Table Of Contents

What Is Company Dissolution?

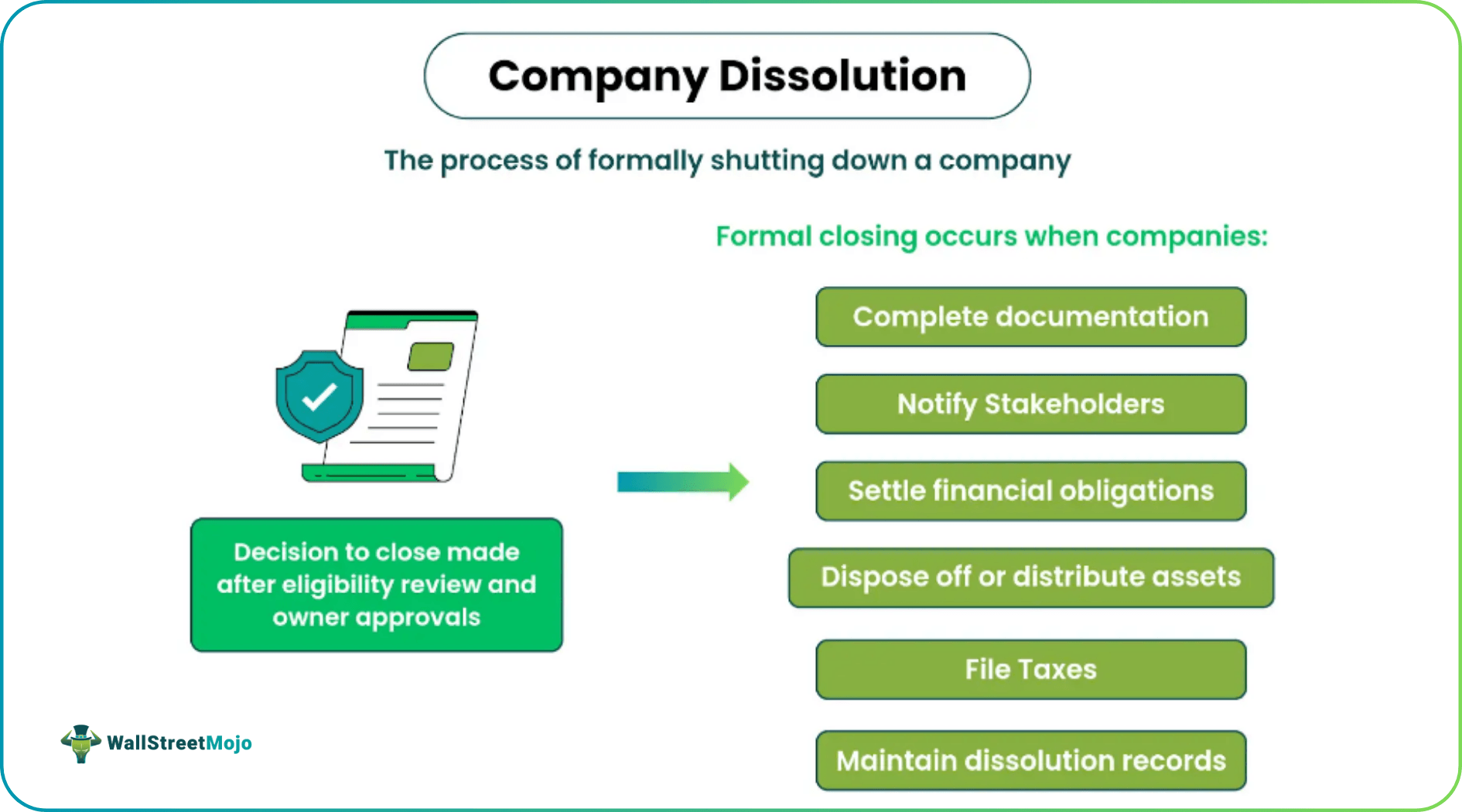

Company Dissolution is the process of closing down a company and dissolving its name to ensure that it ceases to exist as a corporate entity. Business operations conclude at this point, and the company's name is removed from the records of the Secretary of State or any other formal listings, comprising registered businesses.

The dissolution process is administered under the direction of a liquidator. The liquidator is appointed under the laws relevant to the state of dissolution. Owners are required to publish the dissolution decision in an official gazette to notify stakeholders. Liquidators facilitate valuation, debt settlement, and asset distribution, among other things. All company assets and property are redistributed among the legal owners.

Table of Contents

- What Is Company Dissolution?

- Company dissolution results in a formal closure of a business, with the company losing its legal identity, name, and existence.

- Company assets are disposed of or distributed among legal owners.

- Dissolution can be voluntary, where the owners or the board of directors decide to close down an enterprise, or it may be forced, where non-compliance, fraud, or misconduct may be the cause.

- Winding up refers to the initial process where a company’s business operations are shut down. It is a precursor to the actual dissolution.

Company Dissolution Explained

Company dissolution refers to the closure of a company, erasing its identity as a corporate entity, and suspending its legal existence. Owners complete extensive paperwork and legal formalities while setting up a company. Similarly, when they wish to dissolve a company, several prescribed steps must be taken to process the dissolution and settle outstanding debt, vendor payments, tax payments, employee salaries, etc.

To process dissolution in line with company dissolution meaning, owners or shareholders must check the eligibility related to the removal of the company name from the respective Secretary of State’s records. After this, the company loses its legal identity, and no operations or business can be conducted under its name. For this, all the shareholders and owners must vote and unanimously sign off on this decision as part of the approval process. Once approved, a liquidator is appointed to administer and guide the dissolution process.

With the company dissolution letter in place, liquidators initiate the process, which includes every aspect related to closure—from tax filing and settling claims to the redistribution of assets. Liquidators ensure that every document is prepared per the rules and regulations prescribed and that no claim, debt, or settlement is left pending or unaddressed in the winding-up process.

Depending on the company type, dissolution papers are filed with specific government departments. For instance, when an LLC is dissolved in the United States, the dissolution papers are filed with the relevant Secretary of State. The process of winding up a company is extensive, and the guidance of corporate attorneys is recommended to ensure that every activity is completed lawfully without violating any applicable rules.

Dissolution can be voluntary or involuntary. As the name suggests, voluntary dissolution refers to decisions made by owners to shut down a company. Involuntary closure is the result of non-compliance with federal or state laws, gross negligence, fraud, misconduct, etc. Such action is ordered and initiated by government authorities.

Reasons

Companies can be dissolved for various reasons. Let us study them in this section.

- When a company has no projects due to a lack of demand, obsolescence, etc., operating becomes challenging. Hence, owners may decide to shut down.

- At times, owners may go in for voluntary company dissolution. This happens when they wish to discontinue operations in a specific field or do not find the product or service profitable anymore.

- Such decisions may also be made if they lose interest in the product or service being produced and delivered.

- Sick units are unable to meet their financial obligations. A shortage of funds or capital can make survival challenging.

- Significant financial losses over a period may also lead to closure.

- New technology may replace the company’s product or service, offering cheaper options that can be speedily produced.

- The board of directors may force a shutdown when non-compliance is frequent and becomes unmanageable. If it is a systemic issue, resolving it might be difficult. When federal or state laws are not complied with, serious violations occur, triggering penalties.

- When a company is in debt, owners may choose to dissolve and settle pending claims. Bankruptcy may also lead to closure.

- Owners may decide to dissolve an existing business and use the company’s assets at another setup by establishing a different business.

- An economic recession, economic changes, political issues, or shifts in regulations governing businesses may force companies to shut down.

Procedure

The process of dissolution is comprehensive, as every aspect of the business needs to be considered. In this section, we will discuss how a company is formally dissolved.

- Company owner approvals: Approval from shareholders and owners is mandatory for dissolution. In LLCs, members’ approval is needed. The board of directors and shareholders vote to draft a company dissolution agreement. Every action is recorded and documented for further processes.

- Filing the dissolution certificate: After voting, the paperwork is filed with the state in which the corporation or company was formed. In cross-state businesses, paperwork must be filed in other states simultaneously. This process is called the Articles of Dissolution and requires tax clearance.

- Filing federal, state, and local tax reforms: Tax filing across each department must be initiated and handled properly. All tax filings—state, local, and federal must be in order.

- Winding up affairs: Once the dissolution is approved, the winding up of affairs is initiated. It involves settling debts and informing employees, customers, issuers, suppliers, vendors, and other relevant parties. The procedure for canceling permits, registrations, and corporate licenses is also initiated and completed.

- Notifying creditors: Apart from short-term debts and claims that need to be settled, it involves informing creditors about the dissolution and allowing them time to send their claims to the company's mailing address with appropriate paperwork. The deadline may vary from 120 days to more. A statement is also published declaring that claims will be rejected if they are not submitted by the specified deadline.

- Settling claims: After the claims are collected from every party, payment arrangements are made. Reasonable and rightful claims are settled, while others may be rejected. Creditors may agree to negotiate settlements.

- Distributing assets: All remaining assets are distributed among company owners per their ownership rights. The Internal Revenue Service (IRS) must be informed about such distribution, concluding the dissolution.

Difference Between Winding Up And Dissolution Of Company

While these terms are sometimes used interchangeably, there are certain key differences between them. We will discuss them here.

| Key Points | Winding Up | Company Dissolution |

|---|---|---|

| Nature | In a wind-up scenario, the business operations of a company stop. It refers to winding up operations by selling assets, repaying creditors, and distributing assets. | This refers to legally ceasing operations by following the prescribed process through which the company ceases to exist. |

| Legal status | Though business operations cease, the company still exists as a legal entity. | The company no longer exists as a legal entity. |

| Sequence in the scheme of things | This stage comes before dissolution. It means a company shuts down operations while still holding its status as a company or corporation. | Dissolution is the final stage, where the company not only stops operations but also ceases to exist as a legal entity. |

| Authority In charge | The winding-up process is handled by owners or directors. | Articles of Dissolution are filed with the respective Secretary of State. |

Frequently Asked Questions (FAQs)

In liquidation, the company faces a formal closure by a liquidator, but the assets and liabilities, along with other properties and disputes, are still to be dealt with. In contrast, during the dissolution process, the company's name is removed from the ROC as it becomes inactive and loses its corporate identity.

The three types of company dissolution are listed below.

a. Voluntary dissolution: A situation where board members, owners, and shareholders decide to formally close down a company.

b. Judiciary dissolution: A situation where a company is forced or ordered to dissolve.

c. Administrative dissolution: The Secretary of State orders the dissolution when a company fails to comply with certain laws.

For a company to be revived or restored in the United States, it must clear all federal dues and penalties and follow a mandatory documentation procedure. The rules may vary from state to state. Hence, it is advisable to gather the information relevant to the state in which dissolution was initiated and completed.

Recommended Articles

This article has been a guide to what is Company Dissolution. Here, we compare it with winding up, and explain its procedure, and reasons behind it. You may also find some useful articles here –