Table Of Contents

What Are Commingled Funds?

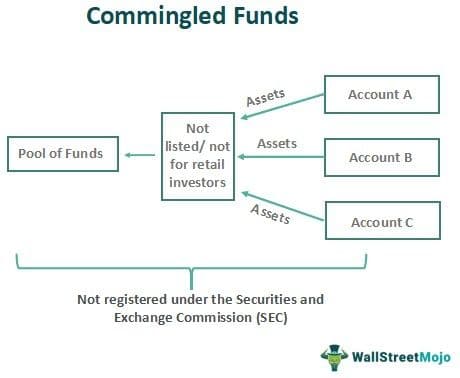

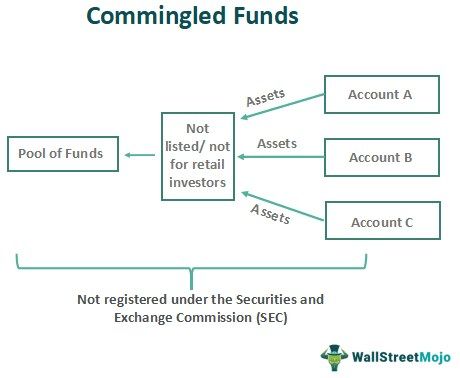

Commingled Funds are professionally managed funds that are usually offered in retirement accounts (401(k)) that combine assets like bonds and equities from multiple accounts and manage the pool as one account, rather than managing each individual accounts separately.

Some professional fund managers or financial institutions manage these funds. Through them, investors can access diverse investment options like stocks, bonds, or real estate and achieve greater returns at minimum cost. They are common as retirement or pension plans.

Key Takeaways

- Commingled funds are professionally managed and combine assets from various accounts into one account, often found in retirement plans like 401(k)s.

- Compared to mutual funds, which have significant regulatory oversight and expense ratios, commingled funds have actively managed portfolios with low expense ratios.

- It has a set holding duration corresponding to the investor's liquidity needs and investment time horizon. Due to their illiquid character, commingled funds cannot be redeemed in an emergency.

Commingled Funds Explained

Commingled funds are a collection of investment funds where many investors can invest in a diverse range of financial instruments at minimum cost and good returns. Investors purchase units of such funds whose value fluctuates based on the performance of the underlying asset.

They are commonly used in pension or retirement plans where a large number of investors contribute to the pool. Similar to mutual funds, they are managed by professional fund managers. They allow diversification benefits and low portfolio risk for investors. be it commingled funds real estate or any other type of investment options.

Special emphasis has to be paid on the asset management company (AMC) managing the respective funds.

Any change in fund managers of commingled funds results in style and performance variation, impacting the investor's capital upwards or downwards. Unethical practices of fund managers can also impact the commingled fund structure. Investors should keep their objectives and risk tolerance in mind while investing in commingled funds and ensure they are in sync with the fund’s objectives and riskiness.

Though not regulated by the SEC, this is reviewed by the United States Office of the Comptroller of the Currency and individual state regulators. However, they do not require to follow lengthy disclosure procedures.

Investors putting their money into such funds should read the offering document carefully to understand and be informed about the different types of investment strategies, the level of risk and the various types of fees that they need to pay. An expert financial advisor are able to guide the investors better since they have a proper understanding of the instrument and they are also aware of the latest rules and regulations of the system.

Examples

Now, let us try to understand the concept of commingled fund structure by using some suitable examples.

Example #1

Consider a group of 10 investors who come together with a fund manager to get their accounts managed separately. As managing individual accounts can be operationally challenging and expensive, the manager tells these people that he will treat this money as one single pool, and whichever assets he will buy from the pool which can be commingled funds real estate or any other investments and will be divided proportionally based on the capital of each account to the combined capital of all the accounts. Also, individual assets will be apportioned to separate accounts on the reporting date, based on overall allocation ratios of assets in the pooled account.

Example #2

Here is another commingled funds example for proper understanding. Let’s assume that three investors (A, B, and C) with the capital of $40,000, $60,000, and $100,000 invested in a commingled fund with only these three accounts. The ratio of their capital in the entire pool ($200,000) is 20:30:50. The fund manager takes the pool and invests in three asset classes: stocks, bonds, and treasuries.

A year later, the pool grew to 250,000, and the allocation to three asset classes stood at 40%, 50%, and 10% for stocks, bonds, and treasuries, respectively. At this time, the manager reports the performance and the current state of a portfolio to respective investors. The return on individual accounts is reported to be the same as the return on pooled investments (25% in this case).

This return gives the end of the year-end values of the individual accounts. The manager then reports the assets in these accounts in the same proportion as the pooled account to ascribe different assets in individual accounts. Refer to the below illustration:

Thus, the above are some commingled funds example which clarifies the concept.

Advantages

Like, every other financial concept has some benefits and limitations, so does this concept. Let us try to understand the benefits first, as given below:

- All the assets are held in one account, eliminating the need for managing different accounts for different asset classes.

- These are less expensive due to their lower operational and regulatory overheads.

- Commingled pool funds are actively managed portfolios with low expense ratios compared to mutual funds, which have high regulatory supervision and expense ratios.

- They provide benefits of portfolio diversification.

- Like mutual funds, commingled funds are managed by professional fund managers.

- It can be a part of your 401(k) retirement account, which helps the investors get tax benefits.

- It performs better than mutual funds due to its better focus and lower expenses.

Disadvantages

Here are a few limitations of the concept, which are detailed below:

- Lack of regulatory supervision and reporting requirements make the commingled funds an opaque investment choice.

- The illiquid and non-marketable nature of these investments put these funds away from the reach of many investors.

- The lack of performance reporting makes tracking these funds in real-time difficult.

- Details of holdings, expense ratios, and other information are not known for commingled funds as it is known for mutual funds.

- Commingled pool funds are not as readily available as other investment alternatives like mutual funds or exchange-traded funds (ETFs).

- It has a pre-specified holding period, which should match the investor’s liquidity requirements and investment time horizon.

- Due to their illiquid nature, commingled funds cannot be redeemed in case of emergency requirements.

- These funds can be purchased only in retirement plans and by institutional investors involved in these plans.

Commingled Funds Vs Mutual Funds

Both the above concepts refer to pooled funds where investors can invest at minimum risk and cost to earn maximum returns. But some points of differences between them are as follows:

- The former is mostly available to institutional investors whereas the latter is available to and accessible by individual investors also.

- The former is not governed by the SEC , but the latter is governed by the SEC.

- The former is regulated by United States Office of the Comptroller of the Currency and individual state regulators but that is not the case with the latter.

- The minimum amount of investment required is much higher in case of commingled fund as compared to mutual funds.

- The expense ratio of the former is lower compared to the latter because of the larger size.

- Mutual funds need to comply with more and stricter rules and regulations as compared to the commingled funds.

Thus the above are some of differences between the two financial instruments.