Table Of Contents

Free College Student Budget Template

The college student budget template refers to the budget template to prepare for every semester to handle a college student's finances. A simple college student budget starts with entering all the sources of the student's income for the period under consideration based on actual and budgeted figures.

Then, list all the actual and budgeted expenses by segregating them into the fixed and variable categories for which payments are to be made during the period. Lastly, deducting total expenses from the total income will derive the balance left during the period.

College Student Budget Template Explained

A college student budget template is an essential financial planning tool designed to assist students in effectively managing their finances during their academic journey. For those juggling academic responsibilities and looking to make the most of their time, some students even look for someone who can write a paper, allowing them to focus on budgeting and other crucial tasks. This template serves as a dynamic guide, promoting responsible spending and ensuring that students can meet their financial obligations while pursuing higher education.

The template’s significance is that it cultivates financial awareness by outlining all potential sources of income and anticipated expenses, enabling students to understand their financial landscape. Also, by categorizing expenses, the template encourages students to prioritize essential costs such as tuition, housing, and academic materials, ensuring that critical needs are met before discretionary spending.

A well-structured budget assists students in avoiding unnecessary debt by providing a clear overview of their financial resources and limitations. It also facilitates goal setting by allowing students to allocate funds for specific purposes, whether it be saving for future expenses, creating an emergency fund, planning for post-graduation endeavors, or covering the costs of attending the most expensive boarding schools.

The reason why every student must have an Excel college student budget template is that a budget ensures efficient management of limited resources, enabling students to cover their academic and personal expenses without unnecessary financial strain.

Therefore, a college student budget template is a practical and empowering tool that not only helps students navigate their immediate financial needs but also cultivates lifelong financial responsibility and resilience. Every student can benefit from the clarity and control that a well-designed budget provides during their academic journey and beyond.

About the Template

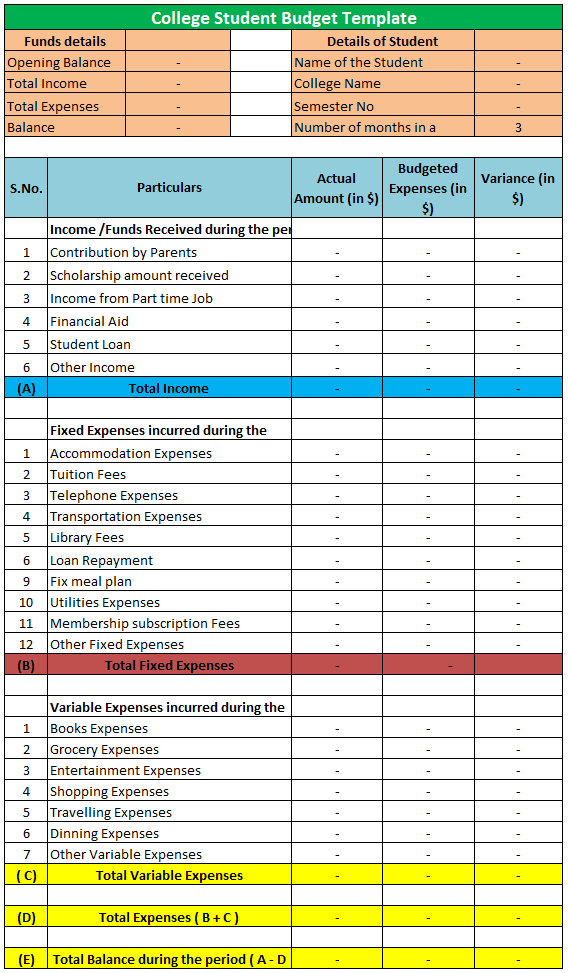

This template shows the semester-wise income and expenses of the college student. All these income and the expenses for the period are not listed bill-wise in a detailed manner. Instead, they grouped into a handful of categories. Also, the actual figures of the income and expenses are shown along with the actual figures. The budgeted figures are also displayed so the student can get an idea about the variance of their actual income or expense from the budgeted one.

Components

Let us understand the components of a simple college student budget template through the detailed discussion below.

#1 - Heading:

At the top area of the college student budget template, one must write the heading college student budget template. This heading clearly explains that the template pertains to the college student budget. Other things may change from person to person, but this heading will remain intact.

#2 - Summary of funds details:

This summary contains the details concerning the opening balance available with the student, its total income from all the sources, its total expenses from all the categories, and the balance left at the end of the semester. The opening balance can be taken from the previous budget, while other details will be picked automatically from the value in the steps below.

#3 - Income /Funds Received during the period:

Under these, it will mention the details of all income received in actual and budget received by the student from all sources.

#4 - Fixed Expenses incurred during the period:

Under this, it will mention all fixed expenses in actual and budgeted values to be incurred by students from all the sources. The fixed expenses include all the expenses the student has to incur, even if it is not availing of the benefits.

#5 - Variable Expenses incurred during the period:

Under these, mention the details of all the variable expenses in actual and budgeted values students incurred from all the sources. The variable expenses include those expenses incurred in the case of any product or service.

#6 - Balance:

Under this, one will calculate the balance by subtracting the total fixed and variable expenses from the total income.

How to use this template?

Now that we understand the intricacies of an online or an Excel college student budget template, it is only fair if we lay out the points to be able to interpret and understand this template in detail. Let us do so through the explanation below.

- A college student using this template must enter all the details as required in the fields that are not already pre-filled.

- For this, firstly, details of the student have to be entered, including the student's name, college name, semester number, and the number of months in a semester.

- One must insert the details of the income received from all the sources, including contributions by parents, any scholarship amount received, income from a part-time job, financial aid, student loan, and other income. For all the income, the budgeted, as well as actual figures, are to be entered.

- Along with the income details, one must enter all expenses incurred by segregating them into two categories: fixed and variable expenses. Here, fixed expenses include accommodation expenses, tuition fees, telephone expenses, transportation expenses, library fees, loan repayment, fixed meal plans, utility expenses, membership subscription fees, and other fixed expenses. Variable expenses include books, groceries, entertainment, shopping, dining, and other variable expenses. However, the individuals in the template can modify these specified fields as per their requirements. One must insert the budget and actual figures for all the expenses.

- Then, the balance at semester end is derived by deducting the total of all the expenses from the total income earned.

- The template will automatically display the summary of fund details at the top left. Also, the variance between budgeted and actual figures will be automatically calculated.