Table Of Contents

What Is The Clientele Effect?

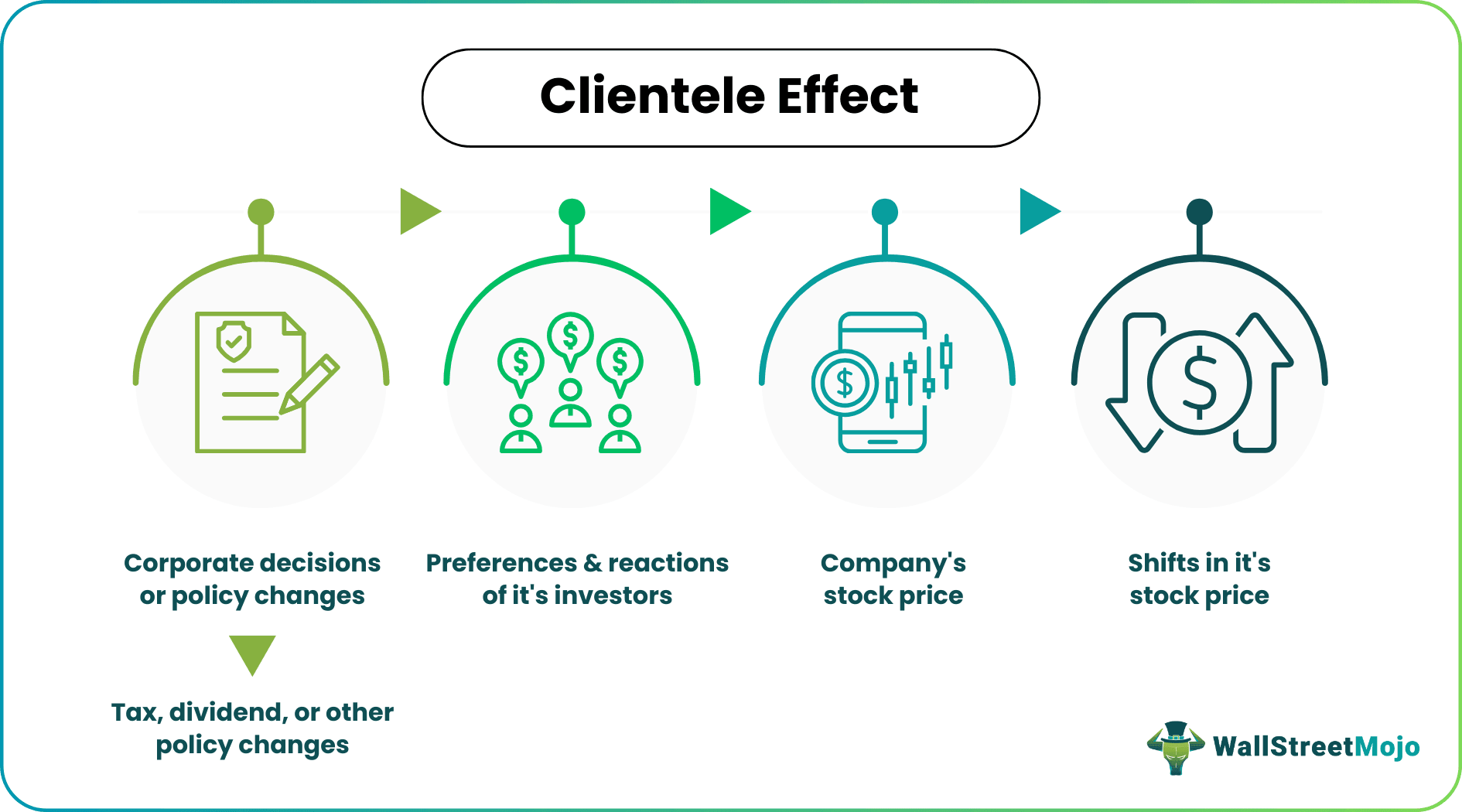

The clientele effect is a financial theory that suggests that changes in a company's dividend policy or capital structure can result in shifts within its shareholder base. Essentially, different groups of investors are drawn to companies with specific financial policies.

Alterations in a company's financial policies, driven by the clientele effect, can lead to fluctuations in demand for its stock. This, in turn, can introduce volatility into the stock's price, as various investor types buy or sell shares in response to policy adjustments. Investors often aim for a diverse portfolio by selecting stocks with different financial policies to align with their income and risk preferences.

Key Takeaways

- The clientele effect in finance and economics is where a company's financial policies, such as dividend payments or capital structure decisions, attract and retain a specific group or "clientele" of investors.

- Companies can maintain a stable and loyal shareholder base by catering to the preferences of their investors. For example, consistent dividend payments can attract income-oriented investors who seek dependable income streams.

- Shifts in the shareholder base can result in stock price movements. If a company's policies change in a way that disappoints existing shareholders, it can lead to share price declines and vice versa.

How Does Clientele Effect Work?

The clientele effect revolves around how changes in a company's policies or circumstances can influence investor interest and, consequently, its stock price. When a company implements significant policy changes, such as altering dividend payments or capital structure, it can attract or deter specific investor groups.

For instance, reducing dividend payments might discourage income-oriented investors who were initially attracted to the stock for its dependable income. Consequently, these investors may opt to sell their shares, potentially leading to a stock price decline.

Various stocks, including blue-chip, dividend-paying, high-growth, and mature stocks, have distinct lifecycles and investor expectations. For instance, high-growth stocks are expected to appreciate as the company expands, while dividend-paying stocks offer consistent income. If a company's policy changes contradict these expectations, it can disrupt investor sentiment and affect stock prices accordingly.

Companies that establish a consistent pattern of policies tend to attract a specific group of investors. A significant deviation from this pattern can introduce uncertainty, prompting shareholders to reassess their investments, possibly resulting in stock price fluctuations. The existence and impact of the clientele effect can be a subject of debate. Some argue that it is not the sole factor influencing stock prices, as other market dynamics also come into play. Additionally, transitioning to companies that better align with an investor's preferences may involve costs such as transaction fees and taxes, making it a less straightforward process.

Examples

Let us look at the clientele effect examples to understand the concept better:

Example #1

Imagine a well-established company known for its stable dividend payments. Income-seeking investors have been loyal shareholders for years, attracted by the dependable income stream. However, the company decided to shift its strategy and reinvest profits for growth, reducing its dividend payments significantly. This policy change could trigger the clientele effect, causing income-oriented investors to sell their shares in search of more reliable income stocks, leading to a decline in the company's stock price.

Conversely, it might attract growth-oriented investors who believe in the company's growth potential. This hypothetical scenario illustrates how a change in corporate policy can influence the composition of a company's investor base and impact its stock price.

Example #2

Consider a technology company that has built a solid investor base of growth-focused shareholders due to its consistent focus on innovation and expansion. However, in response to economic challenges, the company shifted its strategy to prioritize debt reduction over aggressive growth, resulting in lower-risk financial policies.

This change in approach may lead some growth-oriented investors to sell their shares in search of companies with higher growth potential while simultaneously attracting risk-averse investors who appreciate the company's newfound stability. In this scenario, the clientele effect manifests itself through a shift in the company's investor composition, impacting its stock price based on the preferences of its shareholders.

Benefits

The clientele effect can offer advantages to both companies and investors in specific scenarios:

- Attracting the Right Investors: Companies can leverage the clientele effect to align their financial policies with the preferences of specific investor groups. For instance, maintaining a consistent dividend policy can attract income-oriented investors, creating a stable shareholder base.

- Reduced Financing Costs: Raising capital may be easier and more cost-effective when a company's policies align with investor preferences. Investors who share the company's strategy are more likely to invest.

- Share Price Stability: A well-matched shareholder base contributes to share price stability, benefiting long-term investors who seek to avoid extreme price volatility.

- Risk Management: Attracting investors who align with the company's risk profile and strategy can potentially mitigate the risk of sudden shifts in the shareholder base due to policy changes.

- Investor Satisfaction: Investors attracted to a company based on its policies are more likely to be content with their investments. This fosters increased loyalty and support for the company's strategic decisions.

How To Avoid?

To minimize the potential downsides of the clientele effect, companies can employ various strategies:

- Actively target a mix of investors with diverse preferences, including income-oriented, growth-focused, and value investors, to reduce the risk of rapid shifts in response to policy changes.

- Clear and open communication about financial policies and strategies helps investors understand the rationale behind decisions and minimizes surprises.

- Avoid becoming too one-dimensional by balancing dividend payouts with reinvestment in growth opportunities.

- Maintain flexibility in policies to adapt to evolving market conditions.

- Conduct regular reviews of financial policies to ensure alignment with long-term strategic goals.

- Actively engage with a diverse range of investors through investor relations efforts to diversify the shareholder base.

- Employ risk management measures and seek professional advice to navigate and mitigate the challenges the clientele effect poses effectively.