Table Of Contents

What Is A Commodity Option?

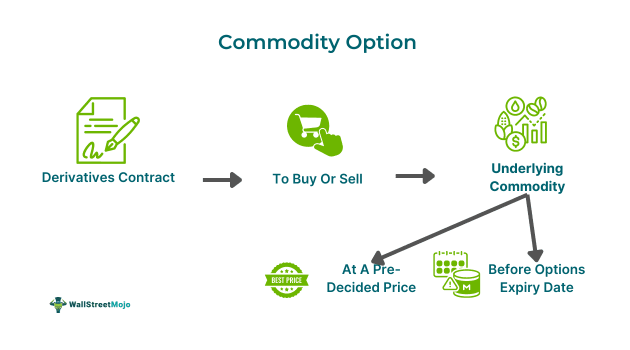

A commodity option refers to a derivative where the parties have the right to buy or sell the underlying commodities, like zinc, copper, etc., in a given quantity at a pre-decided price until or on the expiry date. However, the parties are not bound for such a trade execution.

In such a derivatives contract, the seller holds an unlimited risk while the buyer's risk is limited. Exercising the contract if it seems profitable helps traders take advantage of a short position while limiting risk during commodities futures trade. Moreover, the buyer pays a premium to the commodities options contract seller for taking the additional risk.

Key Takeaways

- A commodity option is a contract whereby a trader proposes to buy or sell an underlying commodity at a pre-stated price on a specific date.

- It provides the buyer with the option to exercise the contract or not, depending on the prevailing market conditions. Also, the buyer pays a margin or premium to the seller since the former is exposed to limited risk while the latter bears unlimited risk.

- The commodities available for trade in the futures market include agricultural products, energy, and metals. \These are exercised three days before their expiry, after which they become futures contracts.

Commodity Option Explained

A commodity option is an arrangement that allows traders and investors to buy or sell commodity futures, i.e., a contract to call or put the underlying commodities at a specified price before their maturity. However, since it is an options contract, the buyer has no compulsion to make the trade. However, the buyer has to give a premium price to the seller for this benefit. Also, if the buyer opts to exercise such a contract, the seller cannot deny it.

The various commodities that can be traded through such contracts include:

- Agriculture: Agricultural produce such as wheat, corn, sugar, soybeans, rice, cotton, coffee, and cocoa are all traded in the commodity markets.

- Metals: The metals as commodities may include gold, platinum, silver, copper, zinc, iron, and many more.

- Energy: These sources of energy available for trading are natural gas, crude oil, gasoline, etc.

The investors and traders can have two different commodity options:

- Call Option: In this arrangement, the investors can purchase the underlying commodity at a specified price, i.e., strike price on or before the contract's expiration date. When the investors exercise the contract, it becomes a futures contract.

- Put Option: Here, the traders intend to sell an underlying commodity at the strike price on or before the expiry date; however, they are not obliged or confined to do so.

Features

The commodity option can be differentiated from the other investment opportunities based on its following distinct characteristics:

- Lot Size: The commodity options lot size is the same as that of its futures contract.

- Options Premium: The trader pays a premium over the actual value for buying such a contract, i.e., an exposure margin and a SPAN margin.

- Diverse Options: The traders have various commodity options, including metals, agricultural products, energy, and other commodities, from different asset classes or commodities markets.

- Options Settlement: The settlement process in commodity options can be either physical delivery of commodities or cash settlement, where the settlement value is the difference between the market price and the commodity options price.

- Expiration: These options have a fixed expiration period, which facilitates traders' opting for contracts that match their investment strategy based on the time a trader prefers to stay invested. The American options can only be exercised before their maturity, while the European options can only be executed on a particular expiry date.

- Expiry Date: Such options usually expire three days before the expiration of the futures contract.

- Strikes: There are 31 strikes in total; when one is at the money strike (ATM), 15 strikes are above the ATM, and the other 15 are below it. ATM is the closest option price to the settlement. Moreover, the two strikes above and two below the ATM are close-to-money (CTM). Also, some strikes are out-of-the-money (OTM) and in-the-money (ITM).

How To Trade?

Trading commodity options is similar to buying and selling any other options. Given below are some of the fundamental steps involved in such trading:

- The trader can form a trading account for online trading.

- It is necessary to ensure that the Futures and Options trading facility is activated in the respective trading account.

- Now, select the buy/sell commodities options maturing at different times and have varying strike prices.

- During the holding period, if the price moves in favor of the trader's strategy, then they can exercise this option.

- However, if the price moves negatively, then the trader can back out from exercising such an option.

Examples

When it comes to options trading, it is better to consider some examples for a more comprehensive understanding. Let us now go through the following commodity option examples:

Example #1

Suppose a trader named Davis is betting on the two-month zinc futures, which are trading at $2,900 per lot on the commodities market. He enters into a two-month call option at a strike price of $2,750, for which he pays a premium of $50 to the underwriter. Now, the prices went as expected, and Davis exercised his option to buy the commodity at a low price. He, therefore, made a gain of $100 (2,900 - 2,750 - 50).

Example #2

The NASDAQ has reported on the launch of 5 new ETFs that allow investors to engage in zero-day options trading for commodities and Treasury bonds. These ETFs include iShares Silver Trust (SLV), United States Oil Fund (USO), SPDR Gold Shares (GLD), United States Natural Gas Fund (UNG), and iShares 20+ Year Treasury Bond ETF (TLT). The zero-day-to-expiration (0DTE) strategy involves options that expire within the same day. This strategy has gained significant traction, especially in the S&P 500, where zero-day options trading volumes have surged. However, experts like Dave Nadig have warned of the risks associated with 0DTE options, particularly for retail investors who may need help understanding the complexities of such trades. Nadig suggests that these options are best suited for institutions, hedge funds, and day traders due to their speculative nature and inherent leverage.

Benefits

The traders and investors in the commodities market often enter into various futures and options contracts to make short-term gains. Let us now explore some advantages of adopting the commodity options trading strategies:

- Call and Put Option: Investors can choose different trading strategies, such as call and put, and various asset classes, offering more freedom.

- Cost Effective: It is a comparatively cheaper and better trading option than the futures contract, with the buyer taking a limited risk and having the opportunity to make high returns.

- Diversification: Such investment products diversify the entire portfolio for risk and return.

- Extended Trading Hours: These options are open for trading even outside the commodity markets' usual hours.

- Flexibility: With different strikes, investors and traders can participate in the commodity's price movement at any point without any restrictions.

- No Mark-to-Market Margins: The buyers are not required to keep any mark-to-market margin when they have already paid a premium value for such contracts.

- Hedges Against Price Volatility: These options provide greater security to investors during market downturns, inflation, and economic crises. Indeed, commodity producers can use them to hedge against price risk.

- Limited Risk: The buyer of such a contract has a limited risk as they can proceed or terminate the contract at their discretion.

- Short Position: Traders can take advantage of the short position in these futures contracts since they have the right but are not compelled to exercise the contract.

Limitations

The commodity options, although more beneficial than the futures contracts, are not accessible from the following pitfalls:

- Complex Valuation: These options are priced using complex models, which require the traders to have proper expertise in gauging the volatility and timing the market.

- Liquidity Challenges: Unlike other instruments, these options do not have an active trading market, which makes it hard for traders to enter or exit their positions at the preferred price.

- Not For Novice Traders: Trading in options and futures requires a complete understanding of the commodities market, which can be difficult for a new investor or trader. However, there are commodity options brokers who can mediate such trades.