Table of Contents

What Is A Club Deal?

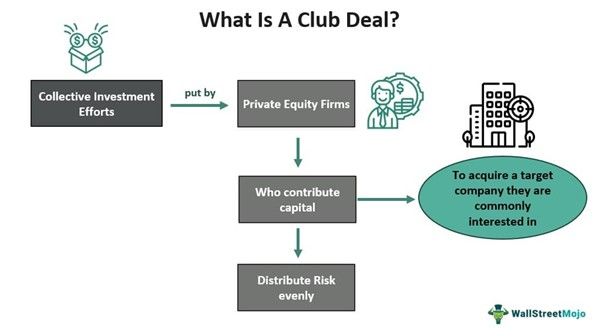

A club deal refers to a collective investment effort of private equity groups contributing capital towards the acquisition of a target company. It is opted for when the planned acquisition is beyond the buying capacity of any single party. With the help of this provision, private equity firms can distribute risks evenly between themselves and carry out high-valued acquisitions, usually meant for bigger strategic acquirers.

Moreover, a club deal in finance also reduces the risk of capital exposure of the individual participants. In some cases, it is categorized as a syndicate loan approved by a consortium of lenders to carry out transactions related to mergers & acquisitions (M&A). The club deals mostly happen for transactions beyond a hundred million dollars.

Key Takeaways

- A club deal is defined as a transaction in which private equity organizations work together to invest money to purchase a target company that is beyond the financial reach of any one party.

- This helps private equity firms compete for high-value transactions, often intended for larger strategic acquirers, by dividing the risks equally among the partners.

- Club Members band together to raise funds to compete in offers to purchase costly enterprises, distributing the risk of significant capital expenditures among club members.

- Here, familiarity between members allows the closure of a deal easily within a month, whereas, in syndication, the unfamiliarity of members results in deals usually taking five days and a lot of effort.

Club Deal Explained

A club deal is a type of transaction recorded when a group of private equity firms come together to invest to buy a costly company by clubbing capital for the transaction. These deals mark buyouts of huge private companies by a group of firms, given their inability to carry out a single-handed acquisition. It gives the seller premium value for its company but adds to negotiation complexities in dealing with multiple parties.

There are instances when a borrower seeks too huge a loan from its bank to finance a merger & acquisition, which is beyond the capacity of the bank. In such a scenario, the member banks underwrite the total consortium loan at the start of the transaction, having no intention of gradually reducing their final hold. Every member becomes an arranger for the deal, and all underwrite the club deal loan in their books.

Sometimes, the participants of the clubbed deal have a specific role in the acquisition transaction. While one handles the deal from start to end, the other ensures the successful closure of the deal. However, when private equity funds get involved in such deals, they mainly focus on certain features of the target firm so as to ensure greater profitability.

Most of the time, sellers prefer club deals as they are rapidly executed and have greater certainty. On the whole, these deals involve selecting the best private equity partner with the necessary expertise, experience, and industry contacts that can maximize the deal’s value in the long run.

Reasons To Form Club Deal

A club deal serves multiple purposes, which include the following:

- Coming together to collect capital, in the form of pooled assets, for competing in bids to acquire costly firms

- To distribute the required capital expenditure responsibilities among participants equally

- Mitigate the individual risk of exposure to huge debt.

- Sharing of industrial and technological expertise amongst each other

Examples

Let us use a few scenarios to understand the club deal definition better:

Example #1

Let’s say two private equity companies, A & B, seek to acquire another firm at $8 billion. However, they do not have sufficient funds to carry out the acquisition single-handedly. As a result, they decide to contribute equally, pool their assets, and involve their capital in financing the acquisition. In the process, they apply to their relationship bank for debt financing of $4 billion each. After they receive the debt finance from the bank, they collectively put the capital of $8 billion into purchasing the target company.

Example #2

In 2021, Forbes published an article that indicated how the number of club deals was over 40% in 2004, but they began deteriorating, accounting for 20% in 2018. The same article talked about the possibility of increasing the number of club deals in the future. However, a set of PitchBook data in 2023 emphasized the changing preferences of the private credit firms, which find it difficult to mutually agree to the terms of the club deals, given the associated uncertainties.

The above scenario indicates how the preferences of the participating lenders and creditors also influence how effectively the deals are carried out.