Table Of Contents

Collateralization Meaning

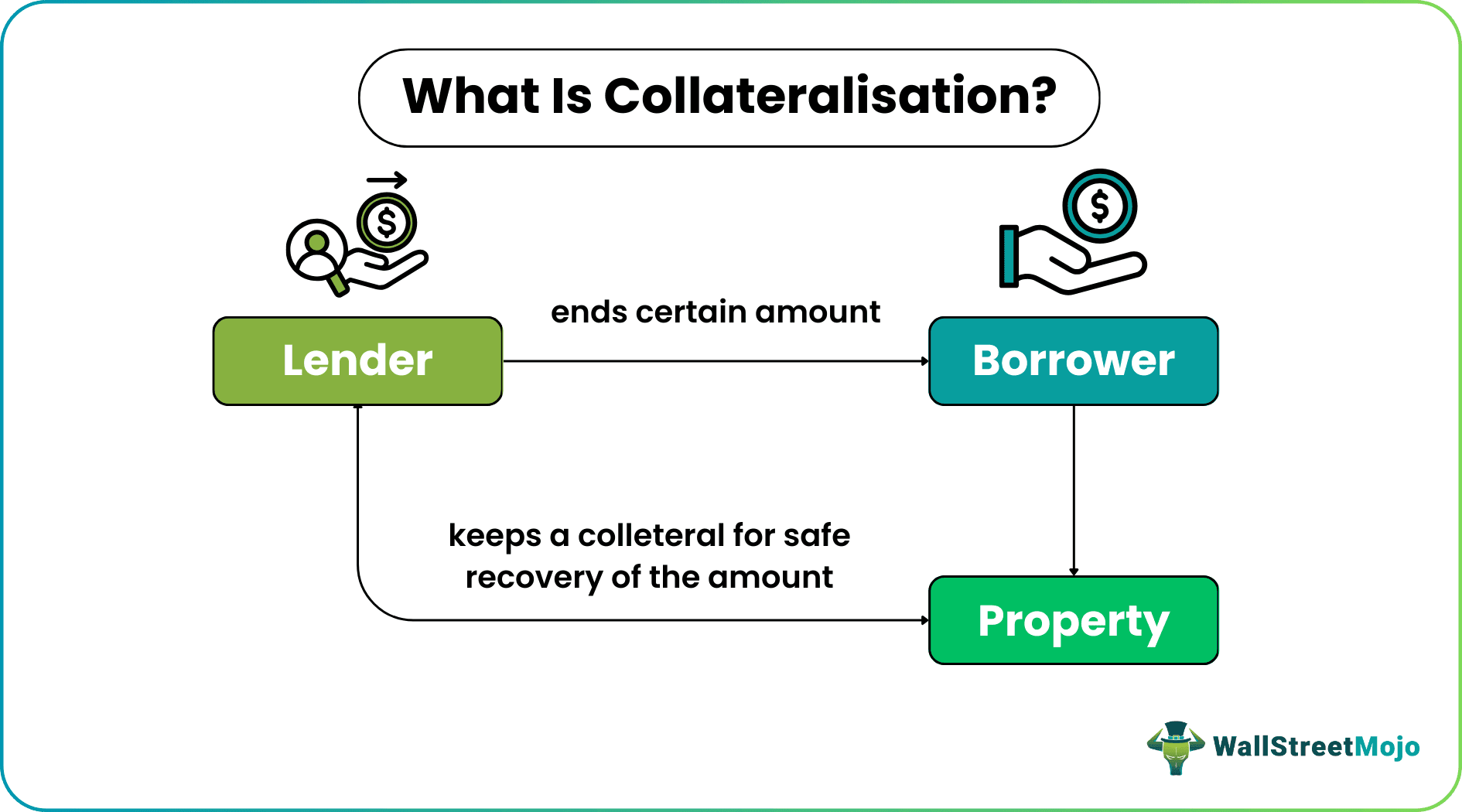

Collateralization is the term that originates from the word "collateral," which means security (asset) is offered against the loan availed by the borrower providing reassurance to the lender on the recoverability of the amount lent. If the borrower defaults on the repayment of a loan, the lender has the right to recover his loan from the security collateralized with him.

An asset is pledged to the lender, who charges the same in this process. It acts as a recourse in the event of default by the borrower. Various assets could be used as collateral, such as jewelry, immovable property, vehicles, inventories, etc.

Key Takeaways

- Collateralization offers specific asset security against a loan or other financial obligation. Business loans, investor loans, and home loans are the different categories of loan collateralization.

- The security he put up as collateral can be used by the lender to recoup his loan if the borrower defaults on the repayment terms.

- Collateralization involves pledging an asset to the lender, who keeps the same fee. When the borrower defaults, it serves as a remedy.

- Before making loans to people or businesses, banks and other financial institutions consider the maximum loan-to-value ratio.

How Does Collateralization Work In Banks?

Collateralization is a mechanism of securing loans by offering assets to the borrower as collateral. Such collaterals usually provide a way faster and ensure access to loans. Banks and financial institutions look at the maximum loan-to-value ratio before releasing loans to individuals or businesses.

Generally, banks and other financial institutions have a maximum suggested loan-to-value ratio, which implies that the maximum loan amount cannot, in any case, exceed a specific percentage of asset value. We can better explain that with the help of the following example: -

BoA Bank has a maximum loan-to-value ratio of 80%. Ms. Susan owns property on Fame Street, New York, with a market value of $800,000, and approached BoA to obtain a loan for her new business venture. She offered to provide the said property as a mortgage.

As per the maximum loan-to-value ratio fixed by the bank, Ms. Susan can avail of a full loan of $720,000.

Types

As collateralization is a mechanism to secure the loan offered by the lender, one can use it for various loan facilities that the bank or financial institutions provide. Some types of loans for which collateralization can be used are as under: -

#1 - Mortgage Loans

A mortgage loan refers to the loan availed against the property's title. A mortgage loan involves regular payment of interest as well as principal.

The title of the property mortgaged against the loan remains with the lender until the loan has been repaid by the borrower, post which the title gets transferred to the borrower. If the borrower defaults in repayment of the principal amount of interest, the lender can sell the mortgaged property to recover the amount due to him.

#2 - Business Loans

There are various types of loans that a business avails, such as a bank overdraft, term loans, issuance of bonds, etc. collaterals are often used in most business loans. Business loans can have all kinds of assets as collateral. For example, a loan availed for equipment purchase by a hospital can have the equipment purchased as mortgaged with the bank. It is pledged to provide security to the lender to repay his amount. In case of default by the borrower, the lender has the right to recover the amount due through the sale of equipment so mortgaged.

Similarly, bonds or debentures issued by the company might have a charge on the specific immovable property of the company that can be sold by the subscribers of these instruments in case of default in repayment of principal or interest thereon the company.

#3 - Investor Loans

Often, brokerage firms allow investors to obtain loans against their securities. Investors who do not have sufficient funds in the account and wish to trade on the margin allowed by the brokerage firms can avail of the margin based on the securities held in their account.

The margin allowed is usually multiple times the value of securities held in the account. Such a margin is permitted only for a short duration, after which it needs to be settled either through the sale of securities purchased or through adding more funds to the accounts.

Examples

Let us consider the market-based examples below to understand the working and impact of collateralization in the financial market:

The impact of collateralization can be seen in various sectors, including on derivative valuation, swap rates, monetary policies, repo rates, etc. Let us look at the consequences in brief quickly:

Example #1

In the derivative market, margins are collateral. When the counterparties involve in a derivatives contract and agree to comply with the terms and conditions, it becomes necessary for them to ensure no defaults. This is what makes them call for margins to secure the deal.

Example #2

In a repo transaction, borrowers sell their assets to lenders to obtain an amount, thereby having the right to purchase the property again at the same old price in addition to a certain amount for the prespecified later date.

Collateralization vs Securitization

Collateralization and securitization are terms that tend to signify the same thing, but they differ. Collateral loans are backed by security, which can be anything from real estate property to a vehicle. Hence, it is often confused with securitized loans.

Let us check how to identify whether a loan is collateralized or securitized:

- Collateralization leads to lenders offering borrowers the loan amount against collateral or security as a backup. In the event of default, they can recover their loan amount by selling or using the property in some manner. On the contrary, securitization is where the mortgages are grouped together along with other financial obligations of the borrowers and then sold collectively to investors.

- In the case of collateralization, the dealing happens using the physical property, which is normally the real estate asset, while in the case of securitization, the investors do not buy physical assets, but they buy a certificate that signifies that the investors have the right to repay.