Table Of Contents

What Are The Classification Of Financial Markets?

The financial market is a marketplace where the creation and trading of financial assets, including shares, bonds, debentures, commodities, etc., is held. Financial markets are intermediaries between fund seekers (generally businesses, government, etc.) and fund providers (typically investors, households, etc.).

It mobilizes funds between them, helping allocate the country's limited resources. Thus, they are a meeting point for both the buyers and sellers where they can purchase and sell financial assets. This helps in proper capital allocation, mobilization of resources, and price discovery.

Key Takeaways

- The financial market is where the financial assets are made and traded. It includes shares, bonds, debentures, commodities, etc. It is an intermediary between fund seekers and fund providers. Moreover, it organizes funds and helps to assign the country's limited resources.

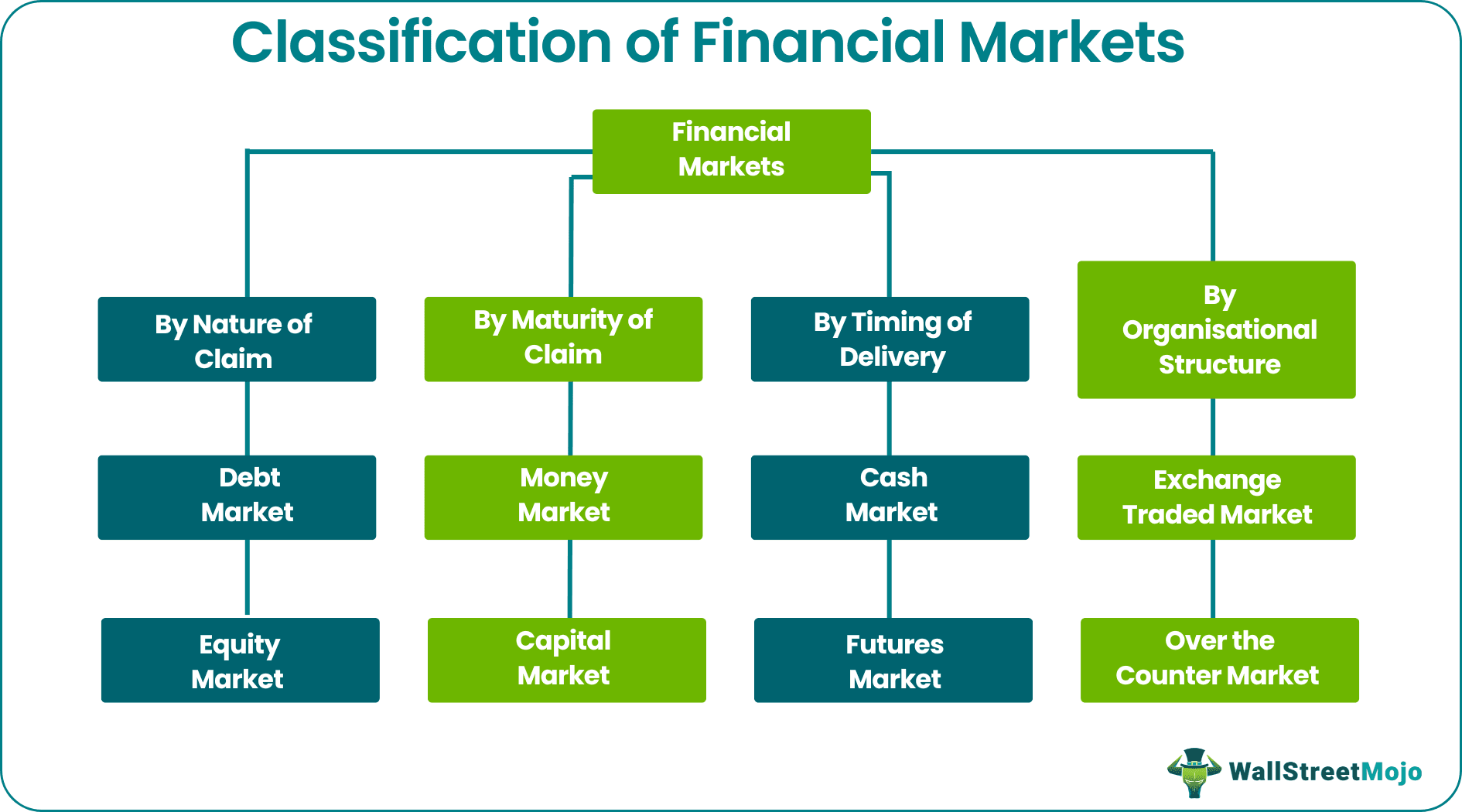

- The financial markets are classified into four categories: By Nature of Claim, By Maturity of Claim, By the Timing of Delivery, and By Organizational Structure.

- Financial markets provide fair pricing and soaring liquidity, protecting investors from fraud and malpractices.

Classification Of Financial Markets Explained

The financial market is a platform or an arrangement in which various types of financial instruments are bought and sold among market participants. These instruments may be bonds, commodities, stocks, derivatives, currencies, etc. The buyers and sellers meet in these platforms to exchange the assets. They form an important part of the financial market and help the participants achieve investment objectives, assess the risk tolerance and develop an outlook towards the market.

The classification of international financial markets can be of four categories: -

- By Nature of Claim

- By Maturity of Claim

- By the Timing of Delivery

- By Organizational Structure

However, these markets are very well regulated by the regulatory bodies and the government of the country. This ensures a transparent and fair-trading practice in the system, proper investor protection and maintenance of market integrity. The entire global financial system operate through these markets, which guides the individuals, corporates as well as economies to manage risk, create profitable investment opportunities and facilitate capital allocation.

Many traders use Saxo Bank International to research and invest in stocks across different markets. Its features like SAXO Stocks offer access to a wide range of global equities for investors.

Types

Let us discuss classification of international financial markets in detail –

#1 - By Nature of Claim

Markets are categorized by the type of claim the investors have on the entity's assets in which they have made the investments. There are broadly two kinds of claims, i.e., fixed and residual. Based on the nature of the claim, there are two kinds of markets, viz.

Debt Market

A debt market is when debt instruments such as debentures, bonds, etc., are traded between investors. Such instruments have fixed claims, i.e., their share in the entity's assets is restricted to a certain amount. In addition, these instruments generally carry a coupon rate, commonly known as interest, which remains fixed over some time.

Equity Market

In this market, equity instruments are traded. As the name suggests, equity refers to the owner's capital in the business. It thus has a residual claim, implying that whatever is left in the industry after paying off the fixed liabilities belongs to the equity shareholders, irrespective of the face value of their shares.

#2 - By Maturity of Claim

While investing, time plays an important role as the amount of investment depends on the time horizon of the acquisition. The time also affects the risk profile of an investment. An investment with a lower time carries a lower risk than an investment with a higher period.

There are two types of market-based on the maturity of claim: -

Money Market

The Money market is for short-term funds, where the investors who intend to invest for not longer than a year enter into a transaction. This market deals with monetary assets such as treasury bills, commercial paper, and certificates of deposits. The maturity period for all these instruments does not exceed a year.

Since these instruments have a low maturity period, they carry a lower risk and a reasonable rate of return for the investors, generally in interest.

Capital Market

The capital market is when instruments with medium- and long-term maturity are traded. It is the market where the maximum interchange of money happens. It helps companies access money through equity capital, preference share capital, etc. It also provides investors access to invest in the company's equity share capital and be a party to the profits earned by the company.

This market has two verticals:

- Primary Market - Primary market refers to the market where the company lists security for the first time or the already listed company issues fresh security. It involves the company and the shareholders transacting with each other. In addition, the company receives the amount paid by shareholders for the primary issue. For the primary market, there are two major types of products, viz. Initial Public Offer (IPO) or Further Public Offer (FPO).

- Secondary Market - Once a company gets the security listed, the deposit becomes available to be traded over the exchange between the investors. The market that facilitates such trading is the secondary market or the stock market.

In other words, it is an organized market where securities trading occurs between investors. Investors could be individuals, merchant bankers, etc. Transactions of the secondary market do not impact the company's cash flow position; as such, the receipts or payments for such exchanges are settled amongst investors without the company being involved.

#3 - By Timing of Delivery

In addition to the above-discussed factors, such as time horizon, nature of the claim, etc., another factor has distinguished the markets into two parts, i.e., timing of delivery of the security. This concept generally prevails in the secondary market or stock market. Depending on the timing of delivery, there are two types of markets:

Cash Market

In this market, transactions are settled in real-time. Therefore, it requires the total amount of investment to be paid by the investors, either through their funds or borrowed capital, generally known as margin, which is allowed on the present holdings in the account.

Futures Market

In this market, the settlement or delivery of security or commodity occurs later. Therefore, transactions in such markets are generally cash-settled instead of settled delivery. For trading in the futures market. Rather, a margin going up to a certain percentage of the asset amount is sufficient to trade in the asset.

#4 - By Organizational Structure

Markets are also categorized based on the market structure, i.e., how transactions are conducted. There are two types of the markets, based on organizational structure: -

Exchange-Traded Market

An exchange-traded market is a centralized market that works on pre-established and standardized procedures. In this market, the buyer and seller do not know each other. Transactions are entered with the help of intermediaries, who are required to ensure the settlement of the transactions between buyers and sellers. There are standard products that are traded in such a market. Therefore, they cannot need specific or customized products.

Over-the-Counter Market

This decentralized market allows customers to trade customized products based on their requirements.

In these cases, buyers and sellers interact with each other. Generally, over-the-counter market transactions involve hedging foreign currency exposure, exposure to commodities, etc. These transactions occur over-the-counter as different companies have different maturity dates for debt, which generally does not coincide with the settlement dates of exchange-traded contracts.

Over time, financial markets have gained importance in fulfilling the capital requirements for companies and providing investment avenues to the investors in the country. Financial markets offer transparent pricing, high liquidity, and investor protection from frauds and malpractices.

Examples

Let us understand the concept with the help of some suitable examples.

Example #1

Let us assume the Jack is an investor who wants to invest funds now in such a way that after 20 years, the fund multiplies enough to meet the educational requirements of his daughter. He contacts the financial advisor who suggests him to invest in long term bonds, which will provide him with a regular interest payment that can be reinvested to increase the amount further. It is also comparatively less risky that stocks but return is more than certificate of deposits.

Thus, here we see that bonds, which are a type of debt market instrument, is giving Jack the opportunity of good and profitable investment.

Example #2

Let us assume that Mike wants to invest in some shares of ABC Ltd, which is a financially strong company and the shares are in an uptrend. Thus, Mike decides to buy 200 shares of the company at $100 each. After 3 months, the share price reaches $150, giving Mike a gain of $50 per share. This is a capital market instrument, which allow investors to gain from share price fluctuation.

Thus, the above examples show two different types of financial market and how investors can invest in them to meet their financial goals.

Disclosure: This article contains affiliate links. If you sign up through these links, we may earn a small commission at no extra cost to you.

Frequently Asked Questions (FAQs)

The 16 classifications of financial markets are primary market, secondary market, money market, capital market, bond market, stock market, mortgage market, consumer credit market, auction market, negotiation market, organized market, Over-The-Counter market, options market, spot market, foreign exchange market, and futures market.

The market is an arrangement under which buyers and sellers bargain the product price, settle the price, and transact their business. However, the buyers and sellers behave differently in distinct markets and affect product prices. Therefore, needs must be classified depending on numerous factors.

Marshall divided the financial need according to the time element. In economics, 'time' refers to the division of time based on a commodity's supply flexibility for a given change in demand.

The main financial markets are money markets, capital markets, and foreign exchange (FOREX).