Table of Contents

What Are The Classifications Of Accounts?

Classification of accounts is the categorization of different types of accounts. A financial account is used to record business transactions, and it serves as a formal record of a firm, individual, or any entity's cash flow and expenses. Without an account, no accounting would be possible, and no maintenance of transactions would ever be created.

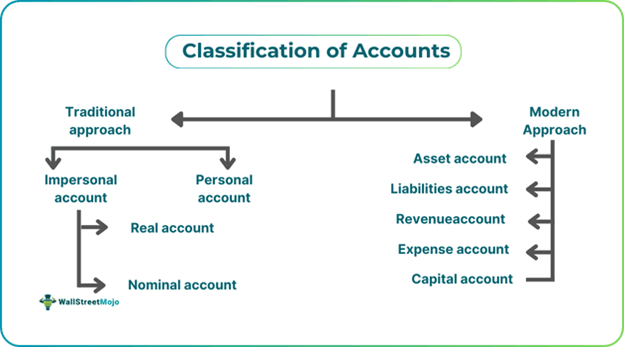

The classification of accounts is done by dividing them into two types or approaches. The traditional approach and the modern approach. More subtype accounts are further distributed under these approaches. These two approaches are accepted and applied worldwide by nations. However, the use of the traditional approach is rare.

Key Takeaways

- The classification of accounts is the division of different types of accounts based on different approaches.

- The two classifications of account approaches are modern and traditional. The former is the American approach, whereas the latter is the British approach.

- In the traditional approach, there are two types of accounts: personal and impersonal, the latter of which is subdivided into real and nominal accounts.

- In the modern approach, there are five types of accounts: capital, revenue, expense, asset, and liabilities.

Classification Of Accounts Explained

Classification of accounts is the bifurcation of different types of accounts that are used by businesses, firms, banks, and financial institutions to maintain transaction records and use them to create balance sheets, profit and loss statements, and ledgers. There are two main approaches to this classification. The first is the traditional approach, also known as the British method, which is rarely used today. The second approach is the modern approach introduced by Americans; this has become a global standard for classifying accounts because of its simple nature and easy understanding. Accounts, accounting, and classification of accounts go hand in hand and are interlinked to each other when it comes to recording, maintaining, and tallying financial data and information.

In accounting, the rules apply to all types of accounts based on their type, and it is the main reason why different classifications of accounts are done to record transactions accurately. The classification allows an accountant or owner to create a separate account for each type of transaction. The two approaches are based on the rule of credit and debit. Without classifying accounts, the whole accounting process can become extremely complicated, and it will also require a lot of time and effort to make it sensible and insightful for anyone interested in studying company financials. At the same time, with the classification of accounts, the owner or accountant has the choice to choose between two different approaches, whichever seems suitable to them.

The Hargreaves Lansdown provides access to a range of investment products and services for UK investors.

Types

There are two distinct approaches to the classification of accounts:

#1 - Modern (American) Approach

In today's accounting practices, the modern or American approach has become a worldwide standard for classifying accounts, and so is adopted by many nations. Under this approach, there are accounts are grouped into five types:

- Asset accounts - These include machinery accounts, accounts receivable accounts, and others such as prepaid rent, land, and cash accounts.

- Liability accounts—This group includes loan accounts, rent accounts, wages and salaries payable accounts, and accounts payable accounts.

- Revenue accounts - This group includes all types of revenue accounts, such as service, rent, and interest revenue accounts alongside sales accounts.

- Expense accounts - As the name implies, this group of accounts only includes all types of expense accounts such as wage, commission, salary, and rent expense accounts.

- Capital accounts - This is simply the owner's account.

#2 - Traditional (British) Approach

The accounts are divided into two groups using the traditional method: personal and impersonal accounts. A personal account is used to record transactions linked to an individual, company, or firm, but impersonal accounts are not associated with any individual. The personal account does not have any sub-sections, but the impersonal accounts are further classified into two types:

- Real account—These accounts, often referred to as permanent accounts, continue to exist beyond the close of an accounting period, maintaining their balances into the next cycle. They are carried forward with a non-zero balance linked to the last accounting period. Some examples of such accounts include furniture accounts, land accounts, machinery accounts, and cash accounts. They are also called balance sheet accounts because they are mentioned in a business's balance sheet.

- Nominal account - The other type of account in impersonal accounts is a nominal account, also known as a temporary account. These are opposite to real accounts as they end with the accounting period and start for the next accounting period with zero balance. These accounts typically cover gains and losses, as well as income and expenses. Nominal accounts help gather income and expense data, which is further used to prepare profit and loss accounts and income statements. This is the reason they are often called income statement accounts.

Examples

Below are two examples to understand the concept better:

Example #1

Suppose Howard opened a new restaurant. There were many expenses, and Howard wanted to streamline them. He never had any experience in accounting, but upon research, he learned that with the modern approach to the classification of accounts, he could have an expense account for every accounting period. Howard starts maintaining a temporary expense account in which he writes every expense, from salaries to rent, utilities, bills, raw material expenses, and all the other day-to-day costs that go into running his restaurant.

At the end of the current accounting period, he tallies the expenses and creates a new expense account for the next accounting period. Expense accounts are mentioned in the income statement. This way, Howard smartly manages and monitors his restaurant expenses.

Example #2

An article published on June 6, 2024, discusses key updates to U.S. accounting standards for 2024, with a focus on areas that impact the classification of accounts. It covers modifications to lease accounting, supplier finance program disclosures, and revenue recognition. Additionally noted are modifications for the shift from LIBOR to other reference rates and new rules for reporting convertible instruments. In order to provide a more accurate and uniform financial statement presentation, these adjustments seek to improve financial reporting transparency and make account classifications easier to understand.

Disclosure: This article contains affiliate links. If you sign up through these links, we may earn a small commission at no extra cost to you.