Table of Contents

What Is Co-Branded Credit Card?

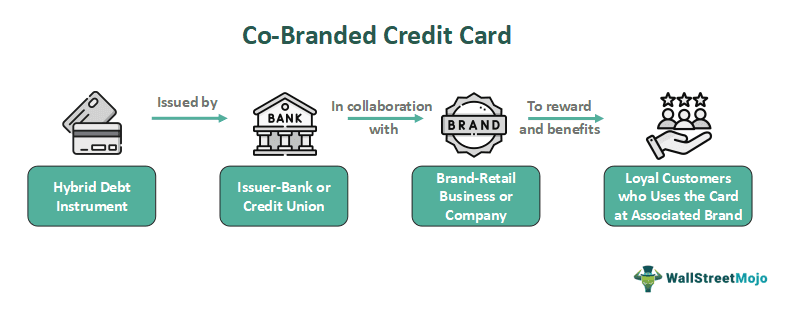

A co-branded credit card is a hybrid debt instrument that is issued by a bank, network, or credit union in alliance with a retailer, brand, or other company. Such a card bears the logos of both sponsors, namely the issuer and the retailer.

The cardholders can easily use this credit card anywhere to access rewards, loyalty points, merchandized discounts, and other benefits when making purchases from its sponsors. It can be used almost everywhere since it is associated with networks such as Visa, Mastercard, Discover, or American Express.

Investors seeking a comprehensive platform may consider Saxo Bank International for a variety of account types and investment options.

Key Takeaways

- A co-branded credit card is a collaborative debt instrument issued by a bank or credit union.

- It's done in association with a particular brand, retail business, or company to provide various purchase advantages and experiences to loyal customers.

- These credit cards are supported by networks like Visa, Discover, and Mastercard and are internationally accepted by merchants.

- It provides multiple loyalty rewards, perks, and merchandise discounts. Customers enjoy these benefits when they use the card to spend on products and services sold by the relevant brand.

How Does Co-Branded Credit Card Work?

Co-branded credit cards are financial products issued in partnership with a bank or credit union and the retail brand or business entity. They facilitate payments through networks like Mastercard and Visa. These cards are issued to loyal customers of a particular brand, offering them special discounts, perks, loyalty rewards, and various other benefits. Cardholders can enjoy these benefits when using the card to purchase goods or services from the relevant brand. Also, they bear the logos of the sponsors, namely the issuer and the brand.

The Hargreaves Lansdown provides access to a range of investment products and services for UK investors.

The primary aim of businesses in launching such credit cards is to tap potential customers in a target market segment and enhance customer lifetime value (CLV). Customers are incentivized through loyalty points, cashback, and rewards when spending money on the partnering brand. Also, they can redeem these loyalty points on their subsequent purchases, ensuring long-term loyalty. Moreover, these cards serve as a marketing and promotional technique for both the sponsors. Furthermore, businesses associated with launching a co-branded credit card often decide to share risk and revenue and other terms of collaboration under a contract to avoid disputes and issues later on.

For efficient cross-border payments, many individuals and businesses use the Wise Money Transfer UK or Wise Money Transfer US services for transparent and low-cost transfers.

How To Get?

Retailers and business organizations often offer some of the best co-branded credit cards to their loyal customers. However, it is much easier to get this card than a regular credit card. The essential requirements for getting one are stated below:

- The applicant must have a good and stable credit history.

- The applicant's credit score should be higher than 690.

- The person should be a resident of the particular nation at the time of application.

- The individual should be self-employed or salaried.

- The applicant should be between 18 years to 65 years old.

The applicant can apply for such a credit card at the respective bank's website or through an authorized financial service provider. The primary documents required for a co-branded credit card application include:

- Legal name in full

- Birth date

- E-mail address

- Individual Tax Identification Number (ITIN) or Social Security number (SSN)

- Income details and proof

- Employment status

- Previous loan or debt information

- Approval to draw the credit history

Where To Use?

Customers often explore a variety of options when considering the list of co-branded credit cards offered by retailers and business organizations. These are open-loop credit cards and are universally applicable while making purchases with merchants who accept payments through the relevant issuer network. Such cards are tailored to meet the specific requirements and lifestyle patterns of the customers. Therefore, individuals should consider their needs, priorities, passion, and spending before applying for a particular co-branded credit card.

Users should compare the benefits, perks, and rewards against associated costs like annual fees, joining fees, and membership charges. If the savings outweigh the expenses, these cards are worth applying for.

Examples

Let us explore some examples to understand the concept better:

Example #1

Suppose an international retail chain, A2Z Mart, partners with XYZ Bank to launch a co-branded credit card for homemakers. The brand offers 5 loyalty points on each $25 spent at the A2Z Mart. Also, it provides a joining bonus of 100 loyalty points if the customer spends $400 within the first month. Mrs. Morris, who resides in Amsterdam with her elder son and spends six months in New York City with her younger son, holds a bank account at XYZ Bank. She obtained this credit card and occasionally uses it for grocery and home utility shopping, particularly because A2Z Mart has stores in both Amsterdam and New York City.

Example #2

Breeze Airways and Barclays US Consumer Bank have introduced the Breeze Easy Visa Signature credit card, marking the airline's inaugural co-branded card, arriving in under three years since its launch. The card provides up to 10X BreezePoints for Breeze-related purchases. This includes airfare and add-ons, coupled with benefits like complimentary inflight Wi-Fi, priority boarding, and accelerated earnings on daily expenditures.

Notably, the card offers an introductory sign-up bonus of 50,000 BreezePoints after an initial spend of $2,000 within the first 90 days, with an associated annual fee of $89. Additionally, Breeze unveiled its loyalty program, Breezy Rewards, offering members opportunities to earn BreezePoints and enjoy perks such as fee-free changes or cancellations. The airline also introduced a new fare-only choice, the No Flex Fare, alongside enhanced bundle options.

Pros And Cons

Let us explore various advantages and disadvantages of such cards:

| Pros | Cons |

|---|---|

| Such credit cards are widely accepted across the globe since they are international cards. | Although not expensive, but some of the high-end co-branded credit cards may require the customers to pay membership fees. |

| The sponsor brands provide loyalty points, rewards, and benefits to the loyal customers, making it worth having a financial instrument. | Customers may end up shopping excessively with such cards in the greed for rewards, loyalty points, and other benefits. |

| It facilitates the users' ability to make transactions without any currency conversion while traveling abroad. | Since many of these cards offer discounts and offers when buying from a particular brand, customers may lose better deals with other brands. |

Want a smarter way to bank on the go? Revolut offers a user-friendly app with global access, crypto and stock trading, and innovative budgeting tools—all in one powerful platform.

Disclosure: This article contains affiliate links. If you sign up through these links, we may earn a small commission at no extra cost to you.