Table of Contents

What Is A Charitable Remainder Trust?

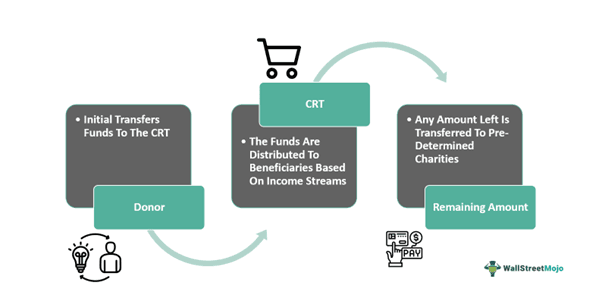

A charitable remainder trust is an irreversible trust in which a donor transfers assets to the trust, and beneficiaries receive income from the trust for a specified period of their lifetime. After this period, the prevailing assets in the trust are forwarded to one or more designated charities, providing both income for beneficiaries and supporting charitable causes.

Charitable remainder trust rates offer immediate tax deductions, provide beneficiaries with income for life or a specified period, and support charitable causes. However, assets in the trust are irrevocably transferred, limiting control over them. Moreover, beneficiaries may face tax consequences upon receiving distributions. Additionally, administrative costs and technicalities associated with managing the trust can be significant.

Key Takeaways

- A charitable remainder trust is an unalterable trust that provides income to beneficiaries for a specified period of their lifetime. Upon termination, the remaining assets are distributed to charitable organizations.

- CRTs offer immediate tax deductions for the grantor upon funding the trust. CRTs allow tax-free growth of trust assets and avoidance of capital gains taxes on asset sales.

- Payments are disbursed to beneficiaries based on the trust agreement, typically annual, biannual, or quarterly payments.

- It provides financial support for beneficiaries while supporting charitable causes and potentially reducing estate tax liability for the grantor.

How Does A Charitable Remainder Trust Work?

A charitable remainder trust (CRT) operates by allowing an individual, known as the grantor, to transfer assets, like cash, real estate, or other securities, into an irrevocable trust. The grantor then selects one or more beneficiaries who will get earnings or income from the trust for a specified period, often their lifetime or a set number of years.

During this income period, the trust assets are managed by a trustee, who invests them to generate income. Beneficiaries receive regular payments from the trust, which can be structured as fixed annuity payments or a percentage of the trust's value (known as a unitrust payment).

Upon the termination of the income period or the passing away of the final beneficiary, the remaining assets in the trust are dispensed to the charitable organizations designated by the grantor. These organizations must meet specific IRS criteria to qualify as beneficiaries of a CRT.

One key advantage of a CRT is that it provides immediate tax benefits to the grantor. Upon funding the trust, the grantor can claim a charitable income tax deduction for the present value of the charitable remainder interest. Additionally, because the trust is tax-exempt, it can sell appreciated assets without incurring capital gains taxes, allowing for tax-efficient portfolio diversification.

A charitable remainder trust form allows individuals to support charitable causes, provide income for themselves or their loved ones, and enjoy tax benefits. They can enjoy these benefits while retaining some level of control over the distribution of their assets.

How To Set Up?

To cover the charitable remainder trust costs and ensure the funds are flawlessly disbursed on a regular basis, it is essential to form the trust by following the process. The step-by-step process of setting up a CRT is mentioned below.

- Seek guidance from experienced attorneys and financial advisors specializing in estate planning and charitable giving. Their advice shall help individuals understand the intricacies of setting up a CRT.

- Select a trustee, typically a financial institution or professional trustee, to take care of the trust's assets and make sure legal and tax regulations are complied with.

- Transfer of assets like cash, real estate, or other securities to the CRT. The assets become irrevocably owned by the trust.

- Specify the income terms for beneficiaries, including the payment amount and frequency and the duration of the income period. The duration can be for the lifetime of beneficiaries or a set number of years.

- Choose one or more qualified charitable organizations to receive the leftover trust assets upon the termination of the income period or the death of the last beneficiary.

- Work with legal professionals to draft an extensive trust agreement that specifies the terms and conditions unique to the CRT. It includes the distribution of income and assets to beneficiaries and charities.

- Complete and file any required paperwork with relevant regulatory authorities to establish the CRT in compliance with state and federal laws.

Taxation & Distribution Rules

Charitable remainder trust rates and other details are based on a set of rules. Below is a detailed discussion with regard to taxation and distribution rules.

Taxation Rules

- CRTs are tax-exempt entities, meaning they do not pay income taxes on the investment earnings generated within the trust.

- Upon funding the CRT, the grantor may be eligible for a charitable income tax (IT) deduction equivalent to the present value of the charitable remainder interest.

- CRTs can sell appreciated assets without triggering capital gains taxes. These deductions allow for tax-efficient portfolio diversification.

- Beneficiaries receive income payments from the CRT, which are subject to income tax based on the type of income generated by the trust (e.g., ordinary income, capital gains, or tax-exempt income).

- Upon the termination of the income period or the death of the last beneficiary, the remaining assets distributed to charitable beneficiaries are exempt from estate taxes, potentially reducing the grantor's estate tax liability.

Distribution Rules

- Beneficiaries of a CRT receive income payments from the trust based on the terms specified in the trust agreement. This income can be structured as fixed annuity or unitrust payments or a percentage of the trust's value.

- Income distributions to beneficiaries are typically made on a regular basis. As in annual, semi-annual, or quarterly, according to the terms of the trust.

- The amount of income distributed to beneficiaries is calculated on the basis of the fair market value of the trust assets and the specified payout rate or amount established in the trust agreement.

- Upon the termination of the income period or the death of the last beneficiary, the remaining assets in the CRT are distributed to one or more designated charitable organizations according to the grantor's instructions.

Examples

Understanding the practicality and real-life application of charitable remainder trust rates shall strengthen understanding and also provide a deep dive into the intricacies of the concept. The examples below are an attempt towards that.

Example #1

Adam is a serial entrepreneur. He has businesses in the renewable energy sector, automobiles, and home appliances. He has two children and four grandchildren. A CRT that can benefit his wife, Lisa, their children, and grandchildren is set up.

According to the agreement, the beneficiaries shall receive payments every quarter for 15 years. After this period, all the assets shall be transferred to a non-profit organization that plants trees across the world and another charitable organization that promotes afforestation.

Example #2

Adam is a serial entrepreneur. He has businesses in the renewable energy sector, automobiles, and home appliances. He has two children and four grandchildren. A CRT that can benefit his wife, Lisa, their children, and grandchildren is set up.

According to the agreement, the beneficiaries shall receive payments every quarter for 15 years. After this period, all the assets shall be transferred to a non-profit organization that plants trees across the world and another charitable organization that promotes afforestation.

Pros And Cons

The pros and cons of charitable remainder trust forms are mentioned below.

Pros

- CRTs offer immediate tax deductions for the grantor upon funding the trust, as well as tax-free growth of trust assets.

- Beneficiaries get systematic payments from the trust for a specified period of their lifetime, providing financial support.

- CRTs allow individuals to support charitable causes and organizations they care about while providing for themselves or their loved ones.

- Assets transferred to a CRT can be sold without incurring capital gains taxes, allowing for tax-efficient portfolio diversification.

- The remaining assets within the trust are forwarded to designated charitable beneficiaries upon the termination of the trust, potentially reducing the grantor's estate tax liability.

Cons

- Once assets are transferred to a CRT, the decision is irrevocable. The irrevocability limits the grantor's control over the assets.

- Managing a CRT can be complex and requires ongoing administration and compliance with legal and tax regulations.

- Beneficiaries may face tax consequences upon receiving distributions from the trust, depending on the type of income generated by the trust and their tax situation.

Charitable Remainder Trust Vs Charitable Lead Trust Vs Charitable Gift Annuity

The distinctions between the three concepts mentioned above shall help us understand the intricacies of the concept and compare its standing with similar trusts.

Charitable Remainder Trust (CRT)

- A CRT is an irreparable trust that provides earnings or income to beneficiaries for a specified period of their lifetime. The remaining assets are given to charitable organizations upon termination.

- Beneficiaries get structured income from the trust, which can be structured as fixed annuity payments or unitrust payments.

- CRTs offer immediate tax deductions for the grantor upon funding the trust, as well as tax-free growth of trust assets.

- CRTs allow individuals to support charitable causes and have a provision to provide income for themselves or their loved ones.

Charitable Lead Trust (CLT)

- A CLT is an irreplaceable trust that dispenses income to charitable organizations for a certain period. The remaining assets are distributed to family members upon termination.

- Charitable organizations receive income payments from the trust during the term specified in the trust agreement.

- CLTs can provide estate tax benefits by reducing the taxable value of assets transferred to non-charitable beneficiaries upon termination.

- CLTs can be used as a wealth transfer strategy, allowing individuals to pass assets to non-charitable beneficiaries while supporting charitable causes.

Charitable Gift Annuity (CGA)

- A CGA is a contract between an individual and a charitable organization, where the individual transfers their assets to a charity in exchange for a fixed income.

- The charitable organization provides regular annuity payments to the donor for the remainder of their lifetime, based on the donor's age and the amount of the gift.

- Donors may be entitled to an income tax (IT) deduction on the basis of the present value of the charitable remainder interest.

- CGAs allow individuals to support charitable causes while receiving a reliable income stream for life.