Differences between both the documents are given as follows:

Table Of Contents

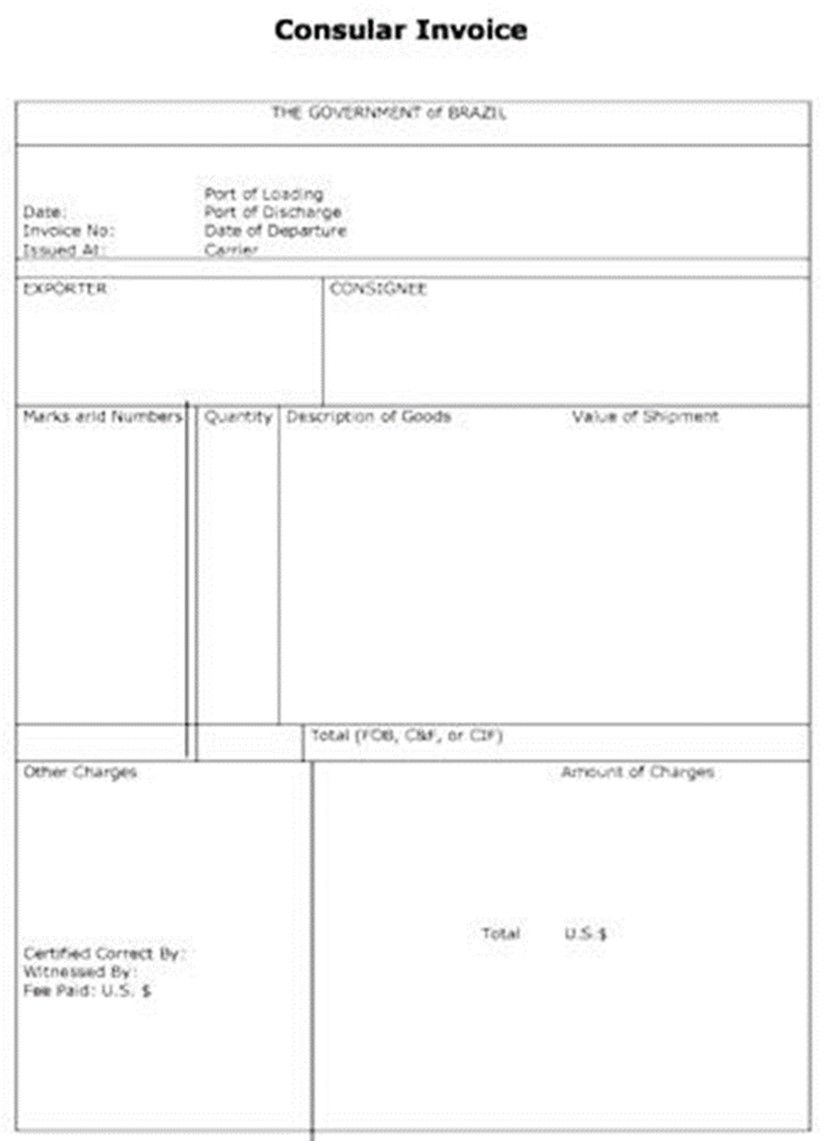

What Is Consular Invoice?

A consular invoice is a proof or document that contains a description of the shipment, its value, and other details including consignor and consignee. A country's customs officials use it to verify the nature, quantity, and value of the shipment that has arrived.

You are free to use this image on your website, templates, etc.. Please provide us with an attribution link.

A few of the most common misrepresentations or manipulations in financial statements and company accounts are misstating liabilities and assets, intentionally missing expense entries, and recording revenue higher than the actual figure. The AICPA (American Institute of Certified Public Accountants) states that two factors lead to unreliable financial statements: theft of assets and dishonest financial reporting.

Key Takeaways

- A consular invoice is a proof of document that is issued or certified by the exporting country.

- It contains information on the shipment, which includes the number, quantity, quality, and value.

- It provides authorities with the customs fee to be charged and the taxes associated with it. It facilitates smooth trade, helps international trade flourish, complies with rules, and increases the country's income.

- The invoice contains the name of the importer and exporter, the description of the goods in the shipment, packing charges, insurance charges, and the certifier's name, among other things.

Consular Invoice Explained

A consular invoice is a shipment document that contains details of shipped goods that are certified by the country that imports them. It helps the importing company verify the quantity in the shipment, the value of the goods, its authenticity, etc. The document should be stamped by the consul of the country that imports it and authorized to be presented to the relevant embassy. The consulate of the destination country affixes their stamp and authorizes the clearance of the shipment with the customs officials.

The exporter needs to provide a certain number of copies to be sent to the importing country's consulate. The consulate does the verification for a fee. One copy is handed to the exporter, and two are sent to the importing country's customs office. This is used to determine the amount of import duty to be paid. The exporter then shares a copy of the consular invoice with the importer along with other requested documents.

The invoice ensures that the shipment is appropriately monitored and the entire transaction is documented. In most cases, paperwork is involved and required by the importing country for processing and expediting the clearance of the customs process. It helps the authorities to identify the contents in the shipment and ensure a smooth flow of goods between countries.

Format And Contents

The invoice may contain certain details, including:

- Name of the importer

- Name of the exporter

- Their other relevant details

- Description of the goods in the shipment.

- Packaging charges

- Insurance charges

- Any other additional charges

- Total value of goods in the shipment

- Certifier's name

- Identification marks, if any.

The format may differ in different countries, and it may include the ports of origin and destination along with the numbers or any identity markings.

Examples

Let us look at a few examples to understand the concept

Example #1

Imagine company A in the U.S. wanting the U.S. to export electronic goods to a company in the U.K. The U.K. consular requires an invoice for the goods to be imported, and the U.S. exporter must obtain the invoice from the U.K. consulate. The invoices must contain all the necessary documents. If they do, then the U.K. consular officer certifies them, and they are ready to be presented to the U.K. customs upon their arrival in the U.K.

Example #2

Imagine Company ABC, based in Brazil, is shipping organic coffee beans to Company PQR in Canada. To confirm the shipping of goods to the Canadian consulate, a consular invoice for export is needed. Using the given consular invoice template, Company ABC creates the document prior to the items being loaded onto a vessel at the Port of Santos.

After filling out the necessary information, the invoice is sent to the Canadian consulate in Brazil for certification. Following certification, the shipping paperwork—which comprises the bill of lading, packing list, and certificate of origin—is forwarded.

Company PQR ensures a seamless and prompt clearance of the shipment by presenting the document to customs officers upon arrival in Canada.

Importance

Below are some of the points that highlight the importance of the consular invoice in international trade:

- The document ensures customs compliance by the countries the transaction takes place.

- Eliminates or reduces the chances of fraud through verification.

- It facilitates trade between two or more countries by having proper checks in place.

- It helps to grow international trade through a systematic review and growth of trust between countries.

- It helps estimate the customs duty to be paid, which is an income source for the government.

- The process prevents dumping.

- Ensures that no illegal trade is happening.

Difference between Consular Invoice and Commercial Invoice

| Aspect | Consular Invoice | Commercial Invoice |

|---|---|---|

| 1. Concept | It is a proof of document that is used to record a shipment transaction. | A commercial invoice is a generalized document that records a commercial transaction between an exporter and an importer. |

| 2. Purpose | It is used for clearance purposes. | It records the business transaction between exporter and importer. |

| 3. Charges | A charge or fee accompanies the consular invoice. | It has no accompanying costs for document preparation. |

| 4. Information provided | It provides details regarding the goods in the shipment, their value, and the details of import and export. | It provides details on the goods and conditions involved in the transaction. |

| 5. Copies | It is prepared in triplicates: one for the consulate's office, the exporter, and customs. | It can be prepared with any number of copies based on the need. |