Table Of Contents

What Is Checkbook Register Template?

A checkbook register template is a registered one that can be maintained for business and personal purposes to track incoming and outgoing funds in the bank account through checks while recording essential details like the category of inflow/outflow, check issuing parties, category of cash flow, etc.

It is a written format meant for organizing account balances for both personal and business purposes. It is designed in the form of a checkbook and helps in tracking finances, and provides a good solution for maintaining budgetary practices. This tool is used for recording personal finance and record keeping.

Checkbook Register Template Explained

The checkbook register template is a perfect solution for individuals and businesses, who wish to maintain a proper record of all check related related receipts and payments in a proper, transparent and systematic manner, ensuring a disciplined approach and updated information regarding the same.

A template for checkbook register is considered a very useful step in organizing finances and keeping clear records of the same. It provides assurance regarding the fact that spending is being done as and when needed only and not crossing the threshold of the budget. In other words, this method keeps habits of spending under control and compels the user of the format to keep examining it time and again to detect any unauthorized transactions. taking place.

This form of document, which can also be checkbook register template google sheets, replicates the actual ledger of a check book that helps a business or an individual to understand the account balances after money is received and paid using checks. Inside the template, it is common to find headings like a check number, date, the value of the transaction, it is a debit or a credit transaction, and finally, what is the remaining amount in the account. Thus, we can see that it is a very easy and practical tool that ensures proper care and tracking of finances.

Since the user of template for checkbook register can clearly identify the amount remaining in their account, they can avoid bouncing of checks or any penalty applicable for due to insufficient funds while making payment.

Example

Let us understand the concept and the format of free checkbook register template with the help of a suitable example, as given below:

We assume that Max has a business of buying and selling stationery items and he is a wholeseller of such good. Therefore, his customers are retailers who buy them in bulk and often on credit of a month or two months. Thus, it becomes very important to keep track of all the receipts and payments which are normally done in check, not cash, due to their substantial value.

In such a case, the format of free checkbook register template comes very handy and helps in proper tracking and recording of the transactions. Max uses a format that he has downloaded from a website and find it very user friendly. In his template, the details that he maintains are check number, check date, the type of goods, the name and address of the customer, the quantity of goods sold, payment due date, payment made or not and if yes on which date, penalty for late payment, check is related to which bank and so on.

Since these templates are customizable, he often added some more related columns and rows for more details. Thus, we see that such templates are very useful for individuals or businesses that do not want a costly and complicated process of maintaining financial details and at the same time wants to be transparent and clear in every step.

How It Can Be Used?

The checkbook register template is relatively simple to keep track of incoming and outgoing check transactions. All fields are input except the balance, calculated as previous balance + deposit/credit – withdrawal/payment.

Elements

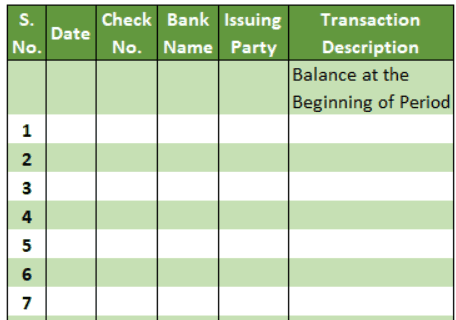

The checkbook register template google sheets or excel consists of the following fields:

#1 - Date

A self-explanatory field where the user will enter the date in the desired format;

#2 - Check No

The user of business checkbook register template must enter the check number for incoming and outgoing checks in this field. A check number is a unique identification of every leaf in a checkbook, and the bank keeps a record of which check numbers are issued to which customers.

Keeping track of the check number is extremely important while maintaining a checkbook register template because, without the unique identity of the check, it will be a little challenging to track the check if it is lost, damaged, or stolen. It is also a structured way to track all the checks in one place.

The user of business checkbook register template must input the check number from checks received or paid out in the field.

#3 - Bank Name

This field is irrelevant when the user puts in details of the checks he has issued from his account. When the user puts in details of checks received, it will populate this field with the name of the bank to which the check belongs. For example, if a third party has issued a check from his account in XYZ Bank while the user has his account in ABC Bank, the user will put XYZ Bank in this column. The user must leave the field blank for outgoing checks.

#4 - Issuing Party

This field is specifically relevant for incoming checks. The user puts in the name of the issuing party of the check and leaves the field blank if he enters the details of outgoing checks.

#5 - Transaction Description

This field is vital as it elaborates on the nature of transactions through checks. For example, your description could be sales, expenses, or any other business or personal income or expense.

One must populate this field in case of both incoming and outgoing checks. The description should be short, precise, and explanatory enough for the user to understand the nature of the transaction that took place using the checks.

#6 - Category

Every cash receipt or payment has a defined category mentioned in this field. The categories can be broad, like sales and expenses, or very specific, like sales from a particular city or expenses relating to specific business activity.

As a business owner, one can define the categories of his business based on the size of the business and the nature of transactions the business undertakes. However, for personal purposes, these categories can also be simple or complex based on the nature and frequency of transactions that one undertakes using checks.

#7 - Withdrawal/Payment

One must populate this column with the amounts of outgoing funds. Therefore, it will mainly be the amount of checks issued by the user.

#8 - Reconciled/Cleared

“Cleared” means that the transaction is settled at the bank. “Reconciled” means the user has verified the account against his records. Next, fill in whether the transaction reconciles or is clear.

#9 - Deposit/Credit

One must fill this space for incoming checks and credit to the user’s bank account.

#10 - Balance

It is the balance at each transaction date. The formula in the field leaves the field blank when there is no input in the withdrawal/payment and deposit/credit fields. It also uses the offset function, which does not let any errors crop up whenever an entire row deletes.

One can calculate the balance as the beginning balance plus incoming check amounts less outgoing check amounts. However, one must note that the template will spit out a negative balance if the outgoing cash is higher than the opening balance and incoming cash combined.

Disadvantages

Following are a few disadvantages of using a checkbook register template:

#1 - Move Towards Digital Mode of Payments and Receipts

As information technology has evolved significantly in the last three decades, checkbook banking is becoming increasingly redundant. Most of the transactions are happening using the online mode and it is extremely easy to access records as everything is electronically stored. One can access years of data with a click, sort it, analyze it, and do many other things that will be challenging in a checkbook template.

#2 - Non Entry for Transactions that Take Place Through Other Modes of Similar Characteristics to Checks

The checkbook template does not consider transactions outside the checkbook route. Although the checkbook spreadsheets give an ending balance, this cannot be considered a final balance. The reconciliation with the bank is always required, as discussed in the earlier point. It will add a host of transactions to this spreadsheet to make sense of the overall banking transactions in a given period.

A checkbook spreadsheet is useful for people or businesses who do almost all their transactions in checks. Or there could be people like retirees who receive checks periodically and need to keep track of their transactions and balances. Those kinds of users will find the template extremely useful.