Table of Contents

What Is A Compensating Balance?

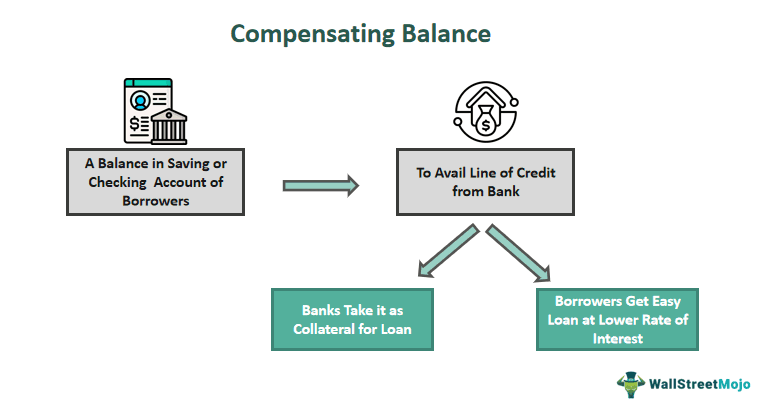

A compensating balance refers to the balance that a corporate borrower has to keep in their savings, checking, or certificate deposit account to qualify for the line of credit or installment loan. This balance serves as collateral against the line of credit to compensate for the risk of the lender providing the loan. Corporate borrowers get easier loans at affordable rates from their banks.

It is a strategy of the lender to keep the loan terms in its favor. By mandating a compensating balance, lenders are able to charge interest on the full loan amount as opposed to paying a lesser loan amount to the borrowers. Most corporate loans have these balances. It can either be current or non-current on the basis of the time for which the loan is approved. Corporate borrowers cannot use the funds in these balances; these funds are often classified as restricted cash.

Key Takeaways

- A compensating balance is a minimum amount that a borrower must maintain in their savings, checking, or certificate deposit account in order to be eligible for an installment loan or line of credit.

- It is used as security against the credit line to offset the lender's risk in making the loan.

- It benefits the banks by providing safety to their huge corporate loans.

- First-time and small borrowers benefit by getting loans for their businesses at affordable rates and with ease without any difficulty.

Compensating Balance Explained

Compensation balance refers to the maintenance of a minimum balance by the borrower in their savings, checking, or loan account. This requirement is in accordance with the lender's loan agreement and approval. The bank can use this balance at its discretion without obtaining the borrower’s permission. The lender charges more for loan amounts given to the borrower, which also mitigates the risk associated with the loan.

It is usually calculated using a compensating balance formula as a percentage of the borrower's approved loan amount. However, it may sometimes be based on the average balance for installment loans and the minimum fixed balance for lines of credit. If a borrower agrees to get into an average balance agreement with the lender, then:

- The borrower has to maintain a certain minimum average balance for a fixed time

- Typically, the fixed time could be thirty days

If the borrower agrees to a compensating balance arrangement of the minimum fixed balance, they have to maintain a prefixed minimum balance with the bank in a checking or savings account. Whenever a firm takes a loan based on the compensatory balance, it has to report it as restricted cash in its balance statements. It will indicate that the restricted cash cannot be used for immediate or general use but can be reserved only as a compensatory balance for bank usage.

Although it may look like a burden to borrowers for small businesses, first-time borrowers for businesses can easily get loans from banks at affordable interest rates. Thus, it benefits both – the bank and the borrower in terms of monetary incentive, the safety of loans, and ease of loans.

The Hargreaves Lansdown provides access to a range of investment products and services for UK investors.

Examples

Let us try to understand the topic using a few examples.

Example #1

Suppose ABC Corporation got a credit line with its bank of five million dollars. The loan agreement between the corporation and its bank stated that it would have to maintain a compensating balance of $300,000 at the minimum with the bank. Despite the significant credit line, the actual loan amount extended to ABC Corporation amounted to $450,000 after considering the compensating balance.

The loan agreement's compensatory balance provision serves as an example of the bank's risk-reduction plan. The bank ensures that ABC Corporation will always have an incentive to pay its debts by imposing a minimum balance requirement. This acts as collateral, giving the bank more security in the case that ABC Corporation experiences default or encounters unanticipated financial difficulties.

Furthermore, because the bank is taking on less risk, ABC Corporation may profit from potentially lower interest rates and better loan terms. However, ABC Corporation may view this balance as a limitation on its access to the entire credit line.

Example #2

Let's assume a company, XYZ Corporation, intends to borrow a sum of $100000 as a credit line from its bank, Best Bank Ltd. Surpassing expectations, Best Bank Ltd provides the company with a credit line of $110000 but with the condition of availing a compensating balance of $10000. As a result, XYZ Corporation would have to pay the compensating balance to the lender every month, irrespective of whether it is using the balance fund or not. Even if XYZ Corporation decides to utilize the credit line in full, it will have to pay the interest on the loan amount plus the compensation balance.

In this case, the requirement of a compensating balance affects the company's ability to borrow money as well as its expenses and financial commitments, highlighting how crucial it is to comprehend the terms and conditions of credit agreements.

Effects

Compensating balance requirements has several effects on both parties, including:

- Banks obtain security on their huge loan amount

- Banks get sufficient liquidity to serve the interest rate on deposits to customers

- Banks can maintain their current account-savings account (CASA) in a healthy manner

- Banks can fund newer projects with the fund

- Banks can give more loans to new customers

- Banks can generate greater returns on their investment

- For lending institutions, the deal of compensating balance leads to a positive net change in overall interest income only.

- Although the income increases, there is no decrease in interest expense for the lender.

- Corporate borrowers get an affordable loan from the agreement

- Corporate borrowers can get lower-interest-rate loans

- It also does not lead to enhanced costs on interest rate payments to the borrowing company.

Disclosure: This article contains affiliate links. If you sign up through these links, we may earn a small commission at no extra cost to you.