Table of Contents

What Is Claims Adjudication?

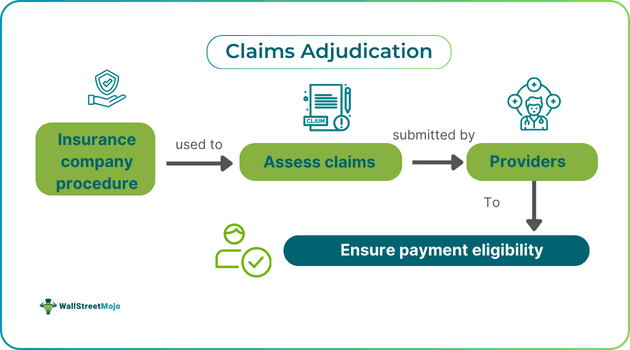

Claims adjudication is the process an insurance company undertakes to review policyholders’ claims to decide whether to approve or reject them and the amount to be paid. This process ensures accurate reimbursement for services provided and manages financial obligations between parties.

Claims adjudication enhances the efficiency of insurance policies and reduces disputes in sectors like healthcare and real estate. It plays a pivotal role in determining responsibility between payer and provider once a claim is submitted. Additionally, it enables timely decisions by insurers, which impact service delivery and cash flow across various sectors.

Key Takeaways

- Claims adjudication is the process by which an insurance company reviews policyholder claims to determine payment eligibility,

- decide on the amount, ensure accurate reimbursement, and assign financial responsibility to the appropriate party.

- The process involves initial processing, automated review, manual review, payment determination, and issuing payment.

- To avoid denied claims, verify eligibility, gather accurate patient information, confirm medical necessity, use specific coding, stay updated on billing,

- understand payer requirements, submit claims on time, leverage technology, and regularly monitor and audit claims.

- The process can be improved by investing in automation, reducing delays, implementing electronic record-keeping,

- using AI for accurate coding, enhancing patient communication, and advocating for standardized industry policies.

Claims Adjudication Explained

Claims adjudication is the procedure through which insurance payers assess claims filed by providers to determine payment eligibility. This process includes verifying claim details against policy terms and reviewing the services for medical necessity. Verification involves multiple steps, such as an initial overview, automated checks for accuracy, human review for complex cases, and, ultimately, a final decision on the claim.

Many claims are straightforward enough to be adjudicated during the automatic review stage. Claims adjudication reduces disputes, ensures timely payments, and positively impacts cash flow for healthcare service providers. It has become essential in sectors requiring precise billing, like healthcare, and can benefit significantly from automation, which reduces errors and increases efficiency.

From a financial perspective, claims adjudication systems streamline the claims process, enhancing operational efficiency and minimizing overhead costs. This benefits both payers and service providers.

Process Steps

The medical claims adjudication process typically follows these steps:

- Initial Processing Review: Checks for errors like incorrect patient names, codes, or dates to prevent rejections using claims adjudication software.

- Automatic Review: Assesses authorizations, eligibility, and duplicate entries based on payment policies.

- Manual Review: A healthcare professional compares medical documentation with claims, especially for unlisted procedures.

- Payment Determination: Evaluate whether the claim should be paid, reduced, or denied based on necessity and accuracy.

- Payment Issuance: Disburses the reimbursed amount to the provider, including details of covered, patient-responsible, and allowable amounts.

Examples

Let us use a few examples to understand the topic.

Example #1

A growing trend in U.S. claims adjudication has made it easier for insureds to bring bad faith claims against insurers, significantly impacting the adjudication process. Recent rulings, like McNamara v. GEICO and Potter v. Progressive, have redefined how excess judgments qualify for bad faith claims by accepting settlements as viable grounds, bypassing the need for a final court judgment. Similarly, New Jersey’s Insurance Fair Conduct Act empowers policyholders to challenge insurers for unreasonable denial of uninsured motorist benefits. Courts in cases like Security Nat. Ins. Co. has expanded adjusters' duties to include a nuanced understanding of legal precedents impacting coverage, demanding insurers proactively stay informed. These shifts emphasize the need for insurers to closely track legal changes, streamline adjudication procedures, and ensure compliance with emerging standards to avoid increasing liability.

Example #2

Claim adjudication is the process through which an insurance company reviews and processes a claim submitted by a healthcare provider. For example, when Sarah visits a doctor for a check-up, the doctor's office submits a claim to her insurance. The insurer first verifies Sarah’s eligibility and checks if the service is covered. It may automatically review the claim; if necessary, a claims adjuster manually reviews any discrepancies. Ultimately, the insurer determines the payment amount based on Sarah's policy and issues payment to the doctor, ensuring a fair and efficient resolution of the claim.

How To Avoid Denied Claims?

To prevent claim denials, follow these guidelines:

- Verify eligibility and insurance to avoid issues with ineligibility or coverage.

- Ensure complete and correct patient information by removing any incorrect or missing data.

- Confirm medical necessity, referrals, and authorizations.

- Code to the highest specificity to avoid errors.

- Stay updated on billing changes, especially those prompted by events like pandemics.

- Understand payer requirements and guidelines.

- Submit claims within filing windows to meet payer deadlines.

- Leverage technology for clean claim filing and automate claims scrubbing.

- Regularly monitor, evaluate, and audit claims to spot trends and reduce denial rates.

- Ensure complete and accurate documentation to support claims and prevent payment disputes.

How To Improve?

- To enhance the claims adjudication process, consider the following steps:

- Invest in automation to reduce human errors and speed up processing.

- Use front-end edits to catch early errors and avoid delays in claim assessments.

- Implement electronic record-keeping to standardize data and reduce transcription errors.

- Use AI for precise coding to reduce denials due to coding inaccuracies.

- Improve patient communication to ensure accurate data submission.

- Advocate for standardized industry policies to simplify claim processing and improve efficiency.