Table Of Contents

What Is Concentration Risk?

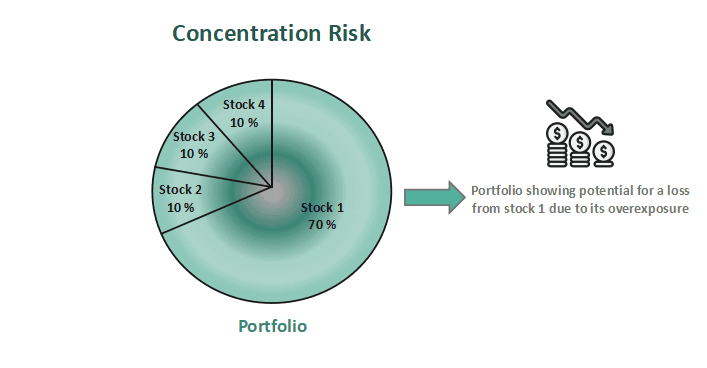

Concentration risk refers to the potential for loss in an investment portfolio. This risk arises from overexposure of funds, investments, or capital allocation to a single asset, sector, or geographic region. It arises when investments are heavily concentrated, making the portfolio vulnerable to downturns in that particular area.

Diversification is crucial for investors, banks, brokerage firms, and other financial institutions. It ensures that portfolios maintain a healthy ratio and contribute to a stable financial system. Less diversified portfolios are prone to this risk. This risk carries the main implication of potentially generating a loss so significant that recovery becomes highly unlikely.

Key Takeaways

- Concentration risk signifies the loss prospect due to a high degree of risk exposure to a single asset, sector, geographic location, or investment project.

- It is of four types: name, geographic, credit and sector concentration risk. Each type of risk denotes the potential for loss through different aspects of the market.

- Investors or market analysts can measure this risk using stress testing and risk metrics along with the Gini coefficient and Herfindahl-Hirschman Index (HHI) ratios.

- This risk is present across various industries and fields, including banking, finance, technology, manufacturing, production, and services-based products.

- It extends to any task where over-reliance on a single entity or source is practiced.

Concentration Risk Explained

Concentration risk is the possibility of a loss due to the overinvesting or over-distribution of capital into a particular asset, sector, credit, or geographic region. Apart from not making a loss, investors look forward to making maximized returns. In greed or race, they sometimes overinvest in a particular asset more than the others. This results in an imbalance in investments, increasing vulnerability to significant losses. If the overallocated asset declines, it adversely impacts the entire portfolio.

Concentration risk is a possible indication of a heavy financial loss. It can occur in any working field. For instance, concentration risk in banking mainly revolves around the financial loss incurred due to default payments, credit, and loans. Such losses are typically huge and can drive even big banks and depository institutions towards liquidation of their capital assets and bankruptcy.

These are simple ways of measuring the risk levels. Once it is determined, investors shall readily make adjustments to balance the portfolio. On the contrary, there lies a possibility that if such assets perform in the right direction, they can bring huge profits and maximize returns. However, this scenario is usually unrealistic and should only be employed by investors and entities with high-risk tolerance and appetite.

Types

This risk encompasses four main types, each representing a different aspect of the potential for loss due to overexposure:

- Credit concentration risk - This usually occurs with banks, credit unions, and other financial institutions. It arises when they have high exposure to a single borrower or a group of borrowers. The lender has to incur substantial losses if the borrower defaults, ultimately affecting the financial stability of the banks.

- Sector concentration risk – This occurs when investors have invested highly in one particular sector in their portfolio compared to other securities and assets. When the highly exposed sector experiences a decline or faces a downturn, it eventually affects the performance of the entire portfolio.

- Geographic concentration risk - Such risk shows the potential for a loss when a business investment or project has significant exposure to a particular geographic area or location. These investments are prone to external events such as natural disasters, changes in policies, and economic or political instability.

- Name concentration risk - It arises or reflects the potential for a loss when investors have heavily invested and have significant exposure to a single security or asset. It can be a particular stock in the portfolio that, when it declines in price, dramatically affects the whole investment, inducing financial instability for the investor, bank, or entity.

Measurement

These are the two types of methods employed in the measurement process:

- Concentration ratios - The two ratios evidently used for measuring this risk are the Gini coefficient and the Herfindahl-Hirschman Index (HHI). The level of such a risk that exists in a portfolio is denoted in levels by these ratios numerically. Investors can interpret the potential areas of overexposure and, based on that, make financially sound decisions or develop strategies to avoid potential losses.

- Portfolio analytics - This involves stress testing and risk metrics to identify potential areas of this risk within a portfolio. Stress testing assesses the portfolio's performance across various market scenarios and economic conditions. Risk metrics aid investors in comparing insights and making necessary adjustments to manage risks effectively.

Examples

Below are two examples to help you understand the concept better:

Example #1

Suppose Jennifer is a new investor. She invests in stocks whenever she earns money from her projects, work, or monthly savings. After a few months, Jennifer created a small portfolio. The only problem is that she has four stocks in her portfolio, but the allocation is disproportionate. Therefore, one stock has over 65% of the invested funds, whereas the other three stocks share the remaining 35%.

Jennifer’s friend suggests that she should measure her portfolio’s concentration risk through ratios and metrics. Upon measuring, the portfolio shows high-risk levels due to high exposure to one stock. If its price declines, it will bring a substantial loss to the whole portfolio.

Example #2

In March 2023, Silicon Valley Bank’s closure by the Californian authorities served as a stark reminder of the adage: never put too many eggs in one basket. The Silicon Valley Bank had half of the US venture capital-backed startups as clients. The bank majorly focused on tech and became a direct example of this risk.

When the tech industry faced a disproportionate hit during the inflationary downturn, clients began withdrawing their deposits from Silicon Valley Bank. This led to a cash shortage for the bank, forcing it to sell its investments at reduced prices. This scenario also underscores the risk of customer concentration. Similar instances in US history include the local bank disruptions caused by the 1970s oil boom.

How to Mitigate?

Steps to mitigate this risk are listed below:

- Diversification - It is the primary and most commonly used method to mitigate this risk. A well-diversified portfolio ensures that the decline of any single investment does not significantly impact the entire portfolio. However, investors should be cautious as over-diversification can negatively affect returns. Striking a balance is essential to optimize risk and return.

- Liquidation - involves periodically selling positions, particularly those that have appreciated. While this may incur tax implications, it's crucial to plan the liquidation carefully. Designing the liquidation strategy to distribute the tax liability over several years can help mitigate its impact.

- Monitoring – It entails actively tracking investments, staying abreast of market news, regularly assessing market fluctuations and trends, and seizing opportune moments to adjust and rebalance the portfolio by reallocating funds as needed.