Table of Contents

What Is Compounding Frequency?

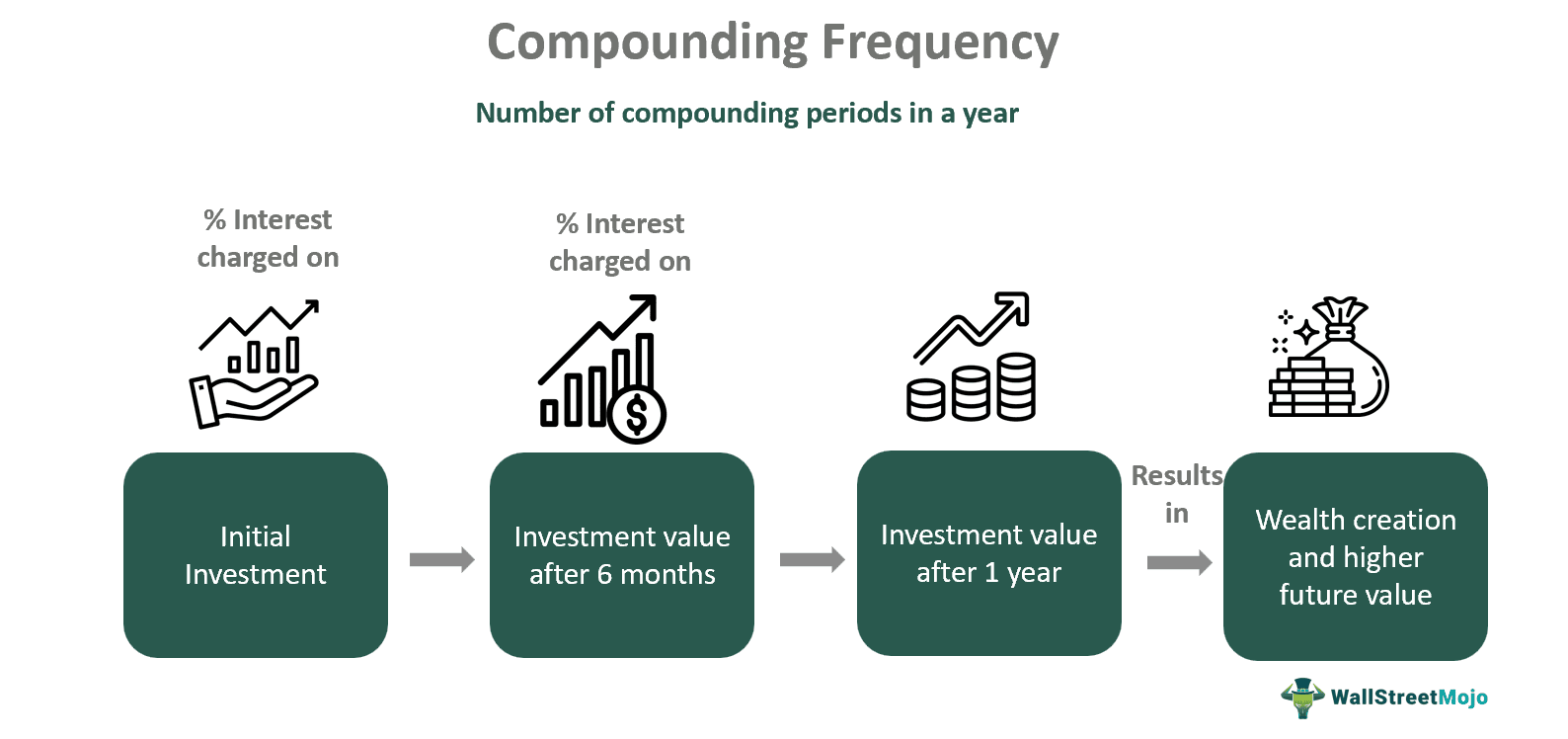

The compounding frequency refers to the number of compounding periods in a particular year, I.e., the number of times or how often the interest is evaluated on the principal sum and the outstanding interest. Thus, an investment compounded monthly has a frequency of 12.

The interest can be compounded annually, semiannually, quarterly, monthly, weekly, bi-weekly, daily, or hourly. Although the interest rates of two investments could be identical, if their compounding frequencies differ, their returns will also vary. A higher frequency of compounding would generate a better annual return on savings and investment. Moreover, it facilitates wealth creation in the long run.

Key Takeaways

- l Compounding frequency refers to the number of periods or intervals in a particular year when the interest on the overall investment value (principal + accumulated interest) is computed.

- l The interest on investments or savings can be compounded daily, weekly, monthly, quarterly, half-yearly, or yearly. Thus, the compounding frequency can be 365, 52, 12, 4, 2, or 1, respectively.

- l The long-term returns and wealth creation potential of an investment scheme or savings account increases when there are more compounding periods in a year.

Compounding Frequency Explained

The compounding frequency is the number of intervals in a particular year at which the interest on the initial investment plus the unearned interest is calculated and added to the overall investment value. We often talk about the power of compounding when investing or saving money in any scheme. But, it is equally important to consider the frequency at which the interest on these funds is compounded.

However, the compounding of interest can have different frequencies: daily, weekly, monthly, quarterly, semiannually, and annually; numerous compounding periods in a month signify a higher yield on the overall investment. However, such a benefit is only available in fixed deposits, mutual funds, certificates of deposits, stocks, and other investments where the interest is reinvested and not encashed before maturity. Also, the PPF compounding frequency helps the investors to yield a lumpsum amount after retirement.

The biggest drawback of the compounding frequency is that it restricts the investors from withdrawing the interest income earlier to maturity to earn a higher return. Also, the frequency at which the interest is compounded may not be the same as its credit or payment frequency since the interest so determined may be credited to the investor's account sooner or later. Moreover, the investment or savings scheme with favorable compounding frequencies usually charges an early withdrawal fee from the investors, which can reduce their overall returns.

The Hargreaves Lansdown provides access to a range of investment products and services for UK investors.

How To Calculate?

The compounding frequency depends upon whether the interest will be determined every day, month, quarter, two times a year, or every year. However, the compounding of interest in stocks and other high-yielding investments can be more frequent than on a daily basis, although it is not very common.

The compounding frequency formula is:

Number of compounding periods in a year = Total number of months in a year/ Number of months in each compounding period

To understand the calculation, let us go through the following table:

Interest Compounded Number of Months in Each Compounding Period Total Number of Months in a Year/ Number of Months in Each Compounding Period Compounding Frequency

Monthly 1 12/1 12

Quarterly 3 12/3 4

Semiannually 6 12/6 2

Annually 12 12/12 1

Examples

The frequency of compounding is a notable factor when selecting an investment plan or opening a savings account. For instance, the PPF compounding frequency is annual. Let us understand its significance through the following examples:

Example #1

Suppose Mrs. Morris and Mr. Clinch invest $1,000 each in two different fixed deposit plans, A and B, respectively. While the interest rate of both the FDs was 8% p.a. and a maturity of 5 years, FD A provides half-yearly compounding of the interest, and FD B provides an annual compounding facility. Thus, the future value of the investment on maturity for both of them will be as follows using the compound interest and compounding frequency formulae:

Mrs. Morris invests in FD A, yielding an interest of 8% p.a. compounded half-yearly:

- n = 2t

- CI = P(1 + {r/2}/100)2t

- CI = 1,000 (1 + {8/2}/100)2*5 = 1,000 (104/100)10 = $1,480.24

Mr. Clinch invests in FD B, yielding an interest of 8% p.a. compounded yearly:

- CI = P(1 + r/100)n

- CI = 1,000 (1 + 8/100)5 = $1,469.33

Thus, on the one hand, $1,000 in FD B turns $1,469.33 on maturity, and the same $1,000, when invested in FD A, would provide $10.9 ($1,480.24 - $1,469.33) more on maturity due to its semiannual compounding frequency. This is the power of compounding frequency.

Example #2

Bank of America's Featured Certificates of Deposit (CDs) come with terms ranging from 7 to 37 months, requiring a minimum deposit of $1,000. Given below are its featured CDs:

l 7 Months: 4.75% APY

l 10 Months: 0.05% APY

l 13 Months: 4.30% APY

l 25 Months: 3.00% APY

l 37 Months: 0.05% APY

Fixed Term CDs vary from 1 month to 10 years. Their APYs range from 0.03% to 4.00%, depending on the term and balance, while the minimum deposit is $1,000. On the contrary, the flexible CD is for 12 months with a 3.51% APY and a minimum deposit of $1,000. While the interest on these CDs is compounded monthly and credited monthly, the early withdrawals are subjected to penalties:

1. For terms of 90 days to 12 months: 90 days' interest

2. For terms of 12 to 60 months: 180 days' interest

However, there is a 7-day grace period for penalty-free withdrawals after maturity.

Generally, Bank of America's CD rates are less than those promised by online banks and credit unions. However, some online credit unions and banks offer CD rates of 5.00% APY or higher. The high-yield savings and money market accounts can offer over 5.00% APY with greater flexibility than CDs.

Effect on Fixed Deposit Returns

The compounding frequency allows the investors to reap a higher future value of money kept in cumulative fixed deposits where the interest is reinvested instead of being withdrawn. FDs the most frequent compounding in FDs is quarterly, semiannually, or annually. When the money is kept in FDs for a long-term period, the value grows through the interest received on the initial investment plus the interest that accumulates at every compounding period. Thus, it facilitates wealth creation and returns maximization over the period.

Now, the scheme where the interest on FD is compounded every quarter would definitely yield more return than the schemes with semiannual or annual compounding frequency. Thus, the greater number of compounding intervals in a year ensures better returns on the fixed deposits. However, in non-cumulative fixed deposits, there is no compounding benefit, as the investors can periodically withdraw the interest amount, and therefore, it is not reinvested.

Disclosure: This article contains affiliate links. If you sign up through these links, we may earn a small commission at no extra cost to you.