Table Of Contents

What is Consolidation Accounting?

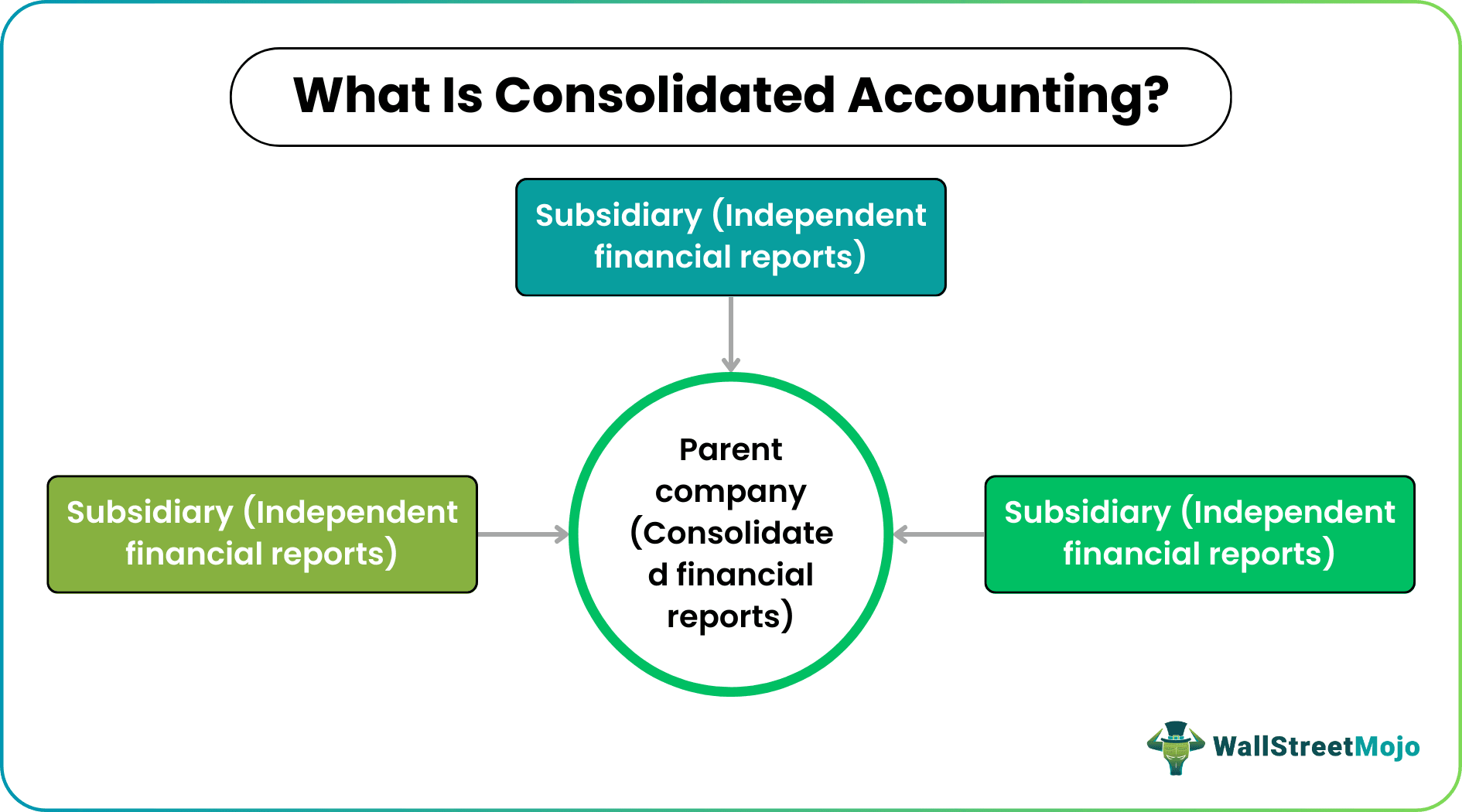

Consolidation accounting is a process whereby financial reports of subsidiary companies are put together and then combined with those of the parent company. The parent company owns the subsidiary company and holds control over it. Financial accounting consolidation works with companies that own more than 50% shares of the subsidiary company.

Consolidated accounting brings together financial aspects like revenue, expenses, cash flows, liabilities, profits, and losses of a branch to that of its mother branch. Under the consolidation method, the accounting statement merges together financial entries of the parent company and its subsidiaries with the necessary elimination of entries so as to avoid overlapping of data.

Table of contents

- What is Consolidation Accounting?

- The consolidation process in accounting brings together financial aspects of subsidiary branches with their mother branch.

- Both the parent and the subsidiary have to follow a set of accounting rules during the consolidation process.

- Full consolidation, proportionate consolidation, and equity consolidation are the three consolidation methods.

- The consolidation process in accounting is used when the parent owns more than 50% of the subsidiary, while the equity method is used when the parent owns 20 to 50% of the subsidiary.

Consolidation Accounting Rules

Consolidation accounting needs to follow a certain set of rules. Some of the regulations guiding the consolidation process in accounting are:

1. Financial statements for parent company and subsidiary companies are prepared on the same date. If a subsidiary cannot submit them on the said date, the company should make adjustments for the effective date. The time difference should not exceed six months.

2. Any minority interest (stock not owned by the mother company) is to be disclosed and accounted for separately.

3. All like transactions and similar events should be accounted together using the same set of accounting policies.

4. Subsidiary reports are compiled as if the same company does not exist. It is done according to the accounting rules that direct the same.

5. The parent company must be in control of more than 50% shareholding. But, in case the mother company controls below 50%, its significance level matters. Such a case occurs where the companies are sharing employees.

6. Intragroup transactions and balances should be eliminated completely.

Types of Consolidation Accounting

With regards to the parental control over the subsidiary, financial accounting consolidation follows three methods:

- Full consolidation

- Proportionate consolidation

- Equity consolidation

#1 - Full Consolidation

In the full consolidation method, the parent balance sheet records the subsidiary assets, liabilities, and equity. Besides, all the subsidiary revenues and expenses are transferred to the income statement of the parent. Thus the account of a subsidiary is in full control of the parent company.

Both the parent and subsidiary income statement is reported as one. Hence, there is a 100% combination of all the subsidiary revenue to the parent.

#2 - Proportionate Consolidation

Proportionate consolidation uses a percentage contributed in the joint venture to generate the financial statements. In other words, it distributes an entity's assets, liabilities, equities, income, and expenses as per its contribution to the venture.

#3 - Equity Consolidation

Equity consolidation is an accounting method used if the investor does not have full control over the subsidiary. For an investor to significantly influence the company, they should own between 20-50% of the shares. Likewise, in scenarios where the investor controls less than 20% of shares and is significant, one uses equity consolidation.

The parent company considers investment held in an associate as an asset. Therefore, the company accounts for the income generated from the asset in its reports. As a result, the higher the equity investment the larger is the value reported.

Examples

Now, let us take a look at a few consolidation accounting examples to gain a better idea of how consolidation accounting works:

Example #1

Ronald PLC spends $150,000 to acquire 80% of the company Pretty's who has assets worth $180,000. In this case, let us calculate how Ronald will account for this consolidation.

Solution

If 80% of Pretty’s is $150,000, it means Ronald would have spent $187,500 (150,000*100%/80%) for purchase of 100% shareholding. Pretty’s will record a net asset in form of goodwill as $30,000 ($180,000-$150,000). In this case, the other investment of $37,500 ($187,500-$150,000) are minority interests.

From the above example, one can see how a parent company treats a subsidiary as part of the company. Obviously, the parent company book does not include minority interests.

Example #2

George’s company wants to acquire 60 % of Benson’s company. Here, the following is the position of both companies for the year-end 31st Dec 20XX

| George | Benson | |

|---|---|---|

| Sales | $80,500 | $30,000 |

| Cost of Sales | ($65,000) | ($18,000) |

| Gross Profit | $15,500 | $12,000 |

The company Benson's bought goods worth $6,000 from George. Initially, George had purchased the goods at $4,000. Half of the goods remained in Benson's inventory. In this case, let us calculate the consolidated revenue for the year 31st Dec 20XX.

Solution

George made a $2,000 ($6,000-$4,000) after selling goods to Benson. Whether the goods remain in the inventory or not, one should eliminate them for consolidation purposes. Since half of the goods remained in the inventory, the profit of $2,000 is an exaggerated number. Therefore, George made a half profit, $1,000 ($2,000/2)

Here is how one would account for the same in their profit and loss account,

Dr. Cost of goods -$1,000

Cr. inventory - $1,000

Note that in this scenario, we are not accounting for unrealized profit.

Therefore, the consolidated revenue at the year-end will be:

= $80,500 + $30,000 - $6,000 (Good sold to Becky)

= $104,500

Also, the Consolidated cost of sales = $65,000 + $18,000 + $1,000 - $6,000

= $78,000

Example #3

The company Forward Co owns the three investments given below. In this case, let us figure out the investment below that would use the Equity consolidation method?

- 25% shares of non-voting rights in Dark Co.

- 16% share capital of Violet Co. Bright Co has 2 out of 5 Board members in Violet Co.

- 40% share capital in Indigo Co. Forward Co has 4 out of 6 Board members in Indigo Co.

Solution

- Despite Forward Co.'s shareholding falling within the range of 20-50%, their shares are non-voting. So, Forward does not have sufficient privileges over Dark Co. In short, one cannot use this scenario in equity consolidation.

- Do not assume 16% shareholding is low. Even though it is not within the range, the board has two members of Forward Co. Thus, Forward has sufficient influence though not full control over Violet Co. Here, one can see an indication that Violet Co is an affiliate or associate of Forward Co. In this case, you can use equity consolidation.

- Here, 40% falls in the range besides the four board representatives out of the six members. This illustration indicates that Indigo Co is a subsidiary of Forward Co. Also, Forward Co. is the parent of Indigo Co. During consolidation, one will use a line-by-line basis. Therefore, one cannot use the equity method.

Hence, from the above consolidation accounting example, scenario II qualifies for equity consolidation.

Frequently Ask Questions (FAQs)

Consolidation accounting is the combining of financial reports of subsidiary companies with that of their parent company. Here, the subsidiaries are branches of the parent company where the parent owns at least more than half of its ownership.

A combined statement with the financial data of both the parent and subsidiary companies is created. Also, consolidated accounting must follow a set of rules. The subsidiary's revenue, liabilities, profits, losses, etc., are consolidated with the parent's. Thus, the parent combines all of its revenue with its subsidiary's revenue. Minority interests are disclosed separately. Besides, elimination adjustments avoid the overlapping of statement data.

The equity method accounts for the income generated from investment in the subsidiary. The equity method of consolidation is used when the parent owns 20% to 50% of the subsidiary company.

Recommended Articles

This has been a guide to Consolidation Accounting and its Meaning. Here we discuss types of consolidation accounting methods & rules along with examples. You can learn more from the following articles -