Table Of Contents

What Is The Commodity Futures Trading Commission (CFTC)?

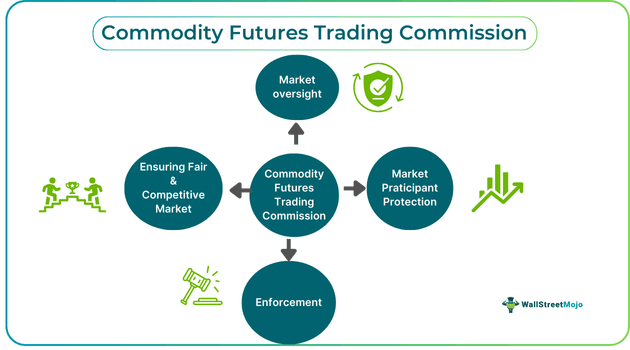

The Commodity Futures Trading Commission (CFTC) is a federal organization responsible for regulating the derivatives market. In the United States, futures contracts, swaps, and options also fall under the CFTC's ambit. The CFTC also ensures improved competition and creates a market environment that prevents investors from falling prey to manipulation, fraud, and abusive trade practices.

Offices and operating divisions process the commodity futures trading commission data in 14 different locations. The CFTC's statutory framework is established through the Commodity Exchange Act of 1974. The regulation of the F&O market has become more complicated with the rise of digital assets such as cryptocurrencies and new FinTech companies.

Many traders use Saxo Bank International to research and invest in stocks across different markets. Its features like SAXO Stocks offer access to a wide range of global equities for investors.

Key Takeaways

- The Commodity Futures Trading Commission (CFTC) was officially registered and introduced in 1974 and replaced the U.S. Department of Agriculture's Commodity Exchange Authority (CEA).

- Its role is to ensure that market integrity is upheld and participants are protected.

- The CFTC is headed by a chairman, who is one of the five commissioners appointed upon the president's and the Senate's approval. They serve a five-year term. The CFTC has 14 offices and divisions that deal with different aspects of the market.

- The CFTC collaborates with various state and local federal agencies, as well as some international authorities, to investigate and prosecute fraudulent activities involving international currencies and digital assets.

Commodity Futures Trading Commission Explained

The Commodity Futures Trading Commission is an independent organization and an extended federal agency established in 1974 by the Commodity Futures Trading Commission Act.

The CFTC regulates the derivatives market in the United States of America, including futures contracts, swaps, and options. Like most regulatory authorities, its prime focus is on developing a competitive and fair market that benefits all market players.

They oversee the market in a way that ensures that investors are safeguarded against manipulative and abusive trade activities and fraud. The regular Commodity Futures Trading Commission report ensures that factors relating to creating a level playing ground for market players are addressed.

The CFTC's structure comprises five commissioners. The president appoints them upon approval from the Senate. Commissioners typically have five-year terms, and the president elects one of them as Chairperson. Moreover, to keep the policies and oversight free of bias, not more than three commissioners can be from the same political party at any given time.

The CFTC operates from the statutory framework provided by the Commodity Futures Act 1936. The Act gives the CFTC the power to introduce new regulations, guidelines, or rules. These introductions or amendments are featured in Title 17 of the Code of Federal Regulations, Chapter One.

In recent years, the CFTC has faced steep challenges, such as the rise of digital assets and Fintech. As a result, it has had to constantly adapt to ensure that all necessary processes are followed and investors' best interests remain protected.

History

A brief account of the history of the CFTC is mentioned below.

- Futures contracts linked to agricultural products have been purchased, sold, and traded in the United States for over one and a half-century. In fact, they have been subject to federal regulation since the early 1920s.

- The Grain Futures Act of 1922 curated the primary authority, which was later replaced by the Commodity Exchange Act of 1936.

- Post the 1970s, futures contract trading expanded rapidly, well beyond orthodox agricultural and physical goods. Foreign currencies, financial instruments, and government securities have been traded.

- The Commodity Futures Trading Commission first gained prominence when Congress created it in 1974 to take the US Department of Agriculture's Commodity Exchange Authority's place.

- The Act significantly changed the Commodity Exchange Act of 1936. John T. O'Hara was the first Chairperson of the commission.

- The CFTC's mandate was expanded in 2000 when Congress put forth the Commodity Futures Modernization Act of 2000. As a result, the SEC and the CFTC were instructed to develop a joint regulatory regime.

- The Dodd-Frank Wall Street Reform and Consumer Protection Act expanded the CFTC's authority over the swaps market as well.

Divisions

Apart from the offices of the Chairman and commissioners, CFTC has 14 operating offices and divisions. Below is an account of five of the most influential divisions.

Division of Clearing & Risk (DCR)

- The Division of Clearing and Risk (DCR) looked after Commodity Futures Trading Commission data’s responsibility of ensuring all transactions uphold the financial integrity as per the CEA. They also look after the clearing operations, which by itself is divided into four sub-branches. They are:

- Examination

- Clearing Policy

- Domestic and International Initiatives

- Risk Surveillance

Division of Market Oversight (DMO)

- The DMO, as the name suggests, is responsible for making sure that the market is stable. One of their fundamental responsibilities is to develop and implement regulations that encourage a fair and efficient derivatives market. The DMO has five sub-branches:

- Chief Counsel

- Market Intelligence

- Compliance

- Product Review

- Market Review

Market Participants Division (MPD)

- A merger between the Customer Education and Outreach Office and Swap Dealer and Intermediary Oversight resulted in the formation of the MPD in 2020. The MPD's responsibility is to oversee CFTC registrants who trade, invest, or deal in derivatives. Its oversight also extends to advisory businesses and the ones that educate Americans about the derivatives market. The MPD's four main branches are:

- Chief Counsel Branch

- Managed Funds and Financial Requirements Branch

- Examinations Branch

- Registration and Compliance Branch

Division of Enforcement (DOE)

The DOE is entirely responsible for detecting, investigating, and prosecuting violations as per the CFTC regulations and the Commodity Exchange Act. Their investigations include cases of fraud, price manipulation, disruptive trade practices, accounting violations, illegal off-exchange activities, and misappropriation.

In addition to these cases, the DOE also assists the US attorney's office, international authorities, and other state and federal civil law enforcement agencies.

Regulations

All of CFTC’s regulations are found in Title 17 of Chapter One of the Code of Federal Regulations. A few of the most prominent CFTC regulations include:

- Registration Requirements: Individuals, firms, Commodity Trading Advisors (CTAs), and Commodity Pool Operators (CPOs) are required to register with the CFTC and comply with their rules.

- Reporting Requirements: The CFTC requires all derivatives market participants to submit their trades and positions at regular intervals.

- Market Manipulation Prohibition: If one watches the commodity futures trading commission news, they will be accustomed to the CFTC's strictness against manipulative and fraudulent activities.

- Position Limits: The CFTC sets clear limits on the volume of contracts a single entity can hold at any given point in time to ensure there is as little scope for speculation as possible.

- Clearing Requirements: Most derivatives trades must be cleared through a recognized central clearing house to eliminate any added risks.

Importance

Various commodity futures trading commission reports shall make it clear that their existence has helped the market uphold its integrity. A few of its most impactful areas of regulation and oversight are:

- The CFTC ensures that the commodity and financial futures market maintains its integrity and operates transparently, fairly, and efficiently.

- Their measures to ensure the protection of market participants from manipulation, abusive practices, and fraud have had significant effects.

- They constantly monitor and investigate various trades and holdings to ensure no misconduct goes unnoticed. As a result, they also enforce punitive actions against perpetrators.

- They work in collaboration with different federal and international agencies to curb fraud in such markets.

- Their policies, regulations, and guidelines ensure that the commodity markets have healthy competition and thrive to reach their maximum potential.

Challenges

Despite the various benefits of their actions, there are a few challenges, according to the Commodity Futures Trading Commission data. They include:

- Since the CFTC was initiated as a regulator of orthodox commodity-linked futures and options and now has a broader role in technology-related products, the transition is an uphill task that goes unnoticed most of the time.

- Cryptocurrencies, fintech, and other digital assets are the latest developments and require the utmost attention to ensure the safeguarding of market participants.

- Emerging technological developments such as Artificial Intelligence and Cloud Computing directly threaten the regulated market by the CFTC. Therefore, they are required to stay on top of these developments.

- Market participants rely on the CFTC's oversight and regulation of fraudulent activities. If the CFTC fails to catch a financial crime in time, other participants might lose trust in the market.

For professional-grade stock and crypto charts, we recommend TradingView – one of the most trusted platforms among traders.

Disclosure: This article contains affiliate links. If you sign up through these links, we may earn a small commission at no extra cost to you.