Table Of Contents

Coinbase Financial Model

On April 14, 2021, cryptocurrency exchange Coinbase reached a new milestone by getting itself listed on the Nasdaq Stock Exchange. Trading under the ticker "Coin", the company did not opt for a standard initial public offering (IPO). Instead, Coinbase's shares were listed directly on the stock exchange at a reference price of $250.

Our experts have once again built an in-depth free IPO financial model for Coinbase. It is designed to help you grasp the mechanics with much simplicity and ease.

Free Download – Coinbase Financial Model

We've built this FREE Coinbase Financial and Valuation Model that you can learn from and reverse-engineer to further your understanding of the IPO model. We have attempted to dissect the most important aspects of Coinbase's direct listing. As a result, you will learn -

- how to model a direct listing transaction,

- what an IPO model informs you about the company and,

- its possible valuation before and after going public.

Please feel free to download and customize it as needed.

Disclaimer: This Coinbase IPO Model is provided solely for educational purposes. Wallstreetmojo does not make any buy or sell recommendations to investors.

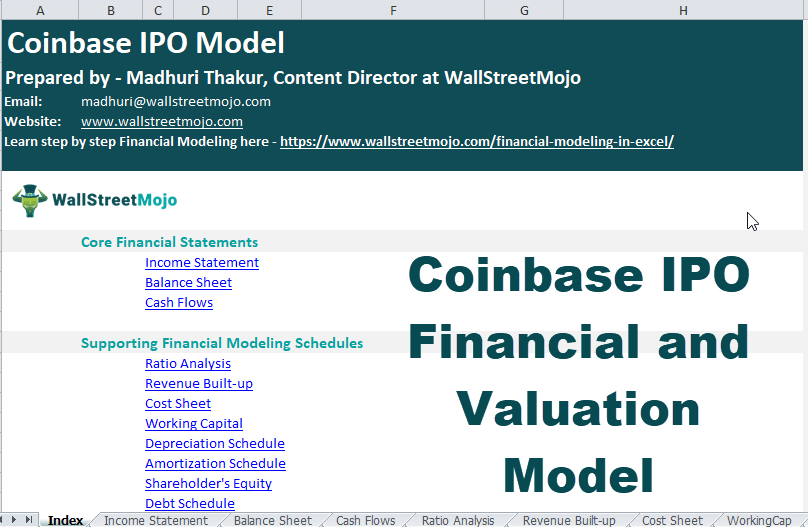

What Does the Coinbase Financial and Valuation Template Include?

- Index page for navigation

- 5-Year projections of Core Statements – Income Statement, Balance Sheet, and Cash Flows

- Essential Schedules: Revenue and Cost sheet, Working Capital, Shareholder’s Equity, etc.

- Detailed depreciation and amortization schedule

- Debt schedule to analyze Financial Feasibility

- Detailed options value calculations

- Discounted Cash Flow Analysis involving Coinbase IPO price prediction

- Relative Valuation

All of these concepts are explored in greater depth in our flagship Financial Modeling Courses.

Coinbase IPO Performance

Nasdaq had declared Coinbase's pre-emptive reference IPO price at $250 per share. The excitement of cryptocurrency and stock trading enthusiasts soon took over. While Coinbase's stock opened at a commendable value of $381 on its trading debut, its share price soon touched $429.54. However, the closing value slumped to $328 on the first day. Thus, Coinbase secured an approximate valuation of $85 billion after the IPO.

Coinbase Inc is a licensed American cryptocurrency exchange platform, functional throughout the US, excluding Hawaii. It is one of the largest platforms in the US for trading digital currency. Designed in a user-friendly way, it also serves as a digital currency wallet. The company was co-founded by Brian Armstrong and Fred Ehrsam in 2012, with the mission to enhance economic freedom worldwide.

It primarily aimed at the accessible and valid exchange of Bitcoins. But today, it is widely used for secured trading of more than 50 different cryptocurrencies, including Litecoin and Ethereum.

The medium is suited for crypto beginners, investors, advanced traders, and businesses. It provides crypto buying, selling, investing, earning, storing, advanced trading, asset listing, accepting payments, and custodial services. It also brings interesting news from the world of digital currencies.

Coinbase makes a profit from the sale and purchase of digital currencies, especially Bitcoin and Ethereum. Its earnings are tied to the ups and downs of Bitcoin prices. Earlier this year, when Bitcoin's value shot up heavily, Coinbase estimated its first-quarter revenue at over $1.8 billion, stunningly overtaking 2020 figures by a huge margin. Many experts have suggested that the fluctuations in Bitcoin price will affect the company's stock price.