Table Of Contents

Colorado CPA Exam

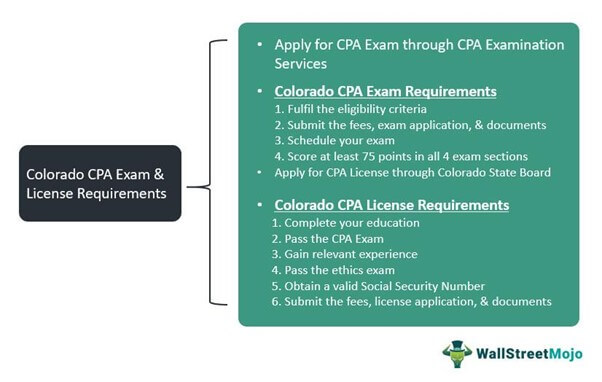

Colorado CPA (Certified Public Accountant) License is a formal permit issued to qualified professionals in the U.S. province to perform public accounting services. To acquire a CPA license in Colorado, candidates must meet the criterion for experience, exam, and other requirements.

The Centennial State follows the one-tier licensing pattern. As per this system, you can directly receive the CPA permit after accomplishing all the necessary license prerequisites without having to apply for the CPA certificate first. Moreover, the Colorado Board of Accountancy has the mandate to issue the accounting license in the state.

Colorado also administers the International Examination Program. Now, let’s learn more about the Colorado CPA exam and license requirements.

Contents

Colorado CPA Exam Requirements

Colorado CPA License Requirements

Colorado CPA Exam Requirements

The stepping stone for Colorado CPA licensure is completing the standardized computer-based set of tests. It analyses the intelligence level of aspiring CPAs and sets a quality benchmark for them.

The American Institute of Certified Public Accountants (AICPA) and the National Association of State Boards of Accountancy (NASBA) conduct and regulate the examination.

CPA exam includes four sections to be passed with at least 75 points in each on a scale of 0-99. The rolling 18-month period given to conclude the test begins on the date you take the first passed exam section.

| CPA Exam Sections | Duration | Testlets | Question Types | ||

| Multiple-choice Questions | Task-based Simulations | Written Communication Tasks | |||

| Auditing & Attestation (AUD) | 4-hour | 5 | 72 | 8 | - |

| Business Environment & Concepts (BEC) | 4-hour | 5 | 62 | 4 | 3 |

| Financial Accounting & Reporting (FAR) | 4-hour | 5 | 66 | 8 | - |

| Regulation (REG) | 4-hour | 5 | 76 | 8 | - |

Eligibility Requirements

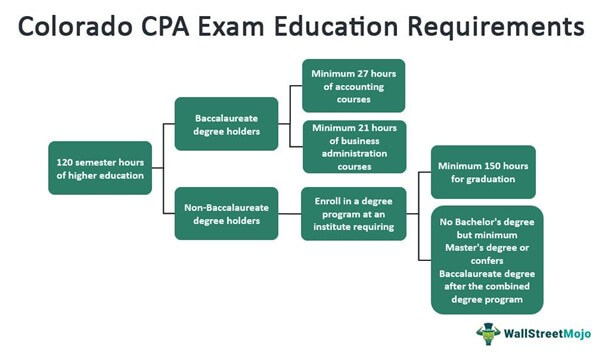

Colorado CPA Exam applicants must complete at least a baccalaureate degree with a minimum of 120 hours of higher education, including,

- At least 27 semester hours of non-duplicative graduate or undergraduate level accounting courses with a minimum “C” grade of which,

- 21 semester hours in non-introductory accounting subjects like:

- Accounting Ethics

- Accounting Information Systems

- Accounting Research & Analysis

- Accounting Theory

- Auditing & Attestation Services

- Financial Accounting & Reporting of Business Organizations

- Financial Accounting & Reporting for Government & Not-for-Profit Entities

- Financial Statement Analysis

- Fraud Examination

- Internal Controls & Risk Assessment

- Managerial or Cost Accounting

- Taxation

- Tax Research & Analysis

- Forensic Accounting

- Tax Auditing

- Other Board-approved areas

- 21 hours must include at least three semester hours in an auditing course focusing on the U.S. Generally Accepted Auditing Standards (GAAS)

- 21 semester hours in non-introductory accounting subjects like:

- At least 21 semester hours of non-duplicative undergraduate or graduate-level business administration courses, like,

- Behavior of Organizations, Groups, & Persons

- Business & Accounting Communication

- Business Ethics

- Business Law

- Computer Information Systems

- Economics

- Finance

- Legal & Social Environment of Business

- Management

- Marketing

- Quantitative Applications in Business

- Statistics

- Other Board-approved areas

- Maximum 6 of the 21 semester hours can be in any one subject area. However, semester hours beyond the 6-hour limit may count toward the 120-semester hour requirement.

Non-baccalaureate degree holders may still qualify for the CPA exam upon completion of the required 120 hours. Furthermore, they must be enrolled in a degree program at an institute that,

- requires at least 150 hours for graduation, and

- does not provide a baccalaureate degree, but at least a master’s degree, or confers the baccalaureate degree after completing the combined degree program

You must submit the exam application, fees, and required documents to CPA Examination Services (CPAES). The complete procedure is explained at the NASBA portal.

Fees

First-time applicants:

| Particulars | Amount | Total Fees |

| Application Fee | - | $160 |

| Examination Fees | - | - |

| AUD | $238.15 | - |

| BEC | $238.15 | - |

| FAR | $238.15 | - |

| REG | $238.15 | $952.6 |

| Total Fees | $952.6 | $1,112.6 |

Re-exam applicants:

| CPA Exam Sections | Exam Fees (per section) | Total Exam Fees (all sections) | Registration Fees | Total Fees |

| 4 exam sections | $238.15 | $899.96 | $85 | $984.96 |

| 3 exam sections | $238.15 | $674.97 | $85 | $759.97 |

| 2 exam sections | $238.15 | $449.98 | $85 | $534.98 |

| 1 exam sections | $238.15 | $224.99 | $85 | $309.99 |

Please note that neither application fees nor examination fees are refundable. Moreover, your Notice-to-Schedule (NTS) in Colorado expires after six months. Hence, apply for sections that are attemptable within the aforementioned period.

Candidates are not permitted to withdraw from the exam or request an NTS extension. However, adverse situations are an exception to avail a limited exam fees rebate or request an NTS extension.

Required Documents

CPAES requires the submission of the following documents:

| Place of education | Documents | Submission |

| Within the U.S. | Official school transcript(s) | Academic institution |

| Outside the U.S. | International evaluations with international transcripts | Academic institution, or |

| NASBA International Evaluation Services, (NIES), or | ||

| A member of the National Association of Credential Evaluation Services (NACES), or | ||

| The Association of International Credential Evaluators (AICE) | ||

| Social Security Number (SSN) Affidavit | Academic institution or evaluation service | |

| Letter from school confirming U.S. GAAS concentration in the audit course | Academic institution or evaluation service | |

| Primary textbooks for the audit course (including the name of the authors & publisher) | Academic institution or evaluation service | |

| Course syllabus | Academic institution or evaluation service |

Know that transcripts can also be directly mailed to etranscript@nasba.org. Moreover, photocopied transcripts are unofficial and thus unacceptable.

Colorado CPA License Requirements

To earn the Colorado CPA License, you must:

- Complete 150 semester hours of education

- Score at least 75 points in all four exam sections of the CPA Exam

- Gain one year of relevant work experience

- Pass the AICPA ethics exam

- Obtain the Social Security Number (SSN)

You must use NASBA’s licensing service to apply for the CPA License. To know the complete process, please check out the NASBA portal.

| Particulars | Fees |

| Initial license | $150 |

| Transfer of grades | $185 |

| Reciprocal license | $185 |

| Firm license | $175 |

Education Requirements

General Requirement

- Baccalaureate degree from a regionally authorized institute

- 150 semester hours of non-duplicative undergraduate or graduate-level coursework

Accounting Course Requirement

- Applicants must gain 33 semester hours of non-duplicative undergraduate or graduate-level accounting coursework with,

- 27 semester hours in only non-introductory accounting courses, including

- Accounting Ethics

- Accounting Information Systems

- Accounting Research & Analysis

- Accounting Theory

- Auditing & Attestation Services

- Financial Accounting & Reporting of Business Organizations

- Financial Accounting & Reporting for Government & Not-for-Profit Entities

- Financial Statement Analysis

- Fraud Examination

- Internal Controls & Risk Assessment

- Managerial or Cost Accounting

- Taxation

- Tax Research & Analysis

- Other Board-approved areas

- 27 semester hours in only non-introductory accounting courses, including

- 6 out of 27 semester hours must be in auditing with a minimum of 3 semester hours in a course with a concentration in U.S. GAAS.

- At least 3 out of 27 semester hours must be in accounting or business ethics, including

- Accountants’ ethical responsibilities (personal & professional)

- Ethics dilemmas of accountants

- Several codes of conduct related to accounting and their application

- Ethical advice for accountants

- Ethical theory and its application

- Application of professional standards

- Remaining hours may be in advanced auditing or a subsection of basic auditing

Note that the accounting program code must designate all the courses, or applicants must demonstrate the coursework as accounting.

Business Course Requirement

- 27 semester hours of non-duplicative undergraduate or graduate-level business administration coursework with,

- Behavior of Organizations, Groups, & Persons

- Business Communications

- Business Ethics

- Business Law

- Computer Information Systems

- Economics

- Finance

- Legal & Social Environment of Business

- Management

- Marketing

- Quantitative Applications in Business

- Statistics

- Other Board-approved areas

- Maximum of 9 out of 27 semester hours can be in any one subject area. However, semester hours beyond the 9-hour limit may count toward the 150-semester hour requirement.

- All coursework must include the above-mentioned subject areas but may not be taken within the accounting or business department.

Non-Mutual Recognition Agreement (MRA) applicants with foreign credentials may check the above Required Documents section to gain detailed information.

Foreign Candidates with an MRA

Colorado State Board may issue the CPA license to candidates with an active license from an organization having an MRA with the International Qualifications Appraisal Board (IQAB).

Moreover, they must satisfy the following requisites:

- Pass the Uniform CPA Exam or International Qualifications Examination (IQEX)

- Complete the below-mentioned work experience and ethics requirements

Applicants may get their work experience verified by an active CPA from an accredited IQAB country.

Exam Requirements

Candidates must pass either the AICPA-administered Uniform CPA Exam or International Qualification Exam. Kindly check the Colorado CPA Exam Requirements section to learn more about the licensure test.

Experience Requirements

Colorado CPA licensure applicants must earn one year of relevant work experience in either public accounting, industry, government, or academia. Let’s view all the details here.

Ethics Requirements

You must score at least 90% in the AICPA Ethics Examination within two years preceding the application date. Moreover, here is everything you must know about the exam.

| Particulars | Requirements | |

| Course Title | Professional Ethics: The AICPA’s Comprehensive Course (For Licensure) | |

| Fees | AICPA Members | $189 (excluding shipping costs & sales taxes) |

| Non-AICPA Members | $245 (excluding shipping costs & sales taxes) | |

| Exam Level | Basic | |

| Format | Self-Study | |

| Mode | Online | |

| Availability | 1 year | |

| How to pass the Exam? | Sign-up for the Ethics Exam | |

| Access the course | ||

| Schedule & Pass the Exam | ||

| Course Content | Conceptual Framework | |

| AICPA Code of Professional Conduct | ||

| Acts discreditable to the CPA profession | ||

| Independence Requirements | ||

| Ethics Interpretations | ||

| Integrity, Objectivity, & Professional Conduct | ||

| Passing Score | 90% |

Continuing Professional Education (CPE) Requirements

Colorado CPA titleholders must obtain 80 hours of CPE credits every two years. Moreover, the state board only accepts CPE sponsors that are listed on the NASBA’s National Registry and comply with the AICPA/NASBA protocols.

Check out all the details here.

| Particulars | Requirements | |

| Renewal Date of License | November 30 of odd-numbered years | |

| Reporting Period for CPE | January 1-December 31 (Every two years ending on odd years) | |

| CPE Requirement | 80 hours every two years | |

| Ethics Requirement | 4 hours | |

| Maximum 2 hours in Colorado Rules & Regulations complying with the content outline in section 7.8 (E) of Accountancy Rules & Regulations | ||

| Credit Limitations | Personal Development | Maximum 20% |

| Published Materials & Instructed | Maximum 50% of the required CPE in a reporting period | |

| Other State Policies | No pre-approval for courses or providers | |

| CPE will be accepted if the licensee and CPE provider satisfies the AICPA/NASBA standards |

The journey to becoming a CPA demands attention to detail, extremely hard work, and undeterred focus. Moreover, Colorado offers several opportunities to specialize in the preferred field of accounting.

It is definitely among the most comfortable places to gain a globally-recognized credential. Needlessly, you can check out recent updates about the CPA exam and license requirements on the Colorado State Board and NASBA websites. You may learn more here - CPEs for CPA

Colorado Exam Information & Resources

1. Colorado Department of Regulatory Agencies (https://dpo.colorado.gov/Accountancy)

Colorado State Board of Accountancy

1560 Broadway, Suite 1350

Denver, CO 80202

Phone: 303-894-7800

Email: dora_dpo_licensing@state.co.us

2. Colorado Society of CPAs (https://www.cocpa.org/)

7887 E. Belleview Ave., Suite 200

Englewood, CO 80111-6076

Phone: 303-773-2877

800-523-9082

3. Colorado Secretary of State (https://www.sos.state.co.us/)

1700 Broadway,

Suite 550, Denver CO 80290

Phone: 303-894-2200

4. NASBA (https://nasba.org/)

150 Fourth Ave. North

Suite 700

Nashville, TN 37219-2417

Tel: 615-880-4200

Fax: 615-880-4290

Recommended Articles

This article is a guide to Colorado CPA Exam & License Requirements. We discuss Colorado CPA requirements, licenses, eligibility, fees, documents, etc. You may also have a look at the below articles to compare CPA with other examinations –