulation – It acts as a guide to any changes in monetary policies through interest rate and money supply adjustment. This will help in keeping inflation under control and maintain a stable economy.

- Business decisions – These decisions can be related to production, inventory or price management, policy regarding wage adjustment of labor, etc. They all depend to a great extent on inflation prevailing in an economy, for which management needs to take suitable decisions.

- Economic assessment – The country’s financial and economic condition can be assessed using this index. It is possible to analyse the changes in index pattern and predict the health of the economy and possible financial situations that may arise in future.

- Predict future trends – The consumer price index forecast is frequently used to evaluate and predict future trends regarding changes in demand, supply, spending, investment, etc. These factors play an important role in economic development.

Thus, the above are some points that identify the importance of the concept.

Limitations

Some limitations of the concept are given below:

- Random data collection - CPI is one of the most important factors to assess the level of inflation occurring or expected to occur in the coming year. Thus, accuracy matters a lot. However, while calculating the CPI, the price changes for the current year are gathered based on random sampling.

- Lack of accuracy - The above point means the samples collected and the price information collected may not necessarily be accurate. For example, the data collected for consumer price index forecast might be more for a certain market or population than the other. As a result, the computation is likely to be influenced by the population figures, the amount of data from which is more.

Therefore, the collection of the correct price data must be ensured to guarantee the proper calculation of the CPI.

Consumer Price Index Vs Producer Price Index

Both the above are important indicators in an economy that can be used for measurement of price changes. However, there are some basic differences between them which are as follows;

- The main focus of the former is to measure the price variation of goods consumed by consumers to show the cost of living. But the main focus of the latter is to measure the price variation in outputs of domestic producers.

- The former deals with basket of goods typically consumed by any household like, food, clothing, rent, household, etc. But the basket of goods in case of the latter are those used by manufacturers like the raw materials, intermediate or finished goods.

- The main purpose of the former is to understand the inflation rate from a consumer’s point of view but the latter monitors inflation rates or price trends during the different stages of production and distribution.

- The former is commonly used to make necessary adjustment in wage, any social security benefits or similar ones that need monetary adjustment due to inflation. But the latter is commonly used for assessing cost-push inflation, producer pricing strategies or problems in supply-chain.

Thus, the above are some points of differences that is worth noting for better understanding of the concept.