Table of Contents

What Is A Closing Disclosure?

A Closing Disclosure is a legal document the bank or mortgage lender provides to the borrower. It is a five-page document mentioning all the information related to the mortgage loan, including the loan terms, lending details, mortgage rules, interest rate, loan amount, and monthly payments, specifying all the additional charges, closing costs and fees. The document helps loan seekers to be aware of all aspects of the mortgage loan before they enter into the deal.

It is an essential document for a borrower planning to buy a new home or refinance their current loan. The document allows them to go through every small detail and understand the loan terms and conditions thoroughly before signing. Once signed, the borrower is committed to the conditions presented in the document. A mortgage lender or bank must give the borrower a closing disclosure.

Key Takeaways

- Closing disclosure is a five-page document carrying all the details of the mortgage loan terms and conditions offered to the borrower to review before signing the deal.

- The main components of this document are loan terms, closing costs, project payments, loan calculations, transaction summary, cash-to-close table, contact information and confirmed receipts.

- The 3-day rule suggests that the borrower must receive the closing disclosure three days prior for borrowers to review, understand, and underline any changes.

- The borrower must practice patience, ensure good paperwork, and read and review all the clauses, terms and conditions before signing these closing disclosures.

Closing Disclosure Explained

Closing disclosure in the mortgage is a legal document shared by the bank or mortgage lender for the borrowers to review all the details, including financial figures, legal clauses, and terms and conditions associated with the loan and identify the discrepancies with the original loan document if shared any. It is a five-page document, usually providing three days for borrowers to go through the terms and conditions before signing the loan deal. These three days are considered the waiting period during which the borrowers themselves, or with the assistance of a lawyer or loan officer, can go through every minute detail and check on terms and financial figures to understand and confirm the loan conditions. Only after the borrower signs and accepts the closing disclosure, the loan closing is initiated on the specified date.

This document is highly confidential and sensitive for both parties; it cannot contain typos, mistakes or general errors. The document is shared to ensure that the borrower has read and understood all the terms and conditions of the loan and is signing to accept it. On the contrary, from the borrower’s perspective, this document serves as the last chance to review, check and verify all the details associated with the loan and clearly mentioned in the closing disclosure. If there is an error, they can report it to the lending party. It is essential because once signed, it simply means that the borrower has agreed to all the clauses, permitting it to be final.

Many traders use Saxo Bank International to research and invest in stocks across different markets. Its features like SAXO Stocks offer access to a wide range of global equities for investors.

Components

The main components of closing disclosure are -

- Loan terms - These are basic loan information, such as interest rate, loan amount, and important dates, including details of balloon payment and prepayment penalty.

- Closing costs - This mentions the closing costs associated with the loan agreement. In general, it is 2% to 5% of the loan amount. Borrower must incur these costs.

- Loan costs - This part breaks down the loan costs. It minutely explains different fees that sum up the loan costs, such as origination fees, application fees, underwriting fees and other loan-related expenses made to involve third parties. It also includes pest inspection fees, credit report charges, appraisal, and title insurance costs.

- Projected payments - This section unravels the monthly payment breakdown to the borrower's estimate on escrow payments, property taxes, mortgage insurance, and homeowners’ insurance.

- Additional costs - A loan agreement comes with many miscellaneous costs, which must be included in the disclosure. These costs include home warranty fees, recording fees, insurance premiums, inspection fees, prorated property taxes, etc.

- Cash to close table - This is mentioned on the top of the third page. A brief table determining how the cash-to-close fees were calculated. The borrower can check this to understand if any costs were changed from the loan estimations and if any concessions were made.

- Transaction summary - A simple summary offering information on all the transactions between the buyer and seller.

- Loan calculations - There is another table with a detailed description of how much the borrower will pay over the loan life. This table highlights the amount financed, interest percentage, annual percentage rate (APR) and other expenses.

- Loan disclosures - For a borrower, any boxes checked off in the loan disclosure will apply to the loan. All these checkboxes must be checked and verified in the review.

- Other disclosures - Loan processing is a time-consuming and tiring process. There are always some minor disclosures that a borrower will come across, but they should check all of these. It generally includes details of appraisal and consequences of not paying the loan on time, foreclosure and state laws.

- Contact information - Basic information of contact and address of the lenders, brokers and settlement agents involved in the mortgage loan process.

- Confirmation receipt - This is the final page of the closing disclosure, where the required signatures are listed for both parties. The borrower signs here on the closing disclosure’s finalized form.

Closing Disclosure 3-Day Rule

The three-day closing disclosure rule states that any bank, financial institution or mortgage lender sanctioning the loan must produce this disclosure in front of the borrower at least three days before closing. This 3-day rule came into effect in 2015 and is also formally referred to as the know before you owe mortgage rule or the TILA-RESPA integrated disclosure rule, combining the Truth in Lending Act (TILA) and the Real Estate Settlement Procedures Act (RESPA).

The three-day time span allows the borrower to review the document, go through every small piece of information, terms and conditions, check all the numbers and figures mentioned in the disclosure document, speak with and consult a financial advisor, housing counselor or lawyer if required, and completely understand and align with the details.

Any borrower who has the following inaccuracies they are entitled to a new three-day review period -

- If the APR increases more than one-eighth of fixed-rate loans or one-fourth of adjustable-rate loans.

- In case the bank or lending institution added the prepayment penalty clause.

- More importantly, if the loan terms are observably changed.

The borrower will not get a new three-day review period for small typos and common mistakes in the document, but they can ask to update the disclosure document.

Examples

Let us check the following instances to understand the closing disclosure definition better:

Example #1

Suppose Scarlet, a home seeker, applies for a mortgage loan to buy her dream house. She undergoes all verification and documentation processes at the initial stage. She discusses with her friend about how the process had been for her. That’s when her friend asks her if she has received the closing disclosure yet from the lenders. Scarlet gets confused as she did not receive anything after the initial statement that the lender provided.

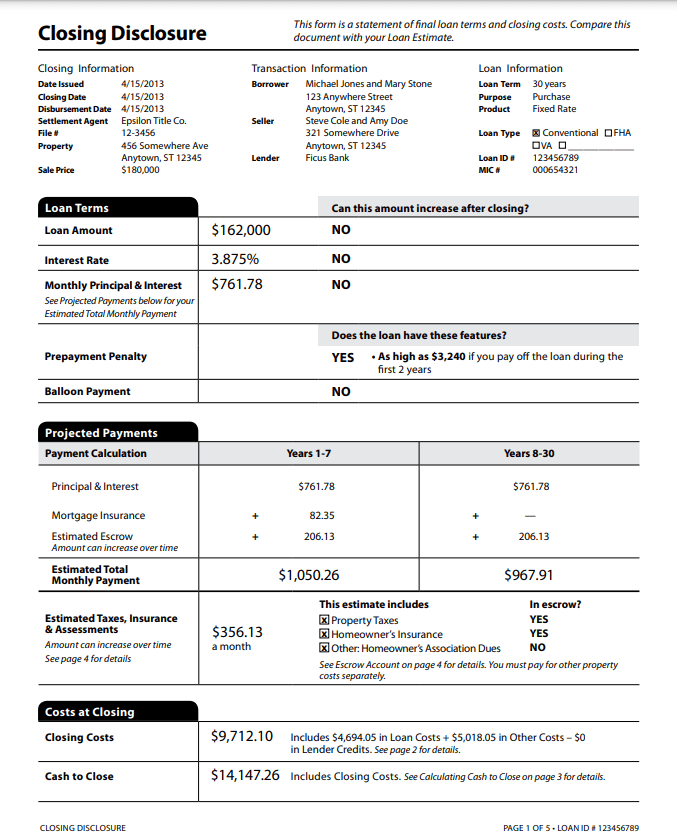

She conducts the research on the Internet and comes across a template to check what this disclosure statement looks like. Here is the closing disclosure sample she comes across:

Looking at the template, Scarlet realizes how easy it would be for her to go through the details properly if she received this document from the lenders. She immediately called the mortgage lender to discuss the issue and learned that the document was being prepared.

In a week, she received the document, and in three days, she checked all details and signed the papers.

Example #2

An October 2024 report discussed how simplifying and standardizing closing cost descriptions in the closing disclosure can make things easier for borrowers. The report cited a July survey whereby lenders were asked to give their opinions on simplifying the cost descriptions to maintain better transparency with the borrowers. Around 81% of lenders stated how increased transparency would make the process smoother, reducing compliance costs and giving consumers the opportunity to compare options before signing a mortgage loan deal.

Initial vs Final Closing Disclosure

The main difference between initial and final closing disclosures are as follows:

- The initial closing disclosure is offered to the borrower first, whereas the final one is provided at the end.

- The initial disclosure contains an estimation of costs and charges but not the exact figures. In comparison, the final one has the final figures and loan terms.

- Initial disclosure is offered three days before the closing for review purposes. In contrast, the final one is issued closer to the final closing date, underlying any changes made in the document.

- Only after the initial closing disclosure is e-signed by the borrower will they receive the final one.

Closing Disclosure vs Settlement Statement vs Loan Estimate

The differences between closing disclosures, settlement statements and loan estimates are -

- Closing disclosure itemizes all the mortgage details, financial and legal, in a detailed format, but settlement statements only focus on how the money will be exchanged with other transactions. On the contrary, a loan estimate is the expected amount a borrower is entitled to receive upon a mortgage application request.

- Settlement statement is a term used in any loan one applies for and takes up. In contrast, when used in the context of a mortgage loan, the same statement becomes a closing disclosure, which is a final set of terms and conditions for borrowers to agree upon before closing the loan deal with the lenders. A loan estimate, on the other hand, is shared in the initial stage for loan seekers to know the amount they would receive if they apply for it.

- Closing disclosure is prepared by the lender and sent to the borrower a minimum of three days prior to the closing date. In contrast, a settlement statement is created by either an attorney or escrow officer and shared with the borrower very close to the last date. On the other hand, a loan estimate marks the starting process of the loan and is shared with the applicant by the bank when they apply or enquire about the loan.

Disclosure: This article contains affiliate links. If you sign up through these links, we may earn a small commission at no extra cost to you.