Table Of Contents

What Is A Conglomerate Discount?

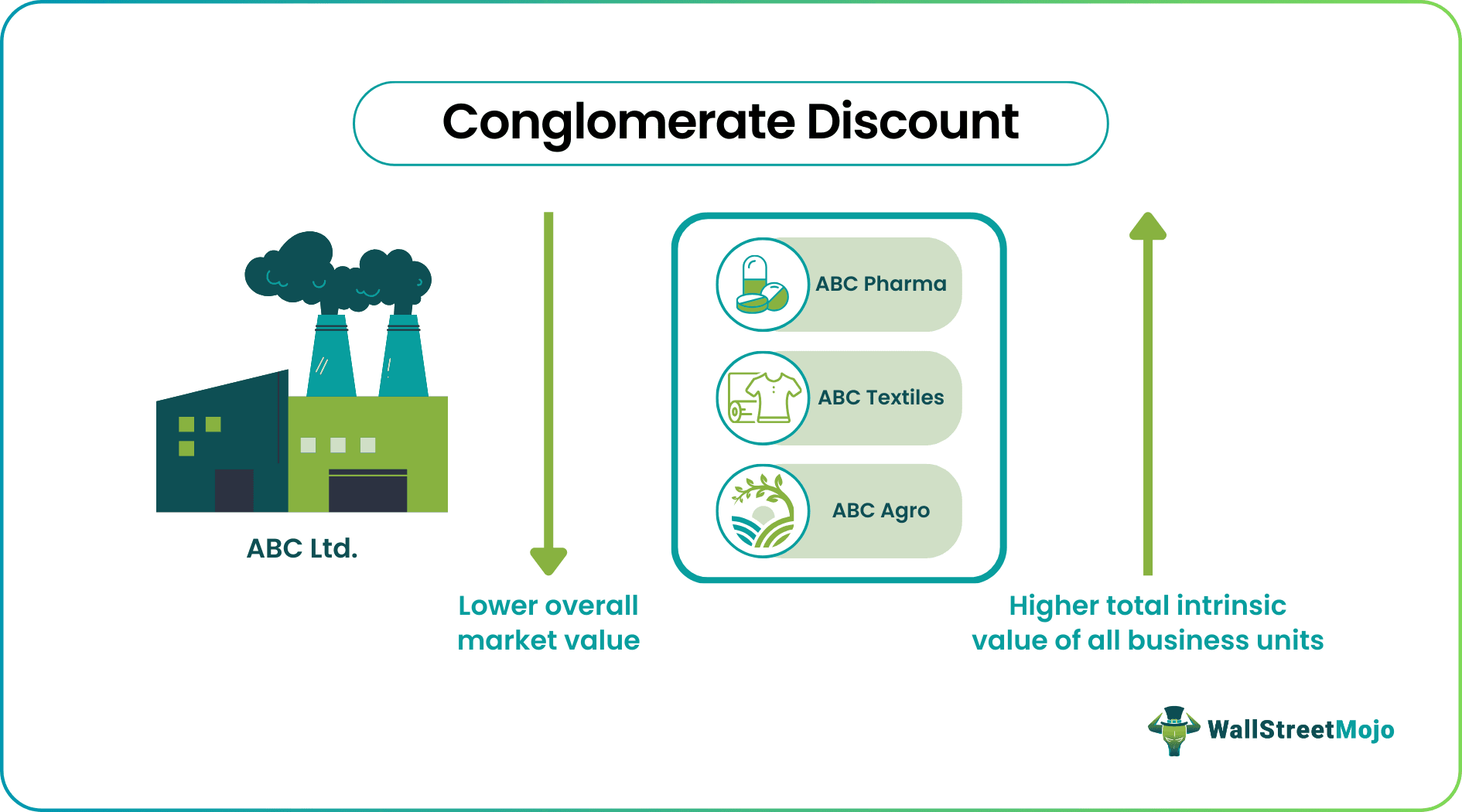

A conglomerate discount refers to a phenomenon whereby the market assigns a lower overall value to a diversified company (conglomerate) compared to the combined value it assigns to its individual parts, divisions, product lines, units, or subsidiaries. It signifies the over-diversification of a business, resulting in discounted corporate value.

Conglomerate discount is driven by investor sentiment and market conditions. It is often based on the idea that a diversified corporation is complicated and tricky to manage and may need to make more effort to make itself suitable for investment compared to an individual business. Moreover, the total market value of a conglomerate declines if its various divisions are average or low performing.

Key Takeaways

- A conglomerate discount is a financial market concept that assigns a lower value to a diversified or multi-unit business than the total value of its separate divisions or parts.

- Such a value reduction occurs due to adverse market sentiment and investors' perception of a not-so-profitable conglomerate business. Moreover, its overall value falls if a diversified corporation has many low or average-performing divisions.

- It is derived as the variance between the overall market value of a conglomerate and the combined value of its business units or assets.

Key Takeaways

- A conglomerate discount is a financial market concept that assigns a lower value to a diversified or multi-unit business than the total value of its separate divisions or parts.

- Such a value reduction occurs due to adverse market sentiment and investors' perception of a not-so-profitable conglomerate business. Moreover, its overall value falls if a diversified corporation has many low or average-performing divisions.

- It is derived as the variance between the overall market value of a conglomerate and the combined value of its business units or assets.

Conglomerate Discount Explained

Conglomerate discount reflects a potential undervaluation of the conglomerate when the consolidated value of its standalone units or parts is comparatively higher. The term 'conglomerate' denotes a business entity with multiple product lines, divisions, units, subsidiaries, or parts, whether related or unrelated. In other words, the parent company holds a significant stake or controlling rights in multiple other business entities functional in different industries.

Its underlying rationale is the perception that conglomerates are less efficient and need more focus than specialized companies. Investors often find evaluating conglomerates' performance and growth potential challenging due to their diverse operations, prompting them to assign a lower valuation to the conglomerate. However, such discounts may differ from region to region because they are affected by a nation's political scenario and economic development.

The discounted value of a conglomerate varies depending on market conditions and investor sentiment. However, not all diversified business entities are subject to conglomerate discounts. Some well-managed conglomerates can trade at a premium by leveraging diversification to create value. It is possible to communicate their strategic advantages effectively, demonstrate successful synergies, and provide a clear plan for creating shareholder value. Conglomerate discount research is likely to shed more light on the evolving scenarios in this area.

Reasons

Due to several factors, the market values a conglomerate at a discount compared to the sum of the standalone values of its separate businesses. The factors to which this phenomenon can be attributed are:

- Negative Market Perception: Past conglomerate failures or value destruction usually make investors believe such businesses are unsuitable for investment. Thus, investor perceptions have often discounted the stock price of conglomerates, irrespective of their financial performance at the time.

- Complexity and Lack of Focus: Conglomerates often engage in diverse industries and operate multiple business units resulting in conflicting visions. Thus, it becomes challenging for investors to gauge a company's strategic path, actual performance, and prospects. As a result, they are less attracted to conglomerates, depreciating their value.

- Inefficient Capital Allocation: Companies sometimes need better investment decisions and allocate capital efficiently across their business units, leading to underperformance, lower returns, and a conglomerate discount.

- Lack of Synergies: Conglomerates are known for the synergies they create across business units. However, if these synergies fail to materialize or are not effectively executed and communicated to the market, investors may discount a conglomerate's value.

- Corporate Governance Concerns: Such corporations often have complex organizational structures, raising concerns about transparency, accountability, and potential conflicts of interest among diverse business units or subsidiaries. These corporate governance issues can undermine investor confidence and contribute to a conglomerate discount.

- Capital Structure and Financial Risk: Conglomerates may have a higher debt burden or more complex capital structures than focused companies. Thus, investors may demand a higher return to compensate for the perceived financial risk, leading to its discounted value.

- Limited Transparency: Conglomerates have complex corporate structures with subsidiaries in various industries. This complexity makes assessing a conglomerate's actual performance difficult for investors, resulting in a discount.

- Risk Diversification: Conglomerates aim to spread risks across different industries or sectors. While risk diversification can reduce overall risk, it may dilute the potential upside of high-performing businesses within the conglomerate. Consequently, investors may assign a lower value to the conglomerate.

How To Calculate?

Computing conglomerate discounts using the conglomerate discount formula involves the following steps:

- Determine the conglomerate's present market capitalization or market value by multiplying its prevailing stock price with its total number of outstanding shares.

- Identify the separate business units or parts that constitute the conglomerate. These could be subsidiaries, divisions, or specific investments where the company holds a significant stake.

- Calculate the intrinsic value of each of these individual business units.

- Add the intrinsic values of all the separate business units computed in the previous step.

- Subtract the sum of all the parts from the conglomerate's market value as a whole to get the difference.

- Find the percentage of difference by dividing the difference by the conglomerate’s overall market value and multiplying the result by 100.

Stock markets typically apply a conglomerate discount of up to 20% on an unrelated conglomerate compared to the sum of the values of the separate business units it holds. This occurs due to the perception that the conglomerate will not be able to perform well.

Examples

Here are some examples of conglomerate discounts.

Example #1

Suppose the intrinsic values of the various divisions of ABC Ltd are:

- ABC Textiles - $29.1 billion

- ABC Pharma - $11.2 billion

- ABC Agro - $23.7 billion

If the market value of each ABC share is $70.4 and there are 1 billion outstanding shares, find the conglomerate discount of the company.

Solution:

Market Capitalization of ABC Ltd. = $70.4 * $1 billion = $70.4 billion

Total Value of All Divisions = $29.1 billion + $11.2 billion + $23.7 billion = $64 billion

Conglomerate Discount = / 100 = 9.09%

Some conglomerates in the real world subjected to such discounts are Berkshire Hathaway Inc. (BRK.A), Alphabet Inc. (GOOGLE), and General Electrical (GE).

Example #2

A recent development in the automotive sector highlights how sensitive conglomerate discounts are and the effect they have on a company’s valuation. While the business association between Renault SA and Nissan is no secret, many do not know much about the conglomerate discount that has affected Renault’s valuation for the past several years.

In an effort to make tangible as well as perception-driven changes to its overall structure, Renault plans to sell its stake in Nissan. The partnership with Nissan continues as it has for 24 years. However, this move is likely to bring a certain balance to Renault's valuation woes.